A Suffolk New York Partial Release of Lien on Assigned Overriding Royalty Interest refers to a legal document that releases a portion of a lien placed on an assigned overriding royalty interest (ORRIS) in Suffolk County, New York. An ORRIS is a type of interest that entitles its holder to a share of the production revenues generated from an oil or gas lease. In situations where an ORRIS holder has taken out a loan or incurred a debt, they may use their interest as collateral, resulting in a lien. However, if the ORRIS holder wishes to release a portion of their interest from this lien, they can execute a Suffolk New York Partial Release of Lien on Assigned Overriding Royalty Interest. This document serves to release the lien on a specific portion of the ORRIS, thereby giving the ORRIS holder more flexibility or the ability to secure new financing. There can be different types of Suffolk New York Partial Release of Lien on Assigned Overriding Royalty Interest, including: 1. Partial Release by Percentage: This type of release specifies the percentage or fraction of the ORRIS that is being released from the lien. For example, if someone held a 5% ORRIS and wanted to release 2% of it, they would execute a Partial Release by Percentage for the 2% portion. 2. Partial Release by Acreage: In cases where the ORRIS covers multiple tracts of land, the release may be based on the designated acreage. This type of release specifies the specific tracts or parcels that are being released from the lien, making it easier to identify the affected areas. 3. Partial Release by Time Period: This type of release imposes a time limit on the release's effectiveness. It specifies the duration for which the lien release is valid. For example, a Partial Release by Time Period might state that the lien is released for a period of five years, after which the lien will be reinstated automatically unless another release is executed. It is important to consult with legal professionals or experts who specialize in oil and gas law when dealing with a Suffolk New York Partial Release of Lien on Assigned Overriding Royalty Interest. They can provide guidance and ensure that the document is prepared correctly, addressing all necessary details and considering the interests of the parties involved.

Suffolk New York Partial Release of Lien on Assigned Overriding Royalty Interest

Description

How to fill out Suffolk New York Partial Release Of Lien On Assigned Overriding Royalty Interest?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring ownership, and lots of other life situations require you prepare formal documentation that varies throughout the country. That's why having it all accumulated in one place is so beneficial.

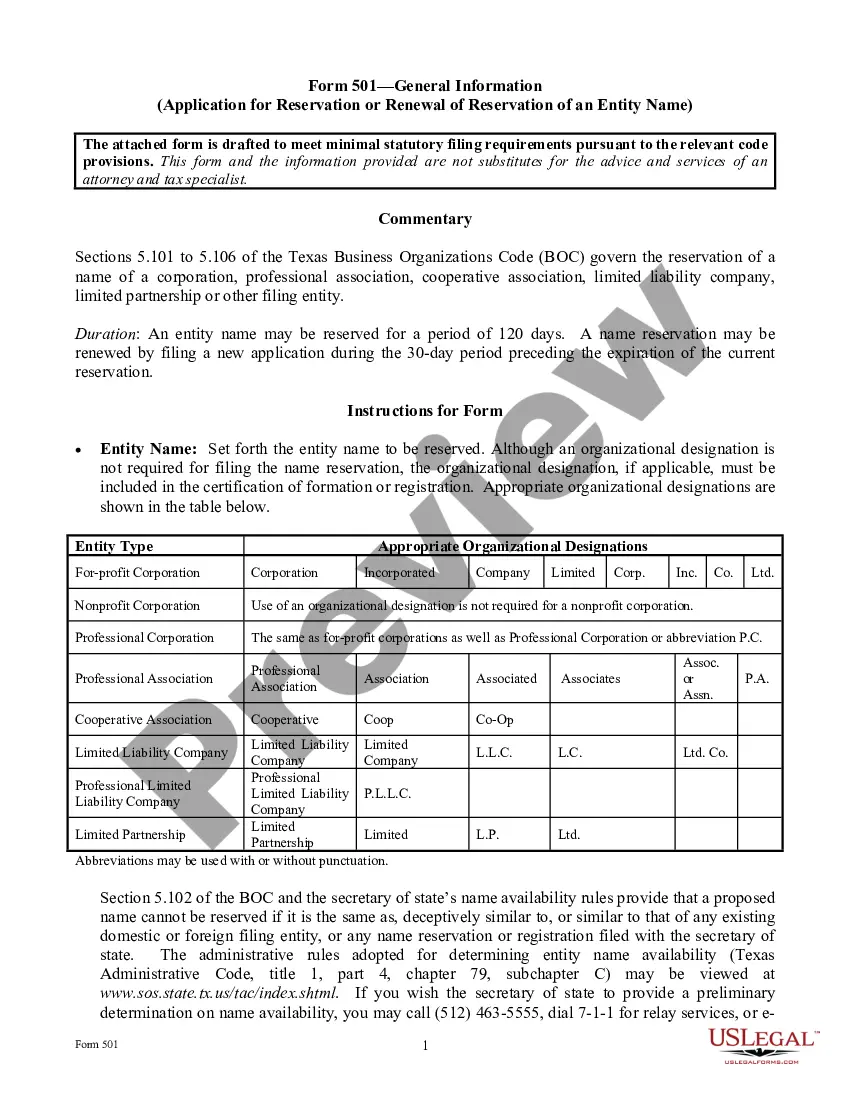

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal templates. Here, you can easily find and download a document for any personal or business purpose utilized in your county, including the Suffolk Partial Release of Lien on Assigned Overriding Royalty Interest.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Suffolk Partial Release of Lien on Assigned Overriding Royalty Interest will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guideline to obtain the Suffolk Partial Release of Lien on Assigned Overriding Royalty Interest:

- Make sure you have opened the proper page with your regional form.

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template meets your needs.

- Look for another document using the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Suffolk Partial Release of Lien on Assigned Overriding Royalty Interest on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

If you receive more than $600 in a calendar year in overriding royalty interest payments, you will receive a 1099 tax form to claim the money as income during your annual tax filing.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

Overriding royalty interests are an important financing tool for oil and gas companies involved in the exploration and development of oil gas and mineral interests. For investors, they provide an opportunity to participate in mineral production without incurring the costs.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

If a prepetition overriding royalty interest transaction is characterized as a transfer of real property (i.e., a sale), then the interest has effectively been transferred from the debtor's ownership and is not part of the bankruptcy estate.