Broward Florida Due Diligence Overview Oil and Gas Properties: Exploring Investment Opportunities Introduction: Broward County, located in Florida, offers attractive investment opportunities in the oil and gas sector. Conducting due diligence is crucial before investing in oil and gas properties to ensure a comprehensive understanding of the potential risks and rewards. This overview aims to provide insights into Broward Florida's oil and gas properties, highlighting the importance of due diligence and discussing different types of investments available. Why Conduct Due Diligence? Due diligence is a critical step when considering oil and gas investments in Broward Florida. It involves a comprehensive examination of various factors such as legal, financial, operational, and environmental aspects. This process helps investors evaluate the potential value, risks, and compliance of oil and gas properties. It is essential to hire experienced professionals to carry out due diligence, ensuring a thorough investigation of the target properties. Types of Broward Florida Due Diligence Overview Oil and Gas Properties: 1. Exploration and Production (E&P) Properties: These properties involve the exploration and extraction of oil and gas reserves. E&P's properties in Broward Florida may encompass both onshore and offshore sites. Due diligence on E&P properties focuses on assessing the geological potential, existing production levels, drilling technology, environmental impact, and regulatory compliance. 2. Midstream Infrastructure Properties: Midstream infrastructure includes pipelines, storage facilities, and transportation systems that connect oil and gas production areas to refineries and distribution networks. Conducting due diligence for midstream properties involves evaluating the integrity and capacity of existing infrastructure, regulatory compliance, maintenance practices, and potential expansion opportunities. 3. Leasehold Properties: Leasehold properties refer to land or mineral rights leased by oil and gas companies to explore and develop oil and gas resources. Due diligence for leasehold properties involves verifying ownership, reviewing lease terms, assessing existing production levels, examining the geological potential, and evaluating the financial obligations associated with the lease. 4. Acquisition of Existing Properties: Investors may also consider acquiring existing oil and gas properties in Broward Florida. Due diligence here involves reviewing production records, conducting asset evaluations, assessing environmental liabilities, and analyzing contractual arrangements, including royalty agreements and existing leases. Understanding the properties' financial performance and the potential for future production is key. Conclusion: Broward County, Florida, presents an array of oil and gas investment opportunities across exploration and production, midstream infrastructure, leasehold properties, and acquisitions. Conducting due diligence is crucial before investing in any of these property types. With the help of qualified professionals, investors can gain an in-depth understanding of the risks, potential rewards, compliance factors, and financial implications associated with Broward Florida's oil and gas properties. Through diligent research and analysis, investors can make informed decisions and unlock the immense potential the region offers in the oil and gas sector.

Broward Florida Due Diligence Overview Oil and Gas Properties

Description

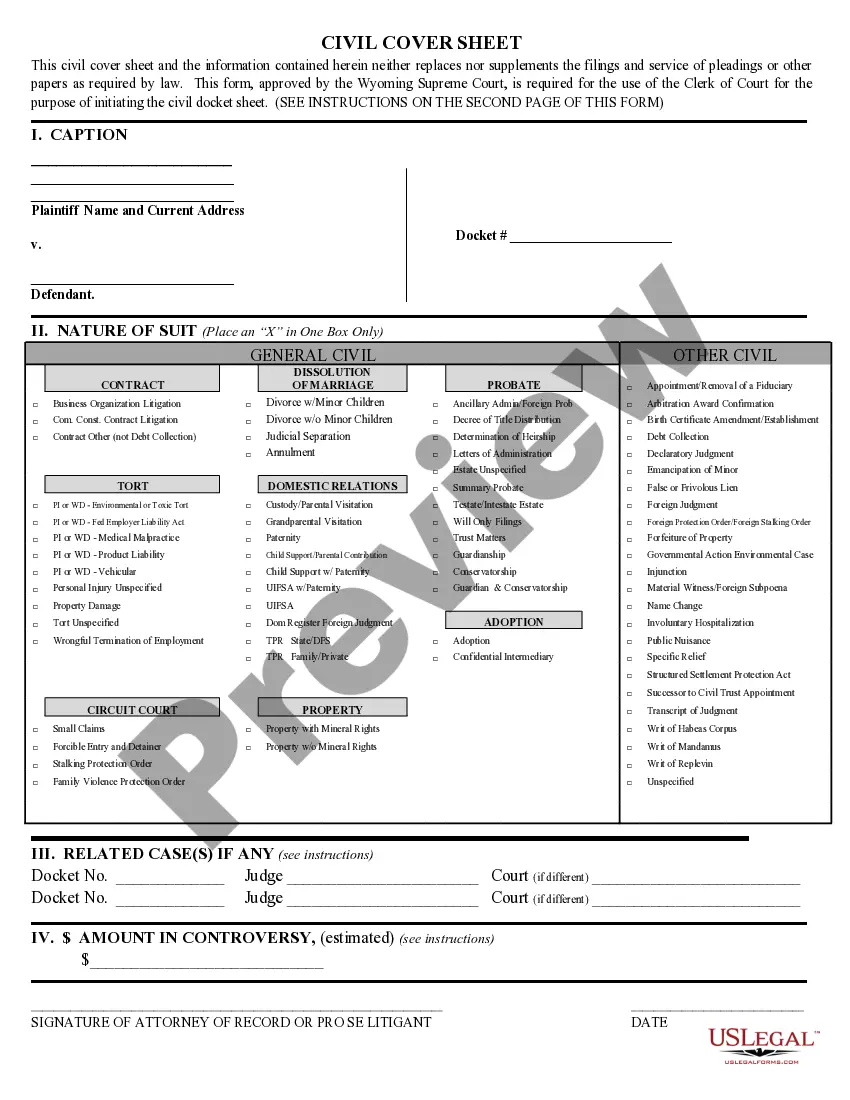

How to fill out Broward Florida Due Diligence Overview Oil And Gas Properties?

Laws and regulations in every sphere differ throughout the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Broward Due Diligence Overview Oil and Gas Properties, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the forms can be used multiple times: once you obtain a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Broward Due Diligence Overview Oil and Gas Properties from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Broward Due Diligence Overview Oil and Gas Properties:

- Take a look at the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the document once you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

In the context of an oil and gas asset transaction, the process of due diligence is an investigation by which the buyer's initial assumptions regarding the condition and value of the assets are verified.

Due diligence requires accountants to review the financial information recorded in the company's general ledger and review it against the actual physical asset. Depreciation methods, many units expense and other assets-related items may also be reviewed during this due diligence procedure.

When writing a due diligence report (what others may call an IT assessment report), keep four things in mind: Write for the target audience. Focus on the report objectives. Limit the report to information that has material impact to your company. Structure the information to be used as valuable reference material later.

Suggestions for Writing a Due Diligence Summary Report in a Right Way Be patient, thorough, and attentive to details. The process is going to take time.Don't lose focus on what's important. With that being said, ensure you are writing about relevant subject matter.Be concise.Ask questions.Seek legal assistance.

Due diligence documents are the research and analysis of a company or organization done in preparation for a business transaction (such as a corporate merger or purchase of securities). Due diligence documents typically include the following categories; legal, financial, sales and marketing, and human resources.

Across most industries, a comprehensive due diligence report should include the company's financial data, information about business operations and procurement, and a market analysis. It may also include data about employees and payroll, taxes, intellectual property and the board of directors.

Due diligence has been used since at least the mid-fifteenth century in the literal sense requisite effort. Centuries later, the phrase developed a legal meaning, namely, the care that a reasonable person takes to avoid harm to other persons or their property; in this sense, it is synonymous with another legal term

Due diligence is defined as an investigation of a potential investment (such as a stock) or product to confirm all facts. These facts can include such items as reviewing all financial records, past company performance, plus anything else deemed material.

Due Diligence Examples A business exhaustively examining another to determine whether it is a sound investment prior to initiating a merger. Consumers reading reviews online prior to purchasing an item or service. People checking their bank accounts and credit cards frequently to ensure that there is no unusual

What Is a Due Diligence Checklist? Preparing an audited financial statement or annual report. A public or private financing transaction. Major bank financing. A joint venture. An initial public offering (IPO) General risk management.