San Jose, California Lien and Tax Search Checklist is an essential tool used by individuals, businesses, and real estate professionals to gather information about property liens and taxes in the city of San Jose, California. Conducting a thorough lien and tax search is crucial for buyers, sellers, and lenders to ensure a property's legal and financial integrity. Below is a detailed description of what the San Jose California Lien and Tax Search Checklist consists of, with relevant keywords: 1. Property Information: The checklist begins by identifying the property for which the lien and tax search is conducted. This includes the property address, legal description, and assessor's parcel number (APN). 2. County Recorder's Office: It is vital to visit the Santa Clara County Recorder's Office to access public records related to the property. Keywords: Santa Clara County Recorder's Office, public records. 3. Lien Search: The checklist prompts a search for any outstanding liens placed on the property. These liens could include tax liens, mechanics liens, judgment liens, or homeowners association liens. Keywords: outstanding liens, tax liens, mechanics liens, judgment liens, homeowners association liens. 4. Tax Assessment: Detailed information about the property's tax assessment should be gathered, including the most recent assessed value, property tax payment history, and contact information for the tax assessor. Keywords: tax assessment, assessed value, property tax payment history, tax assessor. 5. Tax Delinquency: The checklist ensures that any tax delinquencies are identified, providing information on any overdue property taxes, penalties, and interest owed. Keywords: tax delinquency, overdue property taxes, penalties, interest owed. 6. Special Assessments: Special assessments, such as Mello-Roos or improvement district assessments, need to be uncovered to determine any additional financial obligations tied to the property. Keywords: special assessments, Mello-Roos, improvement district assessments. 7. Bankruptcy Filings: Checking for bankruptcy filings related to the property owner is important, as it may impact the property's ownership or ability to sell. Keywords: bankruptcy filings, property owner, property ownership. 8. Judgments and Lawsuits: Researching any judgments or pending lawsuits involving the property or property owner assists in understanding potential legal risks associated with the property. Keywords: judgments, lawsuits, legal risks. 9. Verification of Title: The checklist emphasizes the importance of verifying the property's title status by obtaining a title report or conducting a title search. Keywords: title verification, title report, title search. 10. Additional Considerations: Finally, the checklist may include additional considerations specific to San Jose, California, such as checking for compliance with city regulations or verifying any local tax incentives or rebates. Keywords: city regulations, local tax incentives, rebates. Different types of San Jose, California Lien and Tax Search Checklists can vary based on the entity conducting the search or the nature of the property transaction. For instance, a buyer's checklist might prioritize uncovering outstanding liens, while a lender's checklist may focus more on the property's tax delinquency status and any legal risks.

San Jose California Lien and Tax Search Checklist

Description

How to fill out San Jose California Lien And Tax Search Checklist?

Whether you plan to start your company, enter into a contract, apply for your ID update, or resolve family-related legal issues, you need to prepare certain paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business occasion. All files are grouped by state and area of use, so picking a copy like San Jose Lien and Tax Search Checklist is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of more steps to obtain the San Jose Lien and Tax Search Checklist. Follow the guide below:

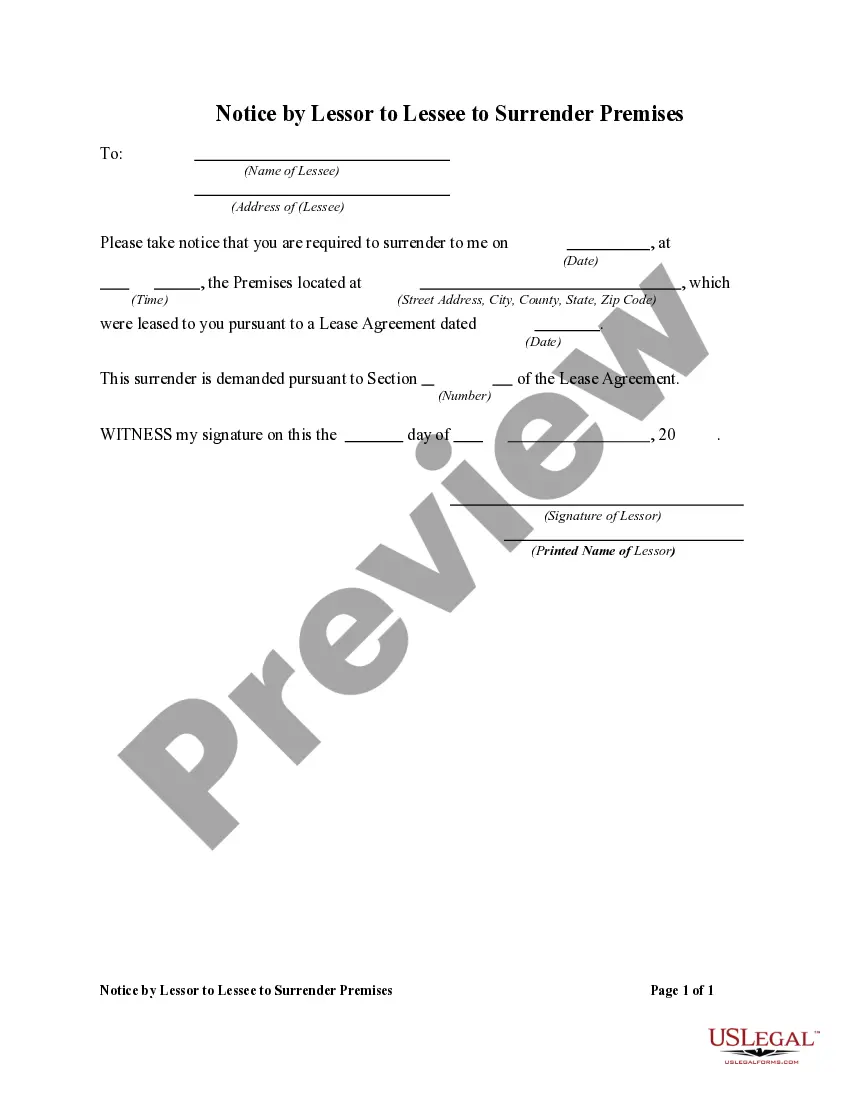

- Make certain the sample meets your individual needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the file once you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the San Jose Lien and Tax Search Checklist in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

What is a Real Estate Transfer Tax? A. A Real Estate Property Transfer Tax is a one-time tax paid whenever real property is sold or transferred from one individual or entity to another. The City of San Jose's current real estate property transfer tax is $3.30 per $1,000 of assessed value.

There are some jurisdictions that dictate who pays the tax, but for the most part, there is no mandate and it's up to the buyer and seller to negotiate who makes the payment. In California, the seller traditionally pays the transfer tax, thus the seller usually pays the Los Angeles County transfer tax.

The local Recorder's Office (or County Clerk) records all property deeds of ownership, property transfers, and related legal documents. Some California counties call it the Registrar of Deeds office. These offices maintain up to date property records. This includes the current property owner's name.

Anyone may view or purchase a copy of any document (official record) that was recorded at the Santa Clara County Recorder's Office after 1850.

The Documentary Transfer Tax is due on all changes of ownership unless an applicable statutory tax exemption is cited. It is computed at a rate of $. 55 per $500 or fractional portion of real property value, excluding any liens or encumbrances already of record.

Please note that traditionally the seller pays the county transfer tax here, and the city transfer tax is split 50 / 50 between the buyer and the seller. This is not fixed by law and can be negotiated.

Santa Clara County Property Records Search Santa Clara County real property records by business name, owner name, address, or registry type.

Let's take a look at the five methods for searching public records to find property owners and other public records information: County Tax Assessor Office.County Record/Clerk.Local Title Company.Mailing List Companies and Mailing List Brokers.Advanced Property Data and Owner Information Platform.

Santa Clara County Typically buyers and sellers split city transfer tax 50/50. Mountain View, Palo Alto, and San Jose all charge an additional city transfer tax of $3.30 per $1,000. In Santa Clara County, sellers typically pay escrow fees and title insurance costs.

Office of the Recorder-County Clerk Phone: (209) 468-3939. Fax: (209) 468-8040. Office Hours: - weekdays, except holidays. Email: recorder@sjgov.org.