Outline of the Acquisition Process Representing Sellers and Buyers in the Sale of Producing Properties, this form is is a outline of the acquisition representing the sellers and buyers in the sale of producing properties in the dealing with oil, gas or minerals.

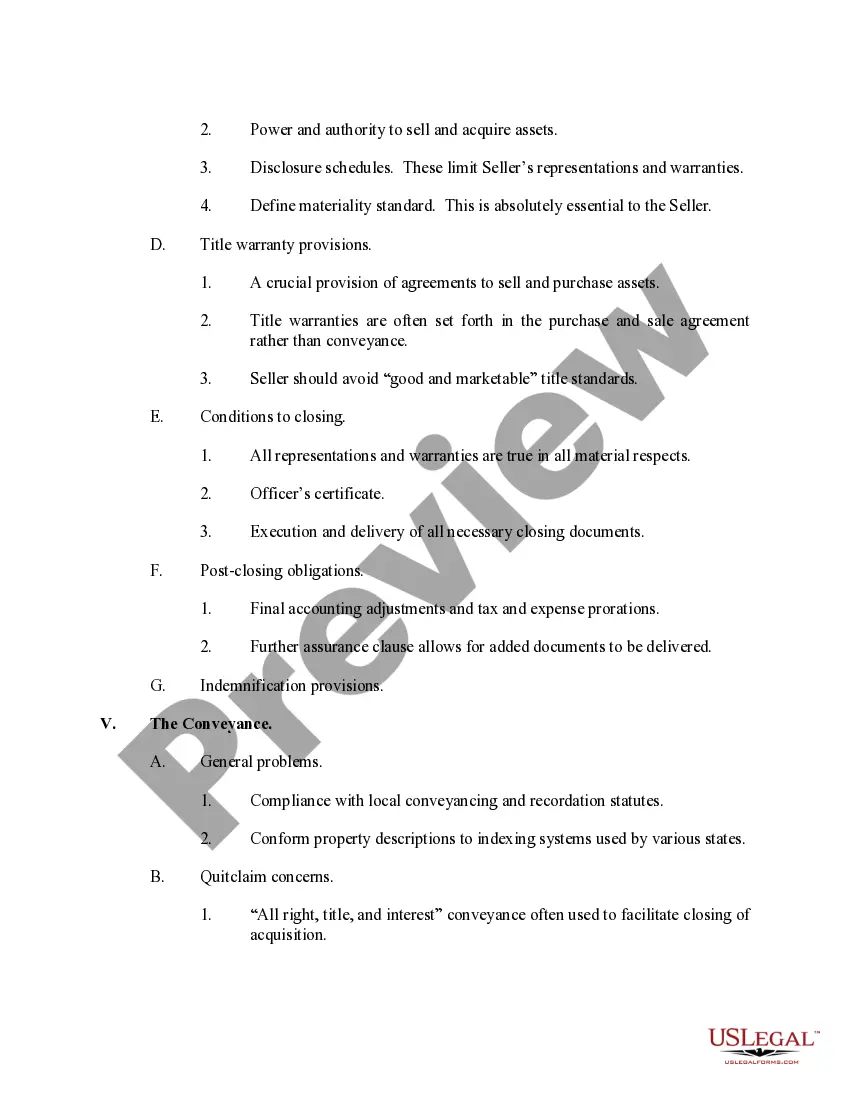

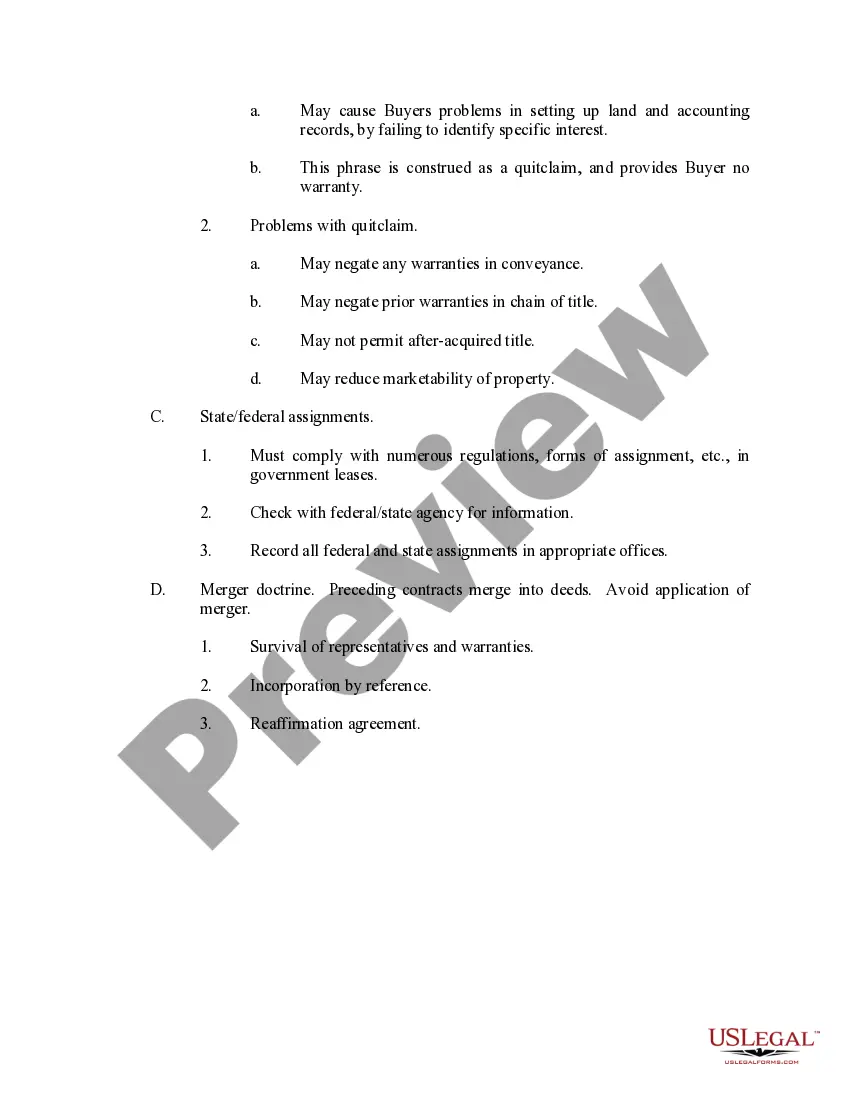

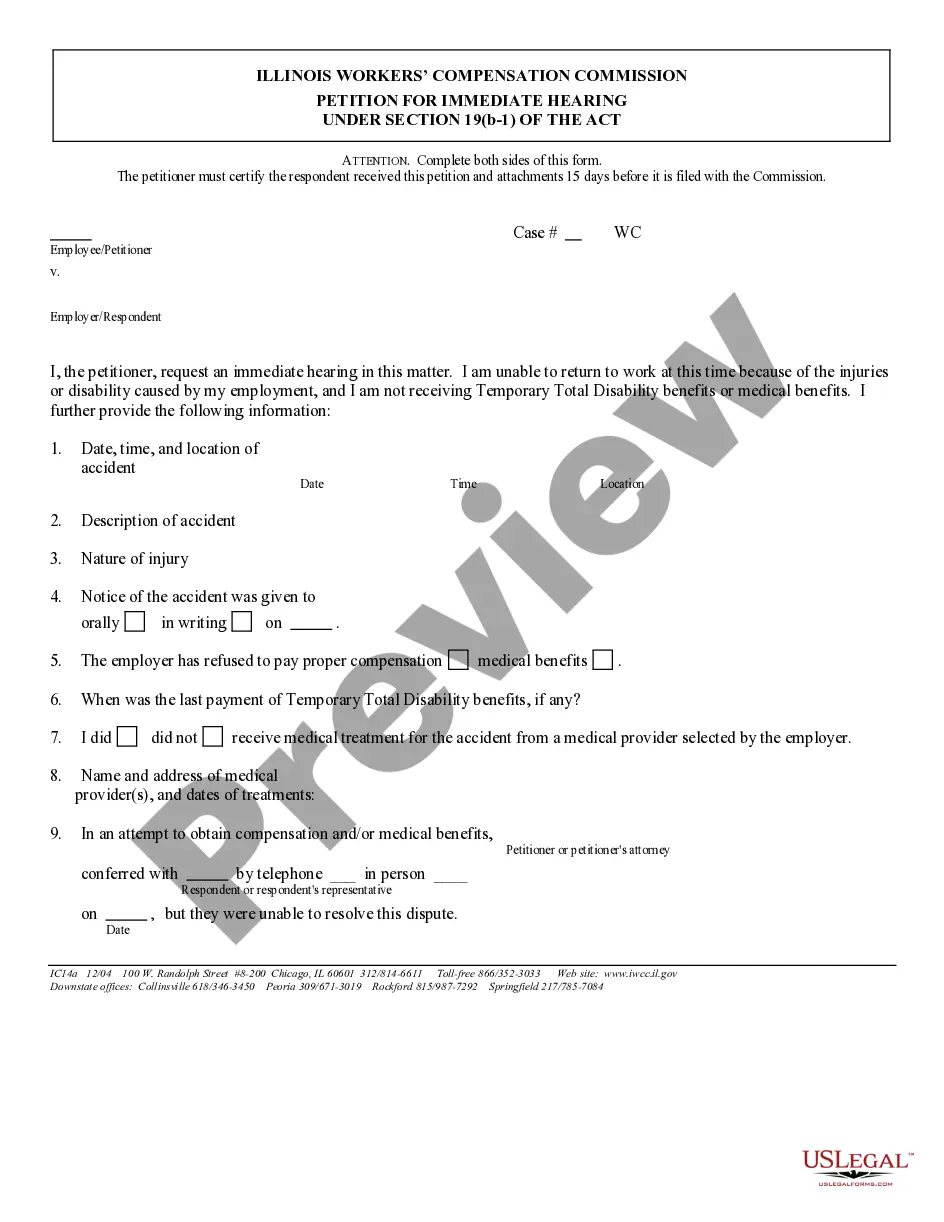

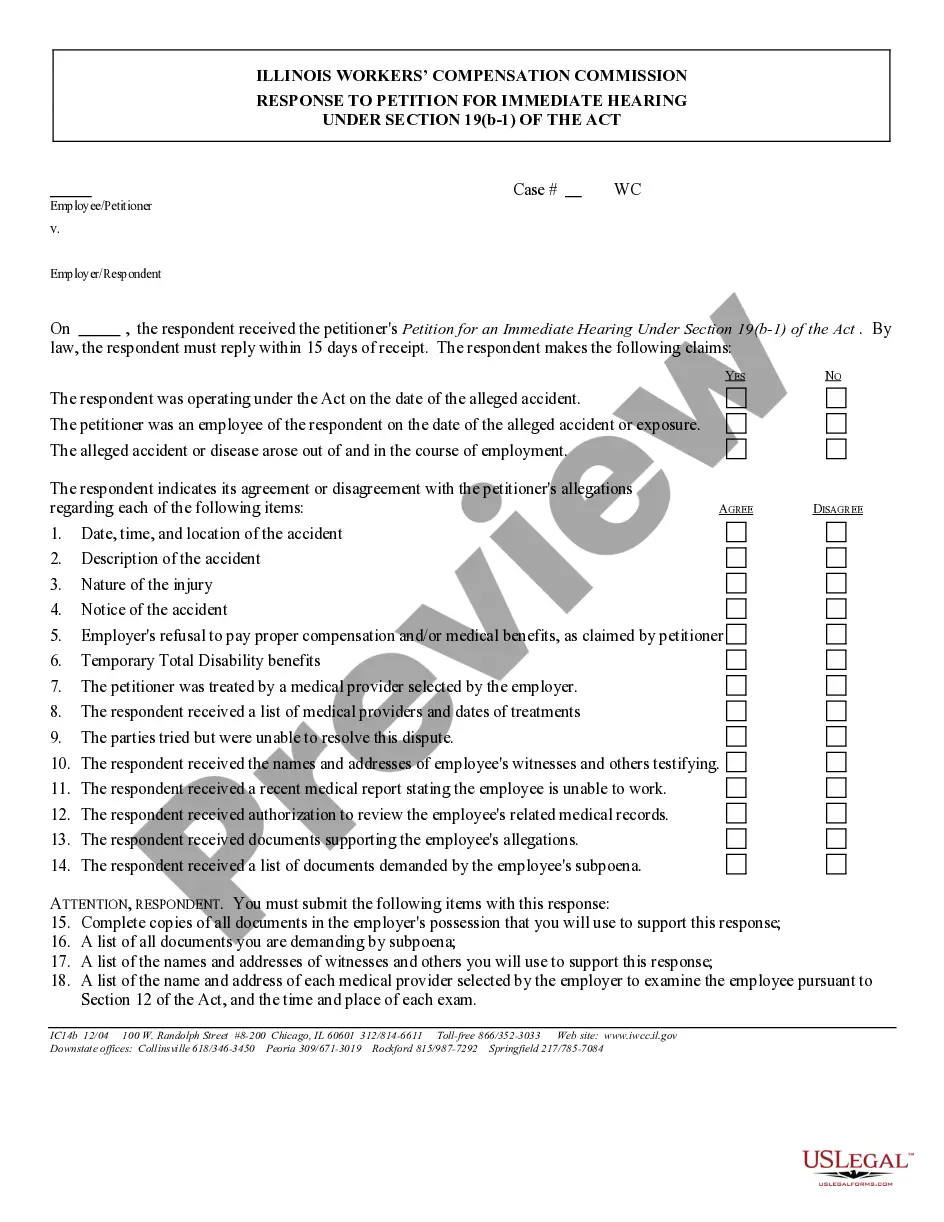

Harris Texas Acquisition Process: Representing Sellers and Buyers in the Sale of Producing Properties Introduction: Harris County, located in Texas, is known for its prosperous oil and gas industry. The acquisition process in this region is a complex procedure involving multiple steps and considerations for both sellers and buyers of producing properties. In this detailed description, we will outline the key steps involved in the acquisition process and highlight the crucial roles played by parties in the sale of producing properties. 1. Property Evaluation: Before initiating the acquisition process, both sellers and buyers must conduct a comprehensive evaluation of the producing property. This assessment involves reviewing the property's historical production data, reservoir potential, existing infrastructure, and any legal or environmental issues. Keywords: property evaluation, historical production data, reservoir potential, infrastructure review, legal review, environmental assessment. 2. Valuation and Negotiation: Once the property evaluation is complete, the next crucial step is determining its market value. Sellers may hire an experienced appraiser to assess the property's current and future revenue potential. On the other hand, buyers may engage a financial analyst to determine the property's investment worthiness. Valuation plays a crucial role in negotiating the terms and conditions of the sale, such as purchase price, royalty rates, and potential contingencies. Keywords: property valuation, market value, appraiser, revenue potential, financial analysis, negotiation. 3. Due Diligence: Upon reaching an agreement, the acquisition process moves into the due diligence phase. Both sellers and buyers must conduct a thorough examination of legal, financial, and operational aspects associated with the property. Sellers need to provide necessary documentation, including title deeds, operational permits, lease agreements, and environmental reports. Buyers carefully review this information to ensure there are no hidden liabilities or risks associated with the property. Keywords: due diligence, legal examination, financial analysis, operational review, title deeds, permits, lease agreements. 4. Purchase and Sale Agreement: After successful due diligence, the parties proceed with drafting a comprehensive purchase and sale agreement. This legal document outlines all the terms, conditions, and obligations of both the seller and the buyer. It covers aspects such as purchase price, payment terms, closing date, title transfer, and any contingencies related to the transaction. Keywords: purchase and sale agreement, terms and conditions, payment terms, closing date, title transfer, contingencies. 5. Closing and Transfer of Ownership: The final step in the acquisition process is the closing and transfer of ownership. During this stage, the buyer fulfills all financial obligations as per the agreement, and the seller transfers all rights and interests in the producing property. A closing agent or attorney facilitates the transaction, ensuring all necessary documents are executed, payments are made, and ownership is legally transferred. Keywords: closing, transfer of ownership, financial obligations, closing agent, attorney, legal transfer. Types of Harris Texas Acquisition Processes: 1. Onshore Oil and Gas Acquisition Process in Harris Texas 2. Offshore Oil and Gas Acquisition Process in Harris Texas 3. Acquisition Process for Other Producing Properties in Harris Texas (e.g., natural gas, shale oil, etc.) Conclusion: The acquisition process for selling or buying producing properties in Harris Texas encompasses various intricate stages, including property evaluation, valuation, negotiation, due diligence, drafting a purchase and sale agreement, and ultimately closing the transaction. Familiarity with these processes is vital for both sellers and buyers to ensure successful, legally compliant, and mutually beneficial transactions.Harris Texas Acquisition Process: Representing Sellers and Buyers in the Sale of Producing Properties Introduction: Harris County, located in Texas, is known for its prosperous oil and gas industry. The acquisition process in this region is a complex procedure involving multiple steps and considerations for both sellers and buyers of producing properties. In this detailed description, we will outline the key steps involved in the acquisition process and highlight the crucial roles played by parties in the sale of producing properties. 1. Property Evaluation: Before initiating the acquisition process, both sellers and buyers must conduct a comprehensive evaluation of the producing property. This assessment involves reviewing the property's historical production data, reservoir potential, existing infrastructure, and any legal or environmental issues. Keywords: property evaluation, historical production data, reservoir potential, infrastructure review, legal review, environmental assessment. 2. Valuation and Negotiation: Once the property evaluation is complete, the next crucial step is determining its market value. Sellers may hire an experienced appraiser to assess the property's current and future revenue potential. On the other hand, buyers may engage a financial analyst to determine the property's investment worthiness. Valuation plays a crucial role in negotiating the terms and conditions of the sale, such as purchase price, royalty rates, and potential contingencies. Keywords: property valuation, market value, appraiser, revenue potential, financial analysis, negotiation. 3. Due Diligence: Upon reaching an agreement, the acquisition process moves into the due diligence phase. Both sellers and buyers must conduct a thorough examination of legal, financial, and operational aspects associated with the property. Sellers need to provide necessary documentation, including title deeds, operational permits, lease agreements, and environmental reports. Buyers carefully review this information to ensure there are no hidden liabilities or risks associated with the property. Keywords: due diligence, legal examination, financial analysis, operational review, title deeds, permits, lease agreements. 4. Purchase and Sale Agreement: After successful due diligence, the parties proceed with drafting a comprehensive purchase and sale agreement. This legal document outlines all the terms, conditions, and obligations of both the seller and the buyer. It covers aspects such as purchase price, payment terms, closing date, title transfer, and any contingencies related to the transaction. Keywords: purchase and sale agreement, terms and conditions, payment terms, closing date, title transfer, contingencies. 5. Closing and Transfer of Ownership: The final step in the acquisition process is the closing and transfer of ownership. During this stage, the buyer fulfills all financial obligations as per the agreement, and the seller transfers all rights and interests in the producing property. A closing agent or attorney facilitates the transaction, ensuring all necessary documents are executed, payments are made, and ownership is legally transferred. Keywords: closing, transfer of ownership, financial obligations, closing agent, attorney, legal transfer. Types of Harris Texas Acquisition Processes: 1. Onshore Oil and Gas Acquisition Process in Harris Texas 2. Offshore Oil and Gas Acquisition Process in Harris Texas 3. Acquisition Process for Other Producing Properties in Harris Texas (e.g., natural gas, shale oil, etc.) Conclusion: The acquisition process for selling or buying producing properties in Harris Texas encompasses various intricate stages, including property evaluation, valuation, negotiation, due diligence, drafting a purchase and sale agreement, and ultimately closing the transaction. Familiarity with these processes is vital for both sellers and buyers to ensure successful, legally compliant, and mutually beneficial transactions.