Collin Texas Acquisition Due Diligence Report is a comprehensive examination of a business or property located in Collin County, Texas, that is being considered for acquisition or investment. This report is crucial for potential buyers or investors as it provides detailed insights into the target company's operations, financials, legal matters, and overall business health. By conducting due diligence, stakeholders can minimize risks, make informed decisions, and negotiate better terms for the acquisition. The Collin Texas Acquisition Due Diligence Report covers several key areas, including financial due diligence, legal due diligence, operational due diligence, and commercial due diligence. Each type focuses on specific aspects to ensure a thorough evaluation of the target company. 1. Financial Due Diligence: This type of due diligence aims to assess the financial performance, stability, and potential of the target company. It includes analyzing financial statements, cash flows, revenue streams, debt levels, profitability ratios, and any potential financial risks or discrepancies. 2. Legal Due Diligence: This aspect involves examining the legal standing of the target company, including contracts, licenses, permits, intellectual property rights, litigation history, ownership documentation, and compliance with local laws and regulations. 3. Operational Due Diligence: This type assesses the target company's operational aspects, such as the efficiency of its processes, supply chain management, manufacturing capabilities, technology infrastructure, human resources, and potential operational risks. 4. Commercial Due Diligence: Commercial due diligence focuses on evaluating the market potential, competitive landscape, customer base, sales and marketing strategies, product/service differentiation, and growth prospects of the target company. This analysis helps the potential buyer or investor understand the market dynamics and future growth opportunities. The Collin Texas Acquisition Due Diligence Report is essential for both strategic and financial buyers/investors, as it provides an in-depth understanding of the target company's strengths, weaknesses, opportunities, and threats. It helps identify potential dealbreakers, negotiate favorable terms, and validate the assumptions made during the acquisition process. By conducting a comprehensive Collin Texas Acquisition Due Diligence Report, stakeholders can make well-informed decisions, mitigate risks, and ensure a smoother acquisition process in Collin County, Texas.

Collin Texas Acquisition Due Diligence Report

Description

How to fill out Collin Texas Acquisition Due Diligence Report?

Preparing legal paperwork can be difficult. In addition, if you decide to ask a lawyer to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Collin Acquisition Due Diligence Report, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario accumulated all in one place. Therefore, if you need the latest version of the Collin Acquisition Due Diligence Report, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Collin Acquisition Due Diligence Report:

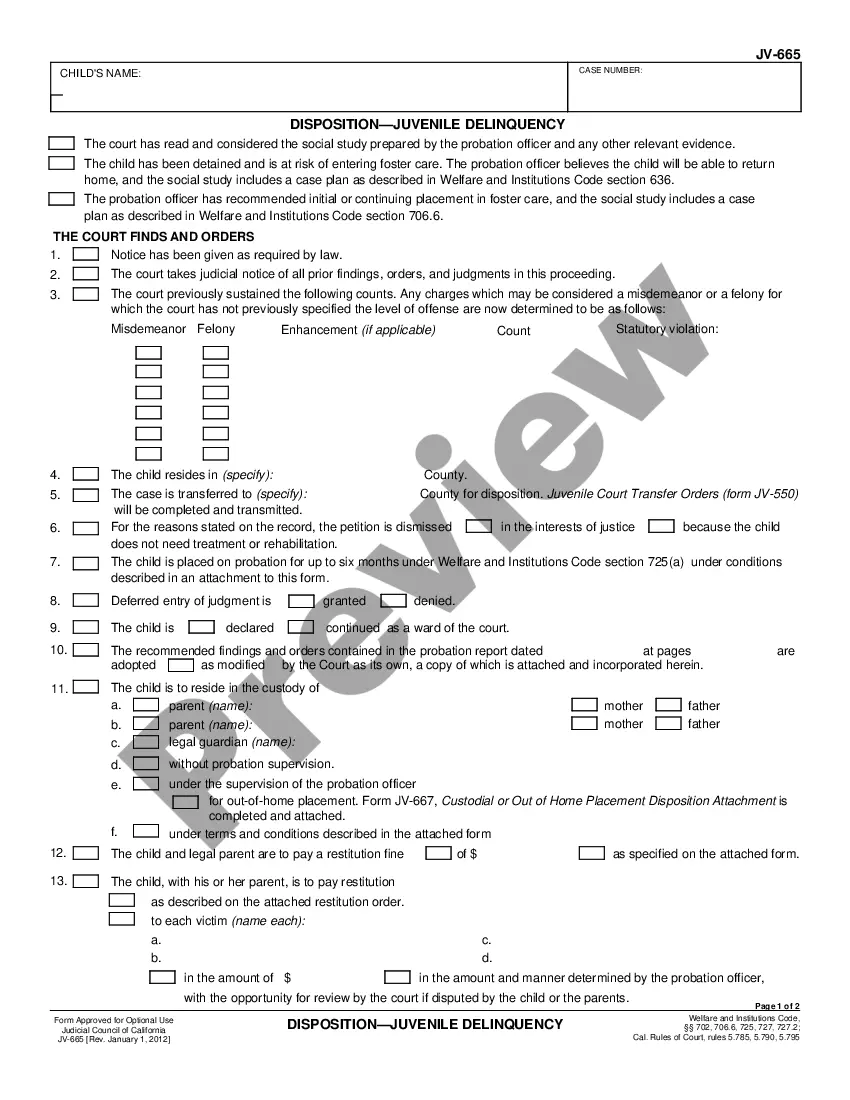

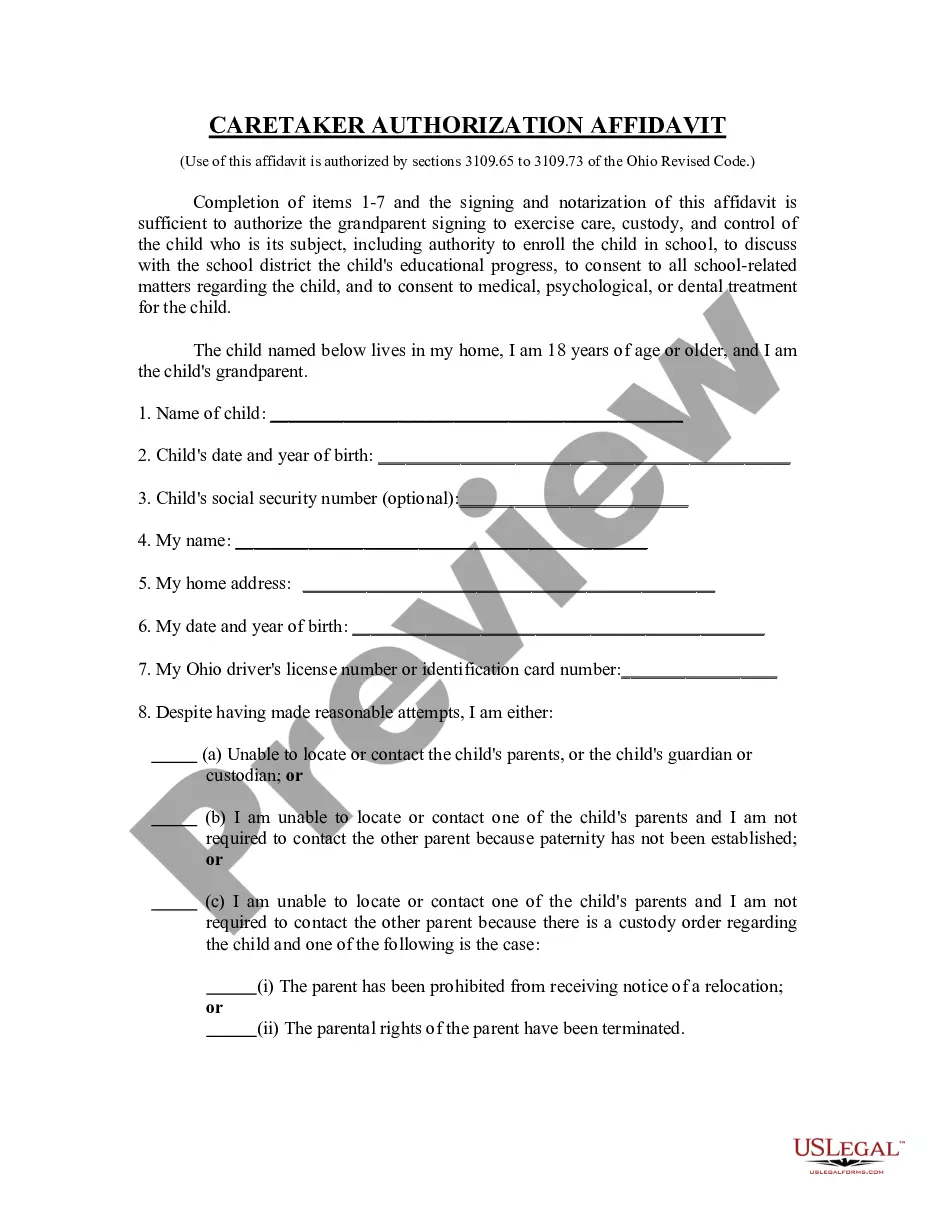

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Collin Acquisition Due Diligence Report and download it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

Across most industries, a comprehensive due diligence report should include the company's financial data, information about business operations and procurement, and a market analysis. It may also include data about employees and payroll, taxes, intellectual property and the board of directors.

The complete list of due diligence documents to be collected Shareholder certificate documents. Local/state/federal business licenses. Occupational license. Building permits documents. Zonal and land use permits. Tax registration documents. Power of attorney documents. Previous or outstanding legal cases.

Due diligence involves examining a company's numbers, comparing the numbers over time, and benchmarking them against competitors. Due diligence is applied in many other contexts, for example, conducting a background check on a potential employee or reading product reviews.

Due diligence checklist Look at past annual and quarterly financial information, including:Review sales and gross profits by product. Look up the rates of return by product. Look at the accounts receivable. Get a breakdown of the business's inventory.Make a breakdown of real estate and equipment.

A due diligence checklist is an organized way to analyze a company. The checklist will include all the areas to be analyzed, such as ownership and organization, assets and operations, the financial ratios, shareholder value, processes and policies, future growth potential, management, and human resources.

In the M&A process, due diligence allows the buyer to confirm pertinent information about the seller, such as contracts, finances, and customers. By gathering this information, the buyer is better equipped to make an informed decision and close the deal with a sense of certainty.

20 Key Due Diligence Activities In A Merger And Acquisition... Financial Matters.Technology/Intellectual Property.Customers/Sales.Strategic Fit with Buyer.Material Contracts.Employee/Management Issues.Litigation.Tax Matters.

Sample Due Diligence Request List Formation documents and operating agreements. Detailed ownership information and member register. Details of any other investment or ownership interest in any other entity held by the company.

Due diligence documents are the research and analysis of a company or organization done in preparation for a business transaction (such as a corporate merger or purchase of securities). Due diligence documents typically include the following categories; legal, financial, sales and marketing, and human resources.