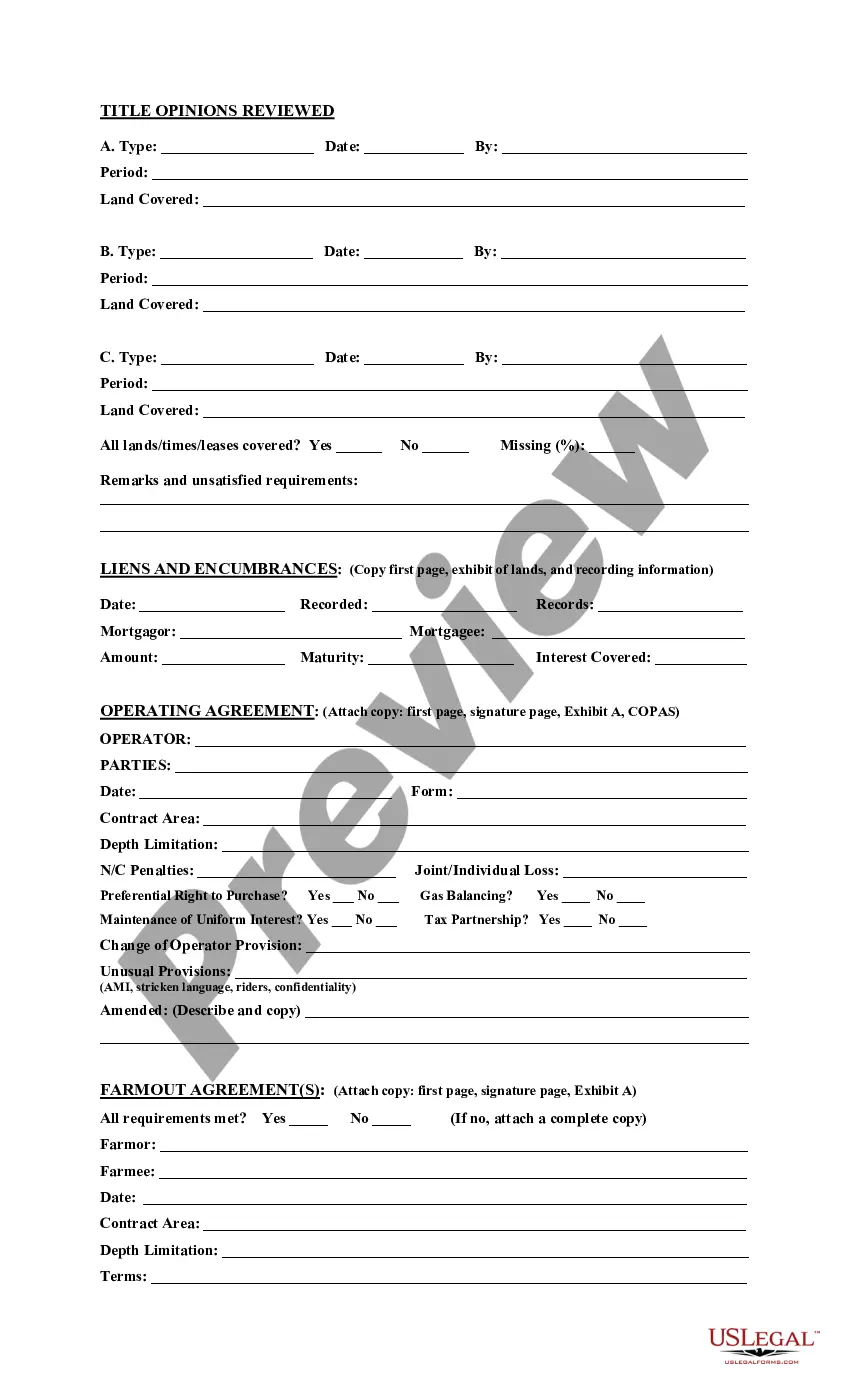

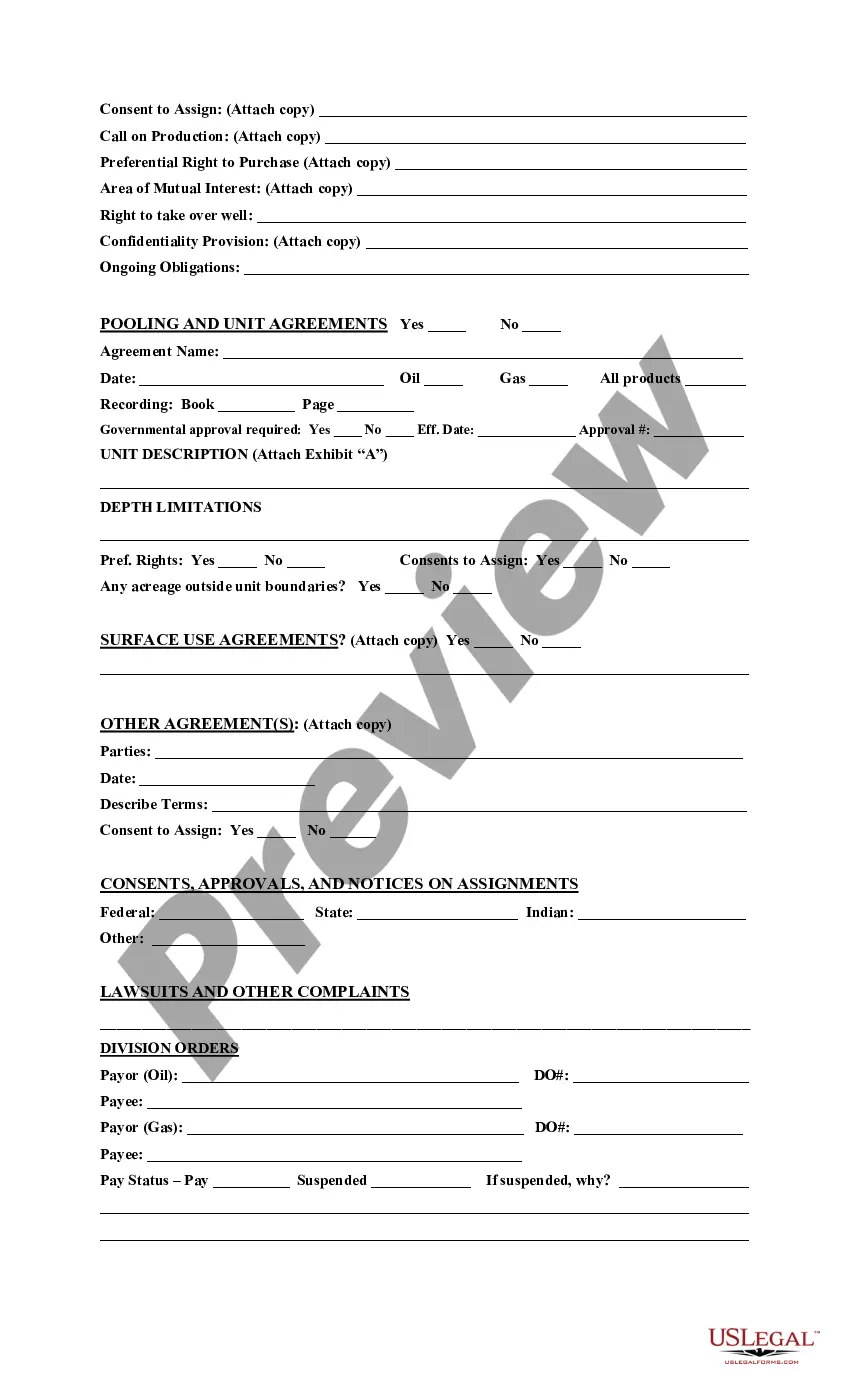

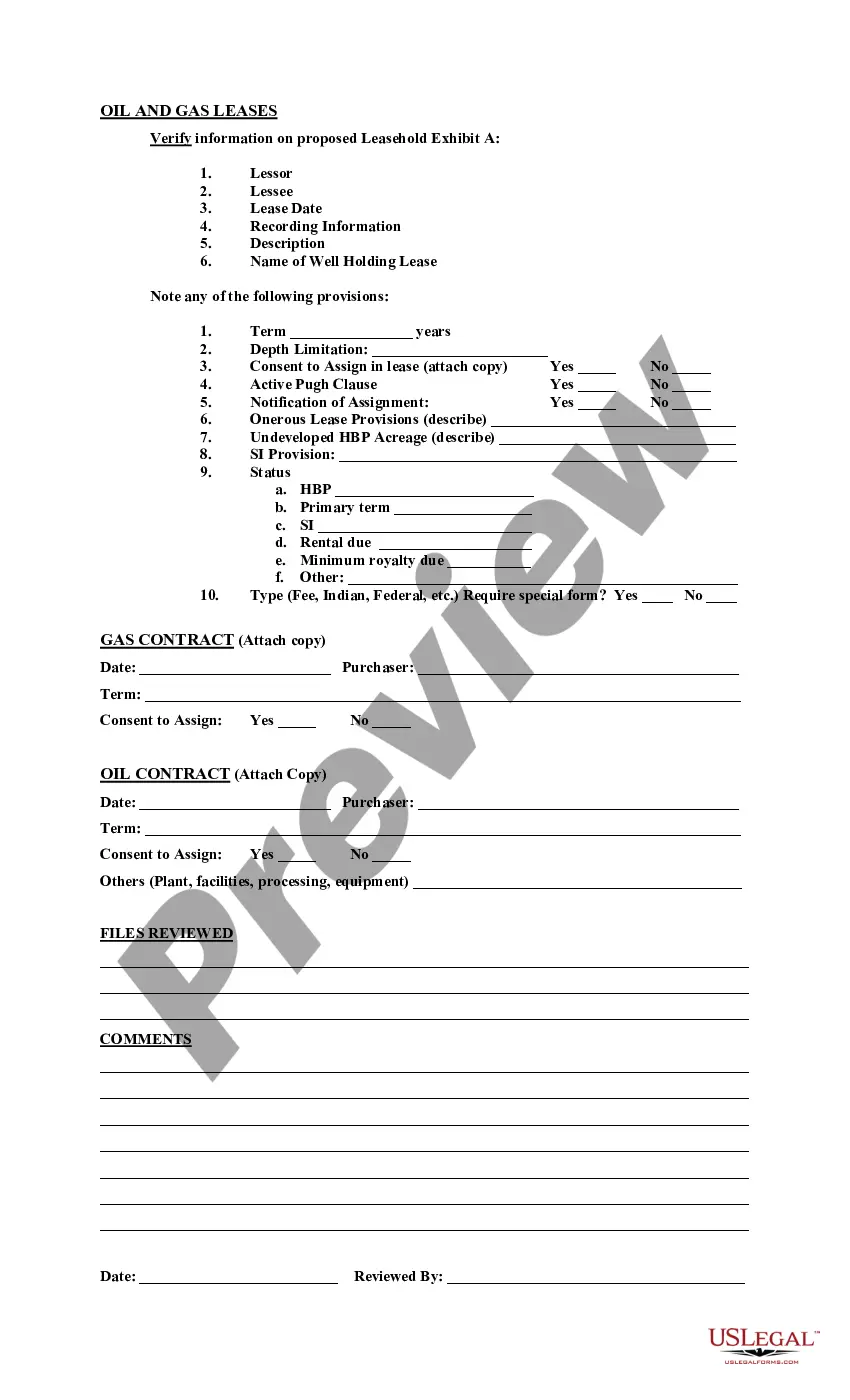

Hennepin Minnesota Acquisition Due Diligence Report is a comprehensive analysis conducted when considering the acquisition of a business, property, or assets located in Hennepin County, Minnesota. This report aims to provide potential buyers with a detailed overview of the target company or property's financial, legal, operational, and commercial aspects to assess the risks and opportunities associated with the acquisition. Key elements covered in a Hennepin Minnesota Acquisition Due Diligence Report: 1. Financial Analysis: This section evaluates the target company's financial performance, including historical financial statements, revenue trends, profitability, cash flow analysis, debt obligations, and any potential financial red flags. It provides buyers with insight into the target's financial health and helps identify any potential financial risks. 2. Legal and Regulatory Compliance: This segment examines the target company's compliance with federal, state, and local laws, licenses, permits, and regulations specific to Hennepin County. It includes a review of contracts, leases, litigation history, intellectual property rights, and any pending legal or regulatory matters that may impact the acquisition. 3. Operations and Infrastructure: This section analyzes the target's operational processes, infrastructure, supply chain management, technology systems, and any existing or potential operational inefficiencies. It helps buyers assess the target's ability to continue operations smoothly after the acquisition. 4. Market and Competitive Analysis: This segment focuses on evaluating the target company's industry positioning, market trends, customer base, competitive landscape, and potential growth opportunities. It allows buyers to understand the market dynamics and competitive advantages of the target business. 5. Human Resources: This section examines the target company's organizational structure, workforce capabilities, key personnel, employee contracts, benefits plans, and potential employment-related risks. It helps buyers assess the human capital aspects and cultural fit. Different types of Hennepin Minnesota Acquisition Due Diligence Reports may include: 1. Real Estate Acquisition Due Diligence: This report focuses on assessing the target property's legal ownership, title deeds, zoning laws' compliance, environmental factors, building permits, and other property-specific considerations. 2. Mergers and Acquisitions Due Diligence: This report is conducted when considering acquiring a business entity located in Hennepin County. It covers all the elements mentioned above, tailored to the specific requirements of a merger or acquisition transaction. 3. Intellectual Property Due Diligence: In cases where the acquisition involves valuable intellectual property assets, this report scrutinizes patents, trademarks, copyrights, licenses, contractual agreements, and potential infringement risks. In summary, a Hennepin Minnesota Acquisition Due Diligence Report provides potential buyers with a comprehensive understanding of the target company or property's financial, legal, operational, and commercial aspects, allowing them to make informed decisions and mitigate risks associated with the acquisition.

Hennepin Minnesota Acquisition Due Diligence Report

Description

How to fill out Hennepin Minnesota Acquisition Due Diligence Report?

Preparing legal documentation can be difficult. In addition, if you decide to ask a legal professional to write a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Hennepin Acquisition Due Diligence Report, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Consequently, if you need the latest version of the Hennepin Acquisition Due Diligence Report, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Hennepin Acquisition Due Diligence Report:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your Hennepin Acquisition Due Diligence Report and download it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

Across most industries, a comprehensive due diligence report should include the company's financial data, information about business operations and procurement, and a market analysis. It may also include data about employees and payroll, taxes, intellectual property and the board of directors.

When writing a due diligence report (what others may call an IT assessment report), keep four things in mind: Write for the target audience. Focus on the report objectives. Limit the report to information that has material impact to your company. Structure the information to be used as valuable reference material later.

Across most industries, a comprehensive due diligence report should include the company's financial data, information about business operations and procurement, and a market analysis. It may also include data about employees and payroll, taxes, intellectual property and the board of directors.

Due Diligence Examples A business exhaustively examining another to determine whether it is a sound investment prior to initiating a merger. Consumers reading reviews online prior to purchasing an item or service. People checking their bank accounts and credit cards frequently to ensure that there is no unusual

Due Diligence Process Steps, Policies and Procedures Evaluate Goals of the Project. As with any project, the first step delineating corporate goals.Analyze of Business Financials.Thorough Inspection of Documents.Business Plan and Model Analysis.Final Offering Formation.Risk Management.

3. In this context it is clarified that in addition to Company Secretaries, banks can also accept the certification by a Chartered Accountants & Cost Accountants.

Due diligence is an investigation, audit, or review performed to confirm facts or details of a matter under consideration. In the financial world, due diligence requires an examination of financial records before entering into a proposed transaction with another party.

As part of this process we focus on three main areas: Commercial due diligence. Financial due diligence. Legal due diligence.

When writing a due diligence report (what others may call an IT assessment report), keep four things in mind: Write for the target audience. Focus on the report objectives. Limit the report to information that has material impact to your company. Structure the information to be used as valuable reference material later.

The Company shall have completed its due diligence review of Buyer and Buyer's business, including, but not limited to, with respect to all business and legal matters, to the satisfaction of the Company in its sole discretion.