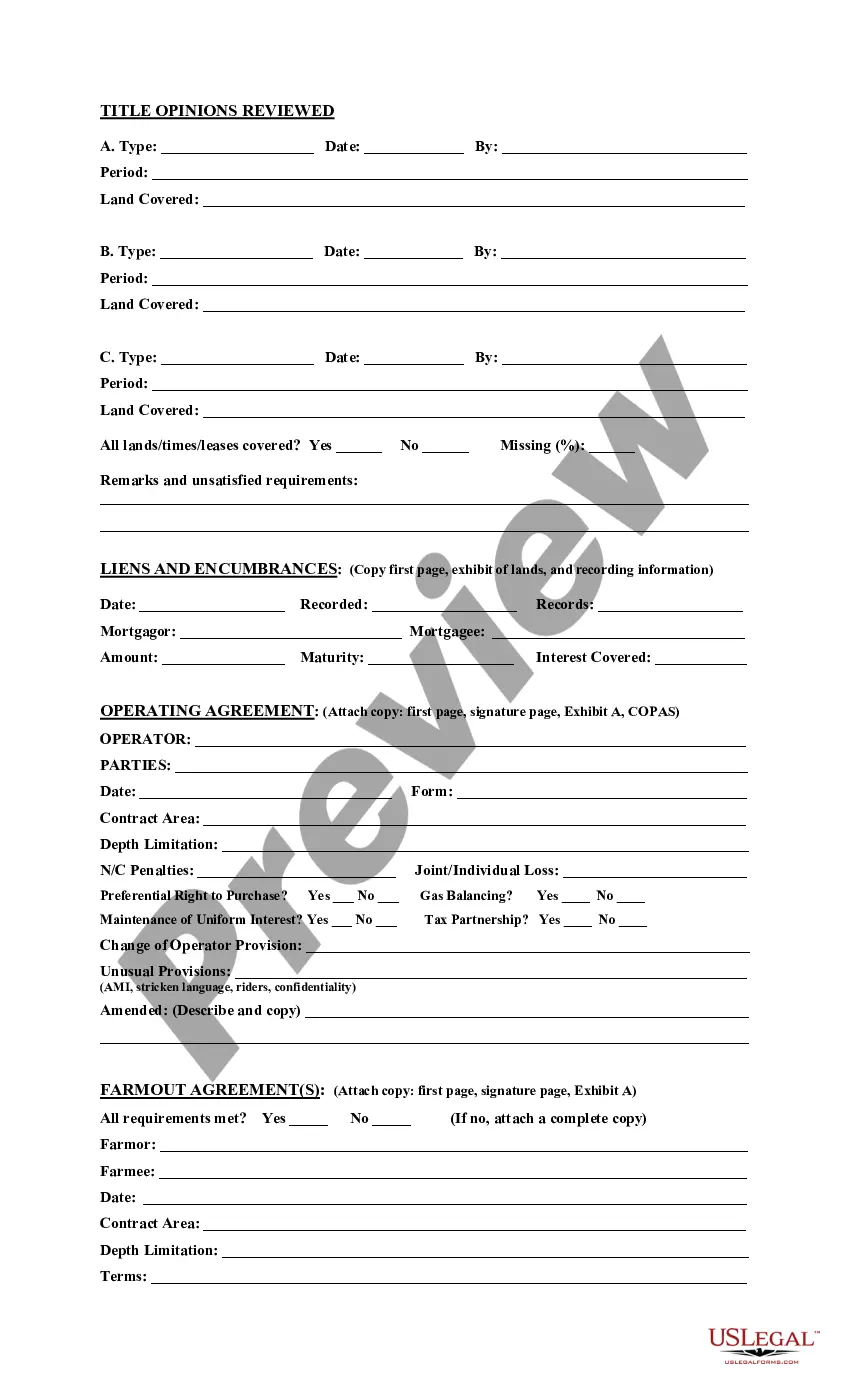

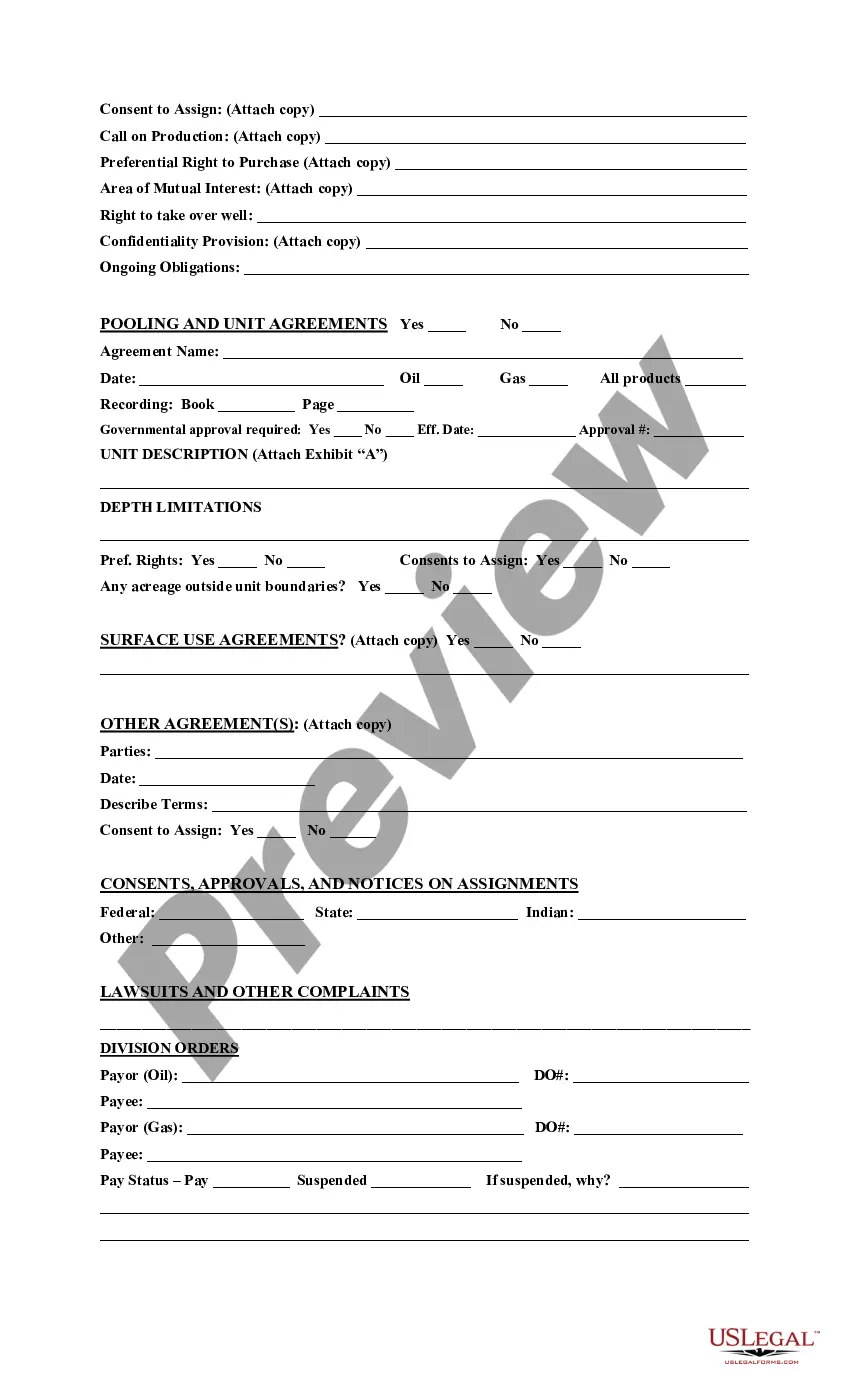

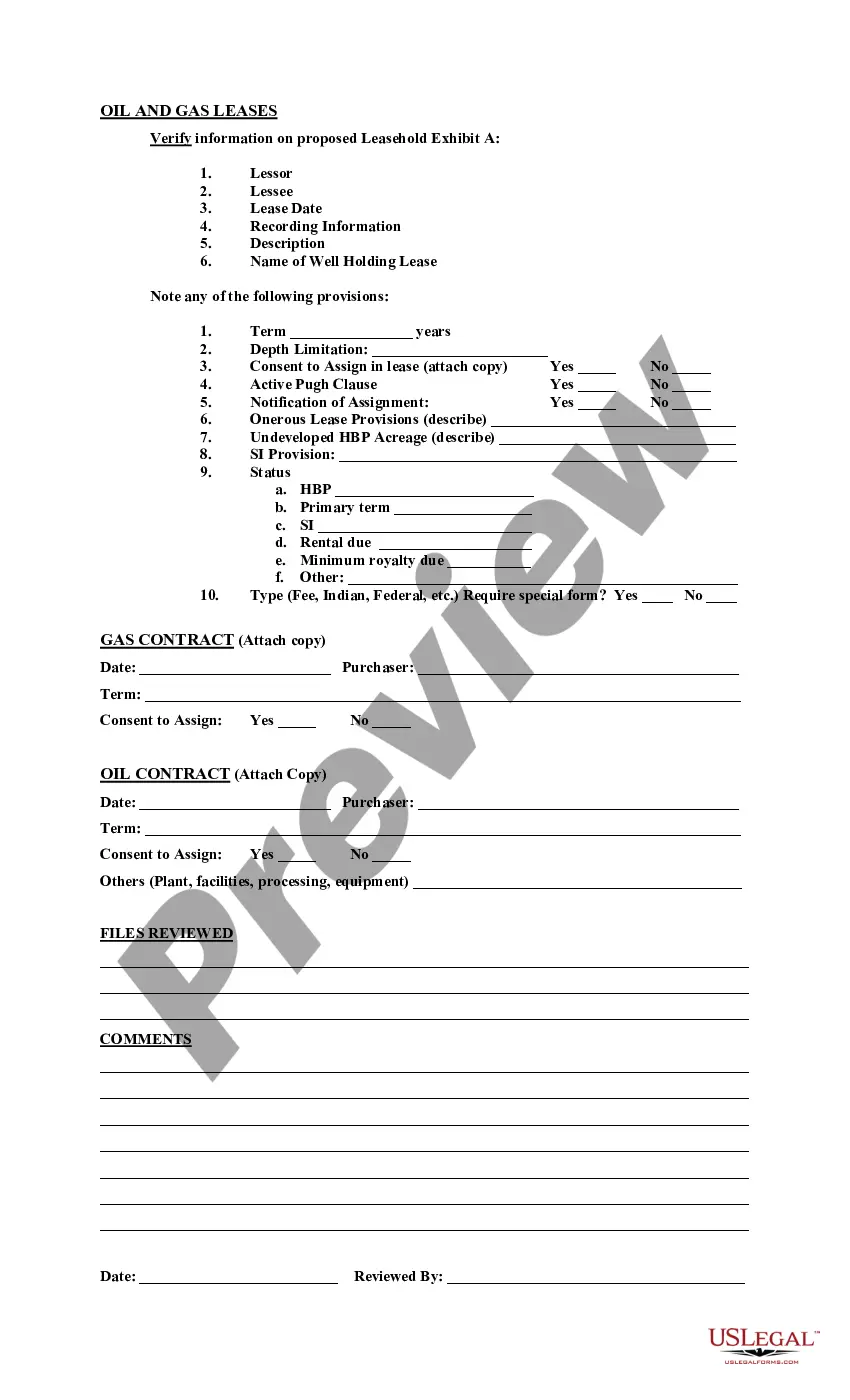

Hillsborough Florida Acquisition Due Diligence Report: A Comprehensive Examination of Property Investment Introduction: The Hillsborough Florida Acquisition Due Diligence Report is a critical tool used by potential property buyers to analyze and assess the feasibility, risks, and potential value of real estate investments in Hillsborough County, Florida. This report provides a detailed evaluation of various aspects, including legal, financial, environmental, and physical considerations, ensuring a well-informed decision-making process. Types of Hillsborough Florida Acquisition Due Diligence Reports: 1. Legal Due Diligence Report: This type of report focuses on verifying the legal aspects of a property, including title deeds, ownership rights, existing liens, zoning regulations, land usage restrictions, and permits. It ensures the buyer's legal protection and identifies any potential legal complications. 2. Financial Due Diligence Report: Financial due diligence aims to evaluate the financial viability of a property acquisition. It involves a thorough examination of financial records, cash flow statements, existing mortgages, leases, tax documentation, and any potential financial risks associated with the property. This report assists investors in understanding the property's profitability and potential return on investment. 3. Environmental Due Diligence Report: This report focuses on assessing potential environmental risks and liabilities associated with the property. It investigates the presence of hazardous materials, soil contamination, improper waste disposal, or any environmental factors that may impact the property's value or future development plans. It also evaluates compliance with environmental regulations and helps identify potential cleanup costs and future liabilities. 4. Physical Due Diligence Report: The physical due diligence report examines the current condition of the property, evaluating its structural integrity, building codes compliance, and any necessary repairs or maintenance requirements. It covers evaluations of electrical systems, plumbing, HVAC, roofing, and overall infrastructure. This report helps buyers assess the physical risks and potential renovation costs. Key Components of a Hillsborough Florida Acquisition Due Diligence Report: 1. Executive Summary: An overview of the report's findings, highlighting key risks, potential value, and recommendations. 2. Property Description: A detailed description of the property, including its location, size, proposed use, and any notable features. 3. Legal and Ownership Analysis: Verification of the property title, ownership history, existing liens or encumbrances, and compliance with local zoning regulations. 4. Financial Evaluation: Analysis of financial records, including rental income, expenses, property taxes, insurance, and potential risks or opportunities for financial growth. 5. Environmental Assessment: Identification of any potential environmental hazards, such as asbestos, lead, mold, or soil contamination, along with an evaluation of compliance with environmental regulations. 6. Physical Inspection and Condition Assessment: A thorough examination of the property's physical condition, including the building's structure, infrastructure, utilities, and any necessary repairs or maintenance requirements. Conclusion: The Hillsborough Florida Acquisition Due Diligence Report provides comprehensive insights into various aspects of a property acquisition, including legal, financial, environmental, and physical considerations. By conducting a thorough analysis using the specific due diligence reports mentioned above, investors can make informed decisions, mitigate risks, and maximize the potential value of their real estate investments in Hillsborough County, Florida.

Hillsborough Florida Acquisition Due Diligence Report

Description

How to fill out Hillsborough Florida Acquisition Due Diligence Report?

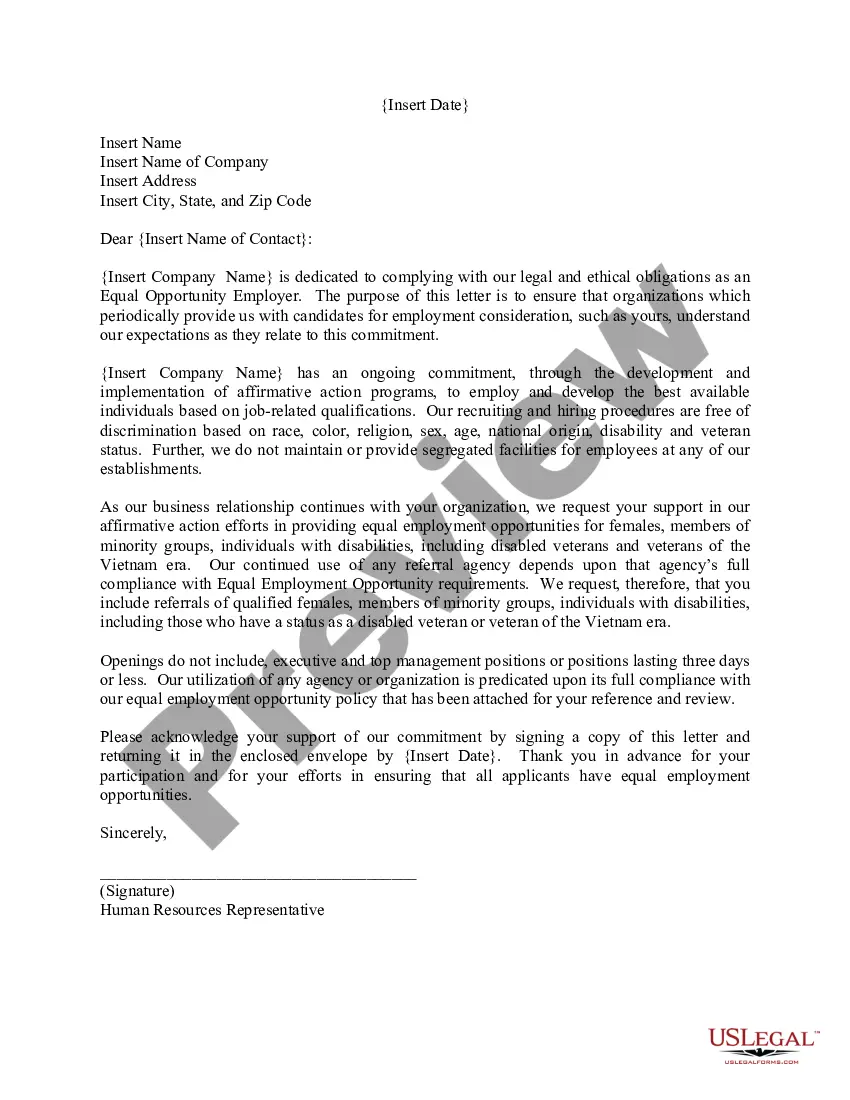

Whether you plan to start your company, enter into a deal, apply for your ID update, or resolve family-related legal issues, you need to prepare specific documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business occurrence. All files are collected by state and area of use, so picking a copy like Hillsborough Acquisition Due Diligence Report is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of additional steps to get the Hillsborough Acquisition Due Diligence Report. Follow the guidelines below:

- Make sure the sample fulfills your individual needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to get the sample once you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Hillsborough Acquisition Due Diligence Report in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you can access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!