Kings New York Acquisition Due Diligence Report is a comprehensive evaluation document that provides detailed information and analysis regarding the financial, legal, and operational aspects of a potential acquisition in the New York market. This report is essential for prospective buyers to gain a clear understanding of the target company's current status, risks, and opportunities. The primary goal of Kings New York Acquisition Due Diligence Report is to help buyers make informed decisions by uncovering any potential issues or red flags that might affect the success of the acquisition. The report covers various key aspects, including financial statements, contracts and legal agreements, outstanding liabilities, intellectual property, operational processes, human resources, sales and marketing strategies, and market analysis. In terms of different types, Kings New York Acquisition Due Diligence Report can be categorized based on the buyer's specific requirements and the complexity of the target company. For instance, there are standard due diligence reports that cover the basics of the target company's financial and legal standing. These reports are suitable for relatively straightforward acquisitions. On the other hand, there are specialized due diligence reports that focus on specific industries or sectors. These reports delve deeper into industry-specific regulations, market trends, customer base analysis, and competitive landscape. Such reports are particularly beneficial for buyers looking to acquire companies operating in highly regulated sectors, like healthcare or finance. Another type of Kings New York Acquisition Due Diligence Report is a forensic due diligence report. This report involves a meticulous investigation and examination of financial records, transactions, and potential misconduct within the target company. Forensic due diligence reports are necessary when there are suspicions of fraudulent activities or irregularities in the financial statements. Overall, Kings New York Acquisition Due Diligence Report plays a vital role in the acquisition process, minimizing risks and ensuring a well-informed decision-making process. It enables buyers to assess the value, potential, and risks associated with the acquisition, thereby positioning them for successful negotiations and post-acquisition integration.

Kings New York Acquisition Due Diligence Report

Description

How to fill out Kings New York Acquisition Due Diligence Report?

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Kings Acquisition Due Diligence Report, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for different life and business scenarios. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Kings Acquisition Due Diligence Report from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Kings Acquisition Due Diligence Report:

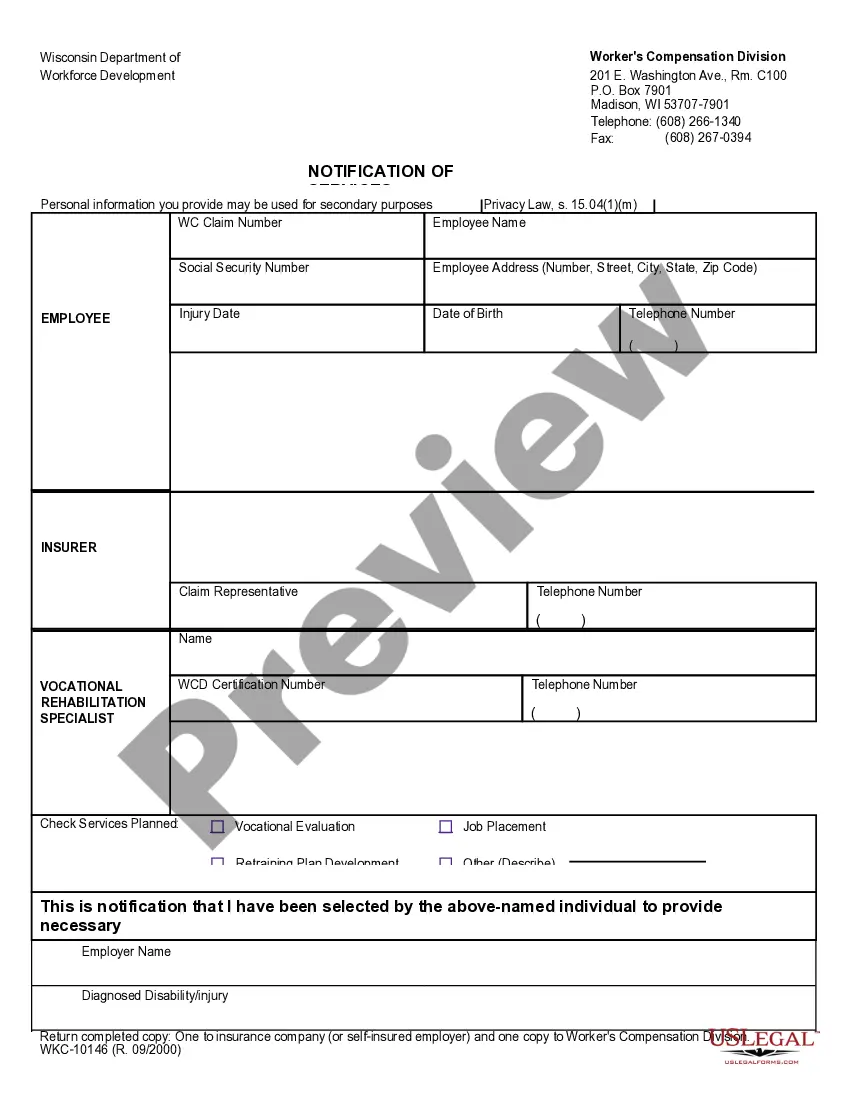

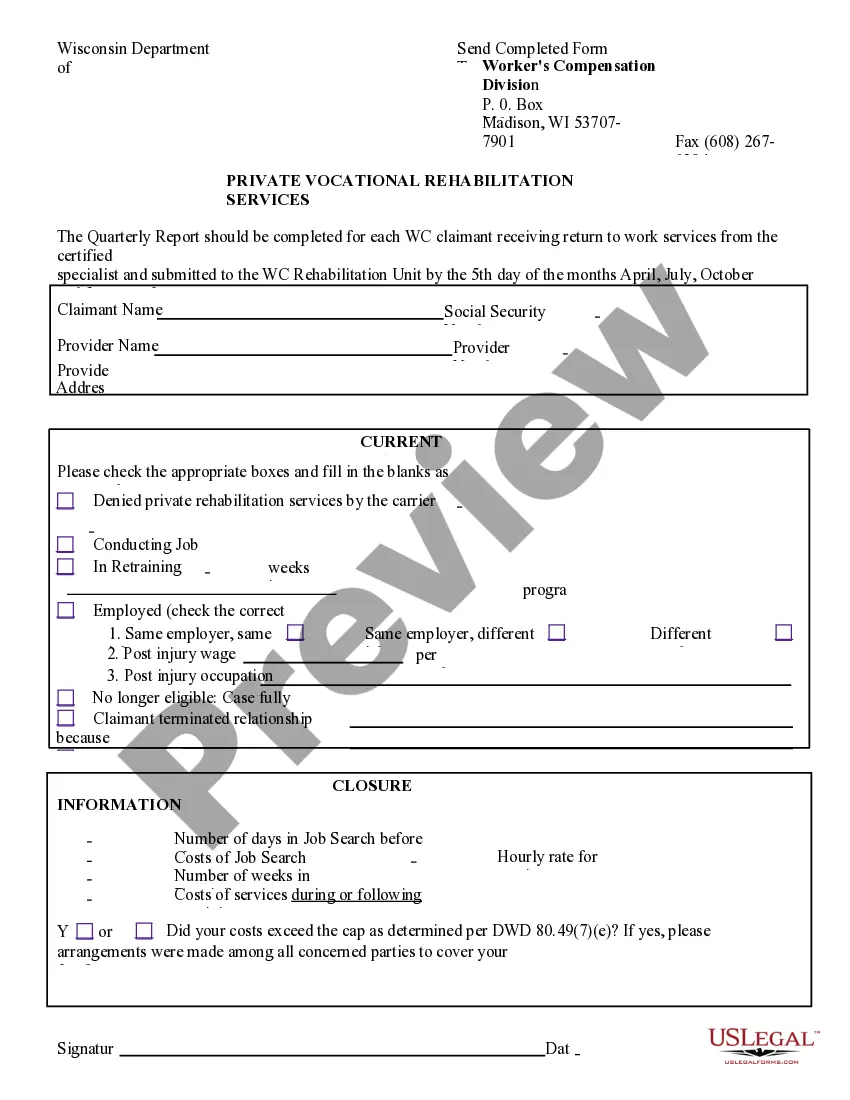

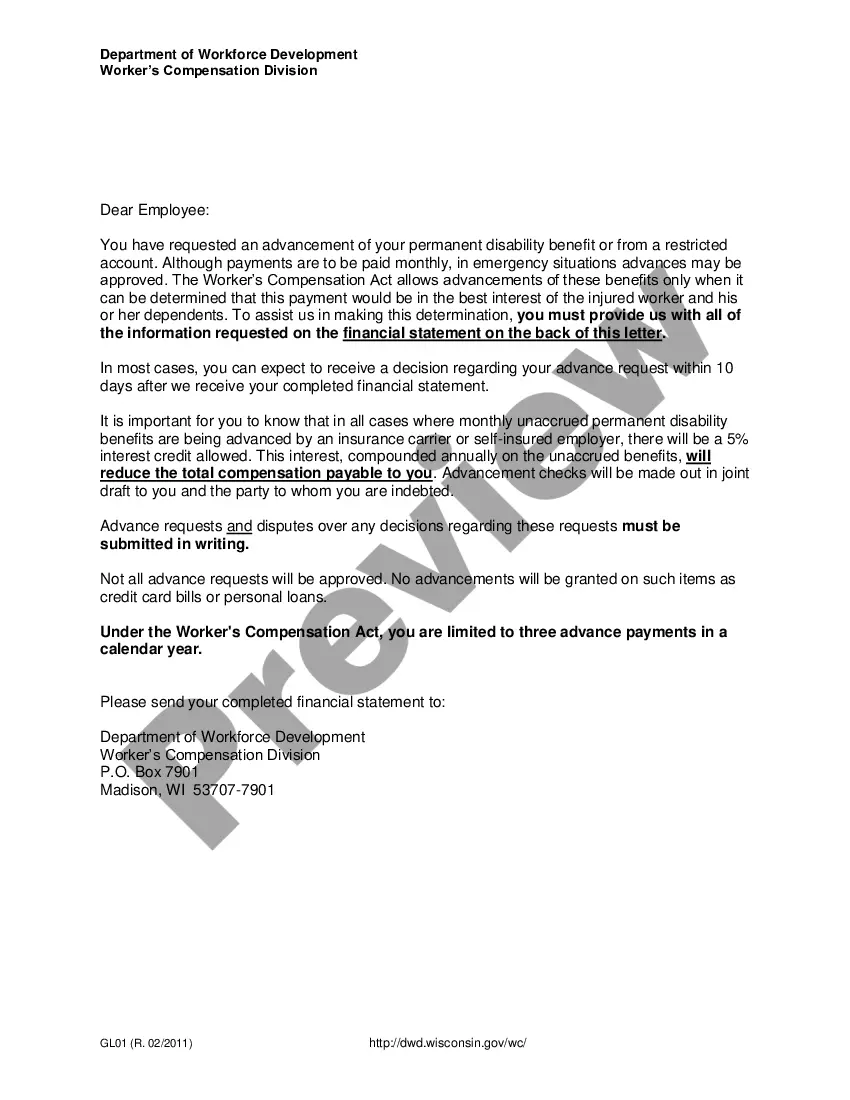

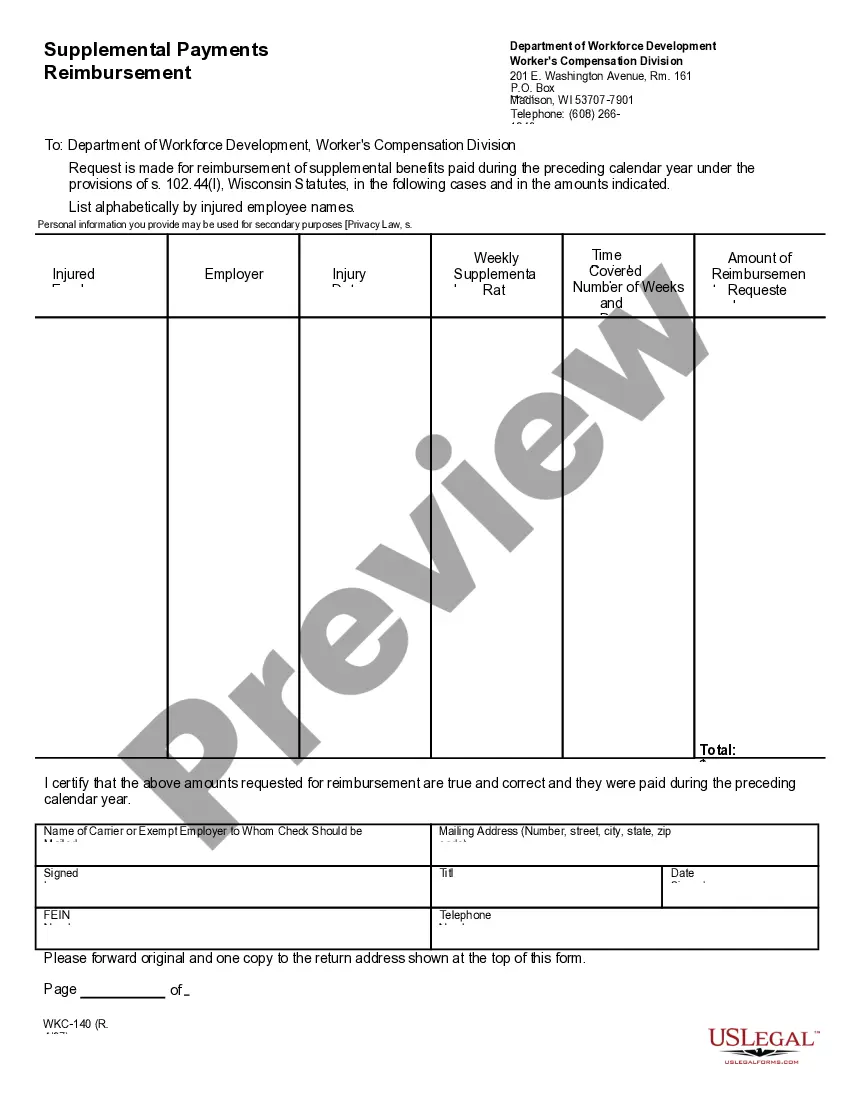

- Examine the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the template once you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!