San Diego California Acquisition Due Diligence Report is a comprehensive assessment conducted during a business merger or acquisition process in the San Diego region. This report provides detailed insights and analysis to potential buyers, investors, or stakeholders to evaluate the true value and risks associated with the target company or property. The San Diego California Acquisition Due Diligence Report encompasses various aspects, including financial, legal, operational, and environmental factors. It aims to ascertain the validity of the financial data provided by the target company, identify potential legal liabilities or litigation, assess the efficiency of operations, and determine any environmental risks or compliance issues. Key components of this report include but are not limited to: 1. Financial Due Diligence: This analysis involves an in-depth review of the target company's financial records, including audited financial statements, tax returns, debt obligations, revenue details, profitability, cash flow, and risk assessment. It assists in identifying any accounting irregularities, understated liabilities, or potential financial risks. 2. Legal Due Diligence: This investigation aims to uncover any legal issues, pending litigation, contractual obligations, intellectual property rights, regulatory compliance, and licenses held by the target company. It assists in determining the legal risks associated with the acquisition and assessing the legal framework within which the business operates. 3. Operational Due Diligence: This element examines the target company's operations, including its business model, production processes, supply chain management, customer contracts, employee matters, and competitive analysis. It helps identify any operational inefficiencies, contingent liabilities, or dependencies that may impact the future performance of the business. 4. Environmental Due Diligence: This investigation focuses on evaluating the environmental impact of the target company's operations, potential liabilities related to pollution, hazardous waste management, adherence to environmental regulations, and any pending lawsuits or violations. It assists in understanding the potential risks and costs associated with environmental compliance and cleanup. Types of San Diego California Acquisition Due Diligence Reports may include industry-specific reports. For instance, a real estate acquisition due diligence report would also encompass property-specific assessments, including property condition assessments, zoning regulations, lease agreements, property valuation, and potential tax or environmental considerations. In conclusion, the San Diego California Acquisition Due Diligence Report provides a comprehensive evaluation of a target company, aiming to mitigate risks, identify opportunities, and ensure informed decision-making during mergers or acquisitions. It serves as a crucial tool for potential buyers, investors, or stakeholders to understand the true value and potential pitfalls associated with acquiring a business or property in San Diego, California.

San Diego California Acquisition Due Diligence Report

Description

How to fill out San Diego California Acquisition Due Diligence Report?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare formal paperwork that varies throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. Here, you can easily locate and download a document for any individual or business objective utilized in your region, including the San Diego Acquisition Due Diligence Report.

Locating forms on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the San Diego Acquisition Due Diligence Report will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to obtain the San Diego Acquisition Due Diligence Report:

- Ensure you have opened the correct page with your local form.

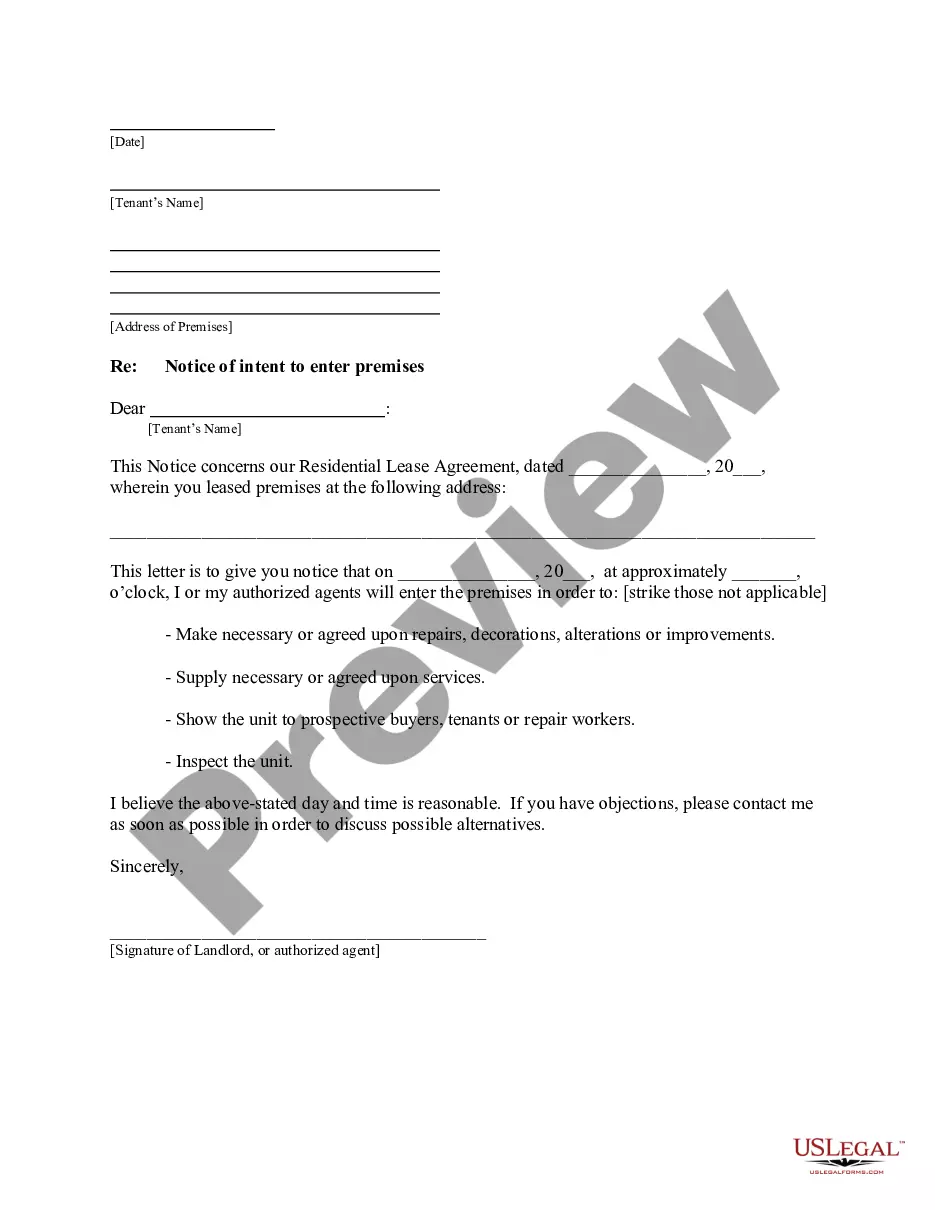

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template meets your needs.

- Search for another document using the search tab if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the San Diego Acquisition Due Diligence Report on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!