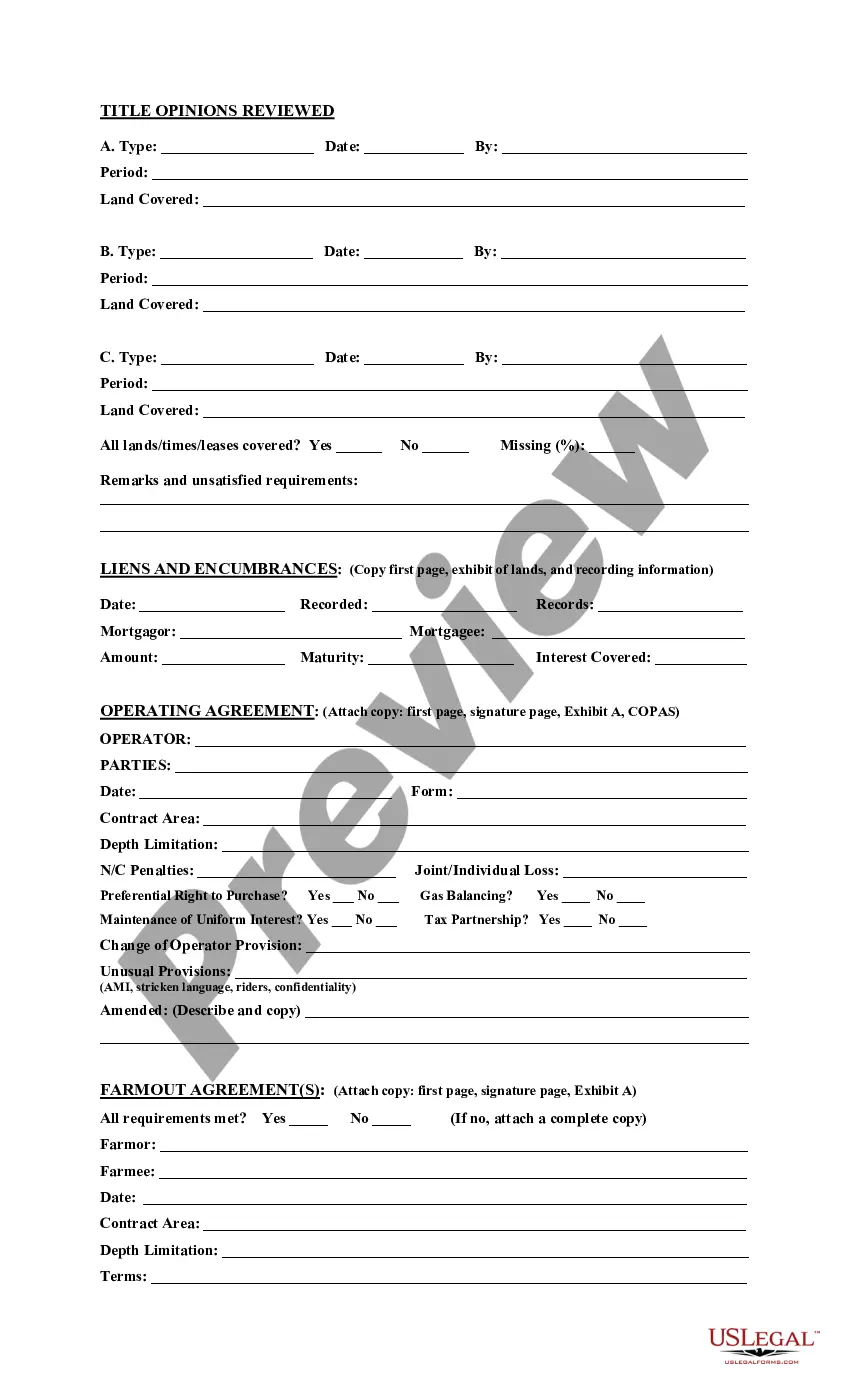

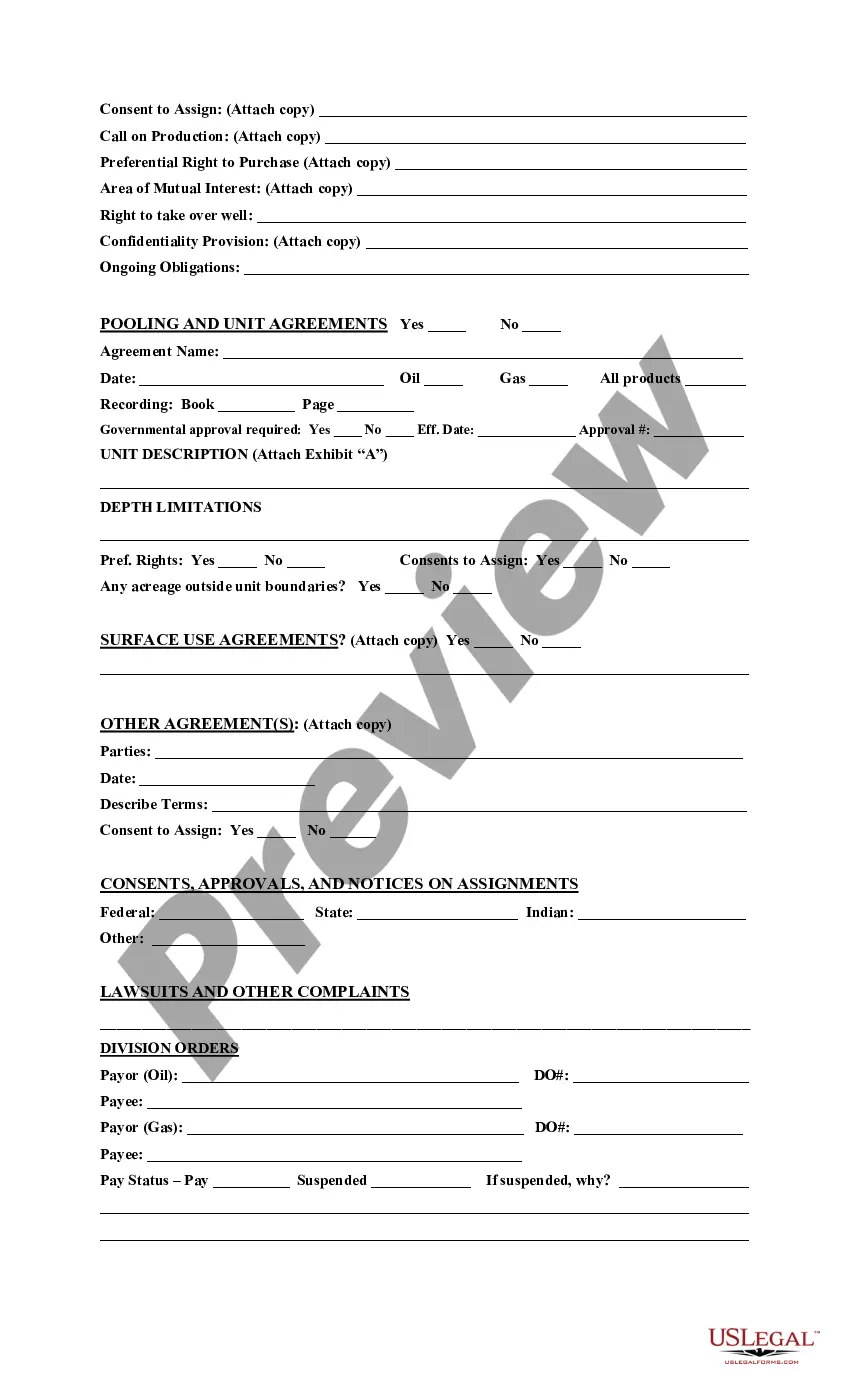

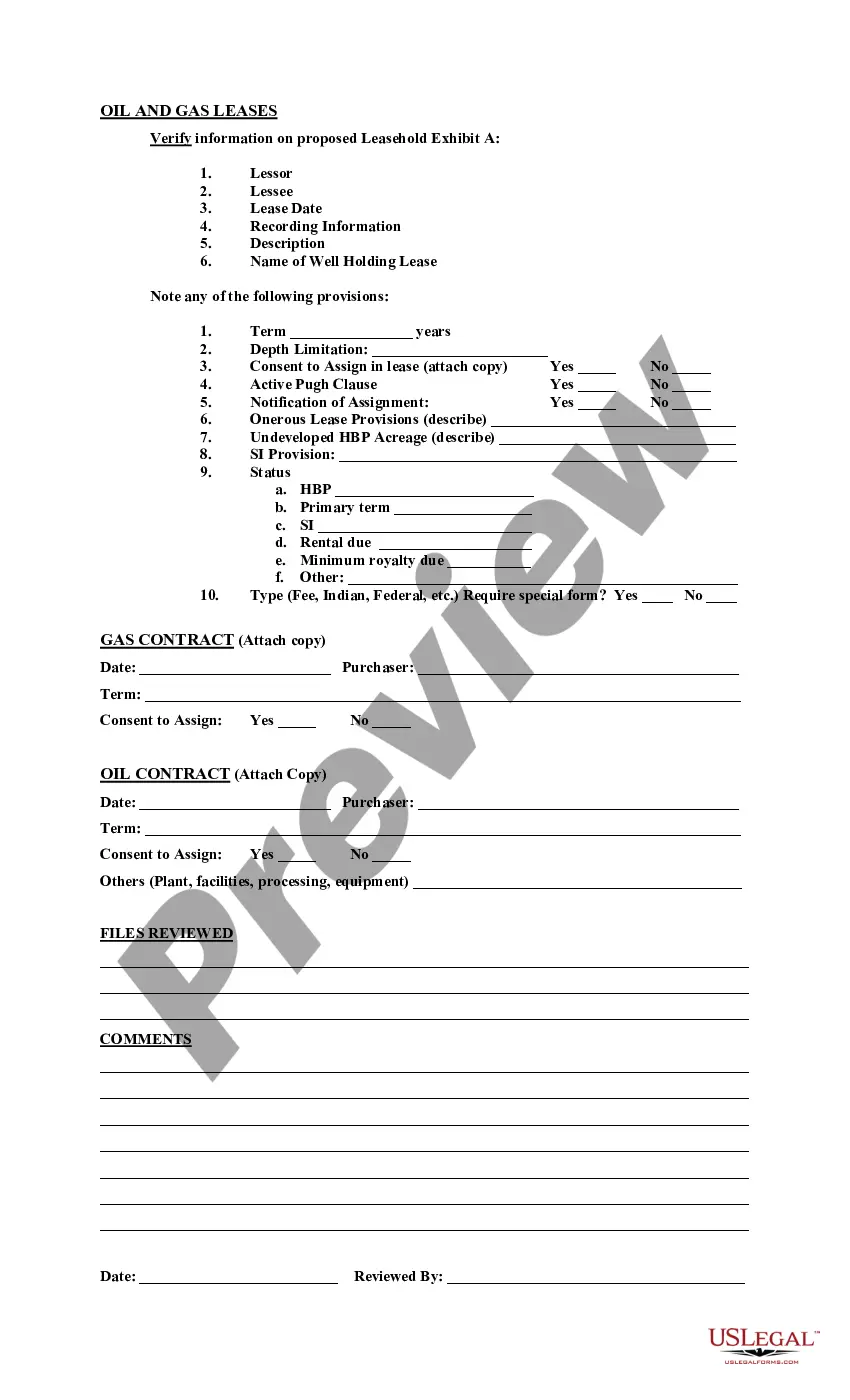

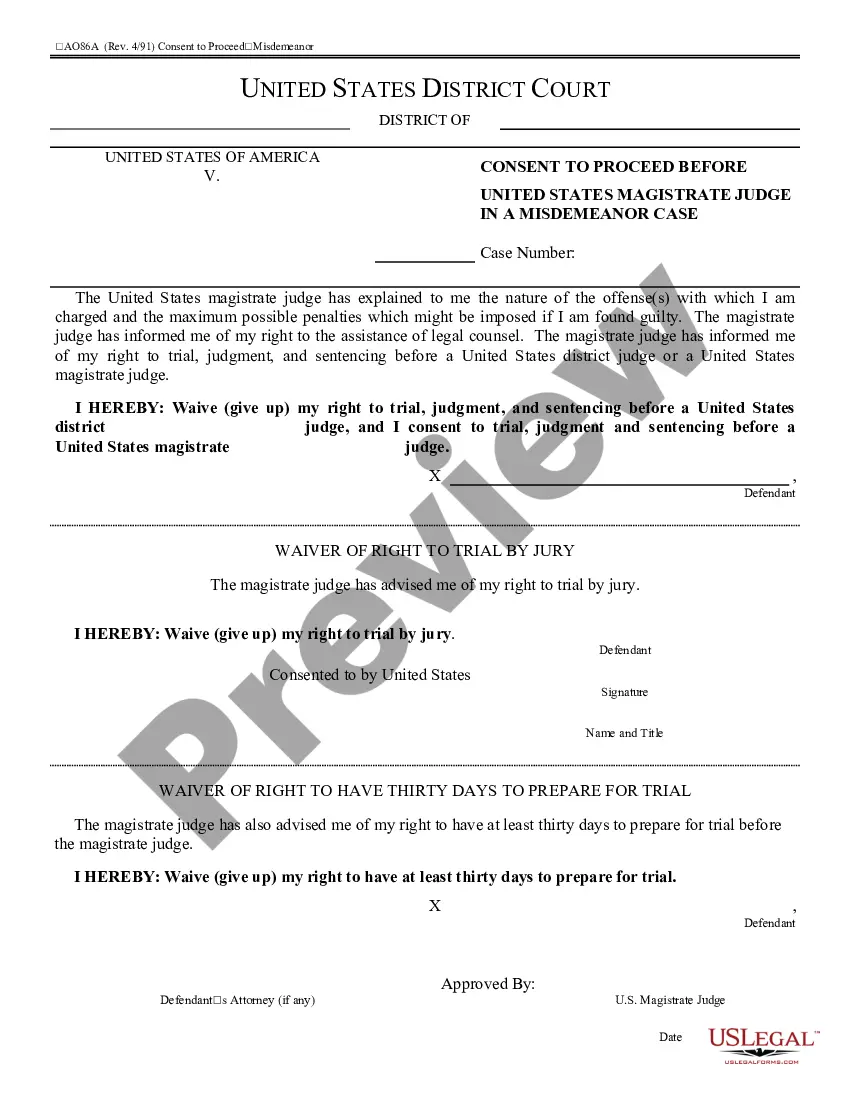

Suffolk New York Acquisition Due Diligence Report is an essential document that provides a comprehensive assessment of a potential business acquisition in Suffolk County, New York. This report aims to analyze and evaluate various aspects of the target company to assist investors, buyers, and stakeholders in making informed decisions. The Suffolk New York Acquisition Due Diligence Report examines multiple key areas to ensure a thorough evaluation. It scrutinizes the financial statements, including income statements, balance sheets, and cash flow statements, to assess the company's financial health, performance, and profitability. This analysis helps identify any red flags or potential risks associated with the target company's financials. Furthermore, this report also delves into the operational aspects of the business being acquired. It examines the target company's organizational structure, operational processes and efficiencies, market positioning, competitive analysis, and potential growth opportunities. By evaluating these operational factors, the Suffolk New York Acquisition Due Diligence Report provides a holistic view of the target company's current and future prospects. In addition, this report assesses the legal and regulatory compliance of the target company. It examines any pending litigation, contractual agreements, licenses, permits, or intellectual property rights held by the business. The due diligence report ensures that the acquisition complies with all applicable laws, regulations, and industry standards, minimizing legal risks for the buyers. Different types of Suffolk New York Acquisition Due Diligence Reports may include: 1. Financial Due Diligence Report: Focuses primarily on the target company's financial statements, performance, profitability, and cash flow analysis. 2. Operational Due Diligence Report: Emphasizes the operational aspects of the business, including organizational structure, market analysis, growth opportunities, and competitive assessment. 3. Legal Due Diligence Report: Concentrates on the target company's legal and regulatory compliance, including pending litigation, contracts, licenses, and intellectual property rights. 4. Tax Due Diligence Report: Evaluates the target company's tax filings, liabilities, and potential tax benefits associated with the acquisition. 5. Commercial Due Diligence Report: Analyzes the target company's customer base, market trends, competitive landscape, and potential synergies with the acquiring company. Each type of due diligence report provides a different perspective on the acquisition, enabling the buyers to make informed decisions based on their specific priorities and objectives. Overall, the Suffolk New York Acquisition Due Diligence Report is an in-depth investigation that covers financial, operational, legal, and commercial aspects of a potential business acquisition. It serves as a valuable resource for stakeholders involved in the acquisition process, offering comprehensive insights to support strategic decision-making and risk mitigation.

Suffolk New York Acquisition Due Diligence Report

Description

How to fill out Suffolk New York Acquisition Due Diligence Report?

Laws and regulations in every sphere differ throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Suffolk Acquisition Due Diligence Report, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals looking for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you obtain a sample, it remains available in your profile for future use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Suffolk Acquisition Due Diligence Report from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Suffolk Acquisition Due Diligence Report:

- Take a look at the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the document once you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!