Harris Texas Due Diligence Memorandum Based on Files Examined is a comprehensive document that provides a thorough assessment of the examined files to ensure the accuracy and completeness of information related to business transactions, legal matters, real estate, and more. This memorandum plays a crucial role in assessing risks, uncovering potential issues, and making informed decisions during due diligence processes. The Harris Texas Due Diligence Memorandum encompasses a range of file examinations, which may vary depending on the specific purpose and nature of the due diligence. These can be categorized into: 1. Financial Due Diligence Memorandum: This type of memorandum scrutinizes financial statements, accounting records, tax filings, and other financial documents to evaluate the financial health of a business or property. It includes analysis of income statements, balance sheets, cash flow statements, and key financial ratios. Potential risks or discrepancies such as underreported income, inflated expenses, hidden liabilities, or irregularities in financial records are highlighted. 2. Legal Due Diligence Memorandum: This memorandum delves into legal documents such as contracts, agreements, intellectual property records, litigation history, permits, and licenses. It aims to identify any legal issues or concerns related to ownership, contractual obligations, zoning regulations, pending litigation, or potential intellectual property infringements. Additionally, it assesses the compliance of the entity or property with relevant laws and regulations. 3. Environmental Due Diligence Memorandum: The examination of environmental records, reports, and assessments falls under this memorandum. It aims to identify any potential environmental risks, compliance issues with environmental regulations, hazardous material storage or disposal concerns, or other factors that may affect the property, business, or surrounding areas. Any prior contamination incidents, violations, or pending environmental litigation are properly documented. 4. Compliance Due Diligence Memorandum: This memorandum focuses on assessing an entity's compliance with regulations, industry standards, and internal policies. It examines internal control systems, corporate governance procedures, anti-money laundering measures, data protection protocols, and other relevant compliance frameworks. Identified weaknesses or gaps in compliance are reported, along with recommendations to address them. The Harris Texas Due Diligence Memorandum Based on Files Examined is a detailed and structured report that compiles findings, observations, and recommended actions resulting from the diligent examination of files. It provides an essential resource for stakeholders, potential investors, and decision-makers to evaluate risks, negotiate deals, and make well-informed choices in the context of Harris Texas business transactions.

Harris Texas Due Diligence Memorandum Based on Files Examined

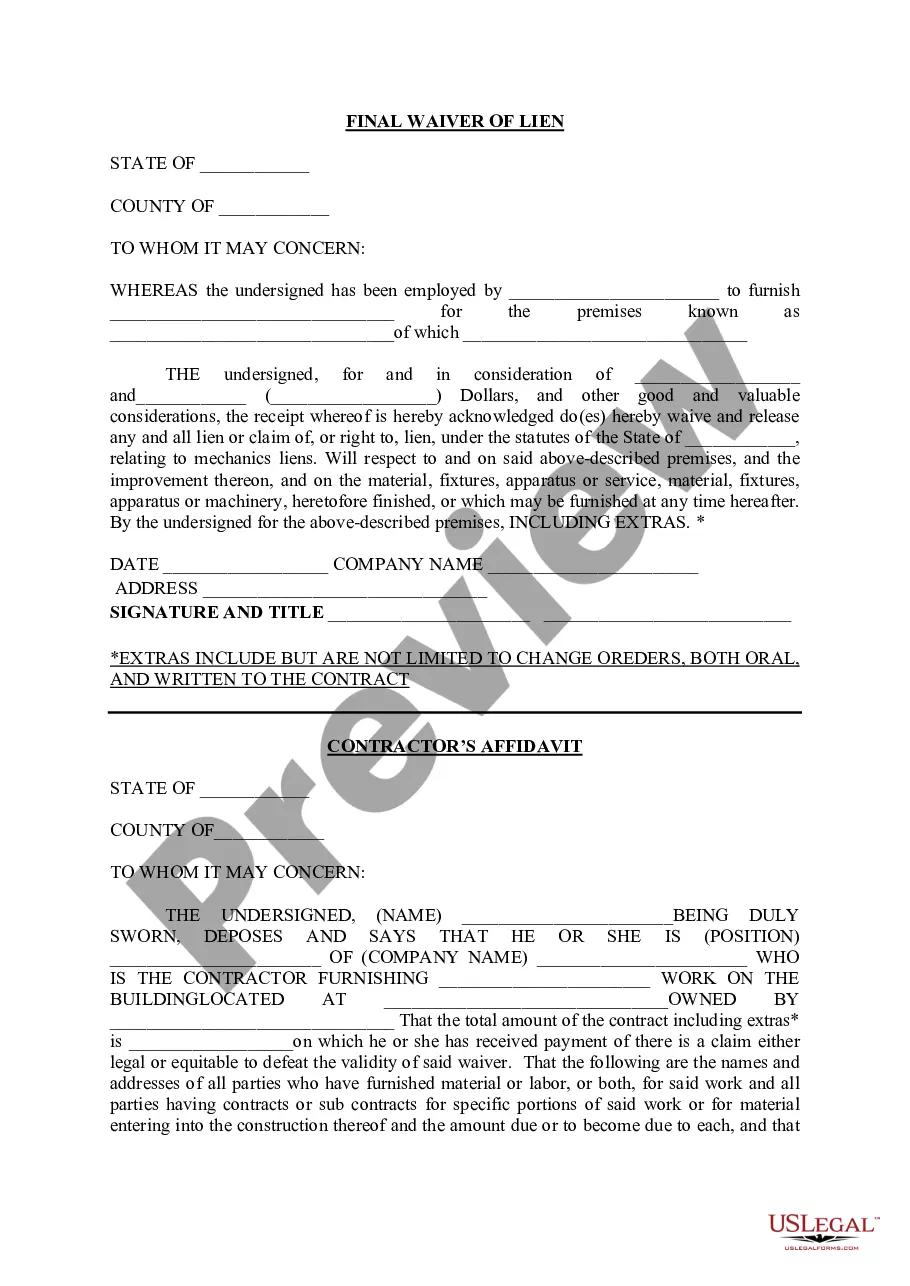

Description

How to fill out Harris Texas Due Diligence Memorandum Based On Files Examined?

Drafting papers for the business or individual demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to generate Harris Due Diligence Memorandum Based on Files Examined without expert help.

It's possible to avoid spending money on lawyers drafting your paperwork and create a legally valid Harris Due Diligence Memorandum Based on Files Examined by yourself, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary form.

If you still don't have a subscription, follow the step-by-step guide below to get the Harris Due Diligence Memorandum Based on Files Examined:

- Look through the page you've opened and check if it has the document you require.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that meets your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any situation with just a few clicks!