Orange California Due Diligence Memorandum Based on Files Examined

Description

How to fill out Orange California Due Diligence Memorandum Based On Files Examined?

Drafting papers for the business or individual needs is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to create Orange Due Diligence Memorandum Based on Files Examined without professional help.

It's possible to avoid wasting money on attorneys drafting your paperwork and create a legally valid Orange Due Diligence Memorandum Based on Files Examined on your own, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary document.

In case you still don't have a subscription, adhere to the step-by-step instruction below to get the Orange Due Diligence Memorandum Based on Files Examined:

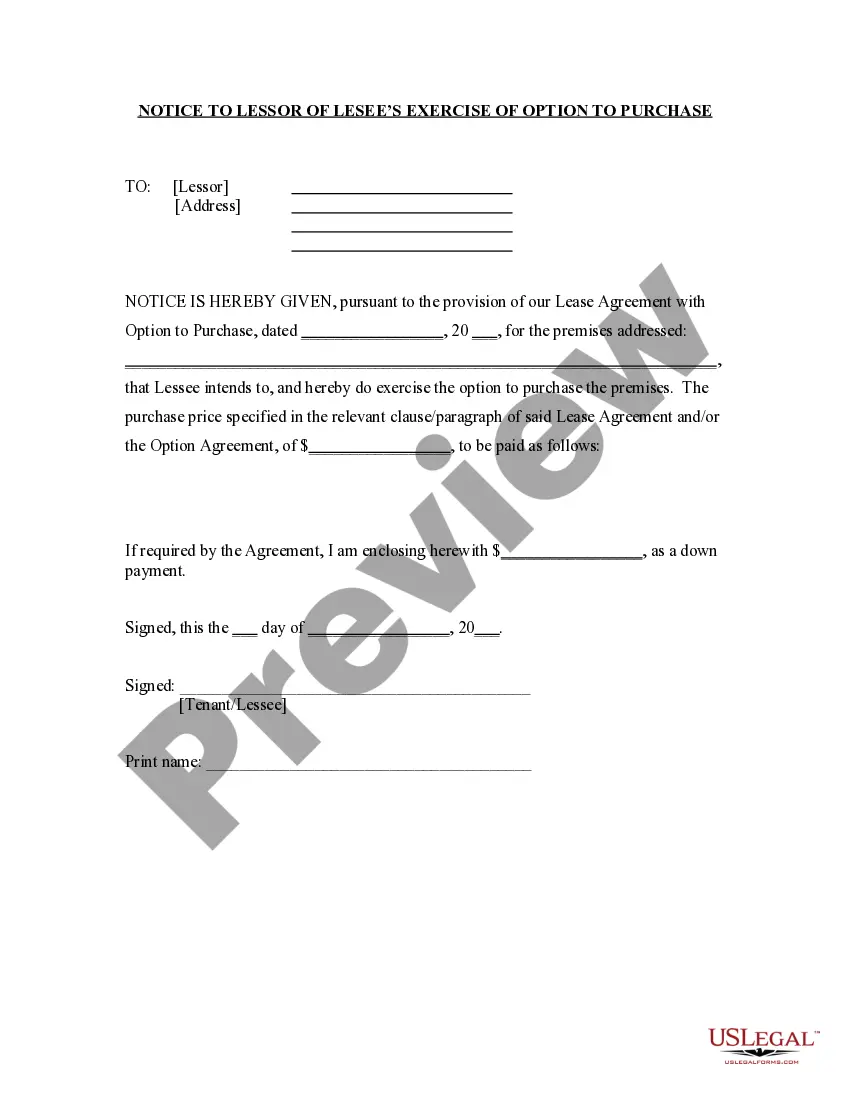

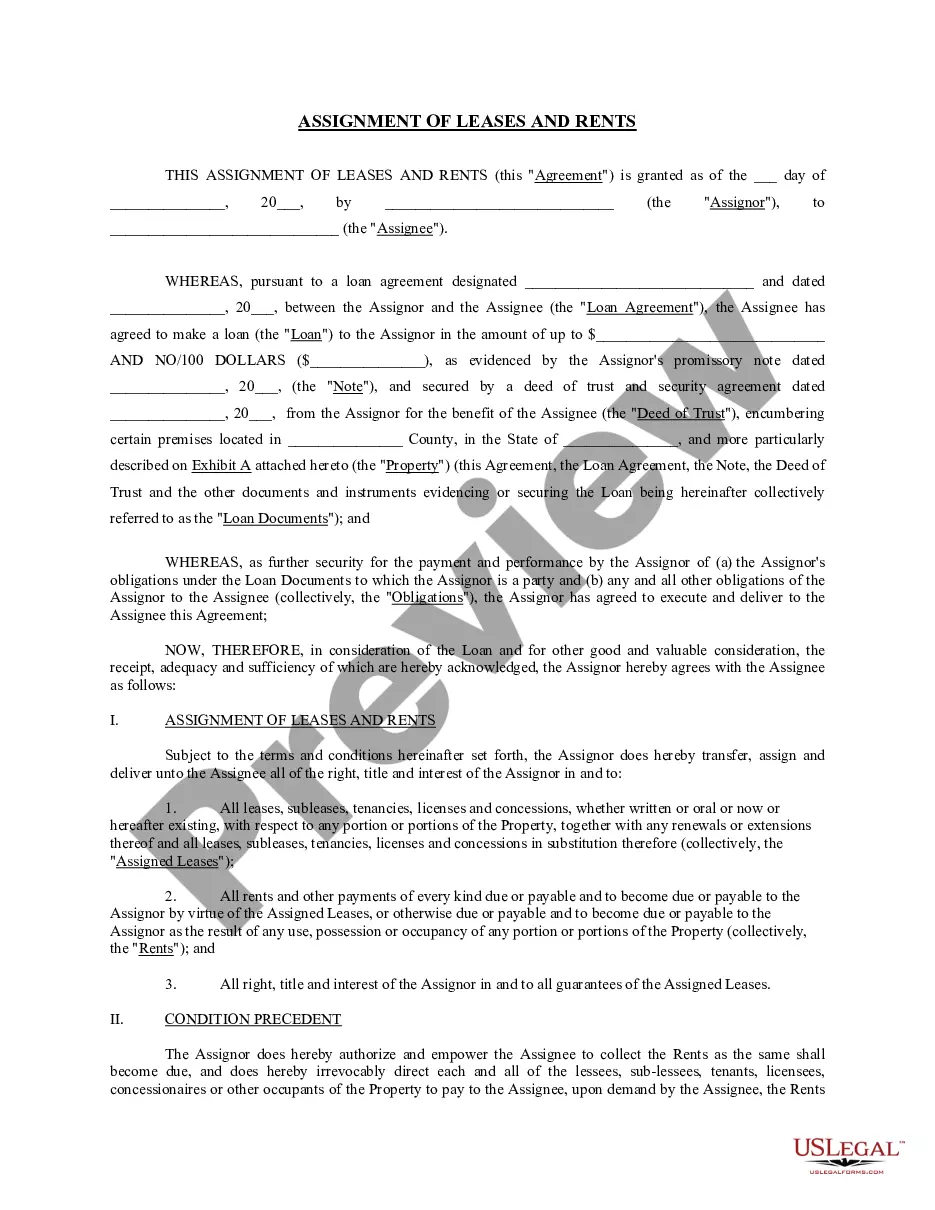

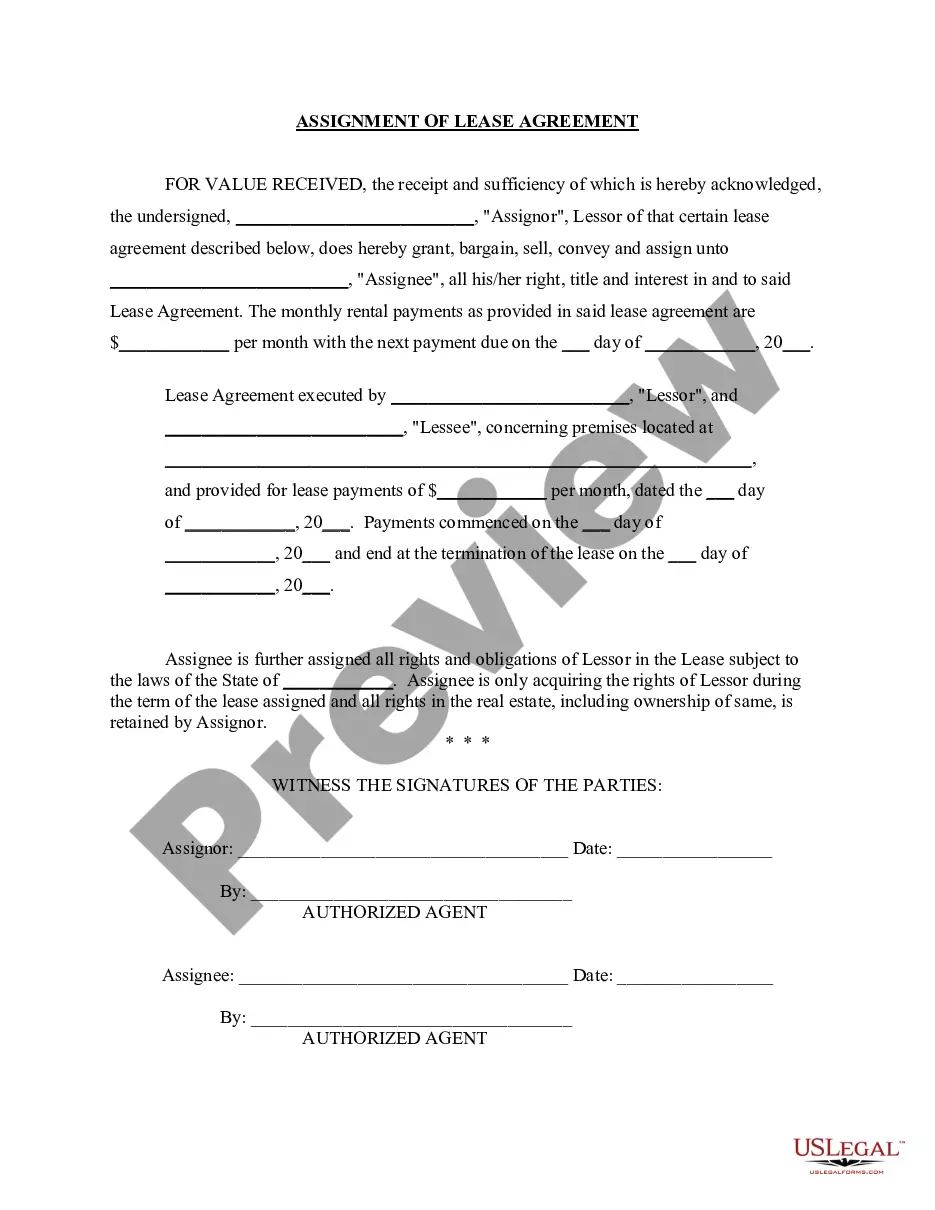

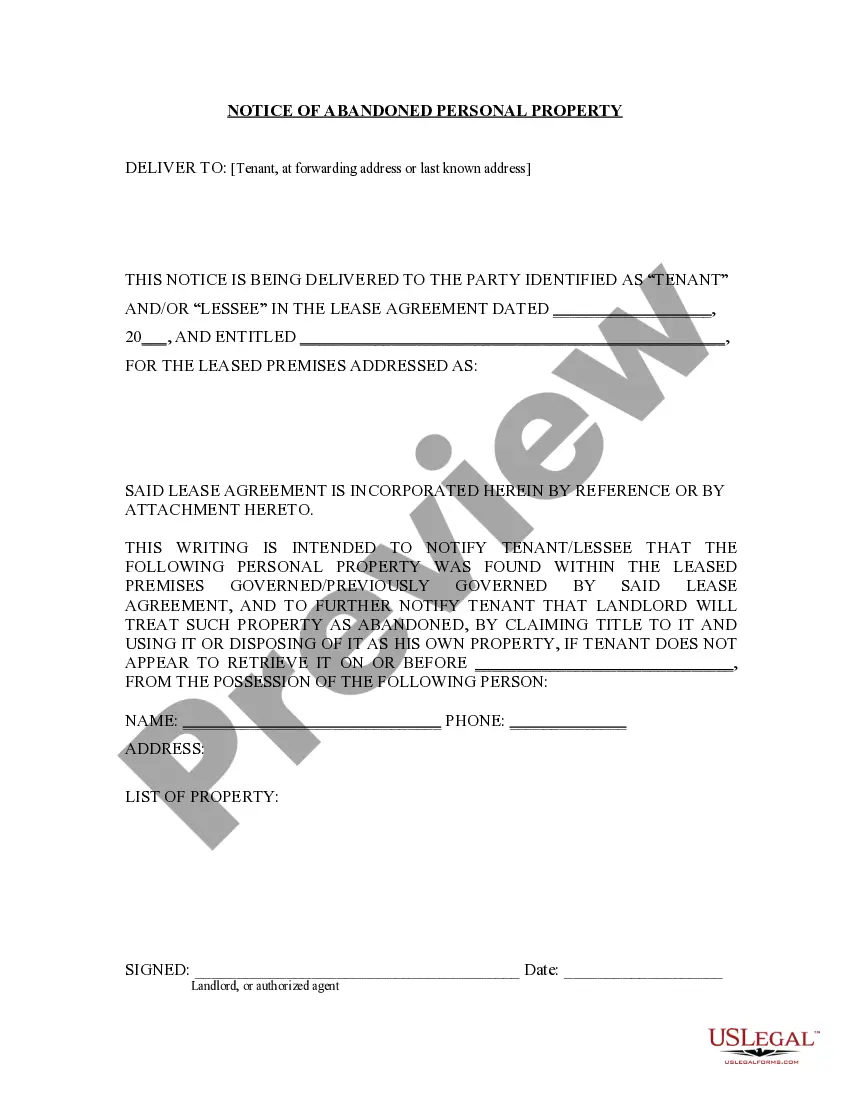

- Look through the page you've opened and check if it has the document you require.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that meets your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any use case with just a couple of clicks!

Form popularity

FAQ

A due diligence checklist is an organized way to analyze a company. The checklist will include all the areas to be analyzed, such as ownership and organization, assets and operations, the financial ratios, shareholder value, processes and policies, future growth potential, management, and human resources.

Step 1: Company Capitalization.Step 2: Revenue, Margin Trends.Step 3: Competitors and Industries.Step 4: Valuation Multiples.Step 5: Management and Ownership.Step 6: Balance Sheet Exam.Step 7: Stock Price History.Step 8: Stock Options and Dilution.

Sample Due Diligence Request List Formation documents and operating agreements. Detailed ownership information and member register. Details of any other investment or ownership interest in any other entity held by the company.

Here is some practical advice to running a smooth due diligence process: 2022 Start early.2022 Let someone who knows what they're doing manage the process.2022 Use a secure, online data room. 2022 Be complete.2022 Keep the information updated.2022 Maintain an updated master list.2022 Be patient.

Types of Due Diligence Financial Due Diligence. Review business strategy.Accounting Due Diligence. Ensure compliance with relevant accounting rules and policies.Tax Due Diligence. Analyze current tax position.Legal Due Diligence. Assess balance sheet and off-balance sheet liabilities and potential risks.

Focus on five financial due diligence factors Power of customers. Start by understanding the borrower's target market.Power of suppliers. Likewise, identify the companies that a borrower purchases raw materials and resources from.Competition.Ease of entry.Product substitution.

It's a process of verifying, investigating, and auditing a potential deal or investment opportunity to corroborate facts, financial information, and other pertinent data. People and organizations perform due diligence in many areas, including the sales of securities, IPOs, private equity funding, and real estate.

The complete list of due diligence documents to be collected Shareholder certificate documents. Local/state/federal business licenses. Occupational license. Building permits documents. Zonal and land use permits. Tax registration documents. Power of attorney documents. Previous or outstanding legal cases.

There are seven necessary steps to conduct effective IT due diligence. Step 1: Initiate.Step 2: Prepare.Step 3: Conduct the on-site discovery.Step 4: Discovery defines the issues.Step 5: Analyze the information and prioritize your initiatives.Step 6: Develop an IT due diligence report.

Due Diligence Activities in an M&A Transaction Target Company Overview. Understanding why the owners of the company are selling the business Financials.Technology/Patents.Strategic Fit.Target Base.Management/Workforce.Legal Issues.Information Technology.