Wake North Carolina Limited Title Opinion is a legal document that provides a detailed examination and analysis of the title to a specific piece of real estate located in Wake County, North Carolina. This opinion is typically prepared by an attorney or a professional title examiner who specializes in real estate law. The purpose of a Limited Title Opinion is to provide an evaluation and assessment of the current ownership status and any potential defects or encumbrances on the property's title. It is often requested by potential buyers, lenders, or other parties involved in a real estate transaction to determine the property's marketability and the risks associated with its ownership. The Wake North Carolina Limited Title Opinion involves conducting a thorough examination of public records, including deeds, mortgages, liens, judgments, easements, and other relevant documents that affect the property's title. The title examiner reviews these records to identify any potential issues, such as conflicting ownership claims, undisclosed interests, unpaid taxes, or legal judgments against the property. The Limited Title Opinion includes a detailed analysis of the findings, outlining potential defects and encumbrances that may impact the property's title. It may also provide recommendations or requirements for resolving identified issues, such as obtaining releases or waivers from previous lien holders, obtaining probate on a deceased owner's estate, or curing title defects through legal means. In Wake North Carolina, there may be different types of Limited Title Opinions based on the specific requirements of the requesting party: 1. Buyer's Limited Title Opinion: This opinion is requested by a potential buyer to assess the marketability of the property's title before completing a real estate purchase. 2. Lender's Limited Title Opinion: Lenders often request this type of opinion to evaluate the risks associated with lending money for the purchase or refinancing of a property. It helps them ensure that the property serves as sufficient collateral for the loan. 3. Refinancing Limited Title Opinion: When a property owner seeks to refinance an existing mortgage, a Limited Title Opinion is often required by the new lender to verify the property's title status and any potential issues that may affect the refinancing process. 4. Attorney's Limited Title Opinion: Attorneys may also request this opinion on behalf of their clients as part of legal representation in various real estate matters, such as land disputes or estate planning. In summary, a Wake North Carolina Limited Title Opinion provides a comprehensive assessment of a property's title to determine its marketability and identify any potential issues or encumbrances. It serves as a crucial document in real estate transactions to ensure the protection of buyers, lenders, and other parties involved in the transfer of property ownership.

Wake North Carolina Limited Title Opinion

Description

How to fill out Wake North Carolina Limited Title Opinion?

Laws and regulations in every sphere differ around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Wake Limited Title Opinion, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

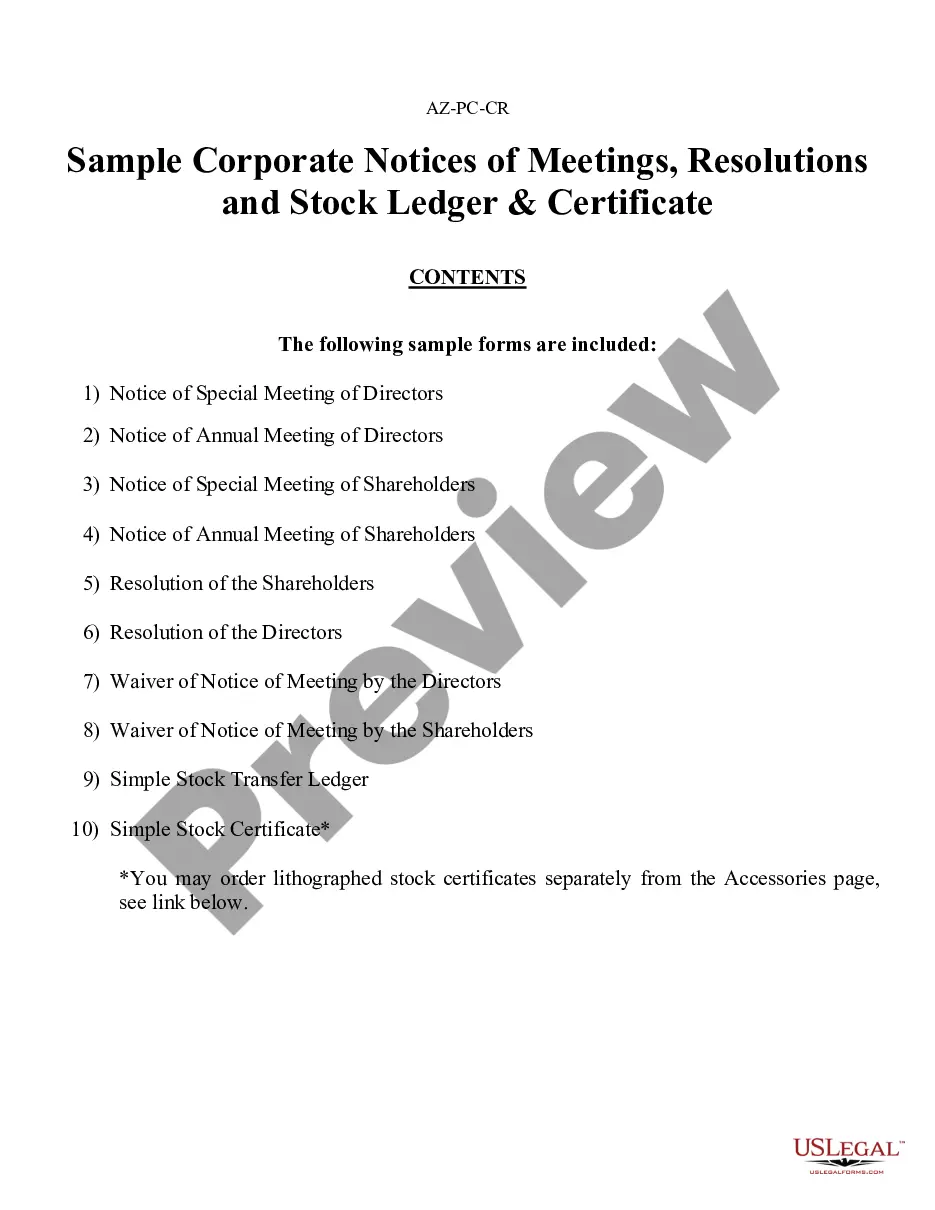

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals looking for do-it-yourself templates for various life and business situations. All the documents can be used many times: once you pick a sample, it remains available in your profile for further use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Wake Limited Title Opinion from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Wake Limited Title Opinion:

- Examine the page content to ensure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document when you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

1. ROB. Received On Board + 1 variant. Gas, Exploration.

A stipulation of interest is a contract that consists of mutual conveyances, and therefore, it must conform to the requirements of both a contract and conveyance. This requires the affiant to state all facts necessary to establish inheritance of a decedent's real estate as well as proportional interest.

Drilling Title Opinions are sometimes referred to as Original Title Opinions. Drilling Title Opinions identify the rightful mineral owners and determine which mineral owners have been properly leased or remain unleased.

Acquisitions and Divestitures (A&D) are a part of the asset allocation strategy for oil and gas companies and are constantly evaluated on both a short and long-term basis. Oil and gas companies seek to acquire assets that maximize core competencies and increase shareholder value.

Another type of title opinion is the Division Order Title Opinion (DOTO). A DOTO sets forth the ownership of production from an existing well, and serves as the basis for preparing division orders.

POP. Possible Oil Production. Petrochemicals, Oil & Gas Services, Gas.

To look at a deed you can: Go to your Register of Deeds Office and look at the document there. Find your Register of Deeds in: Your phone book under county government. The NC Directory of State and County Officials:Look it up online. Many counties have their real property (land) records online. Go to the county website.

A cloud on title is a claim or encumbrance that affects the ownership of a property. These claims or encumbrances can arise from easements or mortgages on the land. They can also arise from a defect in a deed or a lien that may yield title to a third party such as mechanic's liens.

An oil and gas title abstractor performs research to define the ownership of the land used for oil and gas extraction. You investigate both land ownership and mineral and gas rights. Your responsibilities include searching public records to find evidence of possession.

The routine title search made in North Carolina usually covers a period of from twenty to forty years. If the title is to be insured, minimum search of sixty years is usually required.