Chicago Illinois Post Acquisition Opinion: Providing In-depth Insights on Mergers and Takeovers Chicago, Illinois, renowned as a dynamic hub of business and finance, offers an array of post-acquisition opinions that provide comprehensive analysis and expert evaluation of mergers and takeovers. These opinions delve into various aspects, such as financial performance, strategic fit, market implications, and potential synergies for companies involved in acquisitions and post-acquisition integration processes. 1. Financial Evaluation: Chicago Illinois Post Acquisition Opinion meticulously examines the financial outcomes of the acquisition, including financial statements' analysis, profitability trends, debt burden, cash flow patterns, and the impact of the acquisition on the consolidated financial position. Key indicators, such as return on investment (ROI), earnings per share (EPS), and debt-to-equity ratio, are explored to gauge the financial health and potential growth prospects of the acquiring company. 2. Strategic Assessment: These opinions focus on assessing the strategic alignment between the acquiring company and the target business. By analyzing market positioning, competitive landscape, customer base, and product portfolio, Chicago Illinois Post Acquisition Opinion evaluates the potential synergies, opportunities for cross-selling, and diversification benefits resulting from the transaction. Additionally, industry trends, market growth potential, and regulatory considerations are examined to determine the long-term viability of the acquisition strategy. 3. Operational Integration: Chicago Illinois Post Acquisition Opinion thoroughly reviews the integration process of operations, systems, and processes post-acquisition. This analysis gauges the effectiveness of integration initiatives, identifies potential challenges, and suggests strategies to mitigate risks and maximize operational efficiencies. Areas of focus include supply chain integration, organizational restructuring, technology harmonization, and workforce alignment to ensure a smooth transition and successful synergy realization. 4. Stakeholder Analysis: These opinions assess the impact of the acquisition on various stakeholders, such as employees, customers, suppliers, and shareholders. Evaluating the potential cultural clashes, changes in management structure, employee morale, customer retention, and contractual agreements, Chicago Illinois Post Acquisition Opinion determines the overall stakeholder sentiment and provides recommendations to manage potential risks and maintain positive relationships. 5. Market Implications: Chicago Illinois Post Acquisition Opinion delves into the broader market implications resulting from the acquisition. This includes analyzing competitive shifts, market share changes, industry consolidation, and potential regulatory scrutiny for the acquiring company. Market opportunities and threats are identified to guide strategic decision-making in navigating the newly transformed market landscape. By providing a comprehensive analysis of financial, strategic, operational, stakeholder, and market elements, Chicago Illinois Post Acquisition Opinion assists companies in making informed decisions, mitigating risks, and optimizing the value generated from mergers and acquisitions. With its dynamic business ecosystem and a deep pool of expert analysts, Chicago Illinois offers a rich landscape for post-acquisition opinions, supporting companies in their pursuit of growth and success in the ever-evolving corporate world.

Chicago Illinois Post Acquisition Opinion

Description

How to fill out Chicago Illinois Post Acquisition Opinion?

Creating legal forms is a must in today's world. However, you don't always need to look for professional help to create some of them from the ground up, including Chicago Post Acquisition Opinion, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in different types varying from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching experience less overwhelming. You can also find detailed materials and tutorials on the website to make any tasks related to document execution simple.

Here's how to purchase and download Chicago Post Acquisition Opinion.

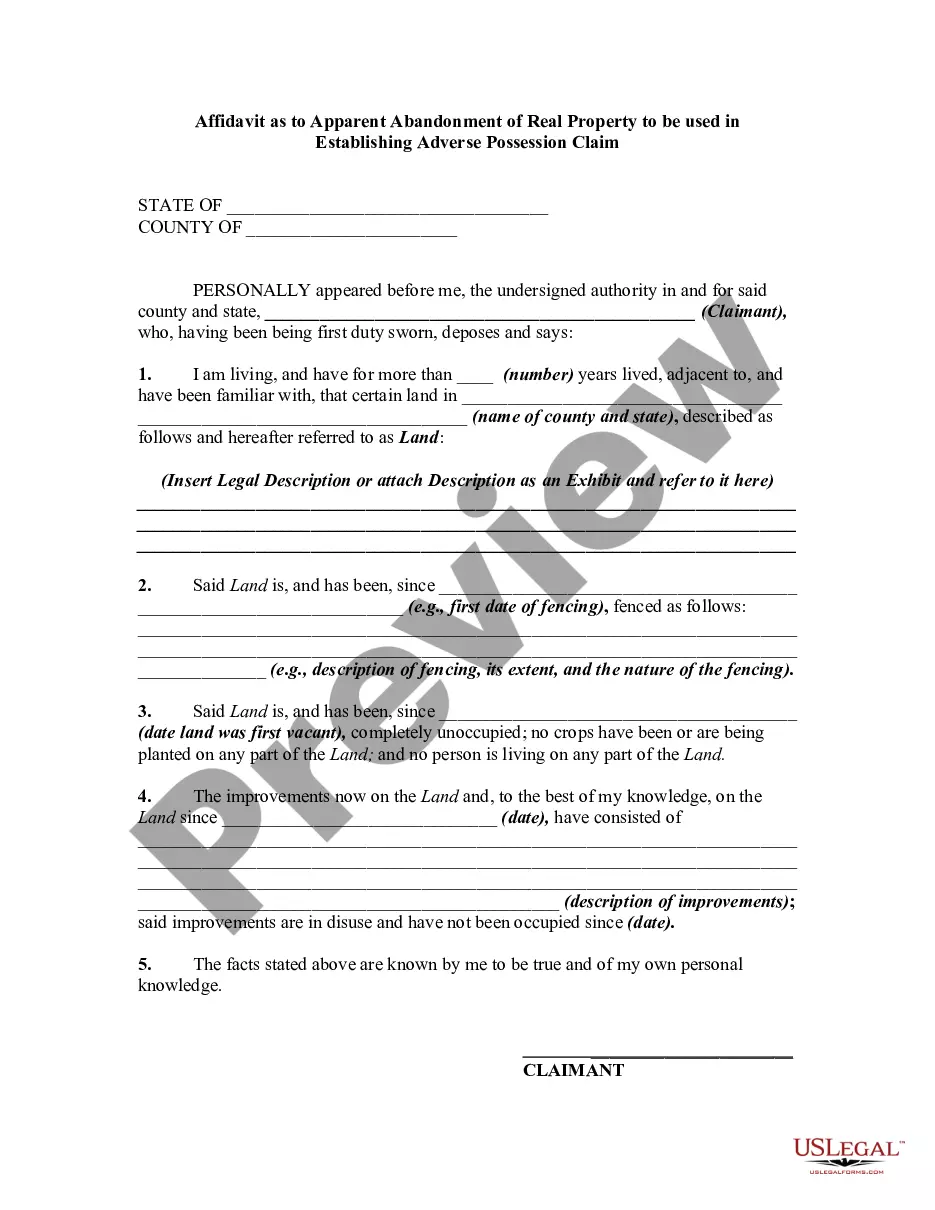

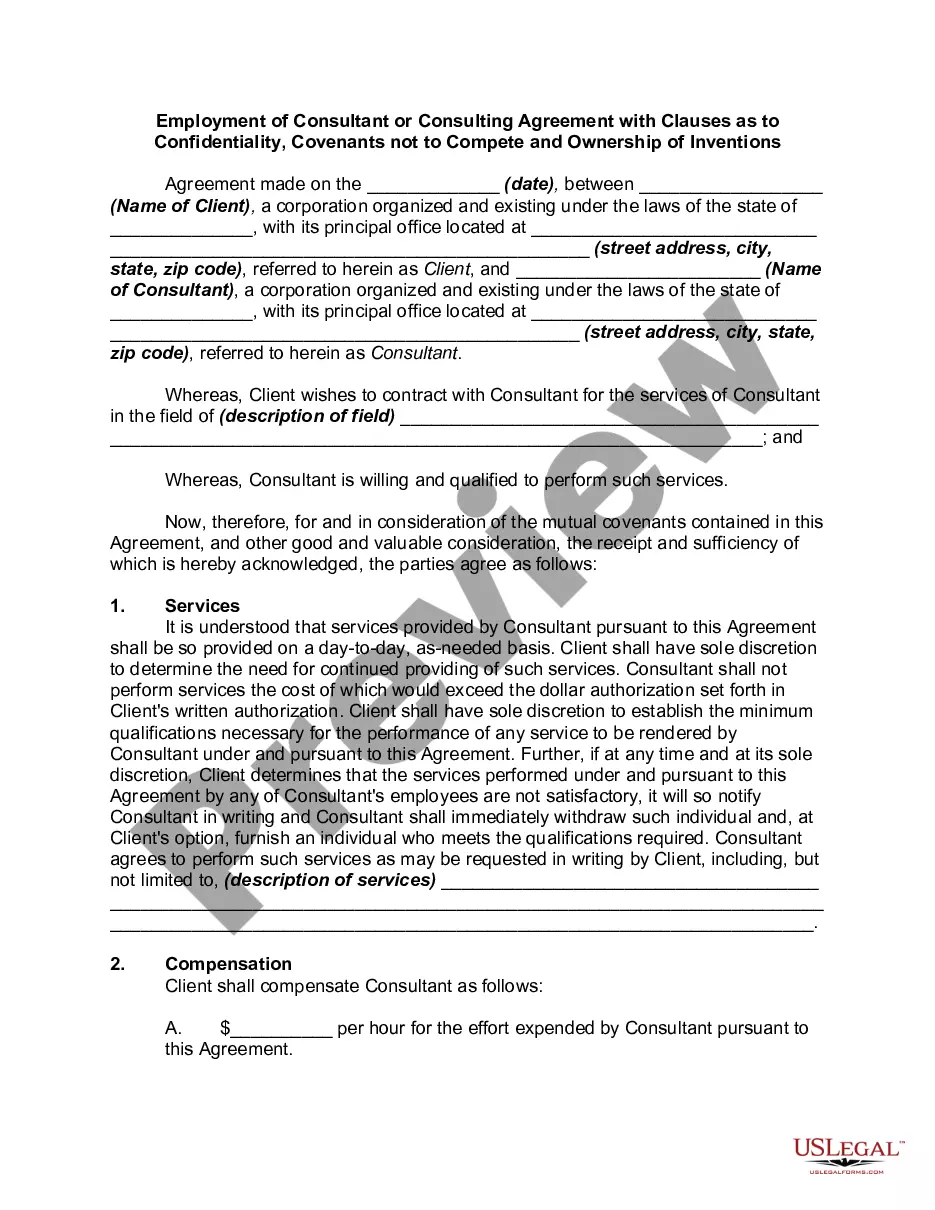

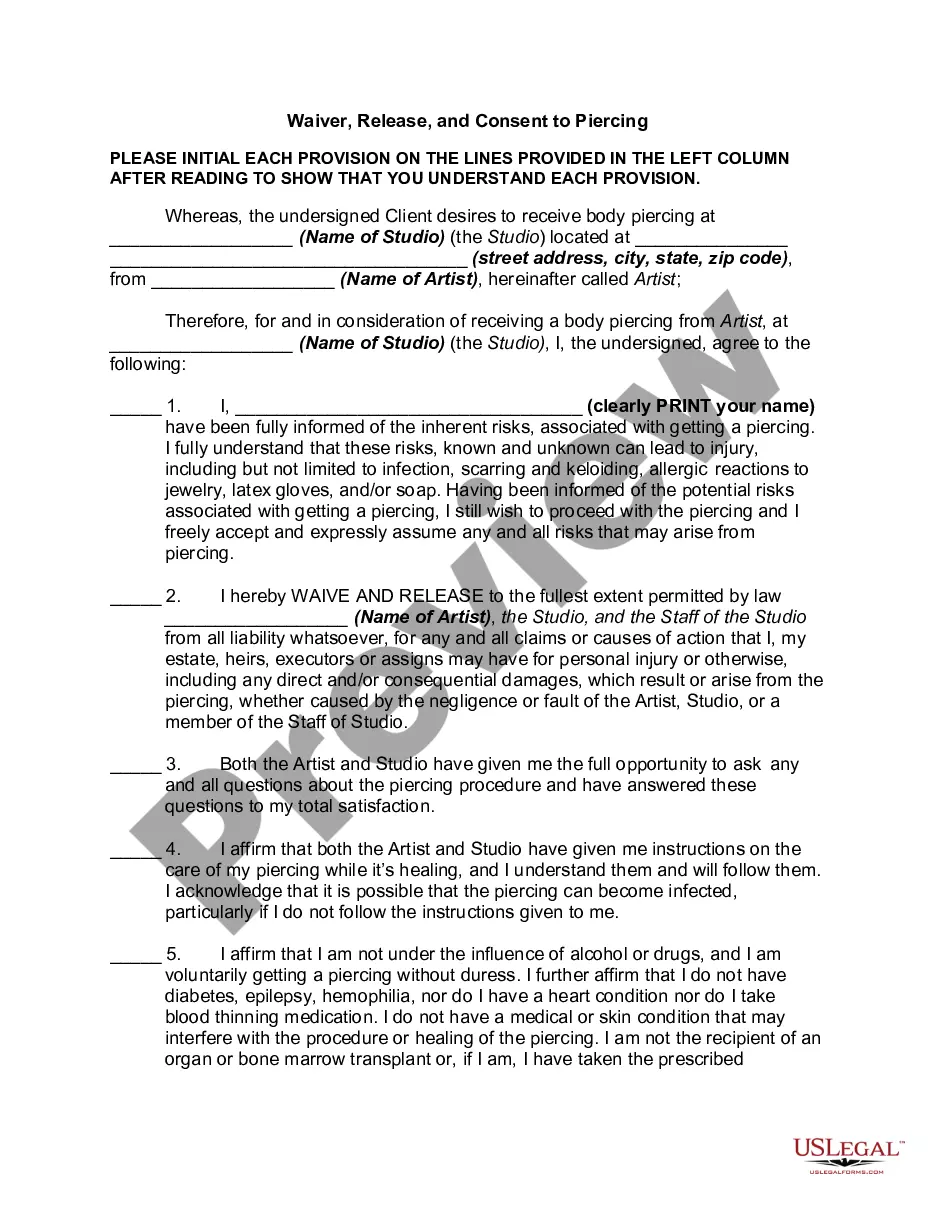

- Take a look at the document's preview and outline (if provided) to get a general information on what you’ll get after getting the document.

- Ensure that the document of your choosing is specific to your state/county/area since state regulations can impact the validity of some documents.

- Check the related forms or start the search over to find the correct file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment gateway, and buy Chicago Post Acquisition Opinion.

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Chicago Post Acquisition Opinion, log in to your account, and download it. Needless to say, our website can’t take the place of a legal professional entirely. If you have to cope with an exceptionally complicated case, we recommend getting an attorney to review your form before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of users. Become one of them today and purchase your state-compliant paperwork with ease!