Franklin Ohio Post Acquisition Opinion is a comprehensive evaluation and analysis of the performance, strengths, weaknesses, and potential of a company or organization following an acquisition in Franklin, Ohio. It involves assessing various aspects such as financial health, operational efficiency, market competitiveness, and strategic alignment. This opinion provides valuable insights to stakeholders, including investors, management teams, and board members, to make informed decisions regarding the acquisition's impact and future direction. Key aspects covered in Franklin Ohio Post Acquisition Opinion may include: 1. Financial Analysis: A detailed examination of the target company's financial statements, cash flow, profitability, and liquidity ratios is conducted. This helps determine the financial stability, overall health, and potential risks associated with the acquisition. 2. Operational Assessment: An evaluation of the company's operations is undertaken to assess its efficiency, productivity, and synergy with the acquiring entity. This includes analyzing production processes, supply chain management, quality control, and resource utilization. 3. Competitive Positioning: Understanding the competitive landscape is crucial to determine how the acquisition enhances or diminishes the combined entity's market position. Analysis of market share, customer base, and industry trends helps assess the target company's competitive advantages and challenges. 4. Management Evaluation: The strength and compatibility of the management team are crucial for successful post-acquisition integration. An assessment of key executives, their skills, experience, and potential alignment with the acquiring organization's culture and goals is conducted. 5. Strategic Fit: This examines whether the acquisition aligns with the acquiring company's long-term strategy and goals. Evaluating compatibility in terms of products, services, target markets, and overall vision helps ascertain the potential for integration success. Types of Franklin Ohio Post Acquisition Opinions can vary based on the specific focus or purpose of the assessment. These may include: 1. Financial Post Acquisition Opinion: Primarily focuses on evaluating the financial stability, profitability, and growth potential of the target company post-acquisition. 2. Operational Post Acquisition Opinion: Concentrates on assessing the operational efficiency, cost structures, and integration challenges to determine the potential for operational improvements and synergies. 3. Strategic Post Acquisition Opinion: Reviews the strategic fit, alignment, and future prospects of the acquiring company with the acquired entity to gauge the overall value and benefits derived from the deal. 4. Cultural Post Acquisition Opinion: Focuses on evaluating the compatibility of organizational cultures, values, and work environments to understand potential challenges and opportunities for successful integration. In conclusion, Franklin Ohio Post Acquisition Opinion provides a detailed and comprehensive assessment of a company's performance following an acquisition in Franklin, Ohio. It includes analyzing financial, operational, competitive, management, and strategic aspects to help stakeholders make informed decisions and ensure successful integration. Various types of opinions can be tailored to address specific areas of interest, such as financial, operational, strategic, or cultural aspects.

Franklin Ohio Post Acquisition Opinion

Description

How to fill out Franklin Ohio Post Acquisition Opinion?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask an attorney to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Franklin Post Acquisition Opinion, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case gathered all in one place. Consequently, if you need the recent version of the Franklin Post Acquisition Opinion, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Franklin Post Acquisition Opinion:

- Glance through the page and verify there is a sample for your region.

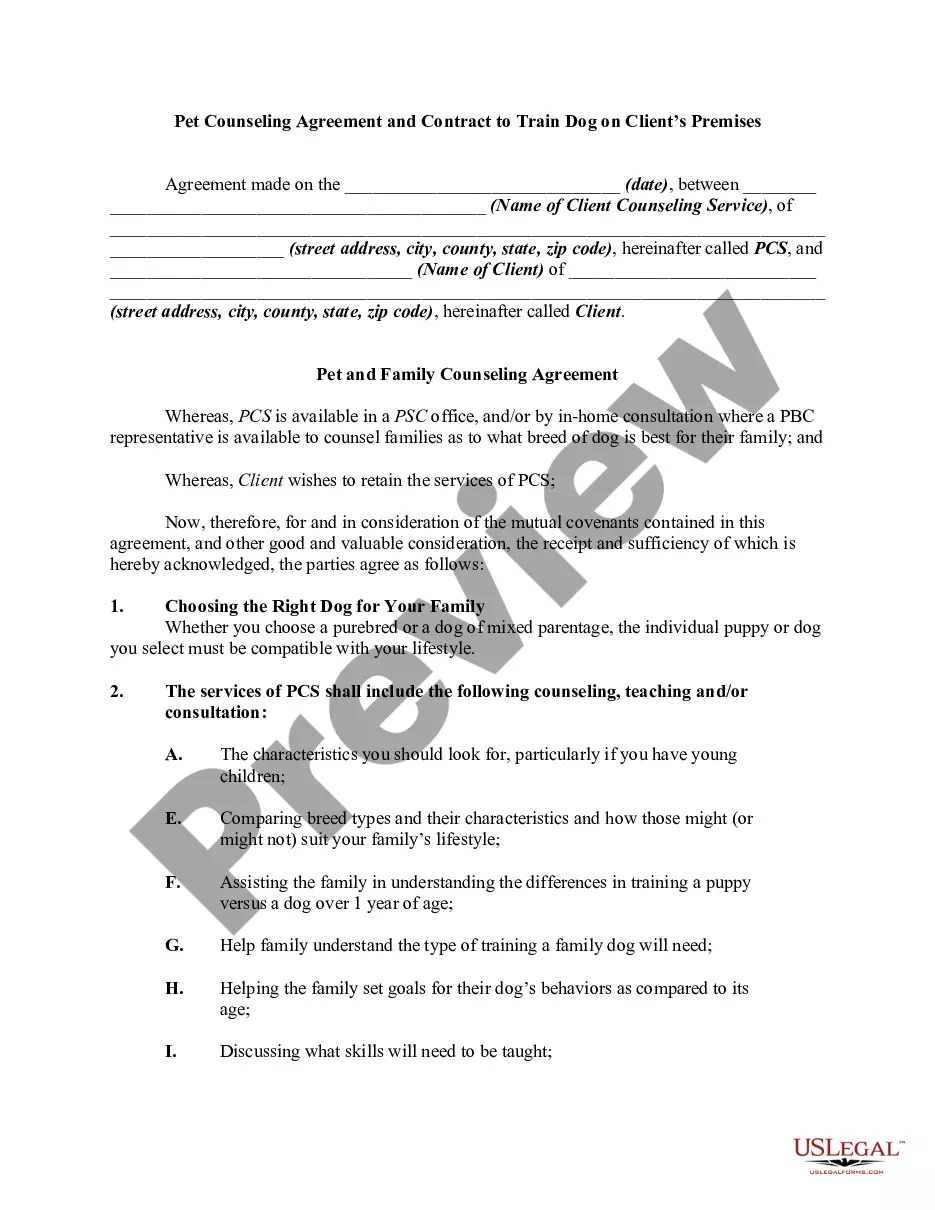

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the document format for your Franklin Post Acquisition Opinion and save it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

Failing to file, or the submission of an inaccurate HSR form, can result in severe civil penalties up to $42,530 for each day of the violation. Typically, both the buyer and the seller must submit their own HSR forms, at which point a mandatory waiting period begins.

Bureau lawyers, along with economists from the FTC's Bureau of Economics, investigate market dynamics to determine if the proposed merger will harm consumers. When necessary, the FTC may take formal legal action to stop the merger, either in federal court or before an FTC administrative law judge.

The Hart-Scott-Rodino Act established the federal premerger notification program, which provides the FTC and the Department of Justice with information about large mergers and acquisitions before they occur. The parties to certain proposed transactions must submit premerger notification to the FTC and DOJ.

The HartScottRodino Antitrust Improvements Act of 1976 (Public Law 94-435, known commonly as the HSR Act) is a set of amendments to the antitrust laws of the United States, principally the Clayton Antitrust Act.

The post-acquisition management stage of the acquisition process follows the completion of the transaction. In this phase, executives of the newly combined firm make decisions in the areas of strategy, structure, systems and people with the objective of achieving the transaction's goals and realizing its value.

The Hart-Scott-Rodino Act established the federal premerger notification program, which provides the FTC and the Department of Justice with information about large mergers and acquisitions before they occur. The parties to certain proposed transactions must submit premerger notification to the FTC and DOJ.

The HSR "size of parties" threshold generally requires that one party to the transaction have annual net sales or total assets of $202 million or more (up from $184 million in 2021), and that the other party have annual net sales or total assets of $20.2 million (up from $18.4 million).

Under 15 U.S.C. § 18a, commonly known as the Hart-Scott-Rodino Antitrust Improvements Act, parties to certain mergers and acquisitions must submit premerger notification filings known as HSR filings and wait a prescribed amount of time before consummating the transaction.

Accounting for an M&A transaction can be broken down into the following steps: Identify a business combination. Identify the acquirer. Measure the cost of the transaction. Allocate the cost of a business combination to the identifiable net assets acquired and goodwill. Account for goodwill.

HSR filings are premerger notifications that parties to a proposed merger transaction make with both the Federal Trade Commission and the Department of Justice. Subject to minor exceptions, both the seller and the buyer must each separately file with both agencies.