Harris Texas Post Acquisition Opinion is a crucial document that provides a comprehensive analysis and evaluation of a post-acquisition situation in Harris, Texas. This opinion serves as a legal and financial assessment of the acquired company or assets, offering insightful information that helps stakeholders make informed decisions regarding the acquisition. The Harris Texas Post Acquisition Opinion includes various important elements to provide a comprehensive overview. These may include analysis of the acquired company's financial performance, market position, assets, liabilities, and potential growth prospects. Additionally, it may assess any potential risks, legal matters, or contingent liabilities associated with the acquisition. There are different types of Harris Texas Post Acquisition Opinion, each tailored to specific needs and requirements. These types may include: 1. Financial Post Acquisition Opinion: This type of opinion exclusively focuses on the financial aspects of the post-acquisition scenario. It analyzes the financial statements of the acquired company, investigates any irregularities, and assesses the accuracy and reliability of the financial data provided. 2. Legal Post Acquisition Opinion: This type of opinion primarily concentrates on the legal aspects of the acquisition. It examines any legal agreements, contracts, or filings associated with the acquisition, ensuring that all legal obligations are met and potential legal risks are identified and addressed. 3. Compliance Post Acquisition Opinion: This type of opinion focuses on evaluating whether the acquisition aligns with regulatory and compliance requirements. It assesses any potential breaches of laws or regulations, identifies necessary compliance measures, and ensures that all necessary permits and licenses are appropriately obtained. 4. Strategic Post Acquisition Opinion: This type of opinion provides a broader assessment of the strategic implications of the acquisition. It analyzes how the acquired company fits into the acquiring company's overall strategy, identifies potential synergies, and assesses the potential impact on market competitiveness. 5. Commercial Due Diligence Post Acquisition Opinion: This type of opinion concentrates on evaluating the commercial viability of the acquisition. It assesses the market dynamics, customer base, competitive landscape, and potential growth opportunities for the acquired company, helping stakeholders make decisions regarding the future growth and profitability of the acquisition. In conclusion, the Harris Texas Post Acquisition Opinion is a crucial document that provides a detailed and comprehensive assessment of various aspects of a post-acquisition situation. Its primary goal is to guide stakeholders in making informed decisions and mitigating any potential risks or challenges associated with the acquisition. The different types of opinions mentioned above ensure that specific aspects are thoroughly analyzed, enabling a well-rounded understanding of the post-acquisition scenario.

Harris Texas Post Acquisition Opinion

Description

How to fill out Harris Texas Post Acquisition Opinion?

Creating documents, like Harris Post Acquisition Opinion, to manage your legal affairs is a difficult and time-consumming task. Many situations require an attorney’s participation, which also makes this task expensive. However, you can take your legal matters into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal documents crafted for various cases and life circumstances. We make sure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the Harris Post Acquisition Opinion form. Go ahead and log in to your account, download the form, and personalize it to your requirements. Have you lost your form? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is just as simple! Here’s what you need to do before downloading Harris Post Acquisition Opinion:

- Make sure that your form is compliant with your state/county since the regulations for creating legal paperwork may differ from one state another.

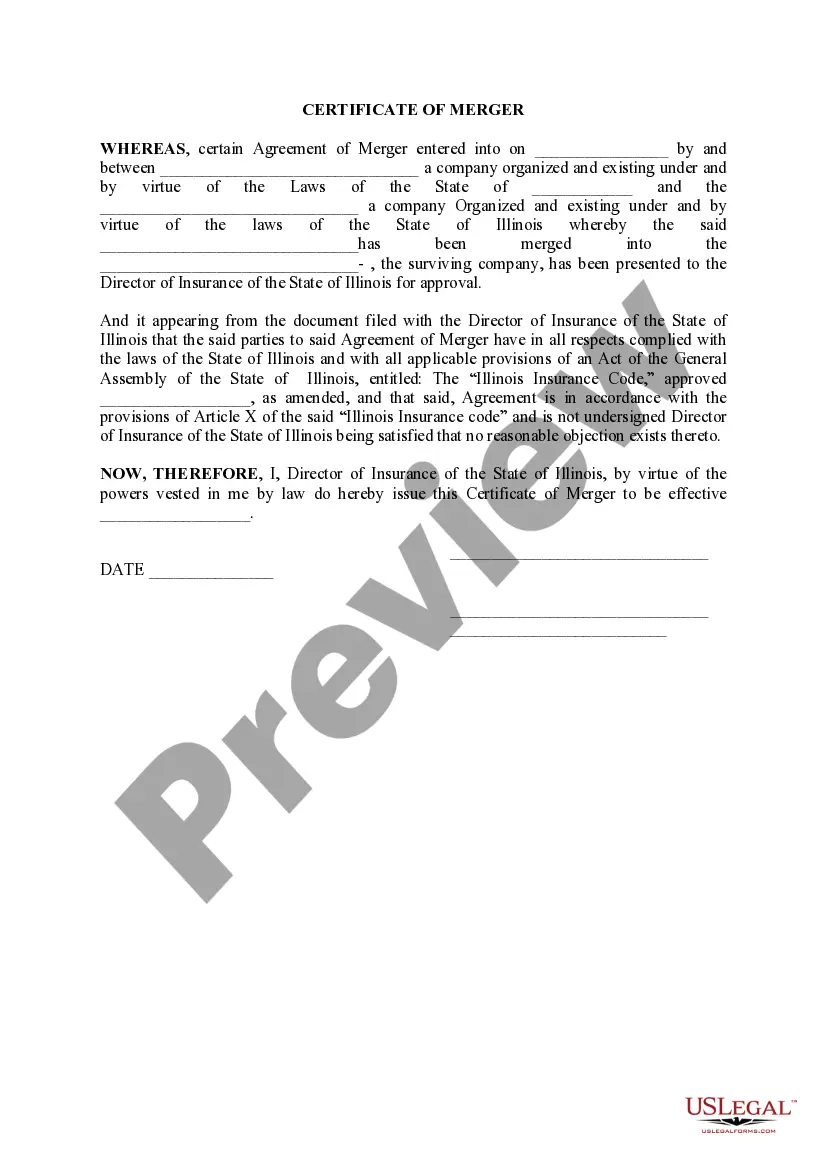

- Find out more about the form by previewing it or reading a quick description. If the Harris Post Acquisition Opinion isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to begin utilizing our website and download the form.

- Everything looks great on your side? Click the Buy now button and select the subscription option.

- Pick the payment gateway and type in your payment information.

- Your template is good to go. You can go ahead and download it.

It’s an easy task to locate and purchase the appropriate template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!