Montgomery Maryland Post Acquisition Opinion, also known as Montgomery County Maryland Post Acquisition Opinion, is a comprehensive analysis and evaluation report prepared after an acquisition or merger of a company in Montgomery County, Maryland. This opinion provides valuable insights and thorough understanding of the target company's current state, potential opportunities, risks, and strategies for future growth. Keywords: Montgomery Maryland, Post Acquisition Opinion, Montgomery County, analysis, evaluation, acquisition, merger, target company, opportunities, risks, growth strategies. The Montgomery Maryland Post Acquisition Opinion encompasses multiple aspects such as financial, operational, and market analysis to determine the overall viability and potential of the acquired company. This opinion serves as a crucial tool for investors, stakeholders, and decision-makers to assess the success of the acquisition and make informed strategic decisions going forward. Different Types of Montgomery Maryland Post Acquisition Opinion: 1. Financial Analysis: This type of opinion focuses on the financial health and performance of the acquired company. It includes an in-depth assessment of the target company's financial statements, cash flow, profitability, debt structure, and future financial projections. The financial analysis enables investors to gauge the financial viability of the acquisition and identify potential areas for improvement. 2. Operational Analysis: This opinion type examines the operational efficiency and effectiveness of the acquired company. It involves evaluating the target company's production processes, supply chain management, human resources, technology infrastructure, and overall operational strategies. The operational analysis helps highlight any operational inefficiencies, redundancies, or opportunities for optimization. 3. Market Analysis: This opinion provides insights into the market dynamics, competitive landscape, and customer perception surrounding the acquired company. It involves analyzing market trends, customer preferences, industry growth potential, and competitive positioning of the target company. The market analysis assists in identifying potential growth opportunities, assessing market risks, and devising effective marketing and sales strategies. 4. Integration Analysis: This type of opinion is focused on the integration process of the acquired company within the existing organizational structure. It evaluates the compatibility of the two entities, identifies potential challenges, and proposes strategies for seamless integration. The integration analysis helps in mitigating post-acquisition risks, ensuring a smooth transition, and maximizing the synergies between the acquiring and target company. In summary, Montgomery Maryland Post Acquisition Opinion is a comprehensive assessment report that delves into various aspects of an acquired company, including financial, operational, market, and integration analysis. It serves as a valuable tool for decision-makers to evaluate the success of an acquisition and devise strategies for future growth and success.

Montgomery Maryland Post Acquisition Opinion

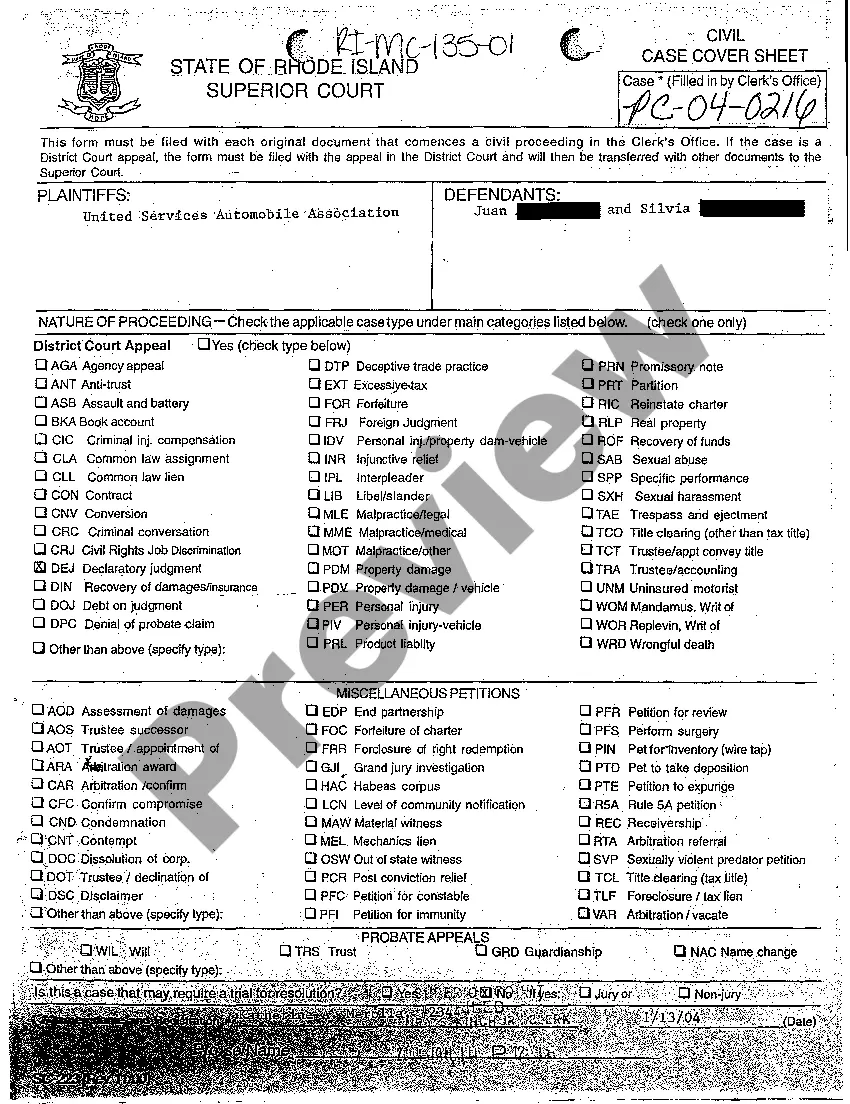

Description

How to fill out Montgomery Maryland Post Acquisition Opinion?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from scratch, including Montgomery Post Acquisition Opinion, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in different types ranging from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching process less frustrating. You can also find detailed resources and guides on the website to make any activities associated with document execution straightforward.

Here's how you can purchase and download Montgomery Post Acquisition Opinion.

- Go over the document's preview and outline (if available) to get a general information on what you’ll get after getting the document.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can impact the validity of some documents.

- Check the related forms or start the search over to find the correct document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a needed payment gateway, and buy Montgomery Post Acquisition Opinion.

- Choose to save the form template in any available file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Montgomery Post Acquisition Opinion, log in to your account, and download it. Needless to say, our website can’t replace an attorney completely. If you have to cope with an exceptionally complicated situation, we advise using the services of a lawyer to review your form before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Become one of them today and get your state-specific documents effortlessly!