Orange California is a thriving city located in Orange County, Southern California. Post-acquisition opinions in Orange California refer to the analysis and insights shared by experts and stakeholders after an acquisition or merger has taken place. These opinions shed light on the impact of the acquisition on various aspects of the city's business environment, economy, real estate market, and community. Key factors influencing post-acquisition opinions in Orange California include: 1. Economic Impact: Post-acquisition opinions explore the economic effects of mergers and acquisitions on Orange California. Experts analyze how these transactions contribute to job creation, increase tax revenue, attract investment, and stimulate economic growth. They also assess the potential risks and challenges that may arise from the consolidation of businesses in the city. 2. Industry-specific Analysis: Different industries in Orange California may have varying types of post-acquisition opinions. For instance, in the technology sector, opinions may revolve around the integration of newly acquired companies' technologies, potential expansions, or impacts on the local talent pool. In contrast, post-acquisition opinions in the real estate industry may focus on property value fluctuations, market trends, and housing availability. 3. Real Estate Market Analysis: After an acquisition, the real estate market in Orange California may experience changes. Post-acquisition opinions assess the effect of transactions on property prices, housing inventory, commercial spaces, and construction projects. This analysis helps investors, homebuyers, and sellers understand the implications of mergers and acquisitions on the local real estate market. 4. Community Development: Post-acquisition opinions also examine how mergers and acquisitions impact the local community in Orange California. This assessment includes considerations such as donations to local organizations, support for community development projects, and corporate social responsibility initiatives undertaken by the acquiring companies. These opinions highlight the social impacts of acquisitions and mergers, making it relevant for stakeholders interested in the city's social dynamics. Overall, post-acquisition opinions in Orange California provide a comprehensive evaluation of the effects of mergers and acquisitions on the city's economy, specific industries, real estate market, and community development. These opinions serve as valuable resources for investors, businesses, and residents seeking insights into the consequences of such consolidation activities.

Orange California Post Acquisition Opinion

Description

How to fill out Orange California Post Acquisition Opinion?

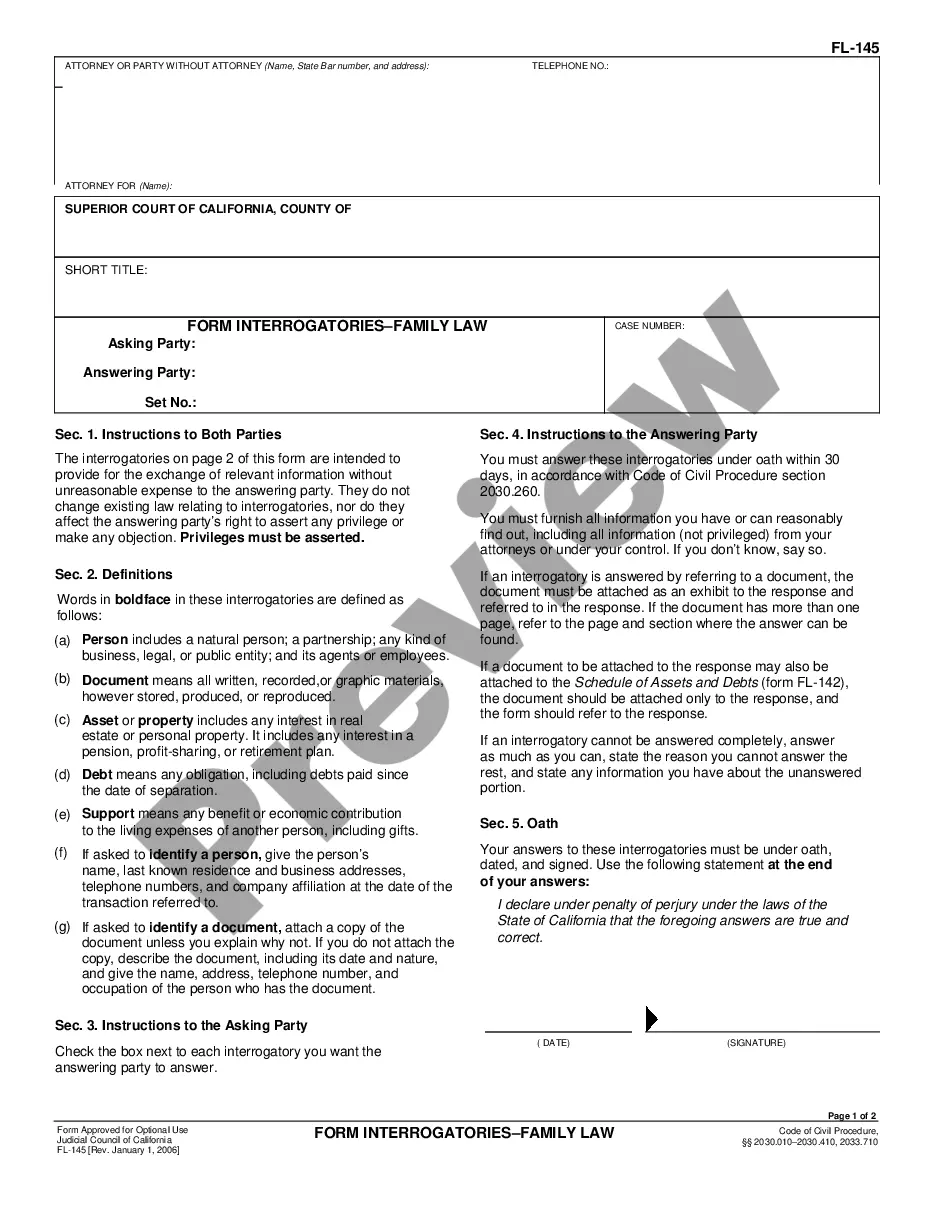

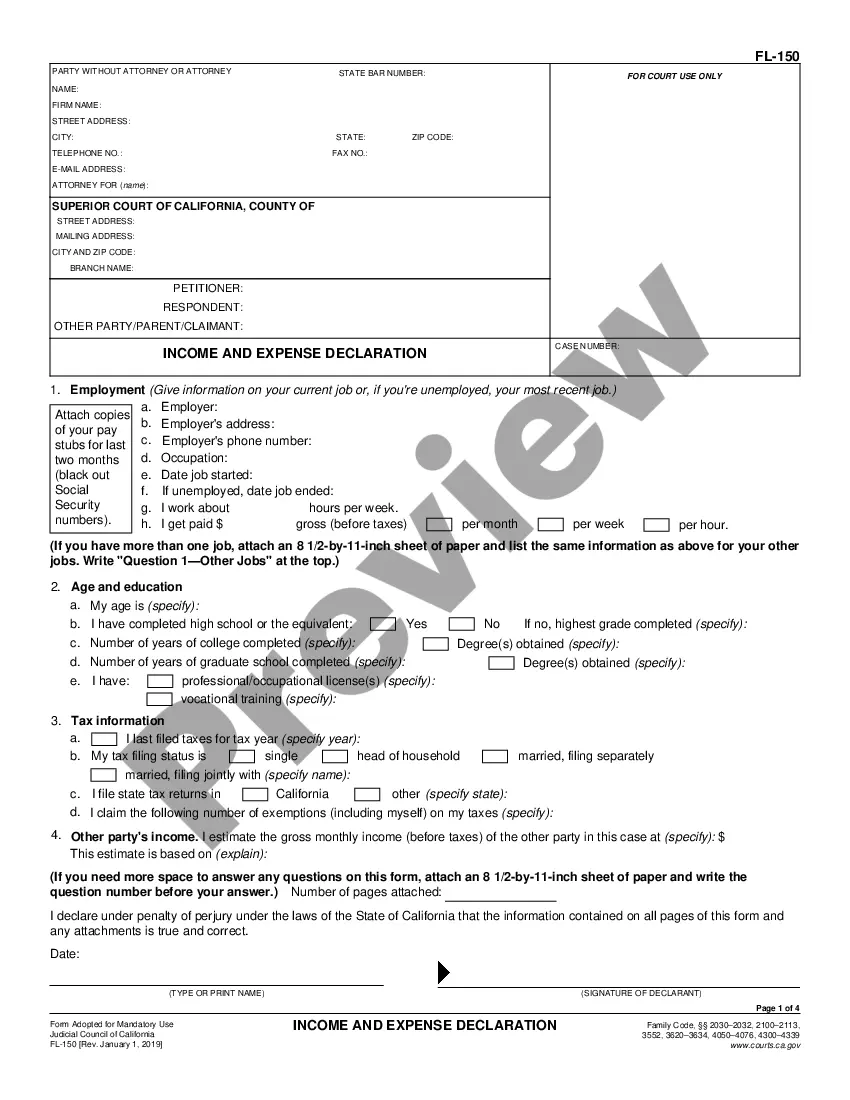

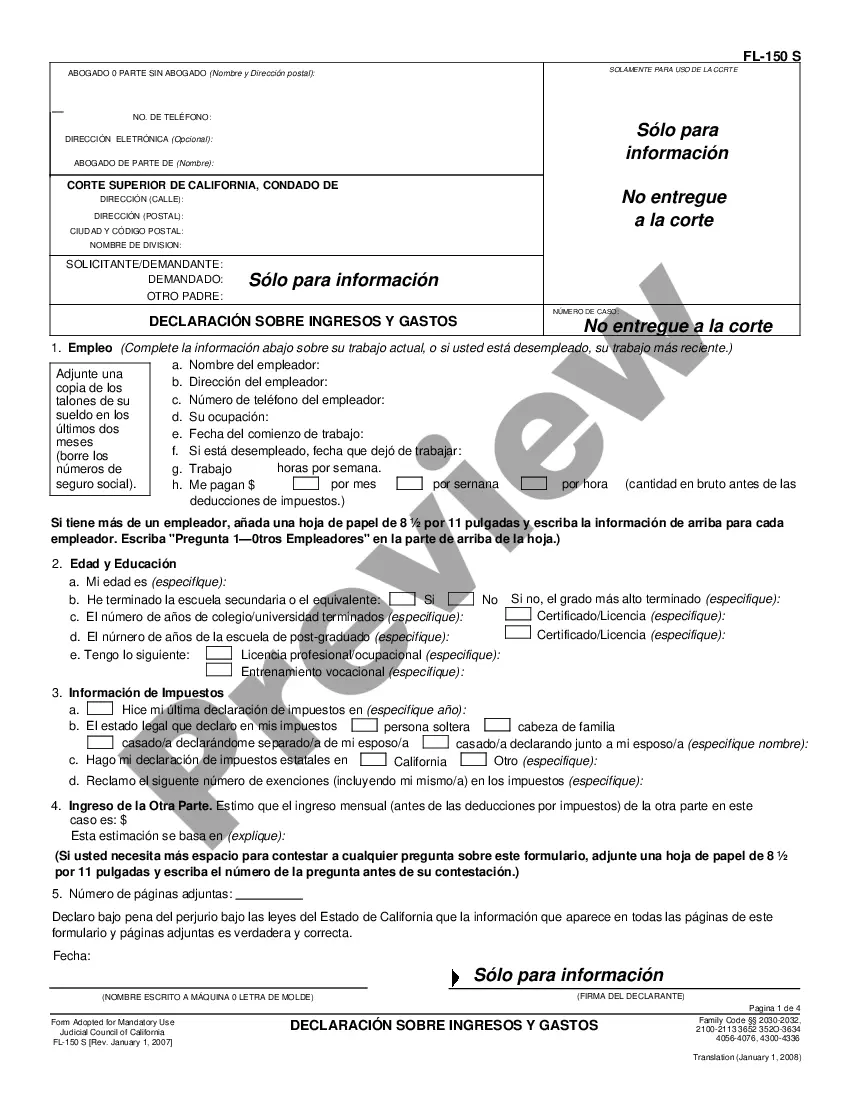

Preparing legal paperwork can be burdensome. In addition, if you decide to ask a lawyer to draft a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Orange Post Acquisition Opinion, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario gathered all in one place. Therefore, if you need the recent version of the Orange Post Acquisition Opinion, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Orange Post Acquisition Opinion:

- Look through the page and verify there is a sample for your region.

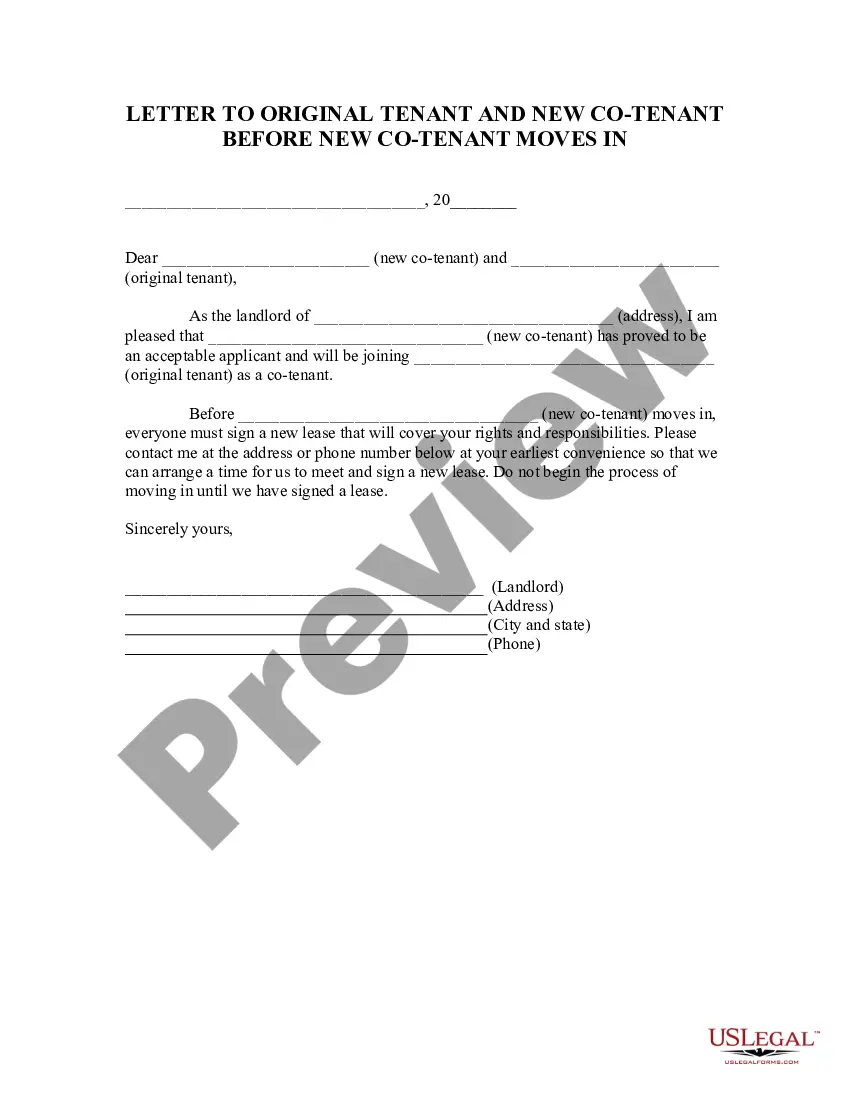

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the document format for your Orange Post Acquisition Opinion and download it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

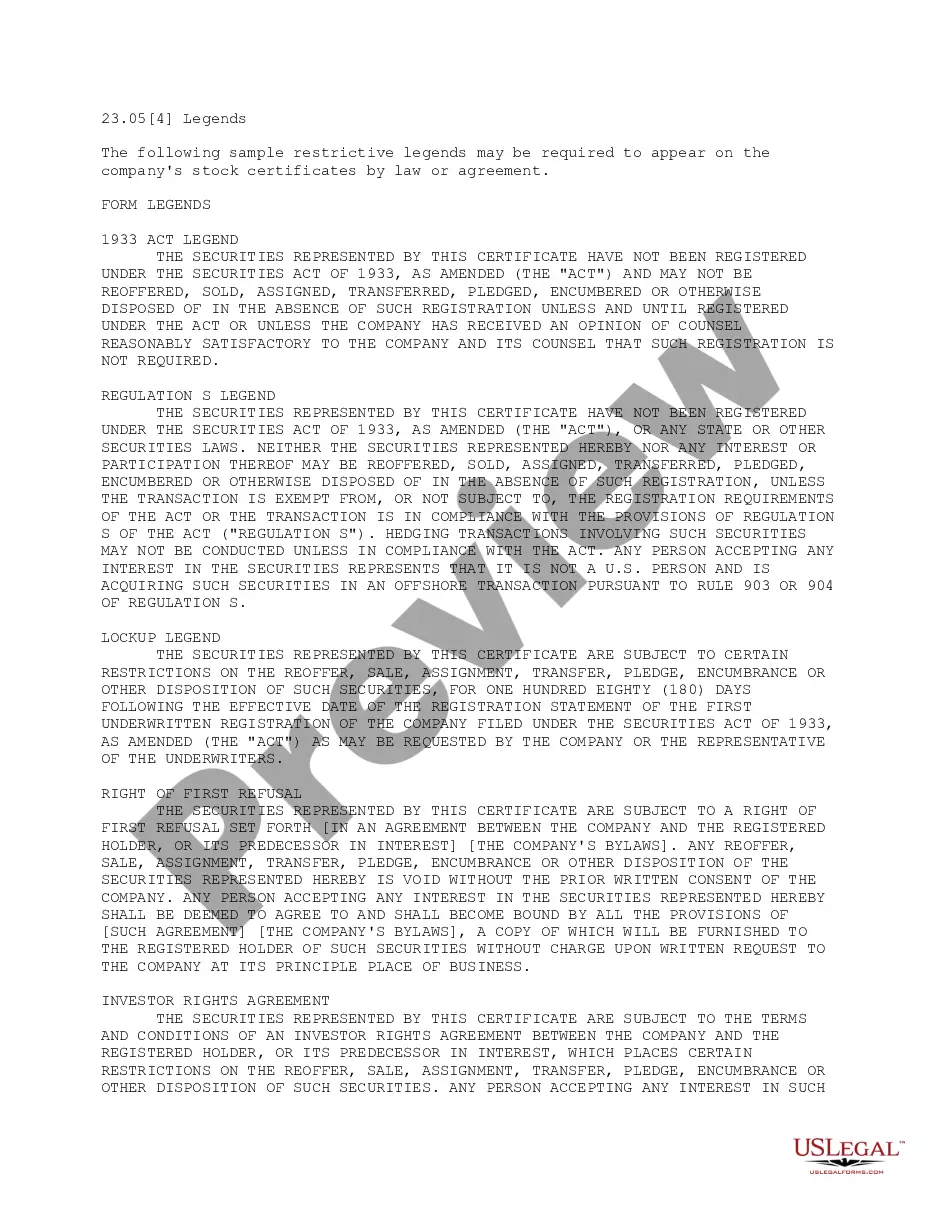

The HSR Act provides that parties must not complete certain mergers, acquisitions or transfers of securities or assets, including grants of executive compensation, until they have made a detailed filing with the U.S. Federal Trade Commission and Department of Justice and waited for those agencies to determine that the

Loss of ownership and control: When a company goes public, it forfeits some of its ownership to the public. Even though the founder usually maintains at least 50% ownership, they still must answer to a board of directors and shareholders. Costs associated with going public: Going public can be a costly process.

Process. In a reverse takeover, shareholders of the private company purchase control of the public shell company/SPAC and then merge it with the private company. The publicly traded corporation is called a "shell" since all that exists of the original company is its organizational structure.

Parties to a transaction subject to the reporting requirements of the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (HSR) must adhere to a statutory waiting period (30 days for most transactions) after filing their Notification and Report Forms before closing on the deal.

The HSR "size of parties" threshold generally requires that one party to the transaction have annual net sales or total assets of $202 million or more (up from $184 million in 2021), and that the other party have annual net sales or total assets of $20.2 million (up from $18.4 million).

The post-acquisition management stage of the acquisition process follows the completion of the transaction. In this phase, executives of the newly combined firm make decisions in the areas of strategy, structure, systems and people with the objective of achieving the transaction's goals and realizing its value.

SEC Form DEFM14A is known as the definitive proxy statement relating to a merger or acquisition. This form is required when there is to be a shareholder vote on a prospective M&A deal, providing enough relevant information to cast an informed vote.

A merger proxy statement is a formal direct communication from a target company to its stockholders that: Provides information about the stockholders' meeting to approve the merger. Solicits proxies from each stockholder for voting on proposals.

If the buyout is an all-cash deal, shares of your stock will disappear from your portfolio at some point following the deal's official closing date and be replaced by the cash value of the shares specified in the buyout. If it is an all-stock deal, the shares will be replaced by shares of the company doing the buying.

For most filings, the mandatory initial waiting period is 30 days, beginning the day after the filings are received complete and ending at pm on the 30th day thereafter (unless a federal holiday is on either date).