Title: Understanding Oakland Michigan Letter in Lieu of Transfer Order Directing Payment to Lender Introduction: The Oakland Michigan Letter in Lieu of Transfer Order Directing Payment to Lender is a legal document that serves as a substitute for a transfer order when a borrower intends to make a payment directly to their lender. This detailed description aims to provide a comprehensive understanding of this process, its importance, and highlight any variations or types of letters that might exist. Key Components of the Letter: 1. Borrower and Lender Information: — The letter starts by clearly identifying the borrower (property owner) and the lender (financial institution). — Relevant details such as names, addresses, and loan account numbers are included. 2. Intent to Make Direct Payment: — The main purpose of this letter is to notify the lender about the borrower's intention to make a payment directly. — It explicitly confirms the borrower's intent to bypass any established transfer order in favor of sending the payment directly to the lender. 3. Payment Details: — The letter specifies the payment amount and due date. It may also include instructions for electronic transfers or mailing a physical payment. 4. Reason for Making Direct Payment: — The borrower needs to provide a valid reason justifying their desire to make a direct payment. — Valid reasons might include the borrower's desire to hasten loan payment, negotiate favorable terms with the lender, or address specific issues related to their loan agreement. 5. Affirmation and Consent Clauses: — The letter includes a section where the borrower affirms that they understand the consequences of making a direct payment. — Additionally, the borrower might need to obtain written consent from the lender if the loan agreement explicitly prohibits direct payments. Types of Oakland Michigan Letters in Lieu of Transfer Order Directing Payment to Lender: 1. Standard Letter: — This is the most common type of letter used by borrowers to make direct payments to their lenders. — It includes all the essential components mentioned earlier and covers regular payment situations. 2. Payment Modification Letter: — If borrowers wish to modify the payment terms, such as restructuring the loan or adjusting interest rates, they can use this letter to request changes while also indicating their intent to make direct payments. 3. Delinquency Resolution Letter: — This type of letter is used when borrowers are behind on their loan payments and want to negotiate a resolution plan directly with the lender. — It outlines the borrower's plan to catch up on missed payments and resolve any outstanding issues. Conclusion: In summary, the Oakland Michigan Letter in Lieu of Transfer Order Directing Payment to Lender is a crucial tool for borrowers seeking to make direct payments to their lenders. By understanding its purpose, key components, and potential variations, borrowers can properly utilize this document to negotiate favorable terms, resolve delinquency issues, or simply expedite loan repayment.

Oakland Michigan Letter in Lieu of Transfer Order Directing Payment to Lender

Description

How to fill out Oakland Michigan Letter In Lieu Of Transfer Order Directing Payment To Lender?

Whether you plan to start your business, enter into a deal, apply for your ID update, or resolve family-related legal issues, you need to prepare certain paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any individual or business occasion. All files are collected by state and area of use, so opting for a copy like Oakland Letter in Lieu of Transfer Order Directing Payment to Lender is quick and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several additional steps to obtain the Oakland Letter in Lieu of Transfer Order Directing Payment to Lender. Adhere to the guidelines below:

- Make sure the sample meets your individual needs and state law requirements.

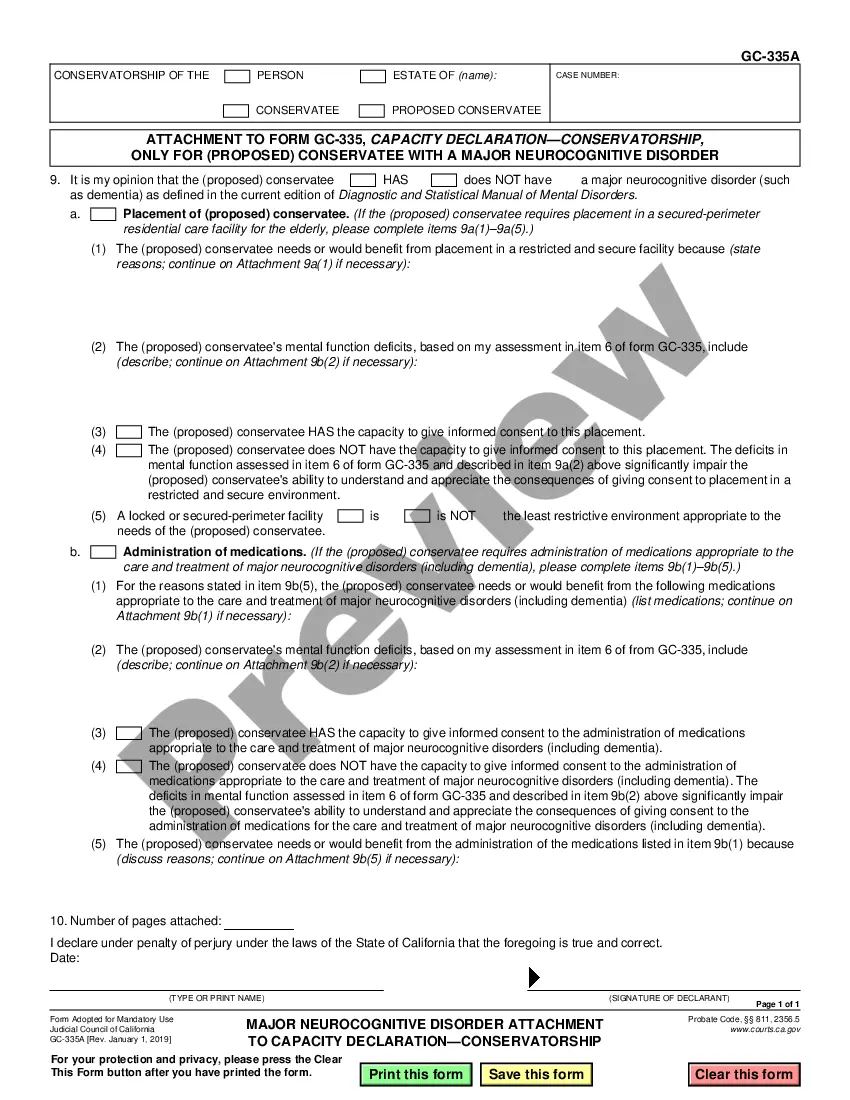

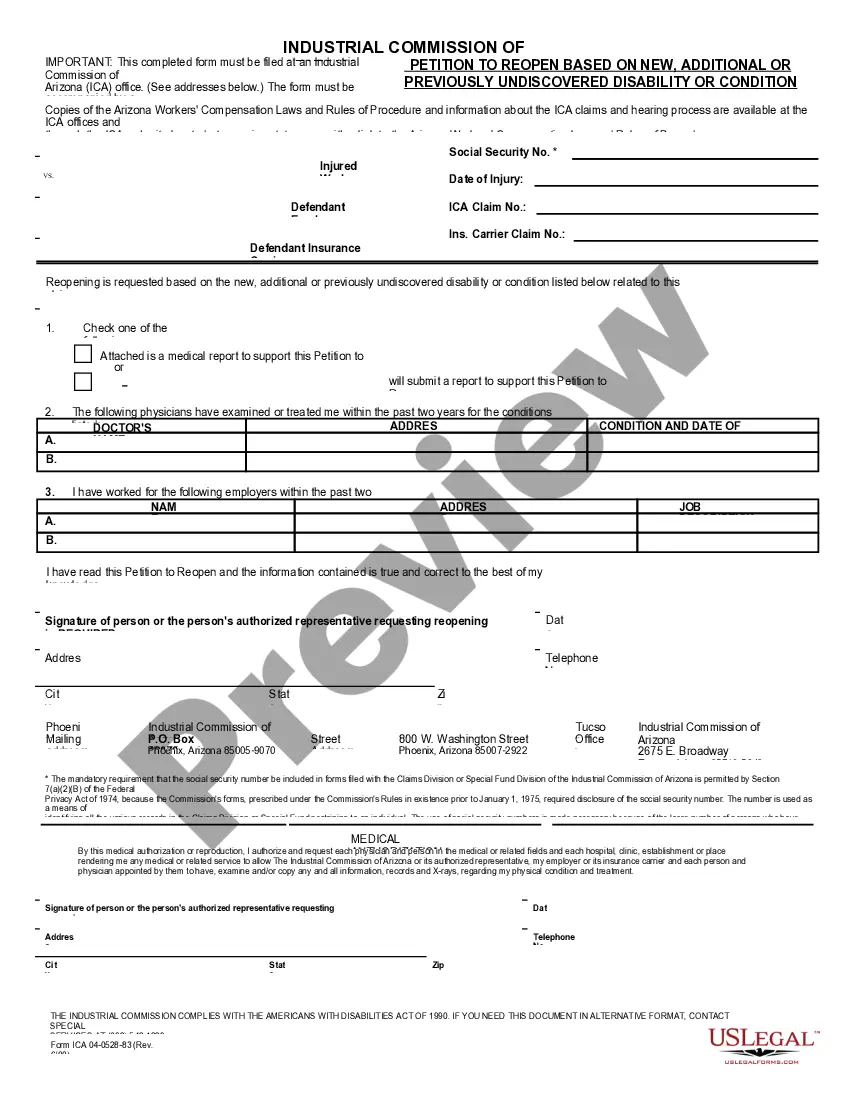

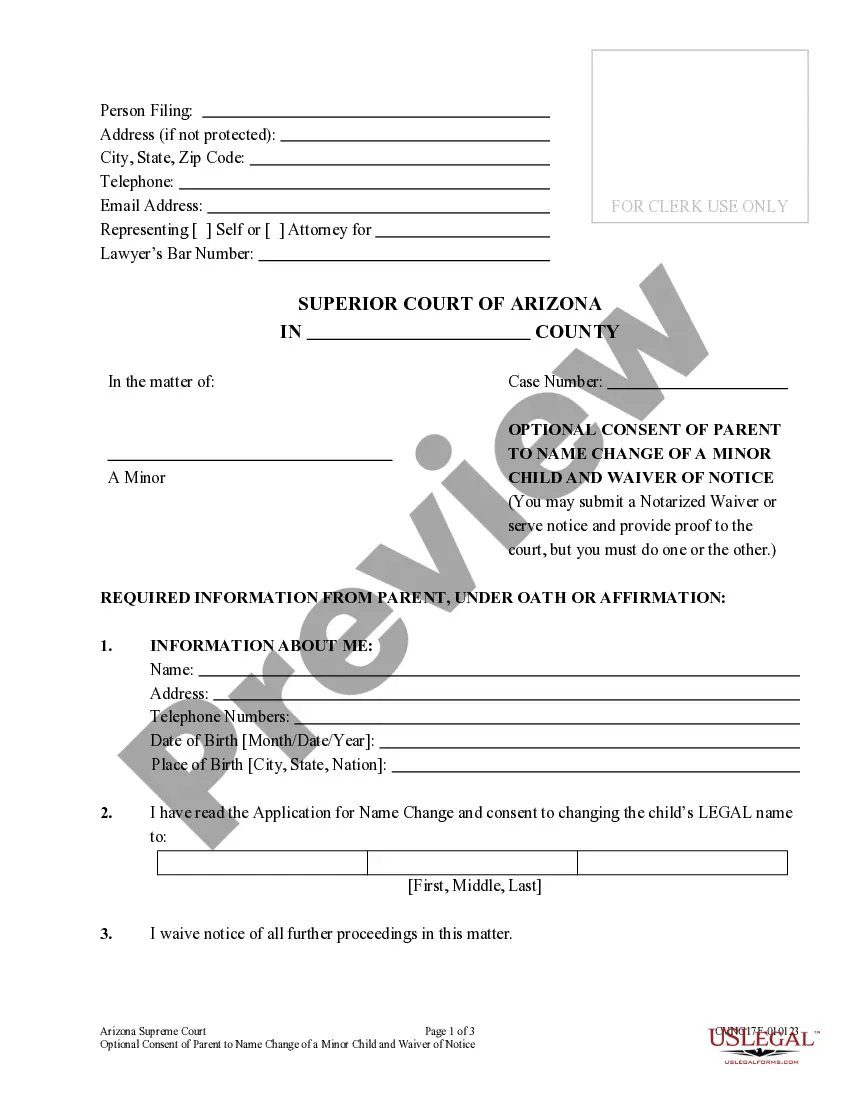

- Read the form description and check the Preview if available on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to get the file once you find the right one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Oakland Letter in Lieu of Transfer Order Directing Payment to Lender in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you are able to access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!