Dallas Texas Reservation of Production Payment is a legal agreement that allows individuals or organizations to secure a share of the production proceeds generated in the oil and gas industry in Dallas, Texas. This payment structure ensures that investors or landowners receive a predetermined portion of the revenue generated from the production of oil and natural gas. Under the Dallas Texas Reservation of Production Payment, there are different types or variations of this agreement, including: 1. Royalty Interest Reservation: This form of reservation entitles the landowner or investor to a fixed percentage of the production proceeds based on their ownership interest. The percentage is determined by the terms of the reservation agreement and is usually paid out monthly or quarterly. 2. Overriding Royalty Interest Reservation: In this type of reservation, a landowner or investor retains a percentage of the production proceeds, known as an overriding royalty interest, which is separate from their mineral interest. This interest is typically created in favor of a third party, such as an individual or entity that holds an operating interest in the oil and gas lease. 3. Net Profits Interest Reservation: This reservation grants the landowner or investor a percentage of the net profits generated from the production of oil and gas, after deducting production costs and other expenses. Net profits interest reservations are calculated based on the net revenue received from the sale of minerals. 4. Working Interest Reservation: This reservation grants the landowner or investor a percentage of the working interest in the oil and gas lease. Working interest holders are responsible for the costs associated with drilling, operating, and maintaining the oil and gas wells. Furthermore, they are entitled to a corresponding percentage share of the production proceeds after deducting expenses. By entering into a Dallas Texas Reservation of Production Payment, individuals or organizations can benefit from the production and sale of oil and gas resources in the Dallas area, ensuring a steady stream of income corresponding to their respective interests. These reservations are commonly executed through contractual agreements between the parties involved, outlining the specific terms, conditions, and payment structure for each type of reservation.

Dallas Texas Reservation of Production Payment

Description

How to fill out Dallas Texas Reservation Of Production Payment?

Creating legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to create some of them from scratch, including Dallas Reservation of Production Payment, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in different types ranging from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching experience less challenging. You can also find detailed materials and guides on the website to make any activities associated with paperwork execution straightforward.

Here's how you can purchase and download Dallas Reservation of Production Payment.

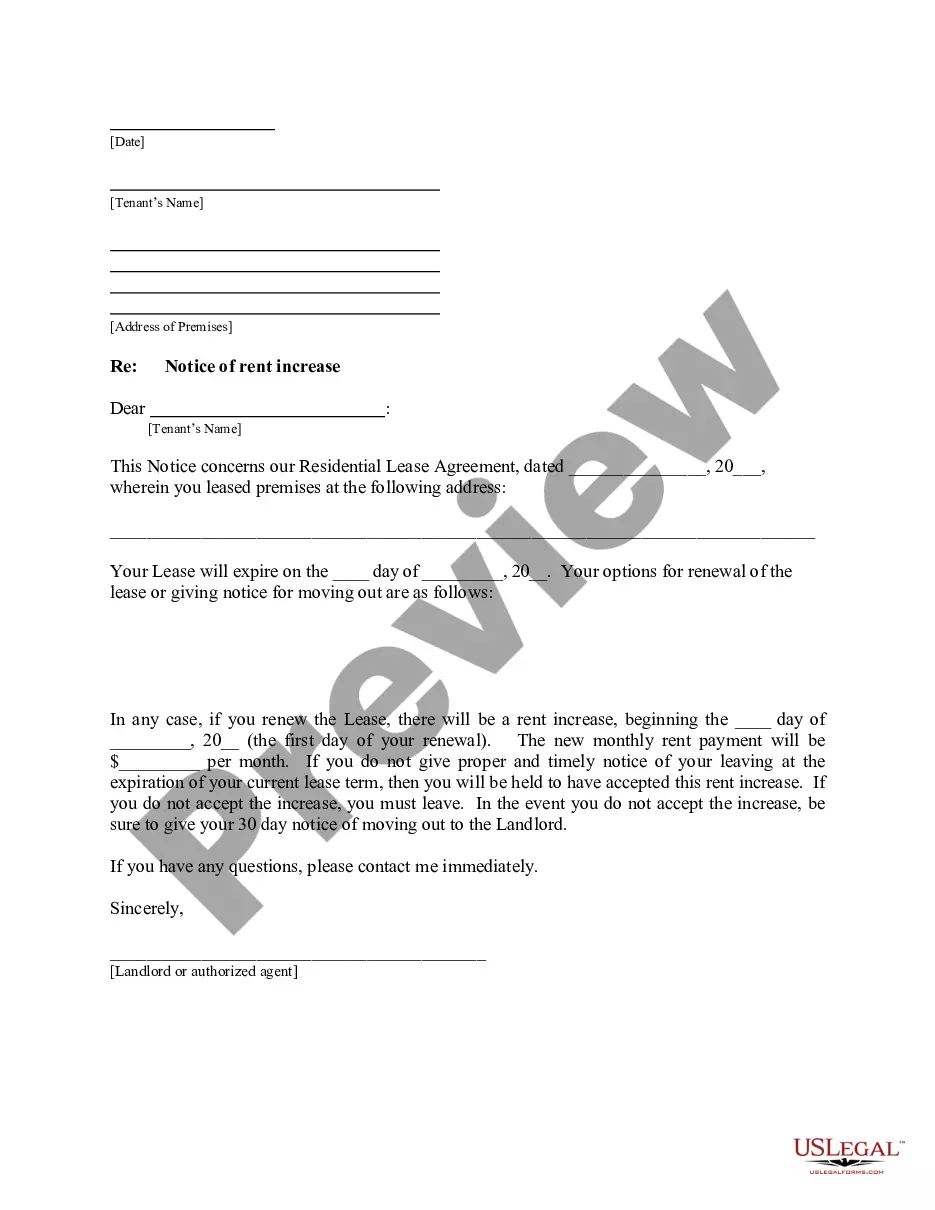

- Take a look at the document's preview and outline (if available) to get a general idea of what you’ll get after downloading the document.

- Ensure that the document of your choice is specific to your state/county/area since state regulations can affect the validity of some records.

- Examine the related forms or start the search over to locate the right file.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment gateway, and buy Dallas Reservation of Production Payment.

- Choose to save the form template in any available file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Dallas Reservation of Production Payment, log in to your account, and download it. Of course, our platform can’t replace a legal professional entirely. If you have to deal with an exceptionally complicated situation, we advise using the services of a lawyer to check your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Become one of them today and purchase your state-specific paperwork effortlessly!