Harris Texas Compliance With Laws refers to the adherence and conformity to the various laws, regulations, and statutes established at the local, state, and federal levels in Harris County, Texas. It encompasses the legal obligations and responsibilities that individuals, businesses, and organizations must uphold to maintain compliance and avoid potential penalties or legal disputes. Harris Texas Compliance With Laws can be categorized into different types to address specific areas of regulation. Some notable types include: 1. Employment Law Compliance: This type of compliance focuses on ensuring that employers follow all applicable laws related to hiring, compensation, working conditions, workplace safety, anti-discrimination, and equal opportunity for employees. It encompasses adherence to the Fair Labor Standards Act (FLEA), Occupational Safety and Health Act (OSHA), Texas Labor Code, and Equal Employment Opportunity Commission (EEOC) guidelines. 2. Environmental Law Compliance: Environmental compliance pertains to adhering to federal, state, and local regulations aimed at protecting the environment, such as air and water quality, waste management, and pollution prevention. Businesses and organizations must comply with laws such as the Clean Air Act (CAA), Clean Water Act (CWA), Safe Drinking Water Act (SDA), and Texas Environmental Quality Act (TEA). 3. Taxation and Financial Compliance: Tax and financial compliance involve abiding by the applicable tax laws, regulations, and reporting requirements set at the federal, state, and local levels. In Harris County, Texas, individuals and businesses must comply with the Internal Revenue Code (IRC), Texas Tax Code, and regulations imposed by the Harris County Tax Assessor-Collector's Office. 4. Healthcare Compliance: This type of compliance mainly applies to healthcare providers and facilities, ensuring that they follow laws such as the Health Insurance Portability and Accountability Act (HIPAA) in protecting patient privacy and confidentiality, along with compliance with state-specific regulations governing healthcare practices. 5. Real Estate and Land Use Compliance: Real estate compliance involves adhering to laws related to land development, zoning, building codes, permits, and other regulations imposed by authorities in Harris County. Compliance may involve navigating requirements set by the Harris County Engineering Department, Building Department, or Planning and Development Department. 6. Consumer Protection Compliance: This type of compliance focuses on protecting consumers from unfair or deceptive business practices. It typically involves compliance with laws like the Texas Deceptive Trade Practices Act (DTPA) and regulations enforced by agencies like the Texas Attorney General's Office or the Harris County Toll Road Authority. Understanding and complying with Harris Texas Compliance With Laws is essential for individuals, businesses, and organizations to maintain transparency, ethical conduct, and legal operations within the county. Failure to comply with relevant laws may result in legal consequences, fines, penalties, civil lawsuits, or damage to reputation. Seeking legal counsel or relying on professional compliance services can help ensure proper adherence to Harris Texas Compliance With Laws.

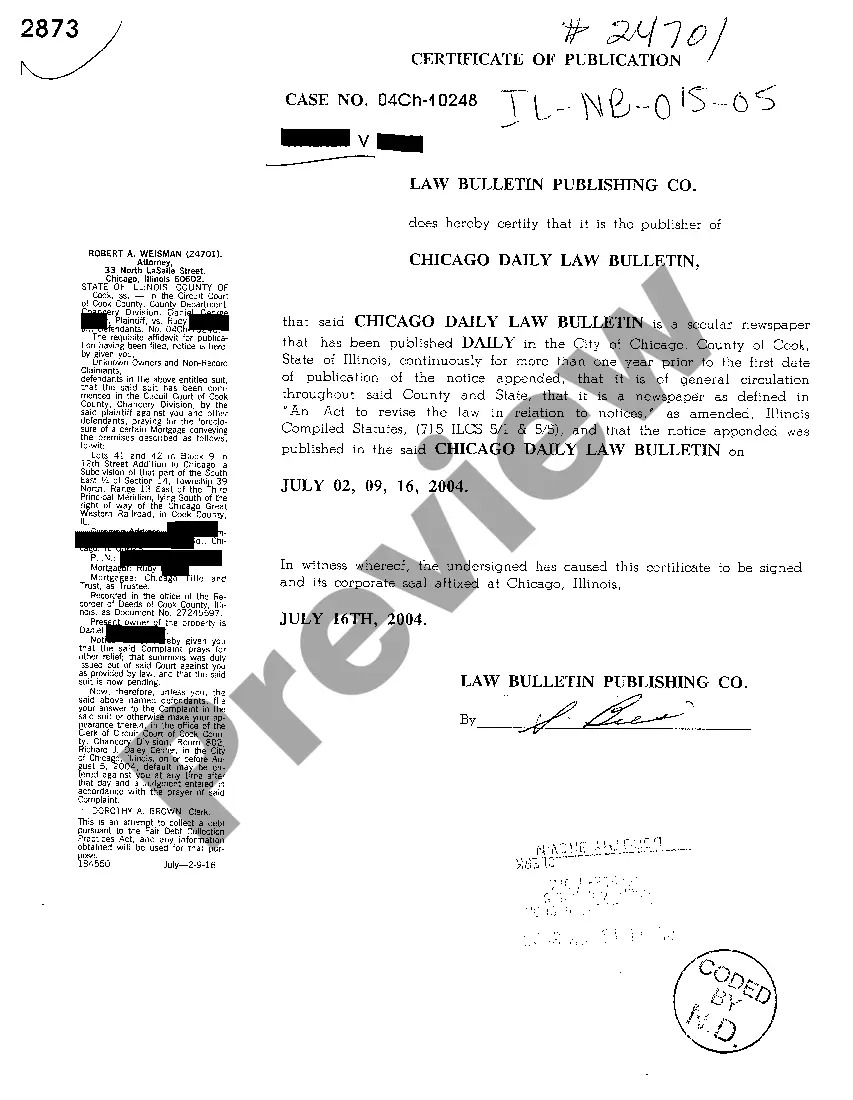

Harris Texas Compliance With Laws

Description

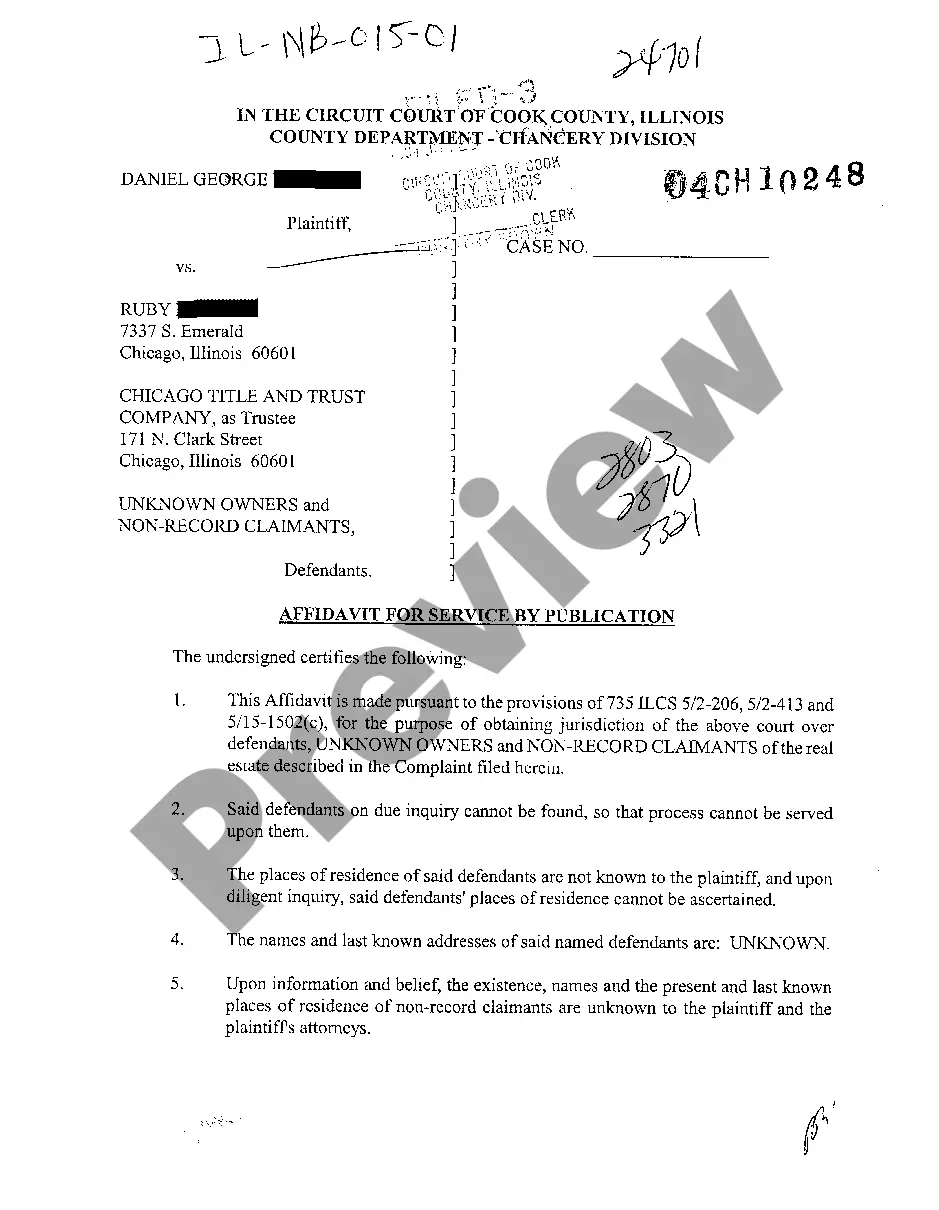

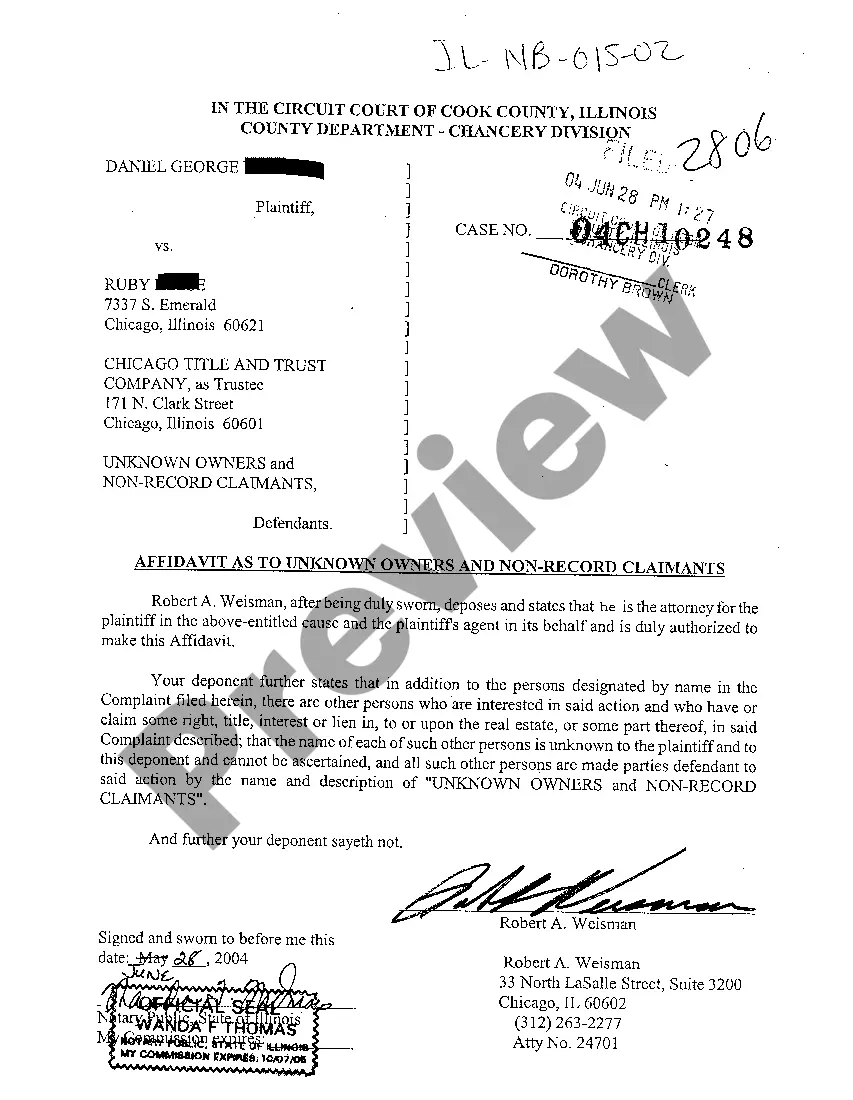

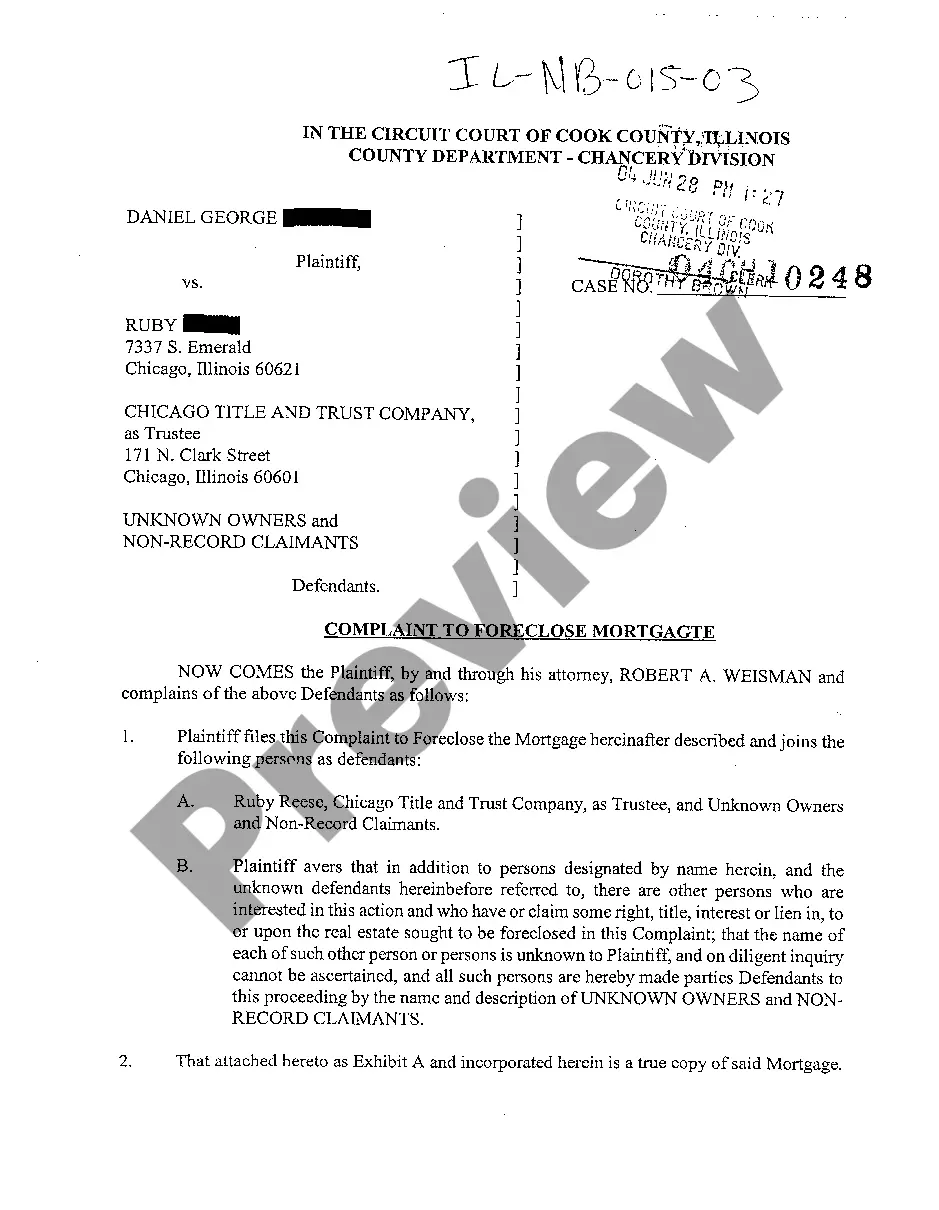

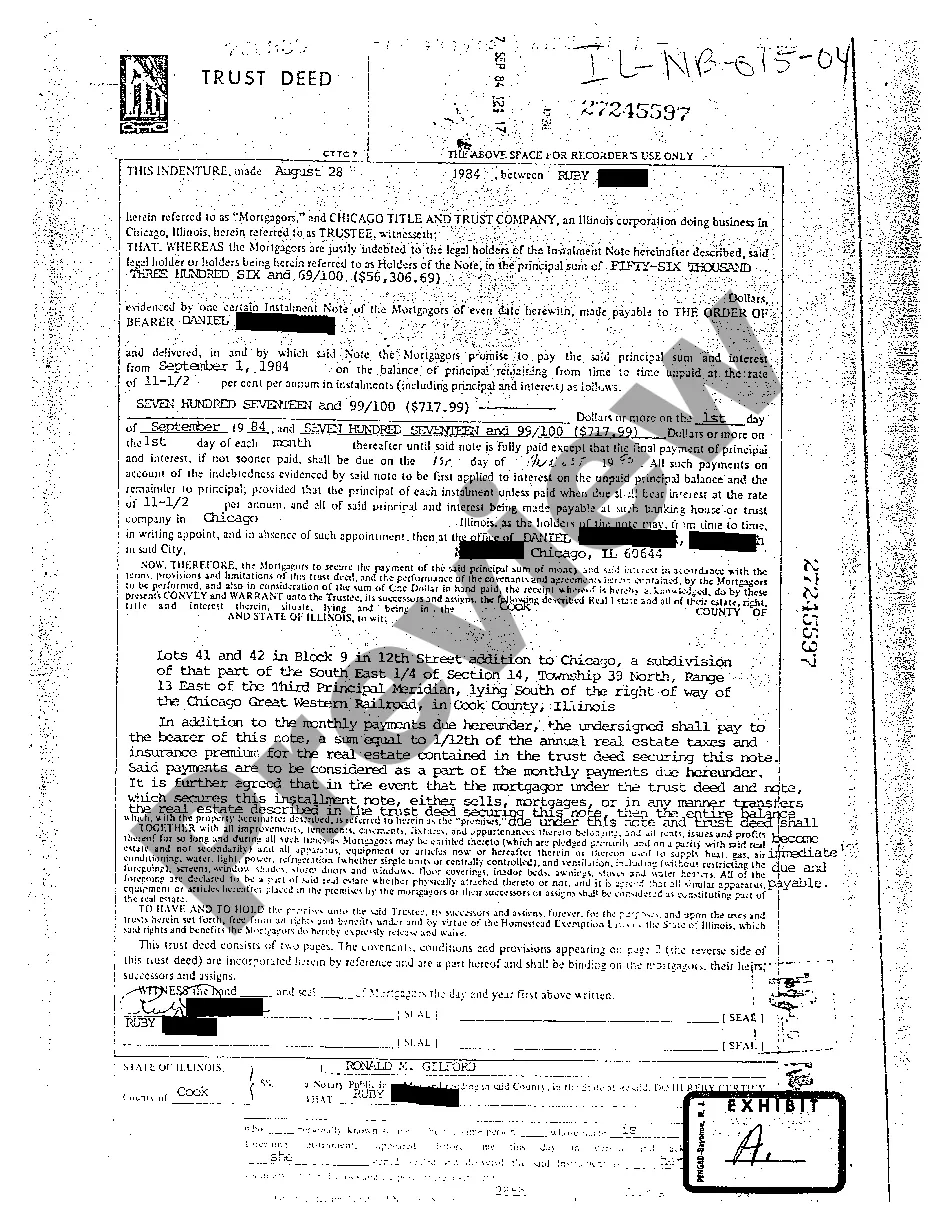

How to fill out Harris Texas Compliance With Laws?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a legal professional to draft a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Harris Compliance With Laws, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario collected all in one place. Consequently, if you need the current version of the Harris Compliance With Laws, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Harris Compliance With Laws:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Harris Compliance With Laws and download it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!