Harris Texas Well Takeover: An in-depth analysis Introduction: Harris Texas Well Takeover refers to a strategic process in which an individual or entity acquires control over one or more oil or gas wells located in Harris County, Texas. This acquisition aims to gain operational control, maximize efficiency, and enhance the production output of the wells. The process involves comprehensive planning, evaluation, negotiation, and implementation techniques to ensure successful Well Takeover. Types of Harris Texas Well Takeover: 1. Conventional Well Takeover: This type of takeover involves the acquisition of conventional oil or gas wells that follow standardized drilling and production methodologies. The focus of this takeover is to improve the existing operations, optimize production efficiency, and potentially explore new zones in the well for increased output. 2. Unconventional Well Takeover: Unconventional well takeovers primarily target non-traditional resources, such as shale gas, tight oil, or other unconventional hydrocarbons. These takeovers require specialized techniques like hydraulic fracturing (fracking) or horizontal drilling to extract hydrocarbons effectively. The objective is to enhance production, reduce operational costs, and maximize recovery rates from these unconventional reservoirs. Process of Harris Texas Well Takeover: 1. Initial Assessment: The first step involves analyzing the target well(s) thoroughly, considering factors like geological data, previous production records, well infrastructure, and potential risks. This assessment helps identify the potential value, risks, and required investments for the takeover. 2. Negotiation and Due Diligence: Once a suitable well is identified, negotiation with the current owner takes place. During this phase, a comprehensive due diligence process is conducted, which includes a thorough review of legal documents, contracts, leases, permits, and compliance requirements. This helps in understanding the liabilities, legal aspects, and potential opportunities related to the well takeover. 3. Financial Evaluation: An extensive financial evaluation is performed to assess the economic viability of the well takeover. This includes estimating future cash flows, analyzing operational costs, determining the payback period, and evaluating the return on investment (ROI). Additionally, potential funding sources and cost-saving measures are explored. 4. Operational Planning and Execution: Once the well takeover is confirmed, a detailed operational plan is formulated, considering aspects like production optimization, well maintenance, equipment upgrade, and workforce management. Skilled personnel are deployed to manage production activities efficiently and implement necessary improvements. Employing advanced technologies and data analysis techniques, such as artificial intelligence and machine learning, can further enhance operational efficiency. 5. Compliance and Regulatory Considerations: Throughout the process, compliance with environmental regulations, safety standards, and industry-specific guidelines is of utmost importance. Necessary permits, licenses, and certifications are obtained to ensure adherence to legal requirements and avoid penalties or fines. Conclusion: Harris Texas Well Takeover is a complex process aimed at optimizing production, enhancing efficiency, and maximizing returns within the ever-evolving oil and gas industry. Whether conventional or unconventional, a successful Well Takeover requires meticulous planning, thorough evaluation, effective execution, and adherence to legal and regulatory frameworks. By strategically acquiring and managing wells in Harris County, Texas, entities can tap into the region's rich hydrocarbon resources and contribute to sustainable energy production.

Harris Texas Well Takeover

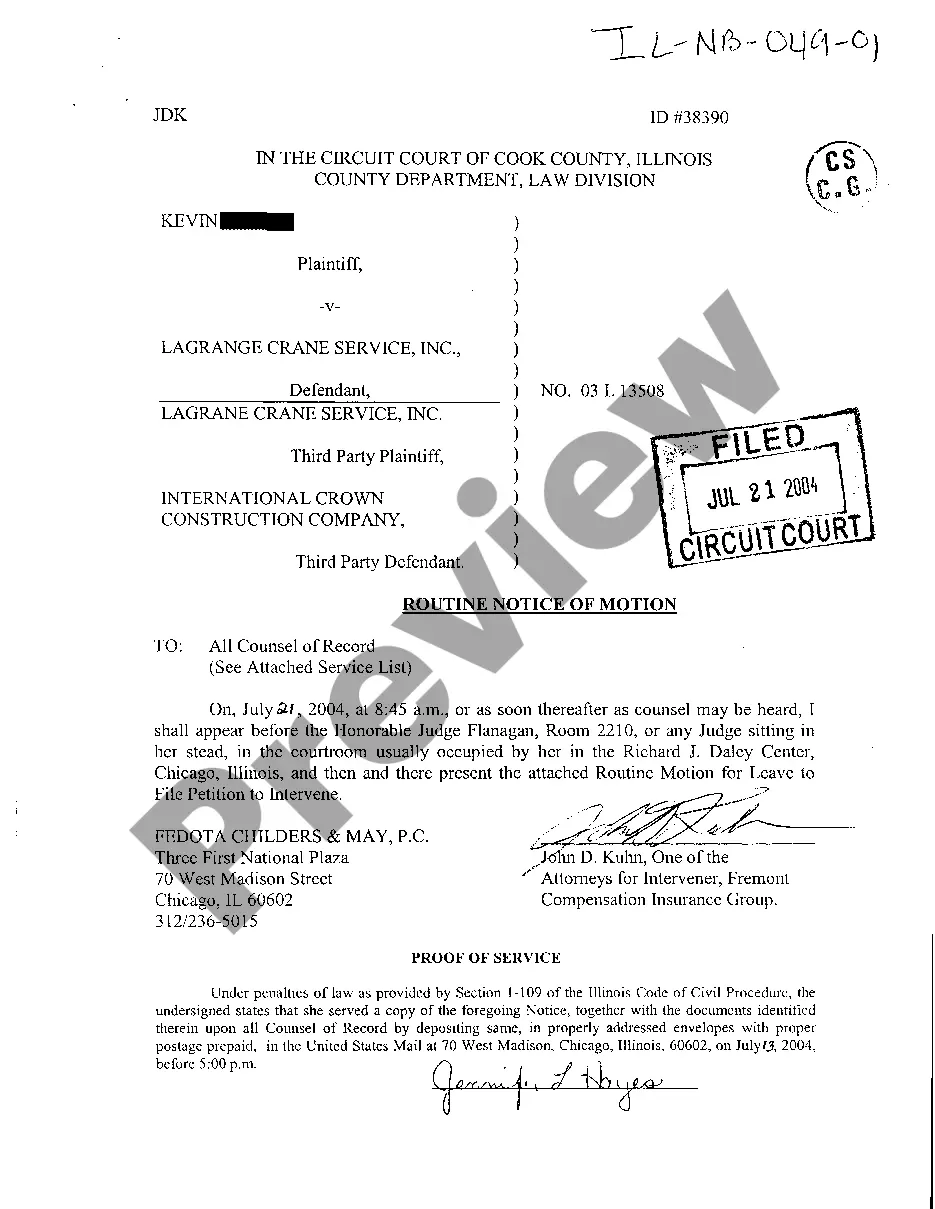

Description

How to fill out Harris Texas Well Takeover?

Dealing with legal forms is a must in today's world. However, you don't always need to seek qualified assistance to create some of them from scratch, including Harris Well Takeover, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in different categories varying from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching process less frustrating. You can also find detailed materials and guides on the website to make any activities related to document execution simple.

Here's how you can find and download Harris Well Takeover.

- Go over the document's preview and description (if provided) to get a general idea of what you’ll get after getting the form.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can affect the validity of some records.

- Examine the similar document templates or start the search over to find the correct document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment gateway, and purchase Harris Well Takeover.

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Harris Well Takeover, log in to your account, and download it. Needless to say, our website can’t take the place of a legal professional completely. If you need to cope with an exceptionally complicated case, we recommend using the services of an attorney to check your document before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of users. Become one of them today and purchase your state-specific documents effortlessly!