San Bernardino California Well Takeover refers to the process of acquiring control or ownership over oil wells located in the San Bernardino, California region. This type of takeover typically involves the purchase or merger of existing oil companies or assets by another company with the intent of extracting oil from the wells for commercial purposes. Key players in the San Bernardino California Well Takeover market include oil and gas companies, investors, and energy corporations. There are different types of San Bernardino California Well Takeover, including: 1. Strategic Acquisition: This type of takeover occurs when a company acquires another company's oil wells in San Bernardino, California to strategically expand its oil production capabilities or gain access to strategic locations. 2. Horizontal Integration: In this scenario, a company acquires oil wells in San Bernardino, California to increase its market share and consolidate its position in the local oil industry. 3. Vertical Integration: This involves a company acquiring oil wells in San Bernardino, California to gain control over the entire supply chain, starting from the production of oil to refining and distribution. 4. Joint Ventures: Companies may collaborate through joint ventures to acquire oil wells in San Bernardino, California, pooling their resources, expertise, and capital to maximize oil production and profitability. 5. Asset Purchase: A company may choose to acquire specific oil wells in San Bernardino, California, either due to their potential for high yields or as part of a diversified investment strategy. The San Bernardino California Well Takeover market is highly competitive, with companies striving to secure valuable assets to meet the increasing demand for oil and energy resources. Factors such as the well's production potential, geological characteristics, regulatory environment, and global oil prices influence the decision to initiate and execute a takeover. It is essential for companies involved in San Bernardino California Well Takeover to conduct extensive due diligence, evaluate risks, and assess the economic viability of the acquisition to ensure long-term profitability and sustainability.

San Bernardino California Well Takeover

Description

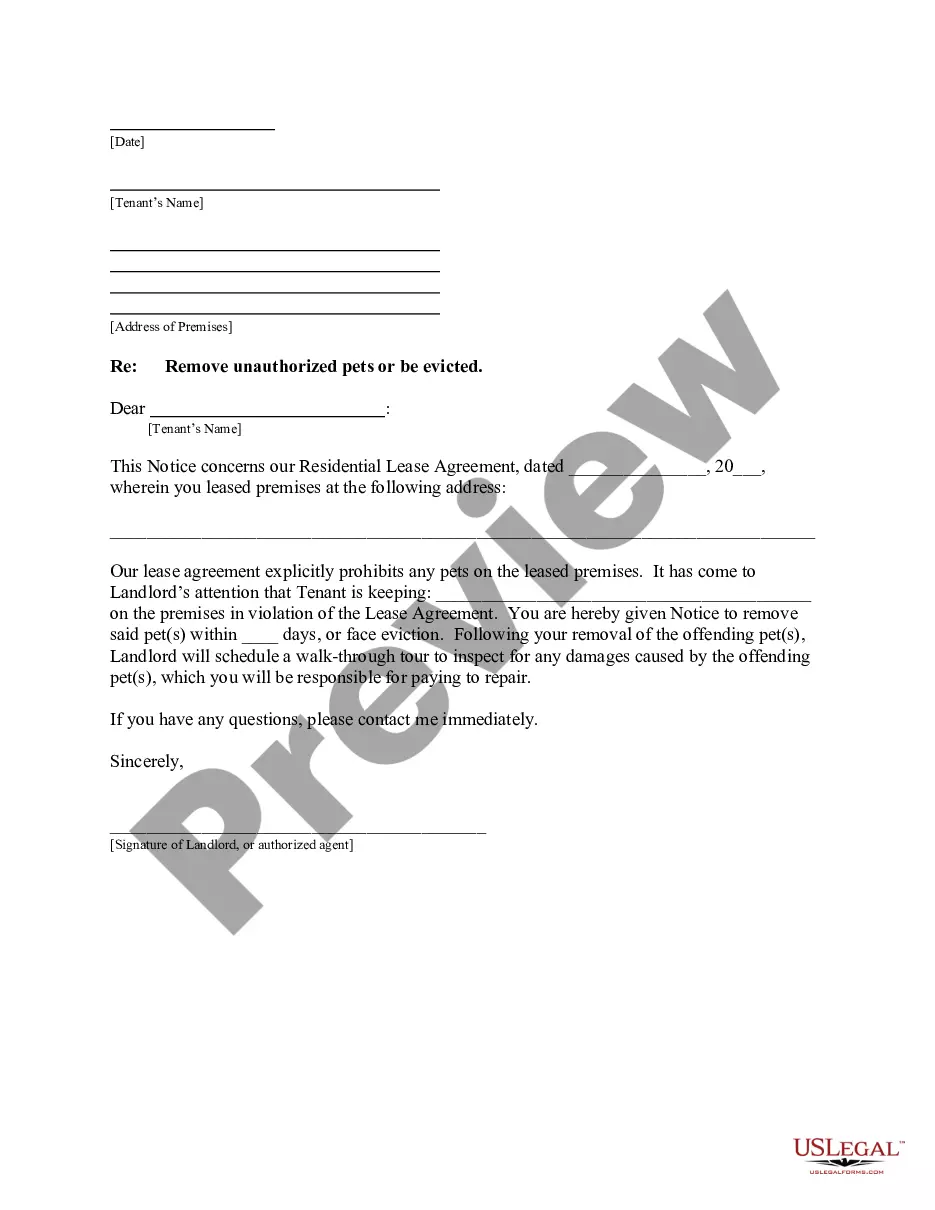

How to fill out San Bernardino California Well Takeover?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from the ground up, including San Bernardino Well Takeover, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in various types ranging from living wills to real estate paperwork to divorce documents. All forms are organized based on their valid state, making the searching process less frustrating. You can also find detailed materials and tutorials on the website to make any activities related to document execution simple.

Here's how you can purchase and download San Bernardino Well Takeover.

- Go over the document's preview and description (if available) to get a general idea of what you’ll get after downloading the document.

- Ensure that the document of your choice is adapted to your state/county/area since state laws can impact the legality of some documents.

- Check the related forms or start the search over to find the appropriate document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a suitable payment method, and purchase San Bernardino Well Takeover.

- Choose to save the form template in any offered format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed San Bernardino Well Takeover, log in to your account, and download it. Needless to say, our platform can’t take the place of a lawyer entirely. If you have to deal with an exceptionally challenging case, we recommend getting an attorney to examine your document before signing and filing it.

With over 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Join them today and purchase your state-compliant documents with ease!

Form popularity

FAQ

No companies that serve legal papers will go above and beyond for your service like eFile Expert. We are an San Bernardino County California e-filing company and certified E-Filing Service Provider (EFSP) for all 58 counties.

Q: Do I need a permit in order to drill a well? A: Yes, the Well Driller is responsible for pulling or obtaining the well permit with the SB EHS, upon pulling of a well permit, the Mojave Water Agency (MWA) receives a copy via Facsimile of the permit from the San Bernardino Environmental Health Services.

Water Wells The construction, reconstruction or destruction of any well requires a valid permit from DEHS and the work must be performed by a licensed California State Contractor as appropriate to the activity to be engaged in (i.e. C-57).

Any water well construction activities must be performed only by a licensed C-57 Water Well Contractor and must meet applicable local and state well standards. Installation, repair, or replacement of a well pump must be performed by a person who possesses a valid C-57, C-61 or Class A contractor's license.

In an effort to expand online services and options for reserving civil motions at the San Bernardino Justice Center, the San Bernardino Superior Court (SBJC) is pleased to announce parties may request motion dates for civil motions heard at the San Bernardino Justice Center by submitting their request via email to SBJC

Civil Division of the San Bernardino District, 247 West 3rd St, San Bernardino, CA 92415-0210 (located in the San Bernardino Justice Center) Filings Accepted: C.E.Q.A.

There are 14 Courthouse Locations. The San Bernardino Court is divided into districts, and the districts are slightly different depending on the type of matter. Please check the name of your city carefully on this page, to see where to go: .

Water Wells (Domestic/Irrigation) If you are planning on building a home in a rural location with no access to public drinking water, you will have to drill a well on your property. Water well permits may only be applied for by a licensed well driller (see the following procedure).

Civil Division of the San Bernardino District, 247 West 3rd St, San Bernardino, CA 92415-0210 (located in the San Bernardino Justice Center) Filings Accepted: C.E.Q.A.

A call to the State Water Board's Permitting and Licensing supervisor responsible for your area or the Division of Water Rights' general information line at (916) 341-5300 may be helpful. Filing an Application.