Chicago Illinois Further Assurances is a term commonly used in legal and financial transactions to provide additional guarantees and assurances to the parties involved. In such agreements, the parties involved are typically seeking to solidify their rights, protect their interests, and ensure the successful completion of a transaction or deal. Chicago, Illinois, being a bustling metropolis and a major commercial hub, witnesses a wide range of business transactions and legal agreements. In many cases, parties engage in agreements where they require additional assurances from each other, particularly when it comes to transfers of property rights, mergers and acquisitions, or financial investments. The concept of Further Assurances in Chicago, Illinois, essentially means that the parties involved will take any necessary steps or actions to ensure that the transaction is fully realized and all obligations are met. This can include but is not limited to the transfer of additional legal documents, consent forms, or any other relevant paperwork needed to complete the transaction. Several types of Chicago Illinois Further Assurances may exist, depending on the nature of the transaction. Some common types include: 1. Property Transfers: In real estate transactions, parties may require further assurances to ascertain the validity of property titles, resolve any existing liens or encumbrances, and ensure a smooth transfer of ownership. Further assurances may involve obtaining additional documents, such as title insurance or proof of clear title, and resolving any outstanding legal issues. 2. Business Mergers and Acquisitions: When corporations merge or one company acquires another, Further Assurances are often required to ensure a seamless transition. This could involve the provision of financial statements, obtaining necessary regulatory approvals, and transferring intellectual property rights. 3. Financial Investments: Investors may require Further Assurances from the issuer to safeguard their investment. This can include additional collateral, guarantees, and documentation that solidify the investor's rights and protect their interests. Further Assurances in this context may also encompass the release of necessary information and compliance with regulatory requirements. 4. Contracts and Agreements: In any contractual agreement, Further Assurances ensure that all obligations and terms are met. This could include actions such as providing additional information, meeting certain performance milestones, or rectifying any deficiencies or breaches. Overall, Chicago Illinois Further Assurances play a vital role in facilitating successful and legally binding transactions across various industries. They provide additional security, guarantee compliance, and establish trust between parties engaged in significant business dealings.

Chicago Illinois Further Assurances

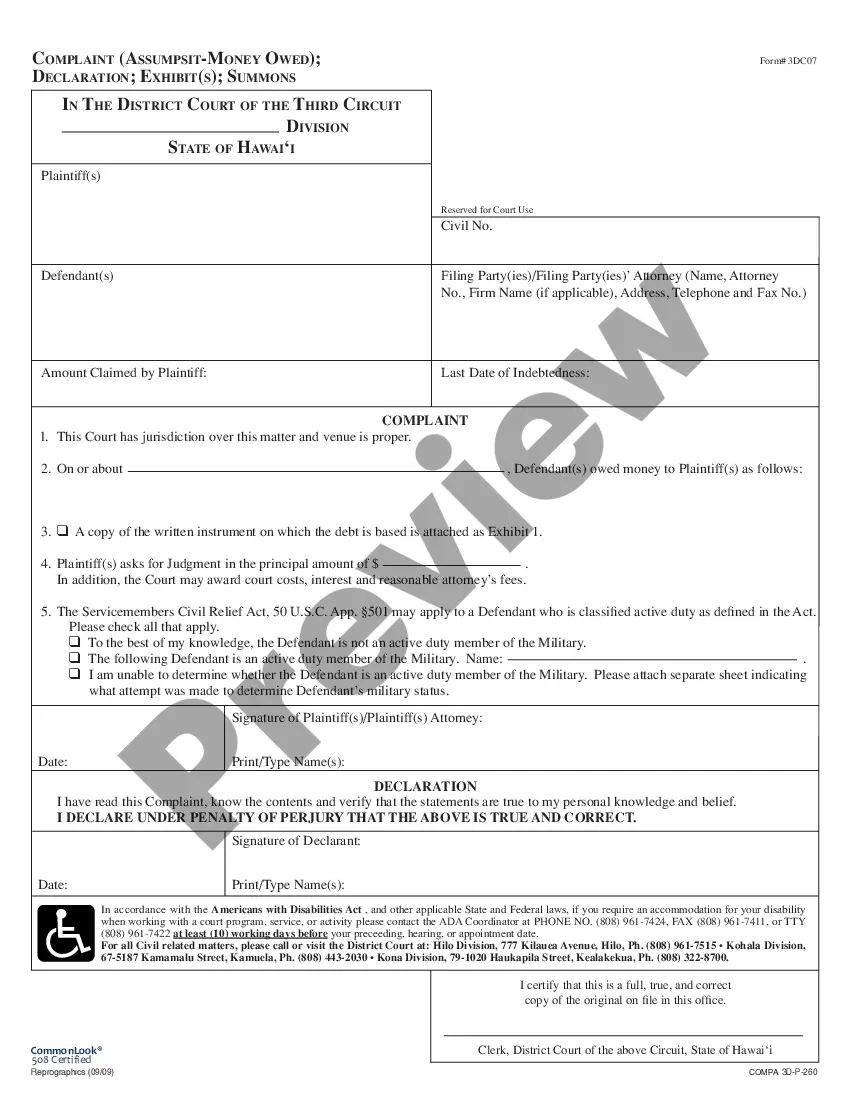

Description

How to fill out Chicago Illinois Further Assurances?

Creating legal forms is a must in today's world. However, you don't always need to look for professional help to create some of them from scratch, including Chicago Further Assurances, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in various types varying from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching process less overwhelming. You can also find detailed resources and tutorials on the website to make any tasks related to paperwork execution straightforward.

Here's how you can locate and download Chicago Further Assurances.

- Go over the document's preview and description (if available) to get a general idea of what you’ll get after getting the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state regulations can impact the legality of some records.

- Examine the related forms or start the search over to find the appropriate document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment gateway, and purchase Chicago Further Assurances.

- Select to save the form template in any offered format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Chicago Further Assurances, log in to your account, and download it. Of course, our website can’t replace a legal professional entirely. If you need to deal with an exceptionally challenging case, we advise getting an attorney to review your document before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of users. Become one of them today and get your state-specific paperwork with ease!