Chicago Illinois indemnities refer to the legal protections and compensations offered in the city of Chicago, within the state of Illinois, to mitigate financial or legal losses incurred by individuals or entities. These indemnities primarily aim to provide security, assurance, and recourse against potential risks or liabilities that may arise from various situations. One of the key types of Chicago Illinois indemnities is the Public Liability Indemnity. This type of indemnity ensures that the city of Chicago takes responsibility for any damages, injuries, or losses suffered by individuals due to the negligence or wrongdoing of a public entity or its employees. For example, if an individual sustains injuries due to faulty city infrastructure, such as a poorly maintained sidewalk, the city may be obligated to provide compensation for medical expenses, lost wages, and the overall impact on their quality of life. Another type of indemnity relevant to Chicago Illinois is the Professional Indemnity. This indemnity specifically pertains to professionals such as lawyers, doctors, architects, and other licensed practitioners who provide services within the city. It ensures that these professionals are protected against claims arising from alleged errors, omissions, or negligence in their professional duties. Professional indemnity coverage helps professionals mitigate legal costs and potential damages that could arise from malpractice claims, ensuring peace of mind in their practice. Furthermore, Chicago Illinois offers Business Indemnities, which encompass a wide range of insurance policies tailored to protect businesses transacting within the city's boundaries. These indemnities often include general liability insurance, product liability insurance, and specific coverage for property damage, theft, fire, and natural disasters. Business indemnities aim to safeguard entrepreneurs and companies against potential financial losses due to unforeseen events, accidents, or legal disputes, allowing them to focus on their operations with reduced risk. Additionally, Chicago Illinois indemnities also extend to personal indemnity insurance, providing individuals with coverage against personal risks. Personal indemnity insurance could include auto insurance, home insurance, health insurance, and umbrella policies that protect against various liabilities and damages. These indemnities help individuals mitigate financial setbacks resulting from accidents, property damage, health issues, or even lawsuits. Overall, Chicago Illinois indemnities encompass a vast spectrum of legal protections and compensations, including Public Liability Indemnities, Professional Indemnities, Business Indemnities, and Personal Indemnities. These indemnities ensure the wellbeing and security of individuals, businesses, and professionals operating within the city, safeguarding against potential financial losses or legal liabilities.

Chicago Illinois Indemnities

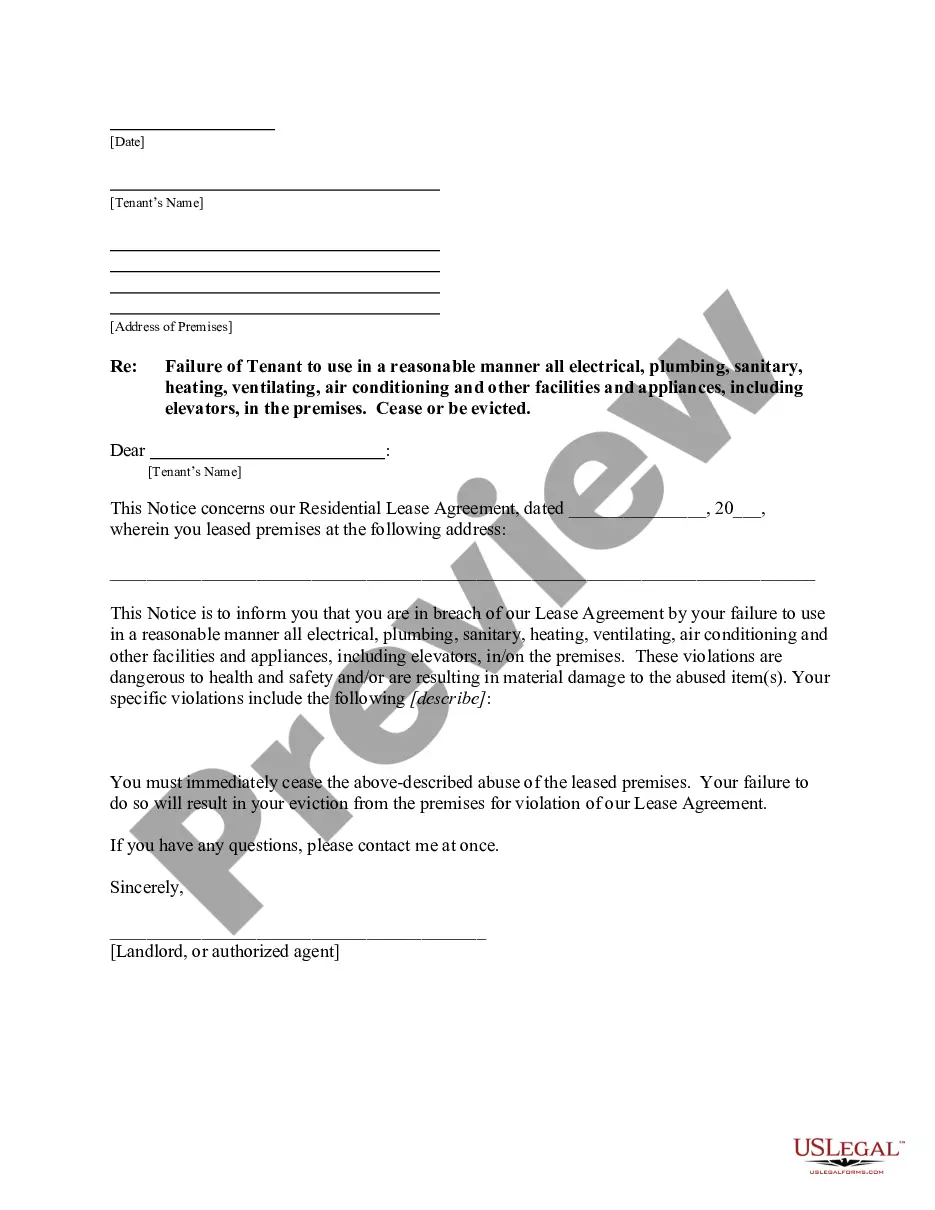

Description

How to fill out Chicago Illinois Indemnities?

If you need to get a reliable legal document provider to obtain the Chicago Indemnities, look no further than US Legal Forms. Whether you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate form.

- You can search from over 85,000 forms arranged by state/county and case.

- The self-explanatory interface, variety of supporting resources, and dedicated support make it simple to find and execute different paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply type to look for or browse Chicago Indemnities, either by a keyword or by the state/county the document is intended for. After finding the needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to start! Simply find the Chicago Indemnities template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Register an account and select a subscription plan. The template will be instantly available for download as soon as the payment is processed. Now you can execute the form.

Handling your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes these tasks less expensive and more reasonably priced. Set up your first company, organize your advance care planning, draft a real estate contract, or complete the Chicago Indemnities - all from the comfort of your home.

Join US Legal Forms now!

Form popularity

FAQ

The most common example of indemnity in the financial sense is an insurance contract. For instance, in the case of home insurance, homeowners pay insurance to an insurance company in return for the homeowners being indemnified if the worst were to happen.

Put simply, indemnity is a contractual agreement between two parties, where one party agrees to pay for potential losses or damages claimed by a third party.

The most common forms of indemnity agreements are broad form indemnity agreements, intermediate type indemnity agreements, and comparative form indemnity agreements. The usage of these agreements depends on the industry.

There are basically 2 types of indemnity namely express indemnity and implied indemnity.

What Is an Indemnity? An indemnity in a contract is a promise by one party to compensate the other party for loss or damage suffered by the other party during contract performance. An indemnity is also known as a 'hold harmless' clause as one party agrees to hold the other party harmless.

Types of Indemnity Express Indemnity. An express indemnity may also refer to written indemnity.Implied Indemnity. Implied indemnity is the other type of agreement that bears an obligation for two concerned parties.Broad Indemnification.Intermediate indemnification.Limited indemnification.

Indemnity benefits are monetary payments you may be entitled to receive as compensation for lost wages or damages related to your workers' compensation claim.

The indemnification method is one way to calculate the amount owed by one counterparty to another in the case of the early termination of a swap. The indemnification method requires the at-fault counterparty to compensate the responsible counterparty for all losses and damages caused by the early termination.

?To indemnify? means to compensate someone for his/her harm or loss. In most contracts, an indemnification clause serves to compensate a party for harm or loss arising in connection with the other party's actions or failure to act. The intent is to shift liability away from one party, and on to the indemnifying party.

There are 3 levels of indemnification: broad form, intermediate form, and limited form. This requires the indemnitor to pay not only for its liabilities but also for the indemnitee's liability whether the indemnitee is solely (i.e. 100%) at fault or partially at fault.