Cook Illinois Corporation is a leading transportation company that specializes in school bus services, charter services, and daily route services. As part of its financing strategy, Cook Illinois has introduced the concept of Assignment of After Payout Interest. The Assignment of After Payout Interest is a financial arrangement used by Cook Illinois to manage its debt obligations. It involves transferring a portion of the interest received from its loans to a third party, usually a financial institution or investor. This arrangement helps Cook Illinois lower its overall interest burden and improve its cash flow position. There are different types of Cook Illinois Assignment of After Payout Interest, each designed to address specific financial requirements and objectives. These types may include: 1. Fixed Assignment: This type of Assignment of After Payout Interest involves a fixed amount or percentage of the interest being assigned to the third party. It provides a predictable cash inflow for the third party and allows Cook Illinois to effectively manage its debt obligations. 2. Variable Assignment: In this type, the amount or percentage of interest assigned to the third party fluctuates based on predefined conditions or performance metrics. It allows Cook Illinois to share the risks and rewards of its debt obligations with the third party. 3. Partial Assignment: Under this arrangement, Cook Illinois assigns only a portion of the interest received from its loans to the third party. It provides flexibility to Cook Illinois in managing its debt obligations while still maintaining control over a portion of the interest. 4. Full Assignment: This type involves Cook Illinois assigning the entire interest received from its loans to the third party. It may be utilized when Cook Illinois wants to transfer the entire interest burden to the third party and focus on other financial aspects of its operations. The Cook Illinois Assignment of After Payout Interest helps the company optimize its debt management strategy, enhance its financial stability, and improve its overall operational efficiency. By partnering with third parties and utilizing these arrangements, Cook Illinois can effectively navigate the financial landscape within the transportation sector. In summary, the Cook Illinois Assignment of After Payout Interest is a financial arrangement that involves transferring a portion of the interest received from loans to a third party. It provides various benefits to Cook Illinois, including lower interest burden, improved cash flow, and enhanced financial stability. The different types of Assignment, such as fixed, variable, partial, and full, allow Cook Illinois to tailor its debt management strategy to its specific requirements and objectives.

Cook Illinois Assignment of After Payout Interest

Description

How to fill out Cook Illinois Assignment Of After Payout Interest?

How much time does it usually take you to draft a legal document? Since every state has its laws and regulations for every life scenario, finding a Cook Assignment of After Payout Interest suiting all regional requirements can be tiring, and ordering it from a professional lawyer is often expensive. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online catalog of templates, collected by states and areas of use. Apart from the Cook Assignment of After Payout Interest, here you can get any specific form to run your business or personal affairs, complying with your regional requirements. Experts check all samples for their validity, so you can be certain to prepare your documentation correctly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can retain the document in your profile at any moment later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you get your Cook Assignment of After Payout Interest:

- Examine the content of the page you’re on.

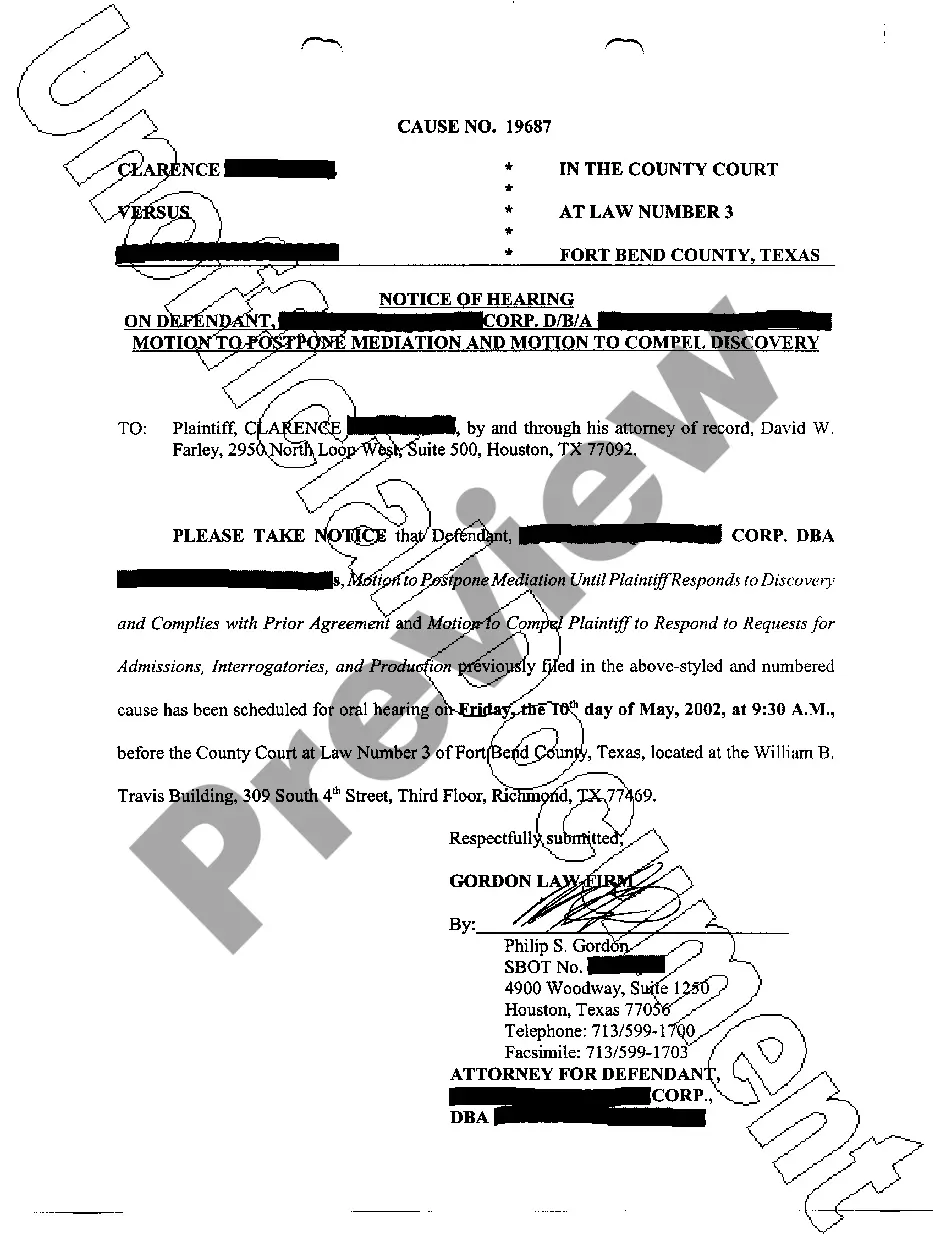

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Cook Assignment of After Payout Interest.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!