Nassau New York Deed

Description

How to fill out Deed?

Drafting documents, such as the Nassau Deed, to handle your legal matters is a demanding and lengthy task.

Many circumstances necessitate the assistance of a lawyer, which also renders this undertaking quite costly.

However, you can take control of your legal affairs and handle them independently.

The onboarding process for new users is just as simple! Here’s what you need to complete before obtaining the Nassau Deed.

- US Legal Forms is here to assist.

- Our platform offers over 85,000 legal templates designed for various scenarios and situations in life.

- We ensure that every document complies with the regulations of each state, relieving you of concerns regarding possible legal issues linked to compliance.

- If you are already familiar with our offerings and possess a subscription with US, you already know how straightforward it is to obtain the Nassau Deed template.

- Feel free to Log In to your account, download the template, and customize it to fit your needs.

- Have you misplaced your document? No problem. You can retrieve it in the My documents section of your account - accessible on both desktop and mobile.

Form popularity

FAQ

Deed Fee Schedule $ 5.00Per Side (Include the front page only of the Suffolk County Clerk Recording and Endorsement Form in the fee calculation.)$ 15.00Cultural Education Fund$ 5.00Real Estate Transfer Tax Return TP-584$125.00Real Property Transfer Report RP-5217 Filing Fee (Residential)5 more rows

In Nassau County, in order to a record a real estate document, a person must pay a $300 block recording fee, a base recording fee of $40, and a $5 per page fee.

"Should you need any further information, or wish to purchase a certified copy of your deed, you may contact the Suffolk County Clerk's Office at 310 Center Drive in Riverhead or online at .

Where can I obtain a copy of my deed or mortgage? The fastest way to obtain this information is to come to the Nassau County Clerk's office here at 240 Old Country Rd, Mineola, NY 11501 with the section, block, and lot of the property. If you want to mail your request download the instructions (PDF).

Recording Fees 5 Boroughs, Westchester and Outer CountiesDeed and RP-5217 NYC Filing Fee (Residential)310Subordination Agreement125Nassau CountyDeed and RP-5217 NYC Filing Fee (Residential)60029 more rows

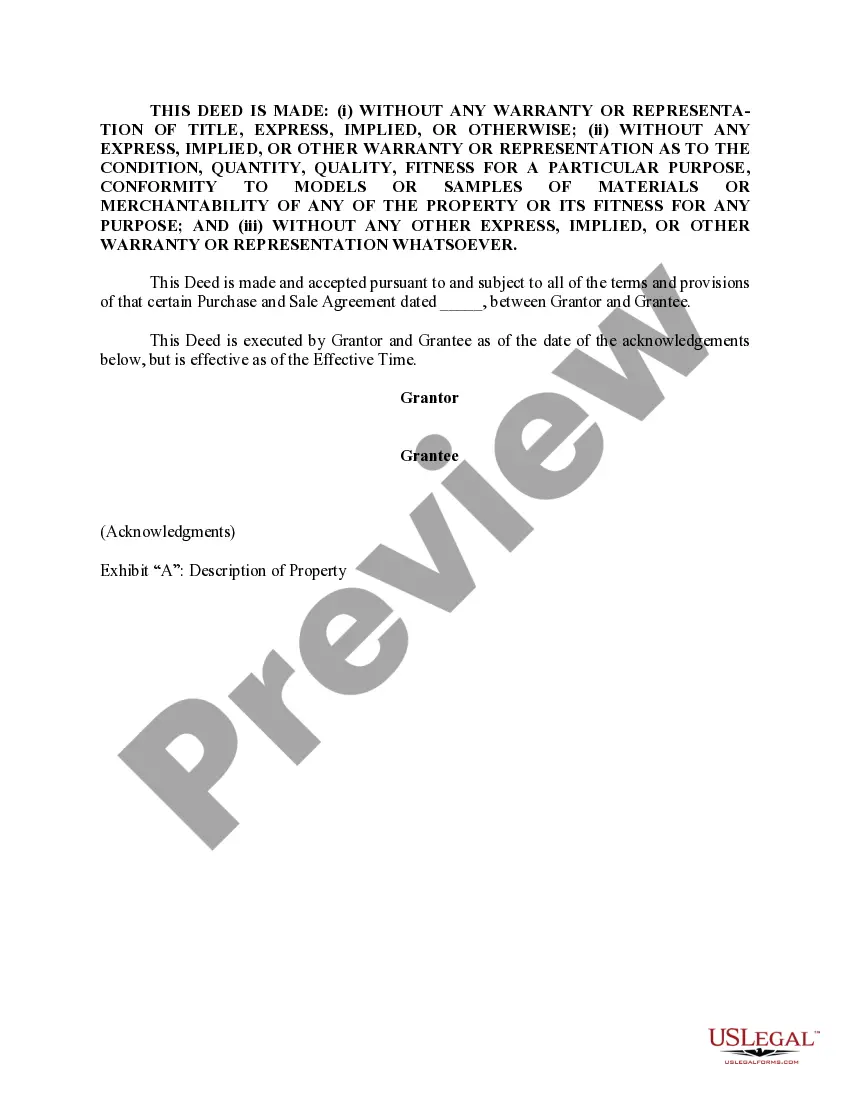

Sign the deed in the presence of a notary public or other authorized official. Record the deed at the county clerk's office in the county where the property is located for a valid transfer. Contact the same office to confirm accepted forms of payment.

Where can I obtain a copy of my deed or mortgage? The fastest way to obtain this information is to come to the Nassau County Clerk's office here at 240 Old Country Rd, Mineola, NY 11501 with the section, block, and lot of the property. If you want to mail your request download the instructions (PDF).

Deeds and Document Certification - Registrar General's Department - Government. Certified copies of deeds or documents may be requested online at a cost of $4 per page for up to 10 pages and $2.50 per page thereafter. Document and deed searches are conducted by the department at a cost of $10 per hour.

You can request a certified or uncertified copy of property records online or in person. Certified copies cost $4 per page. Uncertified copies printed at a City Register Office cost $1 per page. There is no charge for ACRIS copies printed from a personal computer.

The fastest way to obtain this information is to come to the Nassau County Clerk's office here at 240 Old Country Rd, Mineola, NY 11501 with the section, block, and lot of the property. If you want to mail your request download the instructions (PDF). Read the instructions on the form and send in the appropriate fee.