Harris Texas Ratification of Oil, Gas, and Mineral Lease by Mineral Owner, Paid-Up Lease: A Comprehensive Overview Keywords: Harris Texas, Ratification of Oil, Gas and Mineral Lease, Mineral Owner, Paid-Up Lease Introduction: In Harris County, Texas, the Ratification of Oil, Gas, and Mineral Lease by Mineral Owner, Paid-Up Lease serves as a legally binding agreement between a mineral owner and an oil or gas company. This lease allows the company to explore, extract, and develop oil, gas, and mineral resources on the owner's property. In this article, we will delve into the various aspects of the Harris Texas Ratification of Oil, Gas, and Mineral Lease by Mineral Owner, Paid-Up Lease, exploring its significance, types, and key considerations. Types of Harris Texas Ratification of Oil, Gas, and Mineral Lease: 1. Paid-Up Lease: A Paid-Up Lease refers to a lease agreement where the mineral owner receives an upfront payment. This payment eliminates the need for ongoing royalty payments typically associated with traditional leases. It provides the owner with a lump-sum amount, granting the oil and gas company exclusive rights to exploit the resources without additional financial obligations. 2. Primary Term Lease: Under a Primary Term Lease, the agreement remains valid for a specific period, typically a few years. The lease allows the oil and gas company to explore and develop resources during this term. If production does not commence within the primary term, the lease may expire unless otherwise extended or amended. 3. Royalty Lease: In a Royalty Lease, the mineral owner receives a percentage of the revenue generated from the oil, gas, or mineral production. The royalty rate is often negotiated between the owner and the company and may vary depending on the market conditions, type of resource, and other factors. Important Considerations: 1. Rights and Obligations: The Harris Texas Ratification of Oil, Gas, and Mineral Lease outlines the rights and obligations of both the mineral owner and the oil or gas company. It defines the scope of exploration and production, including drilling operations, royalties, surface damage, and other considerations. 2. Primary Term and Extension: The lease specifies the duration of the primary term and any provisions for extensions beyond this period. It is essential for both parties to clearly understand when the lease may expire or be extended to avoid disagreements or disputes. 3. Bonus or Upfront Payment: In the case of a Paid-Up Lease, the upfront payment, often referred to as a bonus, should be thoroughly defined in the agreement. It may depend on factors such as the size of the property, market conditions, and the estimated value of resources. 4. Surface Use and Reclamation: The lease should include provisions for surface use, addressing the potential impact of drilling activities on the property. It should outline measures for reclamation and restoration of the land once operations are completed. 5. Royalty Rates and Payments: If the lease involves royalty payments, the agreement must specify the percentage rate and provide clarity on how and when the payments will be made. It is important to include provisions for auditing the company's records to ensure accurate royalty calculations. Conclusion: The Harris Texas Ratification of Oil, Gas, and Mineral Lease by Mineral Owner, Paid-Up Lease provides an avenue for mineral owners to monetize their resources while granting oil and gas companies the right to exploit them. Whether it is a Paid-Up Lease, Primary Term Lease, or Royalty Lease, it is crucial for both parties to understand the terms, rights, and obligations outlined in the agreement. Seeking professional legal advice is highly recommended ensuring a fair and mutually beneficial lease agreement.

Harris Texas Ratification of Oil, Gas and Mineral Lease by Mineral Owner, Paid-Up Lease

Description

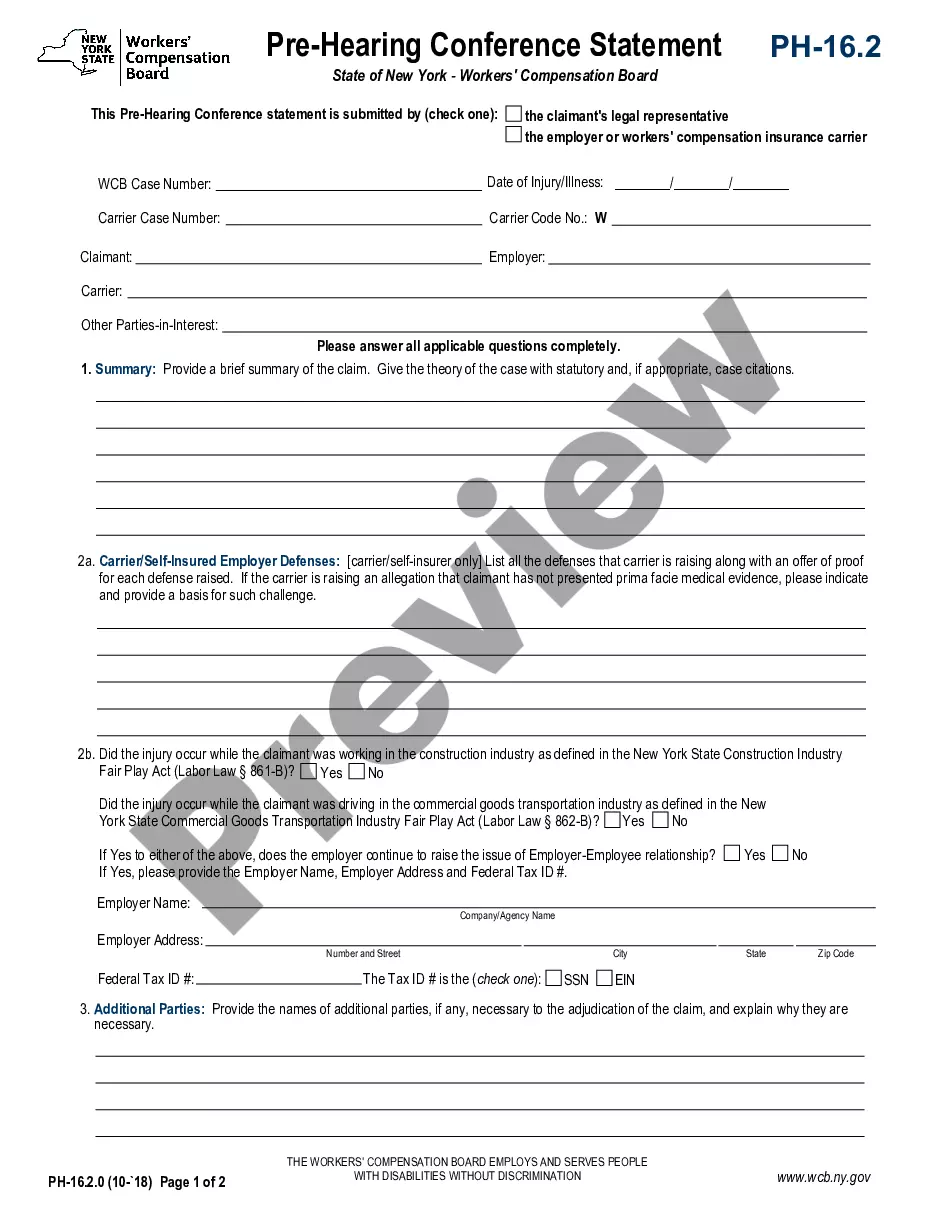

How to fill out Harris Texas Ratification Of Oil, Gas And Mineral Lease By Mineral Owner, Paid-Up Lease?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and many other life situations demand you prepare formal documentation that differs from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily find and get a document for any personal or business objective utilized in your county, including the Harris Ratification of Oil, Gas and Mineral Lease by Mineral Owner, Paid-Up Lease.

Locating samples on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Harris Ratification of Oil, Gas and Mineral Lease by Mineral Owner, Paid-Up Lease will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to get the Harris Ratification of Oil, Gas and Mineral Lease by Mineral Owner, Paid-Up Lease:

- Make sure you have opened the right page with your local form.

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template meets your requirements.

- Look for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Decide on the appropriate subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Harris Ratification of Oil, Gas and Mineral Lease by Mineral Owner, Paid-Up Lease on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!