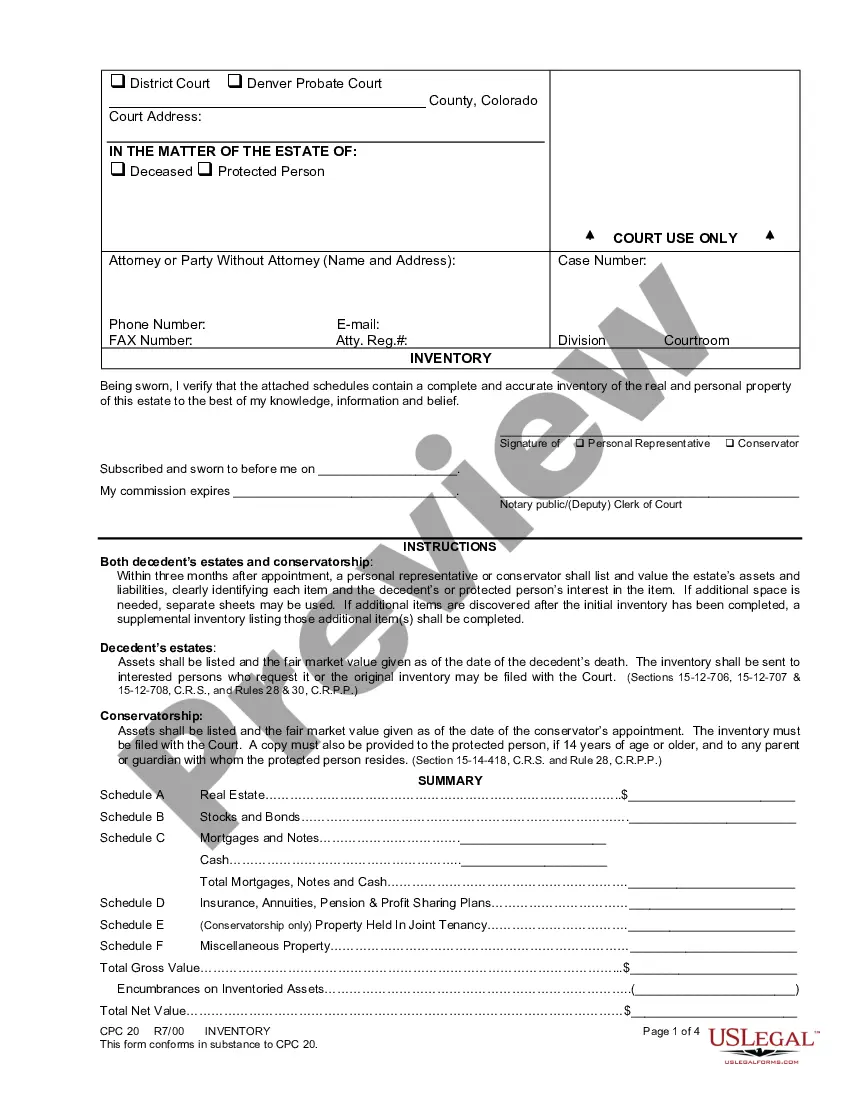

Wayne Michigan Release of Judgment Lien — Full Release In Wayne, Michigan, a Release of Judgment Lien — Full Release is a legal document used to fully release a judgment lien that has been placed on a property by a creditor. This document is essential for property owners who have successfully satisfied the outstanding judgment against them and want to clear the lien from their property's title. When a creditor obtains a judgment against a debtor and records it as a lien on the debtor's property, it creates a cloud on the property's title, hindering the owner's ability to sell or refinance the property. However, once the judgment is fully satisfied, the property owner can initiate the process of obtaining a Release of Judgment Lien — Full Release to remove the lien from the property's title. There are different types of Release of Judgment Lien — Full Release in Wayne, Michigan, depending on the specific circumstances: 1. Voluntary Full Release: This type of release is obtained when the judgment creditor willingly agrees to release the judgment lien upon receiving full payment or satisfaction of the judgment. The property owner can request a voluntary full release from the creditor by filing the necessary paperwork with the relevant court. 2. Court-Ordered Full Release: In some cases, if the creditor fails to respond or is uncooperative in providing the full release, the property owner may need to seek a court order to compel the release of the judgment lien. The court then issues an order, commanding the creditor to release the lien fully. 3. Release of Judgment Lien by Operation of Law: In certain circumstances where the judgment lien expires or is deemed legally unenforceable, the property owner may seek a release of the lien by operation of law. This typically occurs when the judgment reaches its expiration date, typically within a specified number of years, as determined by state law. To obtain a Release of Judgment Lien — Full Release in Wayne, Michigan, property owners need to follow a series of steps. Firstly, they must verify that the judgment lien has been fully satisfied, typically through payment evidence or a satisfaction of judgment document. Then, they need to prepare the appropriate release forms, including a release of judgment lien and an affidavit of full satisfaction, to be filed with the court or recorder's office where the lien was recorded. Finally, the property owner must pay the required fees and ensure that all documents are accurately completed and notarized before submitting them for recording. Overall, a Release of Judgment Lien — Full Release in Wayne, Michigan, serves as a crucial legal instrument in clearing judgment liens from properties, enabling owners to regain full control and marketability of their real estate assets. By diligently following the necessary procedures and paperwork, property owners can successfully navigate the process and enjoy the benefits of a clean title.

Wayne Michigan Release of Judgment Lien - Full Release

Description

How to fill out Wayne Michigan Release Of Judgment Lien - Full Release?

If you need to find a reliable legal paperwork provider to get the Wayne Release of Judgment Lien - Full Release, consider US Legal Forms. No matter if you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed template.

- You can browse from over 85,000 forms arranged by state/county and case.

- The intuitive interface, variety of learning resources, and dedicated support team make it easy to locate and execute various paperwork.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

Simply type to look for or browse Wayne Release of Judgment Lien - Full Release, either by a keyword or by the state/county the form is created for. After finding the needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply find the Wayne Release of Judgment Lien - Full Release template and check the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Create an account and select a subscription option. The template will be immediately available for download once the payment is processed. Now you can execute the form.

Taking care of your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes this experience less costly and more affordable. Create your first business, organize your advance care planning, draft a real estate agreement, or execute the Wayne Release of Judgment Lien - Full Release - all from the comfort of your sofa.

Join US Legal Forms now!

Form popularity

FAQ

Sec. 2809. (1) Unless subsection (2) or (3) applies, a judgment lien expires 5 years after the date it is recorded. (2) Unless subsection (3) applies, if a judgment lien is rerecorded under subsection (4), the judgment lien expires 5 years after the date it is rerecorded.

Judgment liens may be filed with the court and recorded with the register of deeds by an attorney or the judgment creditor. An Order for Seizure of Property may be issued by the court clerk 21 days after entry of a judgment. It is also known as a writ of execution and is authorized pursuant to MCL 600.6004.

Though the lien operates much like a mortgage on real estate owned by the debtor, a judgment creditor cannot foreclose on this lien and sell the property to satisfy the judgment.

A judgment from a Small Claims case expires six years after it is issued. Most other judgments in Michigan expire 10 years after they are issued. You can renew a judgment before it expires by filing a motion to renew a judgment.

The statue of limitations on a civil judgment recorded after 1973 is 10 years. A judgment in Michigan has to be renewed every five years and will not be collectible if not renewed within the five year period.

Judgment liens last for five years. But, a creditor can renew the lien until your judgment expires. Most judgments in Michigan expire after 10 years.

The period of limitations is 6 years for an action founded upon a judgment or decree rendered in a court not of record of this state, or of another state, from the time of the rendition of the judgment or decree.

A judgment from a Small Claims case expires six years after it is issued. Most other judgments in Michigan expire 10 years after they are issued. You can renew a judgment before it expires by filing a motion to renew a judgment.

More info

Please call Howard County Department of Finance at after hours for more information How can I reduce what my local government owes me? In most cases, you are better off making a written payment of what you owe when you call so that you can have an accurate reading of your payment obligation, and can avoid tax evasion. If the property tax office has your current address and the last four digits of your Social Security number, they will be able to verify your payments. This information can be found on the back of your notice of assessment, which will often include a signature line and title number that can be used to verify payments of property tax. In some cases, property tax payments cannot be verified as this information is confidential. However, the county will provide you with a payment history sheet. This can be entered into the local Property Tax Payroll Services System.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.