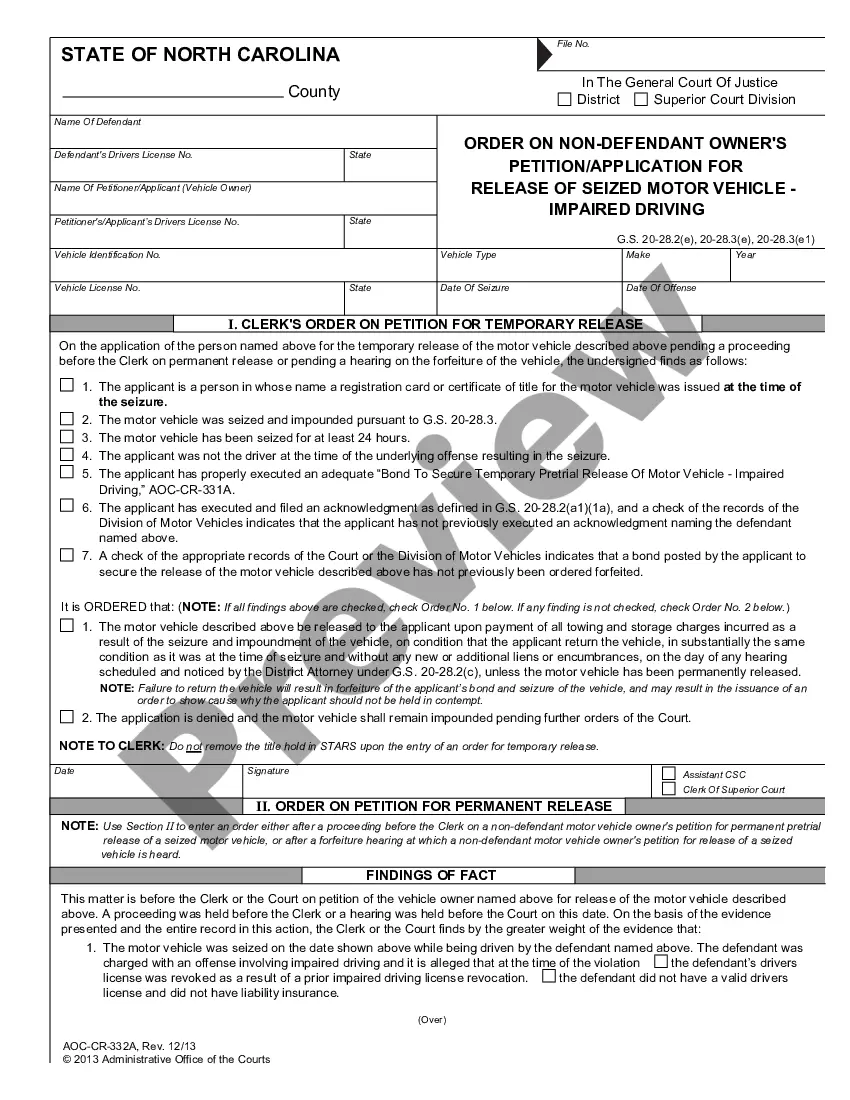

Maricopa Arizona Release of Lien | A Comprehensive Overview In Maricopa, Arizona, a Release of Lien is an important legal document designed to release a claim against a property. It serves as proof that a lien or encumbrance on the property has been fully satisfied or resolved. A Release of Lien is typically issued by the lien holder, whether it is a contractor, lender, or any party with a legitimate claim against the property, once the debt, obligation, or lien has been paid off. This document plays a crucial role in the real estate industry, providing assurance to potential buyers that the property they are interested in is free from any outstanding debts or encumbrances. The Release of Lien acts as a safeguard for potential buyers, ensuring that they acquire clear title to the property. It also protects property owners from any future disputes or claims arising from the released lien. Types of Maricopa Arizona Release of Lien: 1. Construction Lien Release: This type of Release of Lien is commonly associated with construction projects. It is used when a contractor, subcontractor, or supplier has placed a lien against a property to secure payment for their services, labor, or materials provided. Once the outstanding debt is satisfied, the lien holder will issue a Construction Lien Release, releasing the property from the encumbrance. 2. Mechanic's Lien Release: Similar to a Construction Lien Release, a Mechanic's Lien Release addresses liens filed by contractors or suppliers specifically in relation to construction or improvement work done on a property. Upon payment, the lien holder releases the lien, freeing the property from any claims. 3. Mortgage Lien Release: When a property owner pays off their mortgage loan, the lender will issue a Mortgage Lien Release. This document discharges the mortgage lien from the property, showing that the loan obligation has been satisfied, and the property is no longer encumbered. 4. Judgment Lien Release: A Judgment Lien Release occurs when a court-ordered judgment against a property is resolved and the debt is paid. Once the judgment lien is released, the property is no longer subject to the claim. 5. Tax Lien Release: In cases where property owners have unpaid taxes, the government or tax authority may place a tax lien on the property. Once the tax debt is paid, a Tax Lien Release is issued, demonstrating that the lien has been released, and the property is no longer liable for the outstanding taxes. It is essential to have a properly executed Release of Lien document to provide legal clarity and ensure the free and clear transfer of property ownership. This protects both the buyer and the property owner, allowing for a seamless real estate transaction while establishing accountability and releasing any potential claims against the property in Maricopa, Arizona.

Maricopa Arizona Release of Lien

Description

How to fill out Maricopa Arizona Release Of Lien?

Draftwing forms, like Maricopa Release of Lien, to take care of your legal affairs is a challenging and time-consumming process. A lot of circumstances require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can acquire your legal matters into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents created for various cases and life situations. We ensure each form is compliant with the regulations of each state, so you don’t have to worry about potential legal pitfalls associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Maricopa Release of Lien template. Go ahead and log in to your account, download the template, and customize it to your requirements. Have you lost your form? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is fairly simple! Here’s what you need to do before getting Maricopa Release of Lien:

- Make sure that your document is specific to your state/county since the regulations for writing legal papers may vary from one state another.

- Learn more about the form by previewing it or reading a quick intro. If the Maricopa Release of Lien isn’t something you were looking for, then use the header to find another one.

- Sign in or register an account to start using our website and download the form.

- Everything looks great on your side? Hit the Buy now button and select the subscription option.

- Pick the payment gateway and enter your payment information.

- Your form is ready to go. You can try and download it.

It’s easy to find and buy the appropriate template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich library. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!