Title: Understanding Harris Texas Release of Lien for Deed of Trust: A Comprehensive Guide Introduction: A Harris Texas Release of Lien for Deed of Trust is a legal document that serves to clear a property from any outstanding liens or encumbrances recorded against it. This form helps demonstrate that the lender has released all rights to the property, providing the homeowner with a clean title. In Harris County, Texas, there are different types of Release of Lien for Deed of Trust that homeowners may encounter, each serving a specific purpose. Read on to gain a better understanding of this important legal process. 1. Release of Lien for Deed of Trust in Harris County, Texas: The Release of Lien for Deed of Trust is the final step in the mortgage or loan repayment process. It acknowledges that the homeowner has fulfilled their financial obligations and prompts the lender to officially release the lien they hold against the property. This document is crucial in ensuring a clear and transferable title. 2. Voluntary Release: The Voluntary Release of Lien for Deed of Trust occurs when the homeowner has successfully repaid their mortgage or loan in full. It is a voluntary action taken by the lender to relinquish their interest in the property. This release should be recorded with the county clerk's office to ensure a public record of the lien removal. 3. Subordination Agreement: In some cases, homeowners may need to apply for additional loans or lines of credit while a previous lien remains on the property. A Subordination Agreement, a specific type of Release of Lien for Deed of Trust, allows the new lender to establish their claim as the primary lien holder, making the previous lien secondary. This process enables a homeowner to access the equity in their property while maintaining the legal rights and interests of all parties involved. 4. Partial Release: When a homeowner owns multiple properties that serve as collateral for a loan, a Partial Release of Lien for Deed of Trust may come into play. It effectively releases a particular property from the mortgage while the remaining properties remain subject to the lien. A Partial Release is commonly used when refinancing, selling, or dividing properties. 5. Post-Foreclosure Release: In cases where foreclosure proceedings have taken place, but there were no successful bidders at the foreclosure sale, a Post-Foreclosure Release of Lien for Deed of Trust is necessary. This document is filed by the trustee and released by the lender to terminate the lien on the property. It is crucial for homeowners aiming to clear their property from any encumbrances following an unsuccessful foreclosure sale. Conclusion: Understanding the different types of Harris Texas Release of Lien for Deed of Trust is essential for homeowners who seek clarity on their property titles and wish to address any outstanding liens. Whether it's a voluntary release, subordination agreement, partial release, or post-foreclosure release, homeowners should ensure these releases are appropriately recorded to validate a clean title and protect their property rights. Consulting with an experienced real estate attorney can provide further assistance in navigating the specifics of each type of release.

Release Of Lien Deed Of Trust Texas

Description

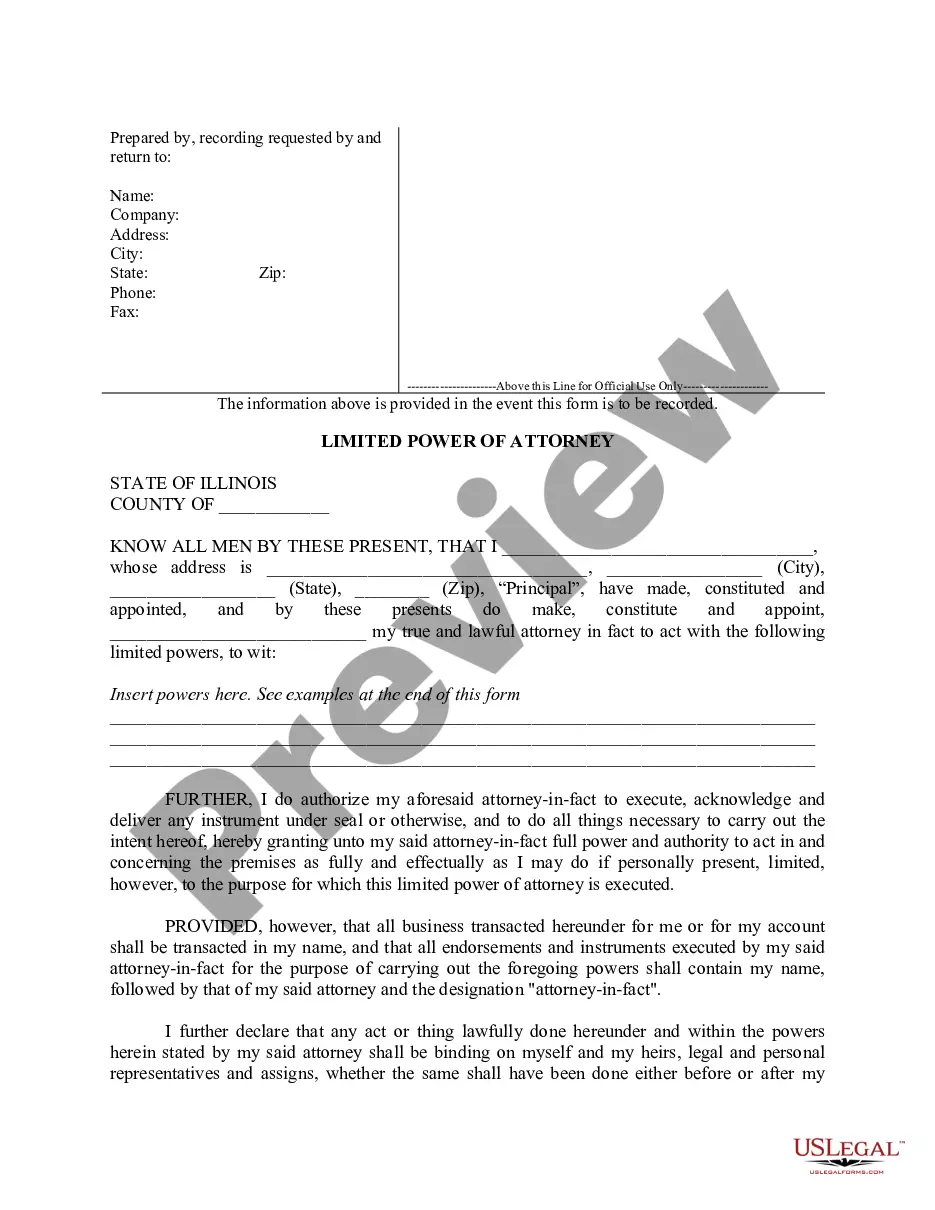

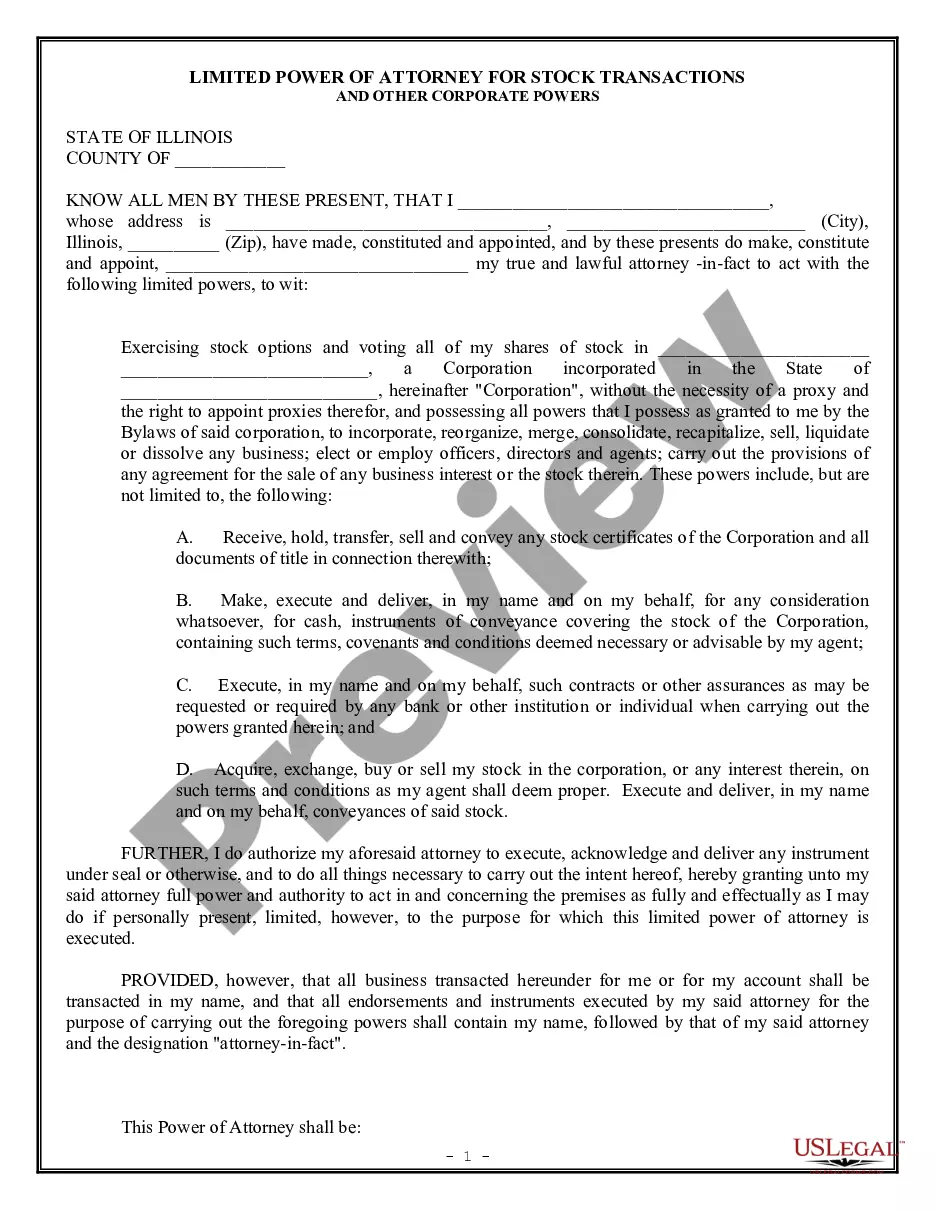

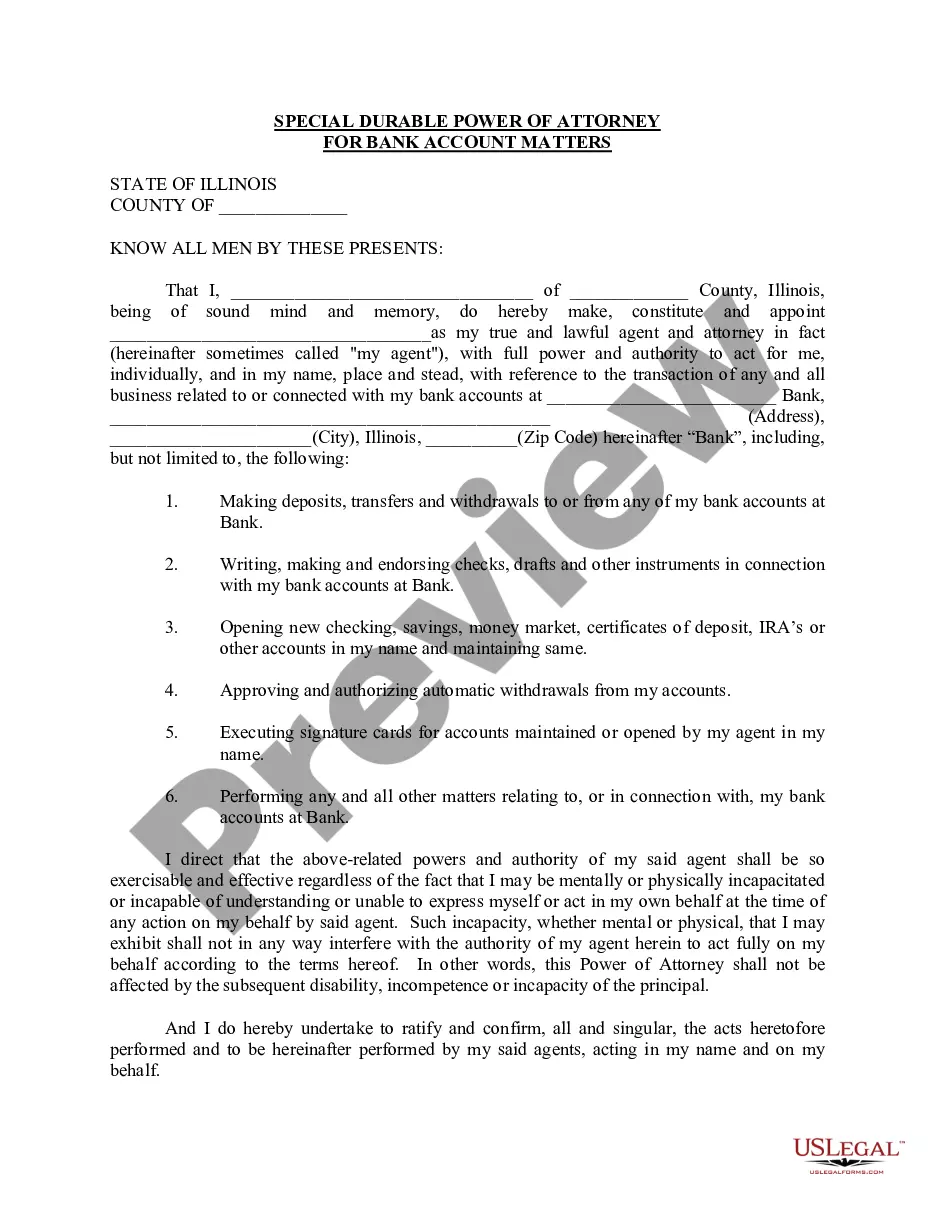

How to fill out Harris Texas Release Of Lien For Deed Of Trust?

If you need to get a trustworthy legal paperwork supplier to obtain the Harris Release of Lien for Deed of Trust, look no further than US Legal Forms. No matter if you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed template.

- You can search from over 85,000 forms arranged by state/county and case.

- The self-explanatory interface, number of supporting materials, and dedicated support make it easy to get and execute various paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply select to look for or browse Harris Release of Lien for Deed of Trust, either by a keyword or by the state/county the form is created for. After finding the needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to start! Simply locate the Harris Release of Lien for Deed of Trust template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Register an account and choose a subscription option. The template will be immediately ready for download once the payment is processed. Now you can execute the form.

Taking care of your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes this experience less costly and more reasonably priced. Set up your first business, arrange your advance care planning, draft a real estate agreement, or complete the Harris Release of Lien for Deed of Trust - all from the comfort of your sofa.

Join US Legal Forms now!