Orange California Release of Lien for Deed of Trust

Description

How to fill out Orange California Release Of Lien For Deed Of Trust?

How much time does it typically take you to draft a legal document? Given that every state has its laws and regulations for every life situation, finding a Orange Release of Lien for Deed of Trust meeting all regional requirements can be exhausting, and ordering it from a professional lawyer is often pricey. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, gathered by states and areas of use. Aside from the Orange Release of Lien for Deed of Trust, here you can find any specific document to run your business or individual deeds, complying with your county requirements. Specialists verify all samples for their validity, so you can be certain to prepare your documentation properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required sample, and download it. You can pick the document in your profile at any moment later on. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Orange Release of Lien for Deed of Trust:

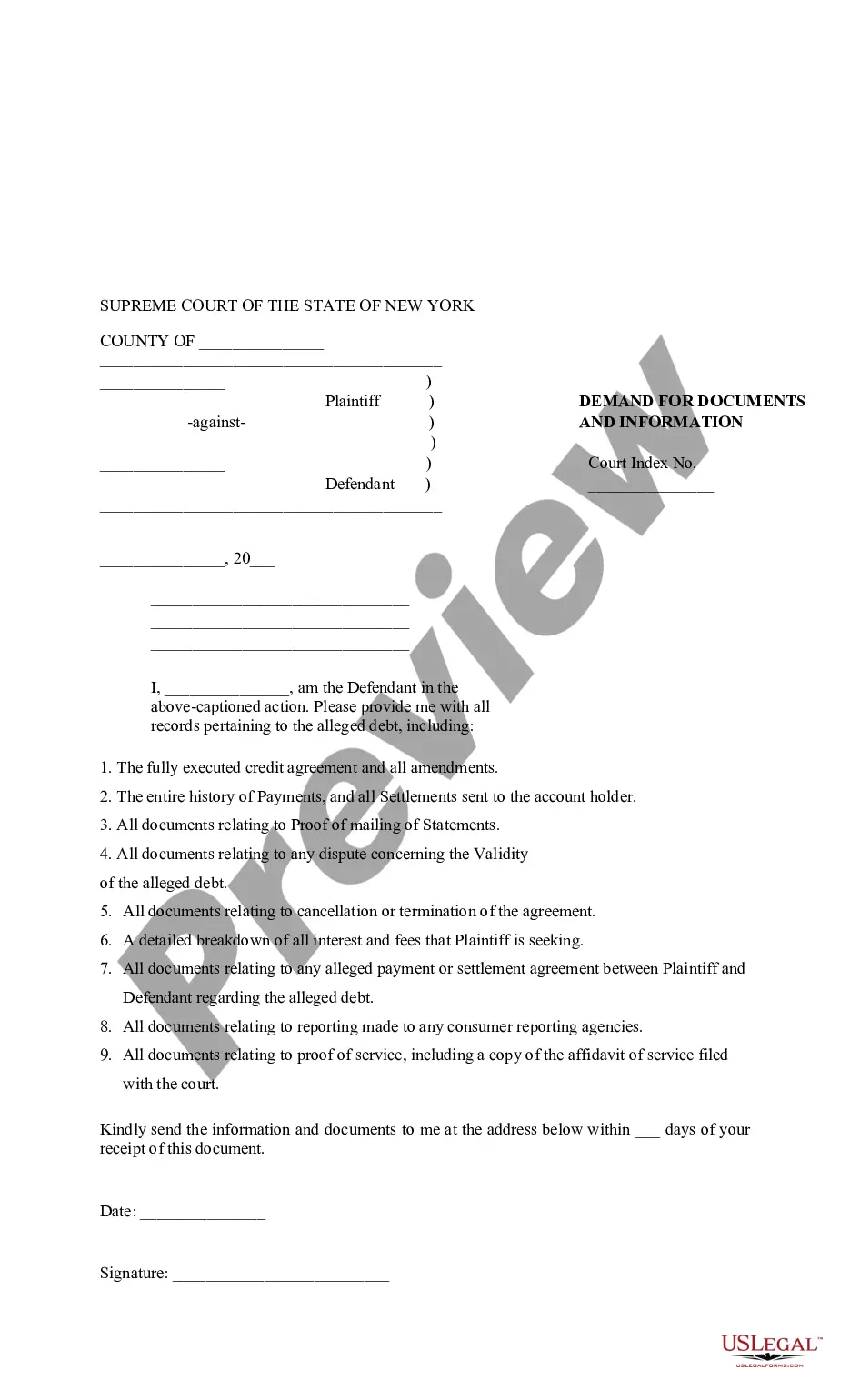

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Orange Release of Lien for Deed of Trust.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

When a deed of trust/mortgage is paid in full, you can record a Full Reconveyance from the trustee stating publicly that the loan has been paid. The Full Reconveyance Form is completed and signed by the trustee, whose signature must be notarized.

Complete the top area of the reconveyance deed. Enter the name of and address of the person who executed the deed of trust, the borrower or debtor. Refer to the original deed of trust for the name spelling. Complete the middle section, the trustee's name and address.

The Reconveyance Process Once you've repaid your loan in full, your lender contacts the title company to issue a deed of reconveyance.

A voluntary lien (like a mortgage), is one that a person has over the property of another as security for the payment of a debt. Deed of Trust are also voluntary liens, which require the notarized signature of the debtor. Remember, liens are attached to the property and not to a person.

The Substitution of Trustee and Full Reconveyance is signed by the present beneficiary and present Trustee under Deed of Trust, whose signatures are notarized.

A mortgage only involves two parties the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid.

A Deed of Trust is essentially an agreement between a lender and a borrower to give the property to a neutral third party who will serve as a trustee. The trustee holds the property until the borrower pays off the debt.

To record the reconveyed deed, the property owner must go to the office of the Registrar-Recorder in which the property is located. For example, if the property is located in Los Angeles County, the reconveyed deed must be taken to the Los Angeles County Recorder's Office.

Trust deeds can be a valuable aid to financial stability, but they are not right for everybody. They are best suited to people who have a regular income and can commit to regular payments.

A Deed of Trust is a type of secured real-estate transaction that some states use instead of mortgages. See State Property Statutes. A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money. In exchange, the borrower gives the lender one or more promissory notes.