Orange, California, Partial Release of Mortgage/Deed of Trust for Landowner is a legal document that allows a property owner in Orange, California, to release a portion of their property from the mortgage or deed of trust. This release is typically done when the property owner wants to sell or transfer a specific portion of their land, but maintain the mortgage or deed of trust on the remaining portion. A Partial Release of Mortgage/Deed of Trust for Landowner in Orange, California, protects both the lender and the landowner. It ensures that the lender's interest in the remaining portion of the property is secured, while allowing the landowner to transfer or sell the released portion without any encumbrances. There are different types of Orange, California, Partial Release of Mortgage/Deed of Trust for Landowner based on the specific situation of the property owner: 1. Partial Release of Mortgage/Deed of Trust for Landowner for Subdivision: This type of release is used when the property owner wants to divide their land into smaller lots and release certain lots from the mortgage or deed of trust while retaining it on the remaining lots. 2. Partial Release of Mortgage/Deed of Trust for Landowner for Easement: In some cases, a landowner may want to grant an easement to another party for access or utilities. This release allows the landowner to release the portion of the land where the easement is granted from the mortgage or deed of trust. 3. Partial Release of Mortgage/Deed of Trust for Landowner for Sale or Transfer: When a landowner intends to sell or transfer a specific portion of their property, they can use this type of release to release that portion from the mortgage or deed of trust without affecting the remaining portion. It is important for landowners in Orange, California, to consult with a real estate attorney or a title company specializing in property transfers to ensure that the Partial Release of Mortgage/Deed of Trust is prepared and executed correctly, as it may vary based on the specific circumstances and requirements of the transaction.

Orange California Partial Release of Mortgage / Deed of Trust For Landowner

Description

How to fill out Orange California Partial Release Of Mortgage / Deed Of Trust For Landowner?

Drafting paperwork for the business or individual demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state laws of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to draft Orange Partial Release of Mortgage / Deed of Trust For Landowner without expert assistance.

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid Orange Partial Release of Mortgage / Deed of Trust For Landowner by yourself, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed form.

In case you still don't have a subscription, adhere to the step-by-step guide below to get the Orange Partial Release of Mortgage / Deed of Trust For Landowner:

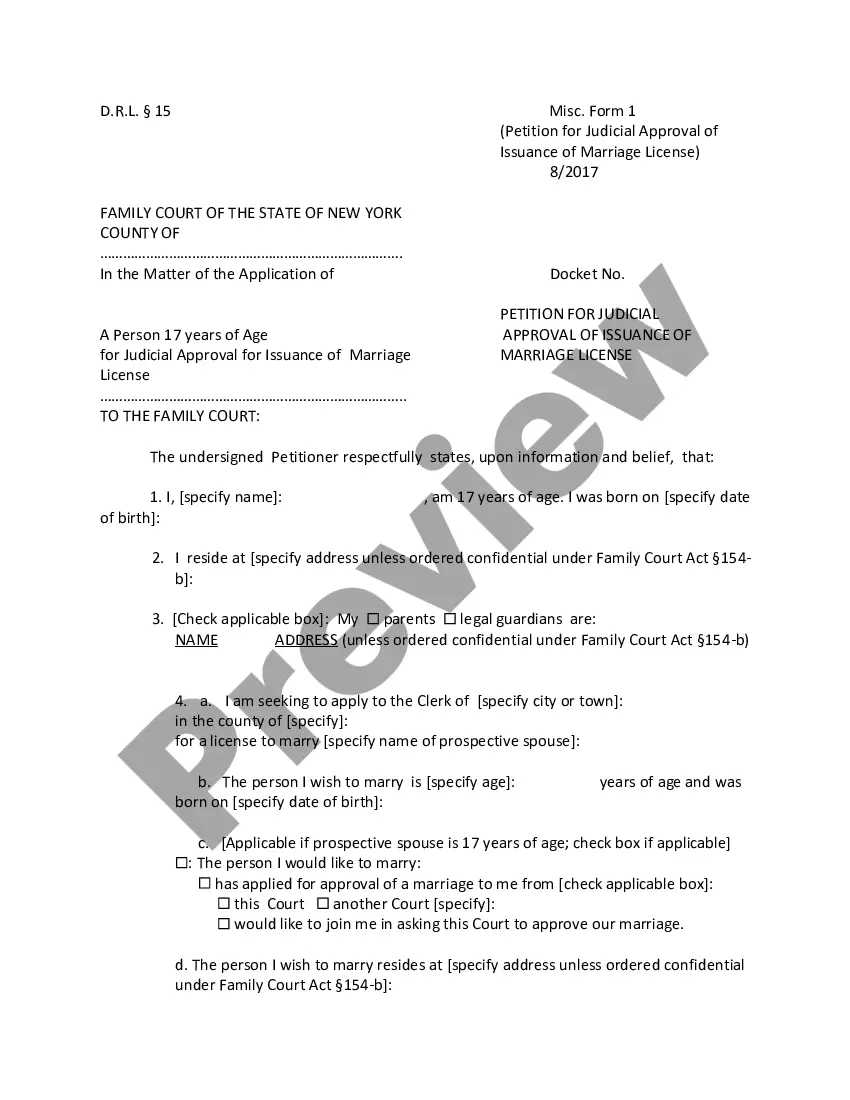

- Look through the page you've opened and verify if it has the document you require.

- To do so, use the form description and preview if these options are presented.

- To locate the one that fits your requirements, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal templates for any situation with just a few clicks!

Form popularity

FAQ

When title to a parcel of real property is partially transferred, a document called a partial reconveyance is used to document the partial transfer of the property to a new owner.

Partial Release Clause is a provision under which the mortgagee agrees to release certain parcels from the lien of the blanket mortgage upon payment of a certain sum of money by the mortgagor. It's frequently found in tract development construction loans.

This document officially discharges you from the debt obligation and removes the lien against the property. The lender should send a copy of the discharge to you, and also to the closing attorney and settlement agent if you're selling the property.

When a partial release of mortgage is granted, specific sections of the property in question will be removed from the collateral backing the debt. This can be particularly useful in scenarios where a borrower is attempting to sell a portion of their property still covered by the mortgage.

Which document is available to the borrower when the loan secured by a deed of trust is completely repaid? The answer is release deed.

Releasing a mortgage lien often involves two or three signatures. Depending on your state, the person who's given the mortgage, the borrower, and the lender may be required to sign the release. In many states, a notary public signature and, possibly, a seal, is also needed to have a legal release of lien.

To sell just part of your mortgaged property, a land transaction between you and the buyer must take place. That transaction must provide the buyer with a clear title to the piece of land you're selling, so you'll need a partial release of a mortgage lien from your lenderwhich we'll help you obtain.

Key Takeaways. A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.

A reconveyance deed is an official document from a mortgage holder releasing the debtor from the mortgage. It is documentation that the mortgage has been paid in full and that the lender has acknowledged the full payment.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.