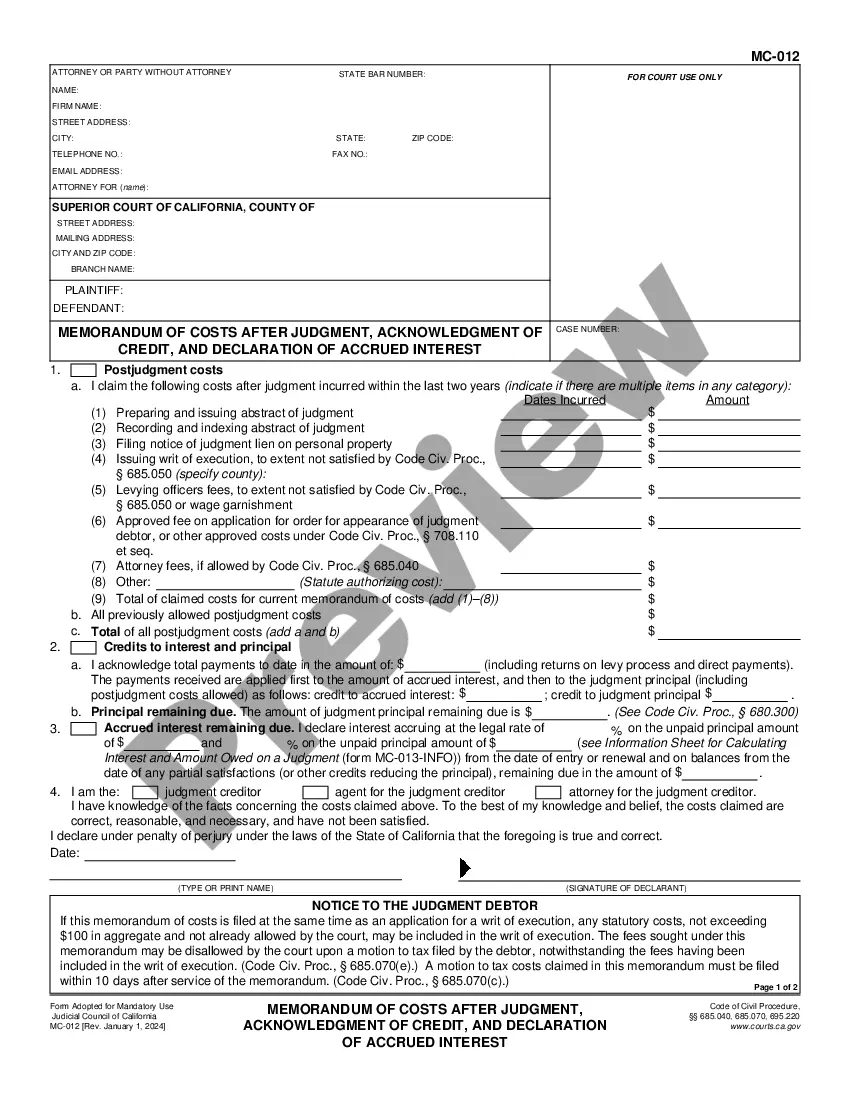

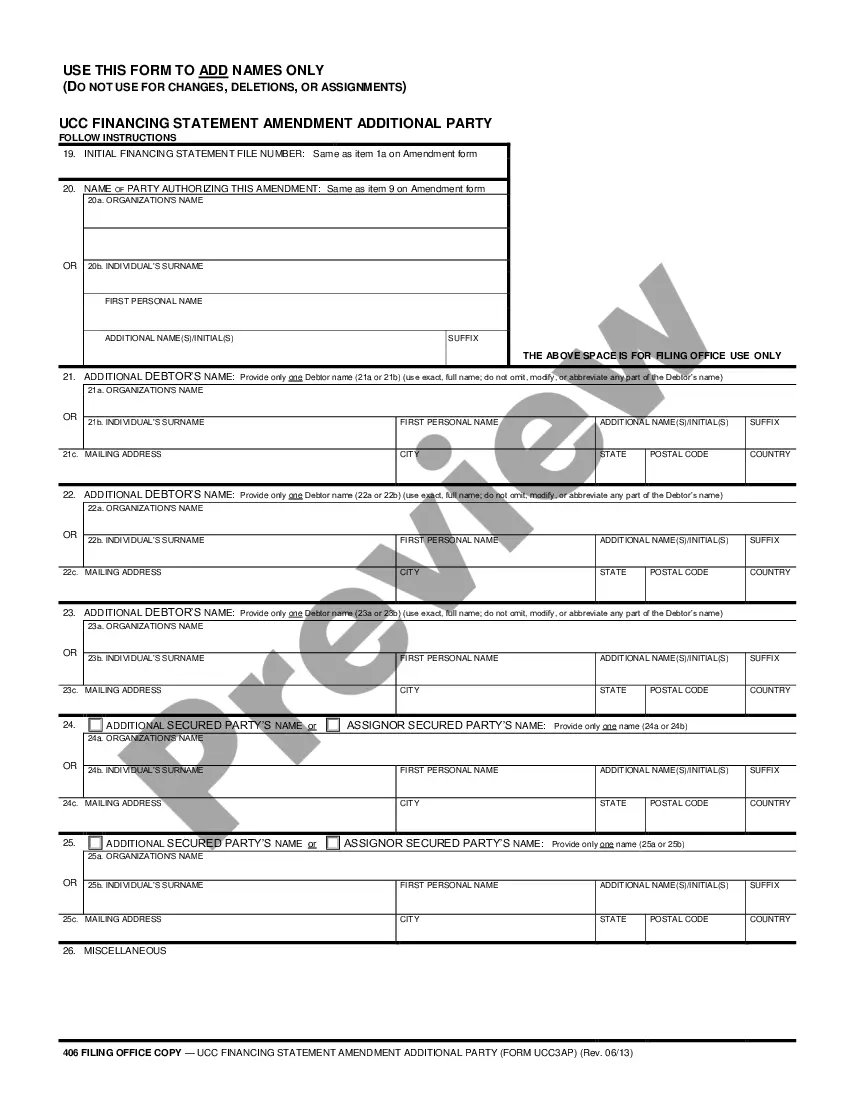

Chicago, Illinois Correction Assignment to Correct Amount of Interest: A Comprehensive Guide Introduction: Chicago, Illinois is a bustling metropolitan city known for its vibrant culture, diverse population, architectural wonders, and remarkable historical legacy. However, within this sprawling urban landscape, there may be instances where errors occur in financial transactions regarding the calculation or application of interest. In such cases, Chicago offers a unique framework called the "Chicago Illinois Correction Assignment to Correct Amount of Interest" which assists individuals, businesses, and financial institutions in rectifying interest-related discrepancies. This article delves into the details of this correction assignment and explores any variations or types that may exist. What is Chicago Illinois Correction Assignment to Correct Amount of Interest? The Chicago Illinois Correction Assignment to Correct Amount of Interest is a procedural mechanism designed to rectify any discrepancies, miscalculations, or errors related to the application or calculation of interest in financial transactions, contracts, loans, or legal agreements within the Chicago, Illinois jurisdiction. This assignment provides a formal avenue to correct and reconcile the accurate amount of interest owed or payable between parties involved. Key Features of the Correction Assignment: 1. Legal Framework: The Chicago Illinois Correction Assignment to Correct Amount of Interest operates within the legal framework established by the state of Illinois and adheres to the city's specific regulations and guidelines. 2. Resolution Process: The assignment provides a structured process for identifying and resolving interest-related errors between parties involved in the transaction. It aims to ensure fairness, accuracy, and adequate compensation for any losses incurred due to incorrect interest calculations. 3. Mediation or Arbitration: Depending on the complexity and nature of the dispute, the parties may opt for mediation or arbitration to resolve their differences regarding the correct amount of interest. 4. Professional Assistance: Experienced financial professionals, attorneys, or mediators well-versed in interest calculations and legal procedures often play a pivotal role in facilitating and guiding the correction assignment process. 5. Documentation: The correction assignment requires meticulous documentation, including the original contract or agreement, transactional records, interest calculations, and any supporting evidence. These documents are vital in determining the correct amount of interest owed or payable. 6. Certification and Validation: Once the correct interest amount is determined, the correction assignment is validated and certified to ensure that the new calculation accurately reflects the revised interest payment. Types of Chicago Illinois Correction Assignment to Correct Amount of Interest: While there may not be distinct types of correction assignments specific to Chicago's jurisdiction, the assignment can encompass various scenarios and contexts. Some common instances where the correction assignment may be applicable include: 1. Loan Interest Corrections: Correcting any errors made in calculating loan interest amounts, including mortgages, personal loans, commercial loans, or student loans. 2. Contractual Interest Adjustments: Rectifying discrepancies in calculating and applying interest rates stipulated in contracts or agreements, be it commercial contracts, leases, or any legally binding arrangements. 3. Financial Transaction Discrepancies: Addressing errors in interest calculations related to financial transactions, such as investments, securities, bonds, or other financial instruments, where interest plays a significant role. Conclusion: The Chicago Illinois Correction Assignment to Correct Amount of Interest provides a structured and procedural mechanism to rectify interest-related discrepancies within the city's jurisdiction. With the assistance of experienced professionals and adherence to the established legal framework, individuals and businesses can ensure fairness and accuracy in interest calculations. Whether it is loan interest corrections, contractual interest adjustments, or financial transaction discrepancies, the correction assignment offers a solution to rectify any errors and uphold the principles of fairness and transparency in financial dealings.

Chicago, Illinois Correction Assignment to Correct Amount of Interest: A Comprehensive Guide Introduction: Chicago, Illinois is a bustling metropolitan city known for its vibrant culture, diverse population, architectural wonders, and remarkable historical legacy. However, within this sprawling urban landscape, there may be instances where errors occur in financial transactions regarding the calculation or application of interest. In such cases, Chicago offers a unique framework called the "Chicago Illinois Correction Assignment to Correct Amount of Interest" which assists individuals, businesses, and financial institutions in rectifying interest-related discrepancies. This article delves into the details of this correction assignment and explores any variations or types that may exist. What is Chicago Illinois Correction Assignment to Correct Amount of Interest? The Chicago Illinois Correction Assignment to Correct Amount of Interest is a procedural mechanism designed to rectify any discrepancies, miscalculations, or errors related to the application or calculation of interest in financial transactions, contracts, loans, or legal agreements within the Chicago, Illinois jurisdiction. This assignment provides a formal avenue to correct and reconcile the accurate amount of interest owed or payable between parties involved. Key Features of the Correction Assignment: 1. Legal Framework: The Chicago Illinois Correction Assignment to Correct Amount of Interest operates within the legal framework established by the state of Illinois and adheres to the city's specific regulations and guidelines. 2. Resolution Process: The assignment provides a structured process for identifying and resolving interest-related errors between parties involved in the transaction. It aims to ensure fairness, accuracy, and adequate compensation for any losses incurred due to incorrect interest calculations. 3. Mediation or Arbitration: Depending on the complexity and nature of the dispute, the parties may opt for mediation or arbitration to resolve their differences regarding the correct amount of interest. 4. Professional Assistance: Experienced financial professionals, attorneys, or mediators well-versed in interest calculations and legal procedures often play a pivotal role in facilitating and guiding the correction assignment process. 5. Documentation: The correction assignment requires meticulous documentation, including the original contract or agreement, transactional records, interest calculations, and any supporting evidence. These documents are vital in determining the correct amount of interest owed or payable. 6. Certification and Validation: Once the correct interest amount is determined, the correction assignment is validated and certified to ensure that the new calculation accurately reflects the revised interest payment. Types of Chicago Illinois Correction Assignment to Correct Amount of Interest: While there may not be distinct types of correction assignments specific to Chicago's jurisdiction, the assignment can encompass various scenarios and contexts. Some common instances where the correction assignment may be applicable include: 1. Loan Interest Corrections: Correcting any errors made in calculating loan interest amounts, including mortgages, personal loans, commercial loans, or student loans. 2. Contractual Interest Adjustments: Rectifying discrepancies in calculating and applying interest rates stipulated in contracts or agreements, be it commercial contracts, leases, or any legally binding arrangements. 3. Financial Transaction Discrepancies: Addressing errors in interest calculations related to financial transactions, such as investments, securities, bonds, or other financial instruments, where interest plays a significant role. Conclusion: The Chicago Illinois Correction Assignment to Correct Amount of Interest provides a structured and procedural mechanism to rectify interest-related discrepancies within the city's jurisdiction. With the assistance of experienced professionals and adherence to the established legal framework, individuals and businesses can ensure fairness and accuracy in interest calculations. Whether it is loan interest corrections, contractual interest adjustments, or financial transaction discrepancies, the correction assignment offers a solution to rectify any errors and uphold the principles of fairness and transparency in financial dealings.