Clark Nevada Correction Assignment to Correct Amount of Interest is a legal process that involves rectifying any errors or discrepancies in the calculation or application of interest on financial transactions in Clark County, Nevada. This assignment primarily aims to ensure fair and accurate interest amounts for all parties involved. In various financial transactions, such as loans, mortgages, credit agreements, or commercial contracts, interests play a crucial role in determining the amount owed or earned over a specific period. However, mistakes or inaccuracies can occur during the interest calculation process, leading to disputes or financial losses. The Clark Nevada Correction Assignment to Correct Amount of Interest serves as a mechanism to address such issues. It involves a thorough review of the transaction details, interest terms and rates, payment schedules, and any relevant documentation associated with the financial agreement. This review is performed by legal professionals and financial experts who specialize in interest calculations and contract law. Once errors or inconsistencies are identified, a correction assignment is initiated to rectify these mistakes. It involves updating the interest calculations, adjusting payment schedules, or applying any necessary amendments to the original agreement. The purpose is to ensure that the correct amount of interest is accurately determined, reflecting the terms agreed upon by the parties involved. There can be different types of Clark Nevada Correction Assignments to Correct Amount of Interest, depending on the specific financial transaction or agreement. Some examples include: 1. Mortgage Correction Assignment: This type of correction assignment focuses on rectifying discrepancies in the interest calculations of mortgage agreements, ensuring that the correct amount of interest is applied for each payment. 2. Loan Correction Assignment: Loan agreements often involve the payment of fixed or variable interest over a specific period. This correction assignment aims to correct any errors in the interest calculation, ensuring accurate repayment amounts and schedules. 3. Commercial Contract Correction Assignment: In commercial transactions or contracts involving interests, errors in interest calculation can have significant financial implications. This correction assignment addresses such errors and ensures fair and accurate interest amounts for the parties involved. 4. Credit Agreement Correction Assignment: Credit agreements, including credit cards or lines of credit, may involve complex interest calculations. This correction assignment aims to correct any mistakes and ensure accurate interest charges or payments. In conclusion, the Clark Nevada Correction Assignment to Correct Amount of Interest is a legal process that aims to rectify errors or discrepancies in interest calculations within various financial transactions. Through careful review and amendment, this assignment ensures fair and accurate interest amounts for all parties involved.

Clark Nevada Correction Assignment to Correct Amount of Interest

Description

How to fill out Clark Nevada Correction Assignment To Correct Amount Of Interest?

Drafting paperwork for the business or individual demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the particular area. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to generate Clark Correction Assignment to Correct Amount of Interest without expert help.

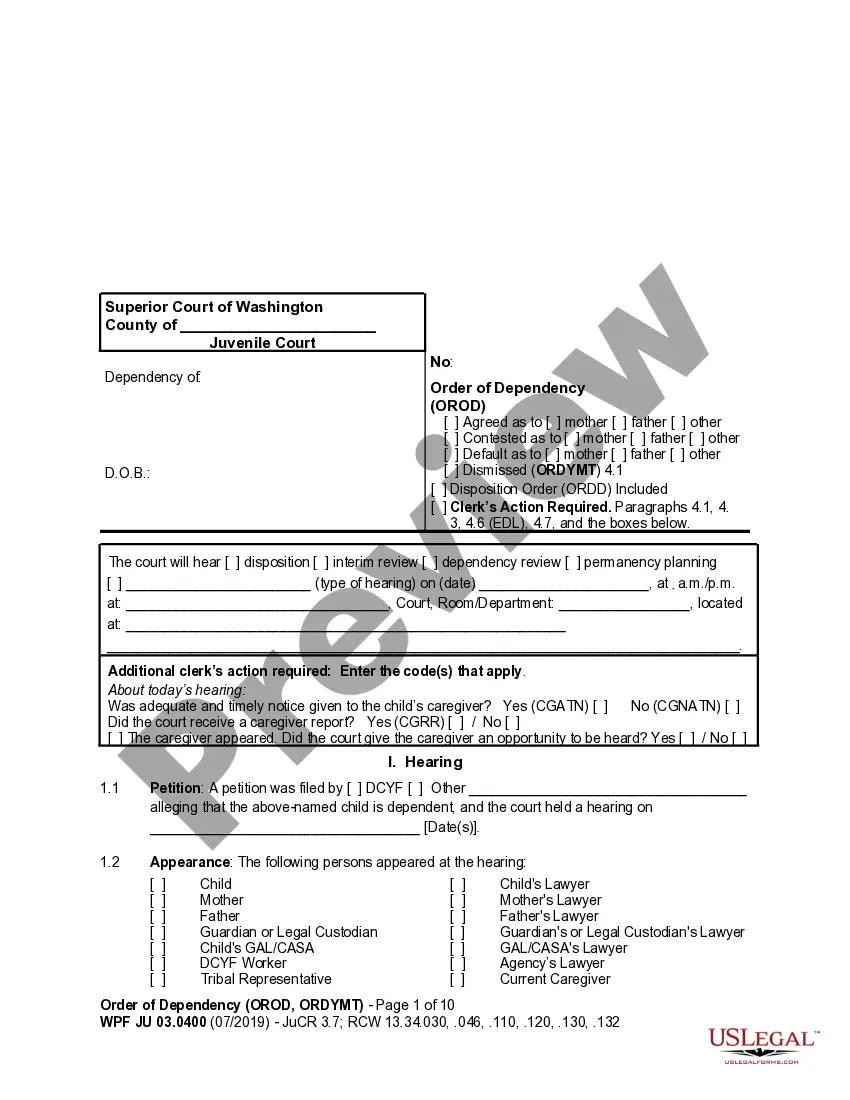

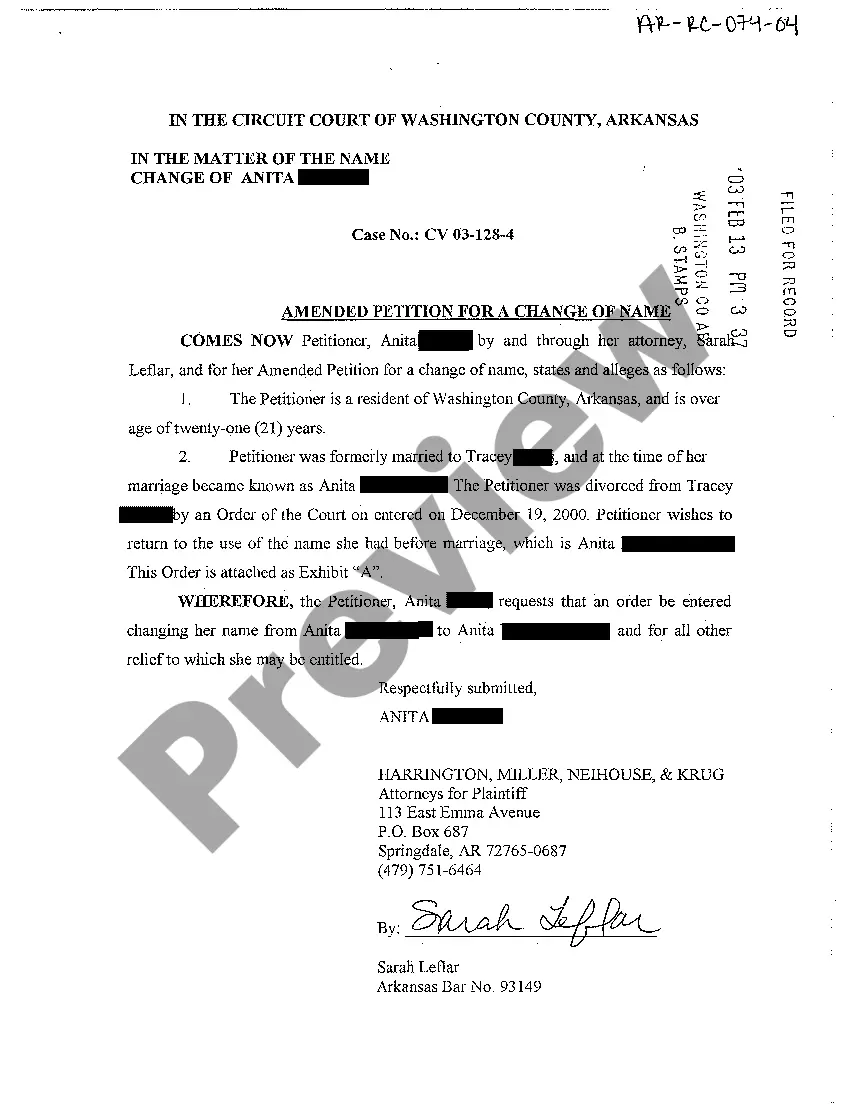

It's easy to avoid wasting money on lawyers drafting your paperwork and create a legally valid Clark Correction Assignment to Correct Amount of Interest on your own, using the US Legal Forms online library. It is the greatest online collection of state-specific legal templates that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed document.

In case you still don't have a subscription, follow the step-by-step guide below to get the Clark Correction Assignment to Correct Amount of Interest:

- Examine the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that meets your requirements, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any use case with just a few clicks!

Form popularity

FAQ

Related Pages Standard Recordings (Not subjected to Real Property Transfer Tax)$42.00 per documentHomestead Filing$42.00 per documentNotice of Default/Breach and Election to Sell Under a Deed of Trust$250.00 + recording fee

Effective December 1, 2018. All Standard documents are $78.00. A Standard document is classified as a deed, lease, lease amendment, mortgage, easement, or miscellaneous document as defined in 55 ILCS 5/3-5018.1 (c).

For the purpose of recording the document, your document must meet all of the recording requirements (the document has to have the property tax number, address, legal description and preparer's name and address, with signatures/notary. For recording you must provide the original plus one copy.

Prepare and Pay Real Property Transfer Tax - The transfer tax is calculated at the rate of $2.55 per $500 of value or a fraction thereof. The transfer tax is based on the full purchase price or the estimated fair market value.

To file an Illinois quitclaim deed form, you must bring your signed and notarized quitclaim deed to the County Recorder's office in the county where the property is located. Make sure that you also bring the required fees. Create a free Illinois Quit Claim Deed in minutes with our professional document builder.

RECORDING FEESSTANDARD DOCUMENTSStandard Documents without RHSP/Non-Gov Filer Fee$88Certified copies of standard documents$55Non-Certified copies of standard documents$27.5035 more rows

Visit one of the Cook County Recorder of Deeds offices. Offices are located in downtown Chicago, Bridgeview, Markham, Skokie, Rolling Meadows, and Maywood. Give the deed to the clerk and ask for it to be recorded. Recording a deed means to file it.

Currently, our firm has experienced document delays in recording of up to 8 weeks from the date the document was submitted for recording.

The fee for recording the vast majority of documents in Cook County is a flat $98.00.