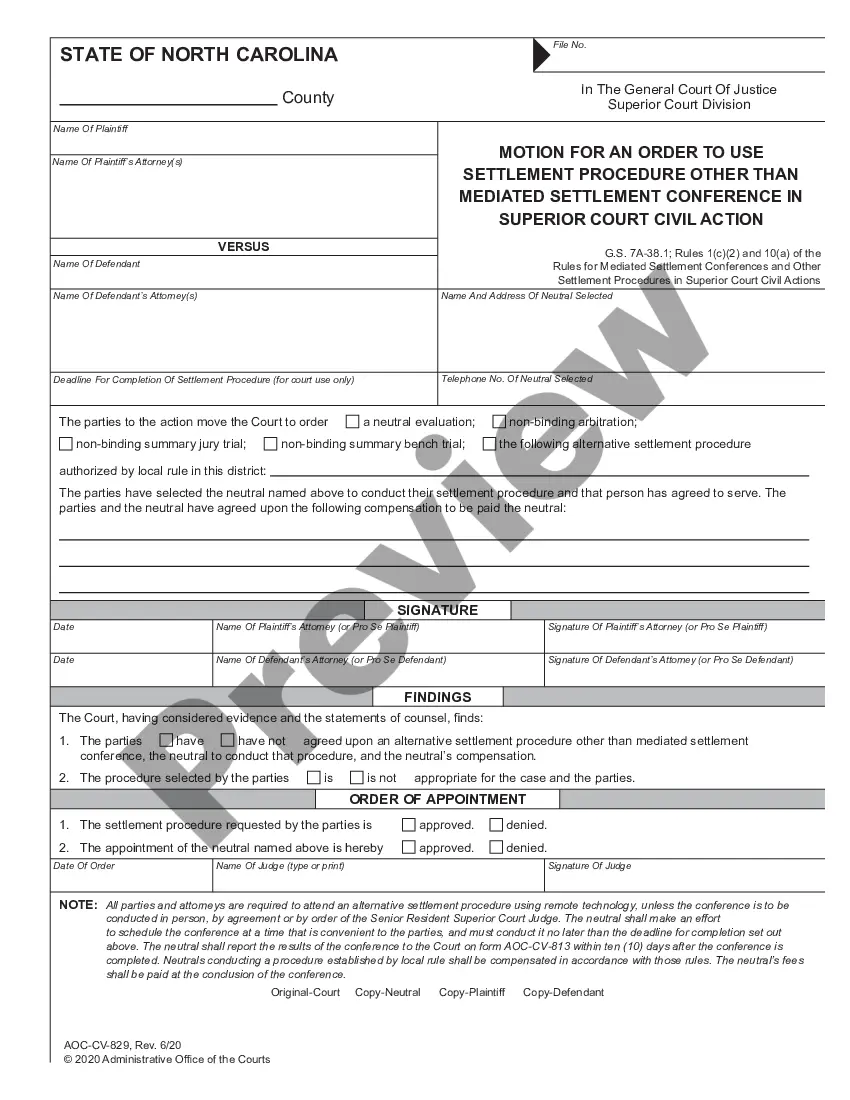

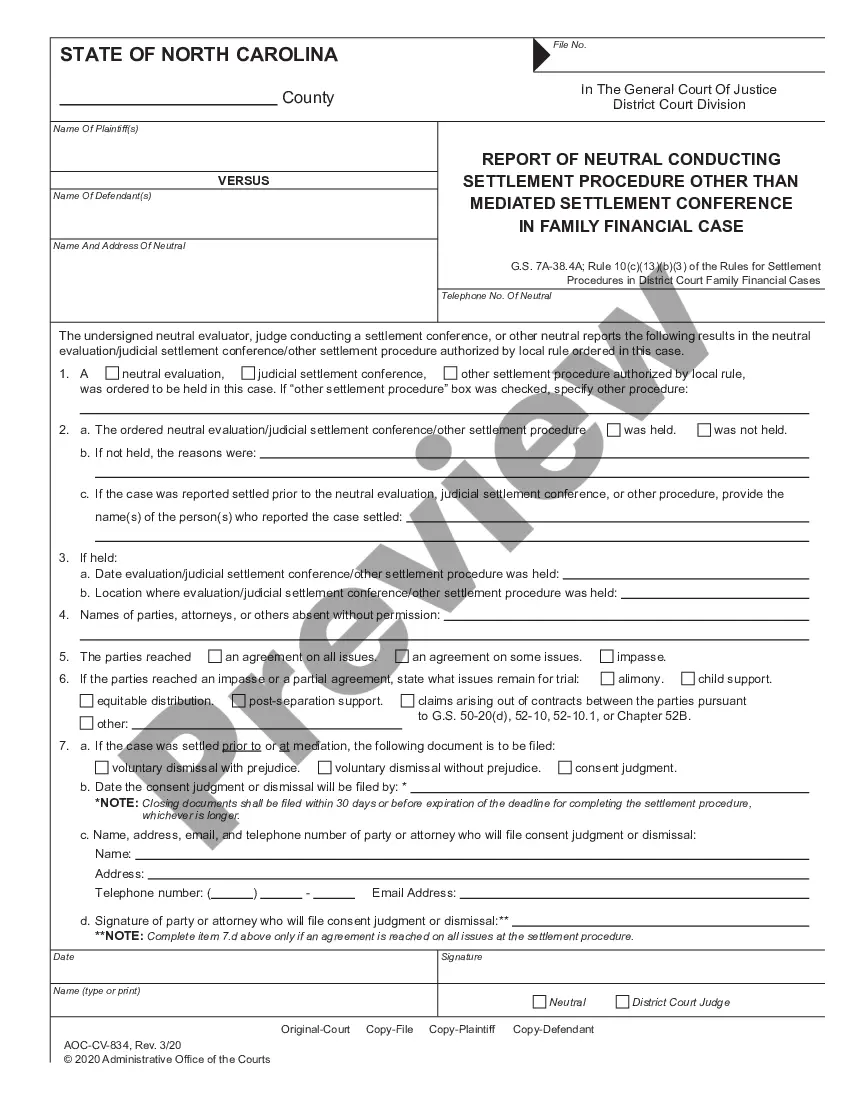

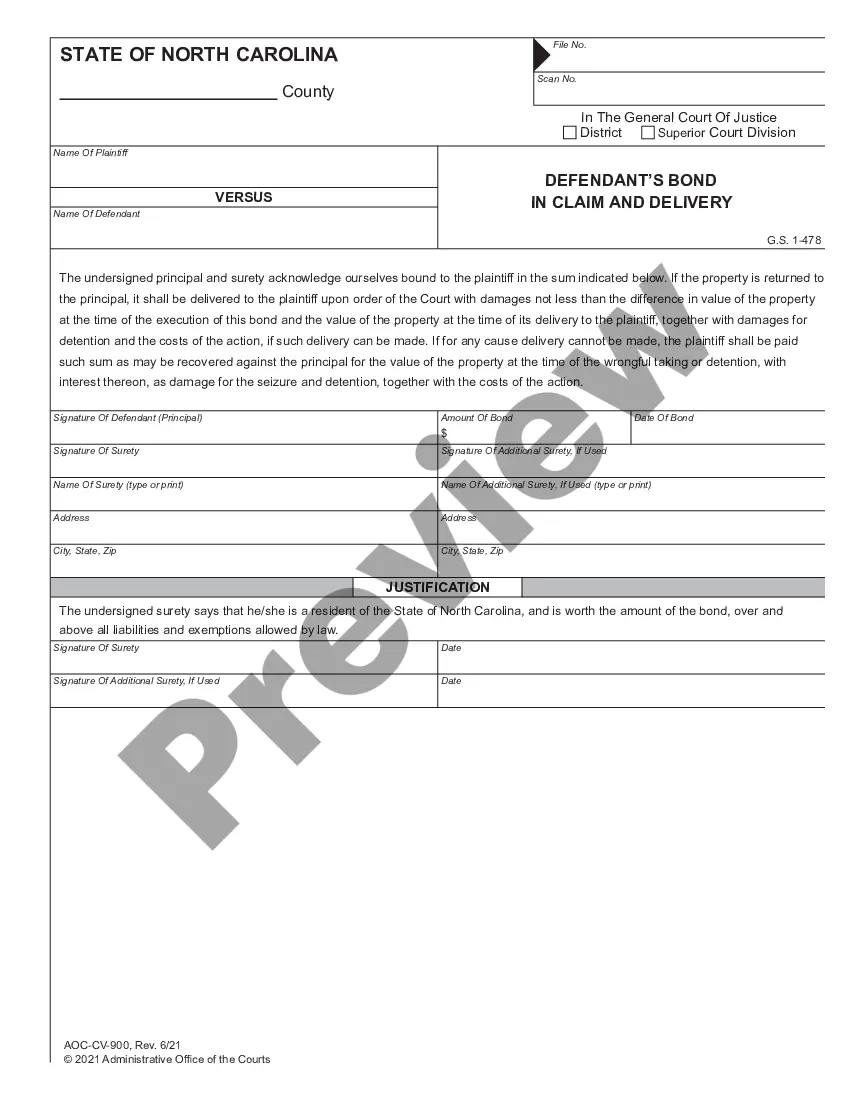

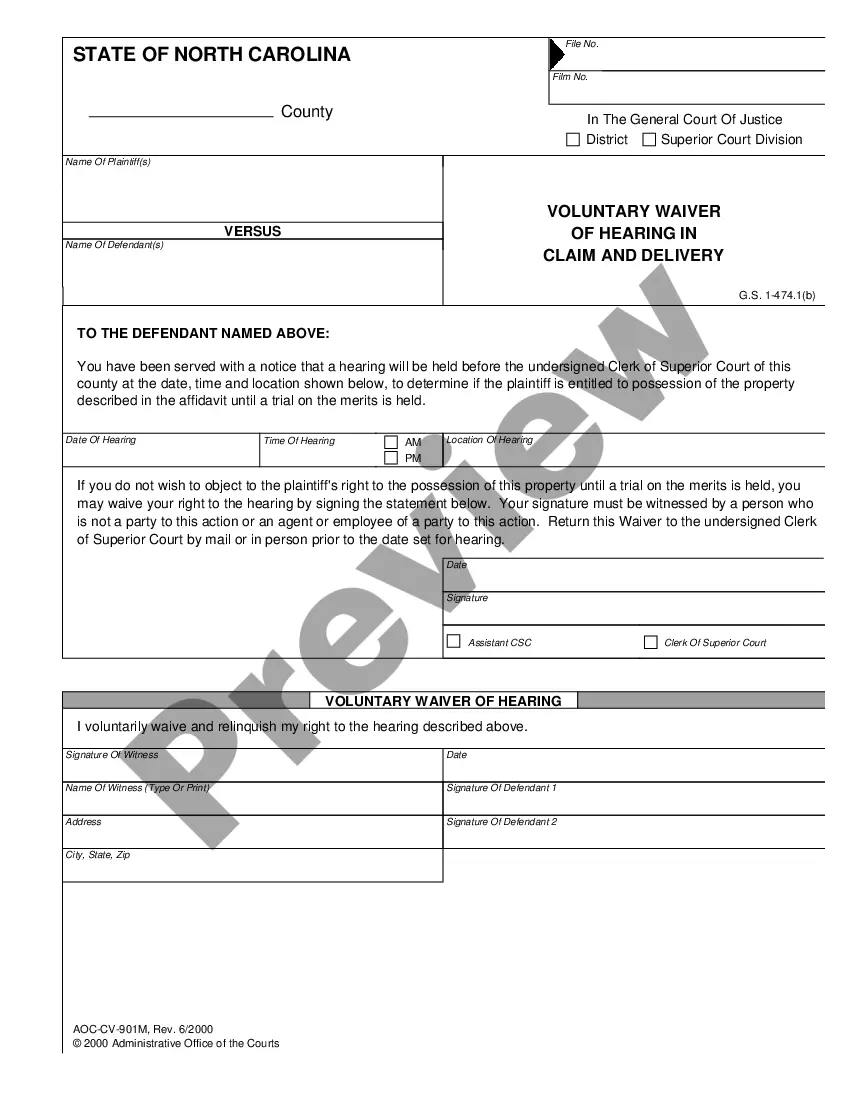

Maricopa, Arizona Correction Assignment to Correct Amount of Interest: An In-depth Look In Maricopa, Arizona, a correction assignment to correct the amount of interest is a critical process undertaken to rectify any errors or discrepancies related to interest calculations within financial transactions. This assignment is essential to maintain accuracy, fairness, and transparency in various financial agreements. By identifying and addressing discrepancies promptly, it ensures that both parties involved are treated fairly and in accordance with the applicable laws governing interest calculations. The correction assignment to correct the amount of interest may vary based on the specific context it is used in. Here are a few different types of correction assignments commonly encountered in Maricopa, Arizona: 1. Mortgage Interest Correction Assignment: This type of correction assignment involves rectifying any errors in interest calculations related to mortgage loans. It could include adjusting incorrect interest rates, miscalculations of interest charges, or inaccuracies in the loan repayment schedule. By addressing such issues promptly, mortgage borrowers and lenders can ensure that the correct interest amount is reflected in the loan account, preventing any financial loss or dispute. 2. Credit Card Interest Correction Assignment: In the realm of credit card transactions, errors in interest rate calculations can occur due to technical glitches, manual errors, or misinterpretation of terms and conditions. A correction assignment in this context aims to rectify any discrepancies in interest charges, ensuring that cardholders are billed accurately without any undue financial burden. 3. Business Loan Interest Correction Assignment: Entrepreneurs and businesses often rely on loans to fund their operations and expansion. However, errors in interest calculations can lead to significant financial implications for both borrowers and lenders. A correction assignment aimed at correcting the amount of interest in business loans helps maintain fair and accurate calculations, mitigating the risk of disputes and ensuring the smooth flow of capital in the business ecosystem. 4. Personal Loan Interest Correction Assignment: Similar to business loans, personal loans can also face interest-related errors. Whether it's an incorrect interest rate or wrongly calculated interest charges, a correction assignment is used to amend any mistakes, guaranteeing accurate financial transactions between the borrower and the lender. In conclusion, a correction assignment to correct the amount of interest plays a crucial role in Maricopa, Arizona, ensuring fairness and accuracy in financial transactions. Whether in mortgage loans, credit card transactions, business loans, or personal loans, this assignment aims to rectify any discrepancies and prevent potential financial loss or disputes. By understanding and utilizing correction assignments effectively, individuals and businesses can uphold integrity and transparency in their financial dealings, fostering a trusted and reliable economic environment.

Maricopa Arizona Correction Assignment to Correct Amount of Interest

Description

How to fill out Maricopa Arizona Correction Assignment To Correct Amount Of Interest?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and many other life scenarios require you prepare official paperwork that varies throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and get a document for any individual or business objective utilized in your region, including the Maricopa Correction Assignment to Correct Amount of Interest.

Locating forms on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Maricopa Correction Assignment to Correct Amount of Interest will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guide to get the Maricopa Correction Assignment to Correct Amount of Interest:

- Make sure you have opened the proper page with your local form.

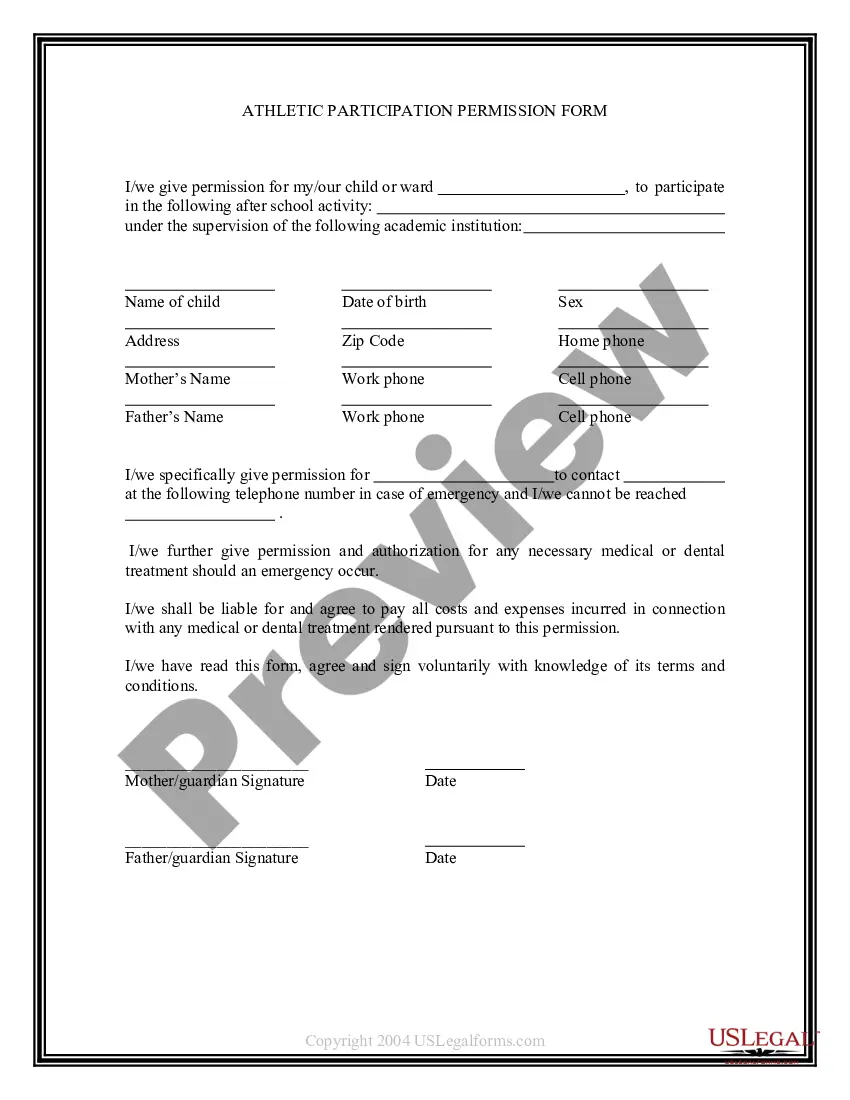

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Look for another document via the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Decide on the appropriate subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Maricopa Correction Assignment to Correct Amount of Interest on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!