Queens New York Correction Assignment to Correct Amount of Interest: A Detailed Description Queens, New York, a vibrant borough in the heart of the Big Apple, is home to a variety of correctional facilities offering correction assignments intended to rectify discrepancies in the calculation of interest rates. These assignments play a crucial role in maintaining accuracy and fairness in financial transactions by addressing errors or omissions commonly associated with interest calculations. Below is a detailed description of this correction assignment and its various types. 1. Purpose: The Queens New York Correction Assignment to Correct Amount of Interest aims to rectify errors in interest calculations, ensuring financial transactions adhere to legal and regulatory requirements. Additionally, it safeguards the rights of both borrowers and lenders and promotes transparency in the lending process. 2. Types of Correction Assignments: a. Simple Interest Correction: This assignment type addresses inaccuracies related to simple interest calculations. It involves recalculating interest rates based on the principal amount, interest rate, and time period to ensure correct figures are recorded. b. Compound Interest Correction: This assignment type deals with errors in compound interest calculations. It involves revisiting the compounding periods, interest rate, and principal amount to modify the incorrect interest figures and recalculate the accurate amount. c. Variable Interest Correction: Variable interest correction assignments tackle inaccuracies associated with varying interest rates. These assignments require a review of interest rate fluctuations over a specific time frame and the recalculation of interest to match the actual fluctuating rates. d. Late Payment Interest Correction: In cases where borrowers make late payments on loans or credit accounts, this correction assignment addresses the additional interest levied due to the delayed payment. It ensures fairness and compliance when charging late payment penalties. e. Penalty Interest Correction: When borrowers fail to comply with loan terms or contractual obligations, penalty interest may be imposed. This type of correction assignment focuses on accurately determining, modifying, or eliminating the penalty interest based on the borrower's compliance history and the terms of the agreement. 3. Process: The correction assignment process typically involves the following steps: — Identification of the interest calculation error or discrepancy. — Gathering relevant financial documents, such as loan agreements or credit statements. — Performing a thorough analysis of the incorrect interest calculation. — Applying the appropriate correction method based on the type of error. — Recalculating the interest accurately and documenting the revised figures. — Communicating with borrowers or lenders to inform them of the correction outcome, if required. — Updating financial records and documentation to reflect the corrected interest amount. In conclusion, the Queens New York Correction Assignment to Correct Amount of Interest is a crucial process in rectifying errors or miscalculations related to interest rates. With various types of correction assignments catering to different interest calculation discrepancies, this system ensures fairness, accuracy, and compliance within the financial realm.

Queens New York Correction Assignment to Correct Amount of Interest

Description

How to fill out Queens New York Correction Assignment To Correct Amount Of Interest?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios demand you prepare formal documentation that varies from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and download a document for any personal or business objective utilized in your county, including the Queens Correction Assignment to Correct Amount of Interest.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Queens Correction Assignment to Correct Amount of Interest will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guide to get the Queens Correction Assignment to Correct Amount of Interest:

- Make sure you have opened the proper page with your local form.

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form corresponds to your needs.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Queens Correction Assignment to Correct Amount of Interest on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

The USPTO does not require patent assignments to be notarized. The patent office only requires that the assignment be executed and signed by both the assignor and the assignee. Once an agreement is executed and signed by the parties, the assignment must be recorded with the patent office.

Recordation of a document in the Copyright Office gives all persons constructive notice of the facts stated in the recorded document, but only if (1) the document, or material attached to it, specifically identifies the work to which it pertains so that, after the document is indexed by the Register of Copy- rights,

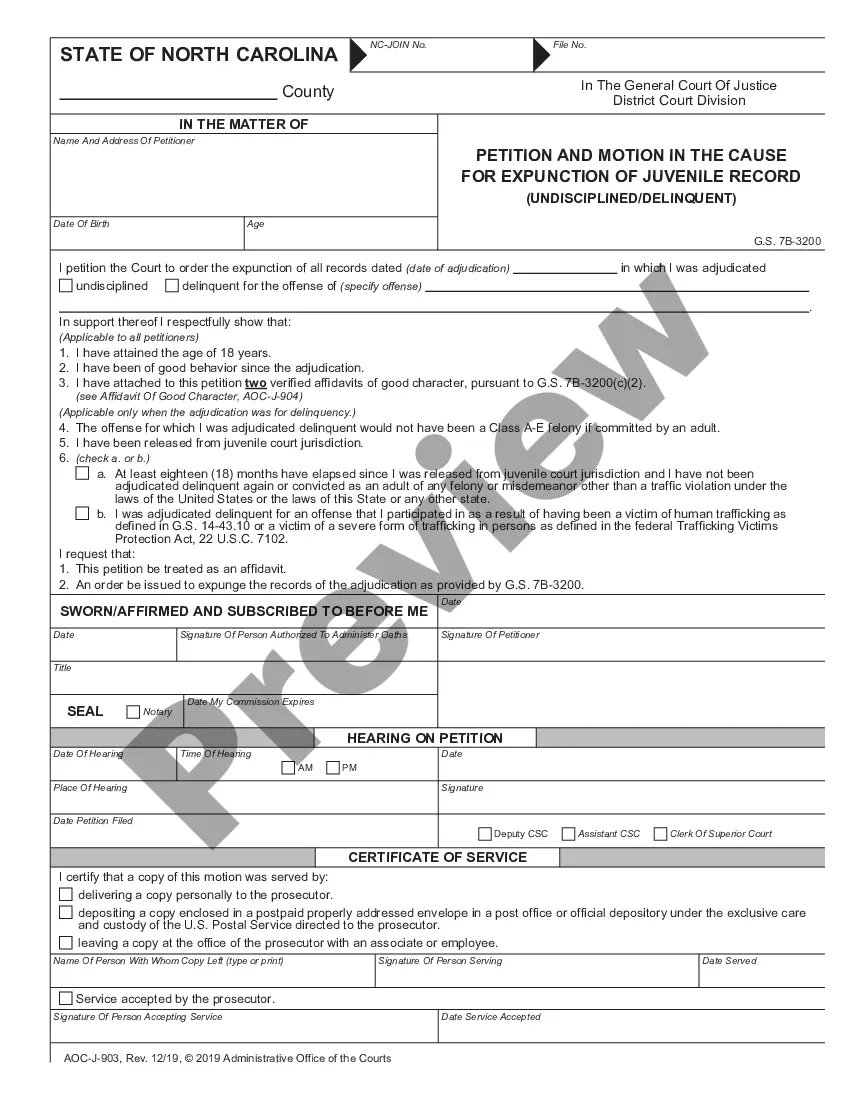

A party who wishes to correct a typographical error on a recorded cover sheet must submit the following to the Assignment Services Division: (A) a copy of the originally recorded assignment document (or other document affecting title); (B) a corrected cover sheet; and.

To transfer ownership or update your information to reflect a legal name change: Use Electronic Trademark Assignment System (ETAS) to request the change. If you're filing a TEAS form within the next week, you may need to manually update the owner information on the TEAS form.

Assignment Recordation puts the USPTO on official notice pertaining to ownership of the Intellectual Property. Subject to the provisions set forth in the MPEP, patents shall have the attributes of personal property. A patent for an invention is the grant of a property right to the inventor.

Motions made by notice of motion and petitions and notices of petition in special proceedings are processed by the General Clerk's Office (Room 119) and are to be made returnable in the Motion Submission Part Courtroom (Room 130) on any business day of the week at AM.

In basic terms, a nunc pro tunc is a type of assignment that is backdated. Nunc pro tunc is Latin meaning now for then.A nunc pro tunc assignment will be signed on a particular date, but parties will deem the assignment to have been granted on some earlier date.

You can file such a request by mail as described in MPEP 302.08 or by fax as described in MPEP 302.09. To use EPAS to file electronically, the MPEP instructions say to mark the box labeled "Other" under "Nature of Conveyance" and then fill in the reel and frame information and describe the correction.

After recording the document and cover sheet, the USPTO will issue a notice of recordation that reflects the data as recorded in the Assignment database. The party recording the document should carefully review the notice of recordation.

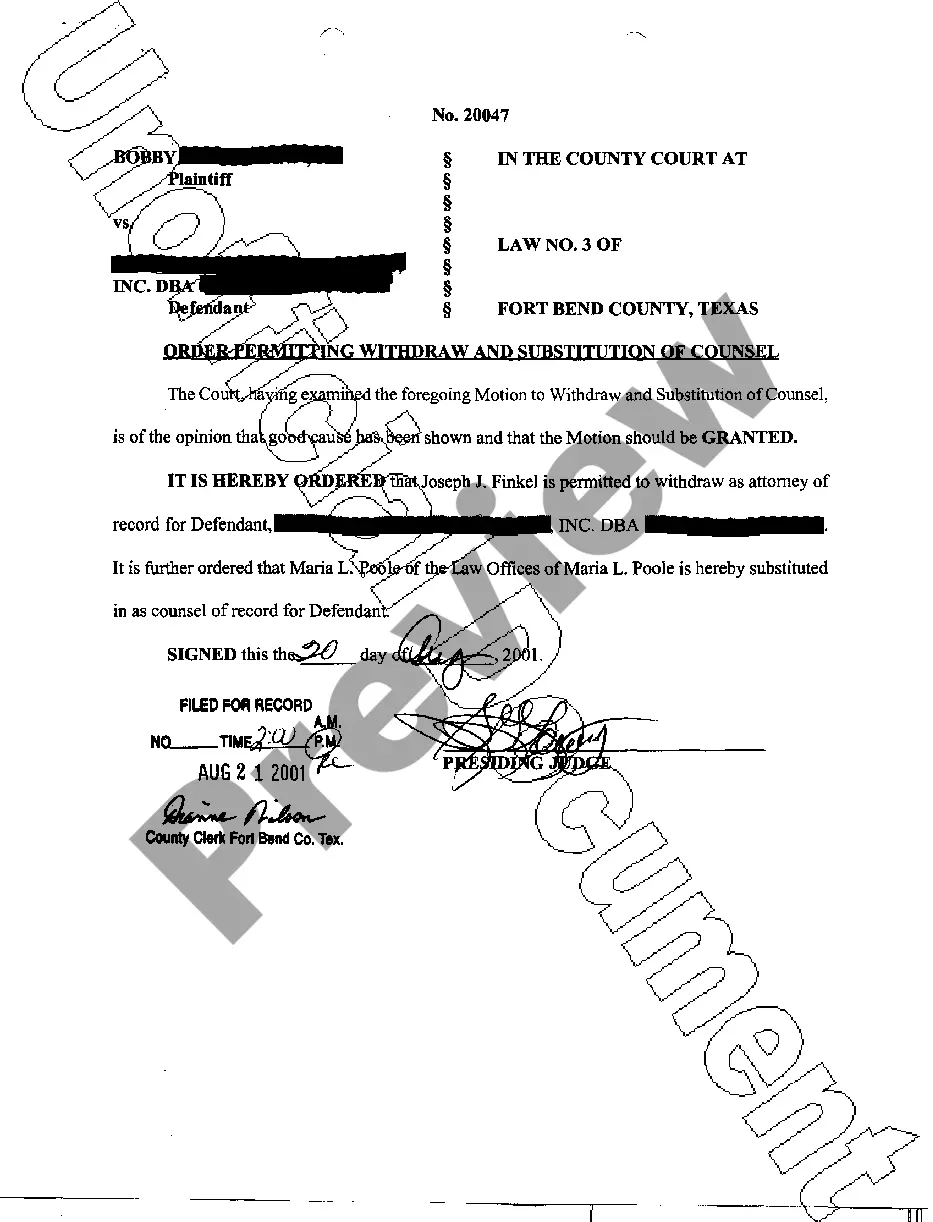

A corrective assignment is a way to rectify an error in a recorded document. The Assignment Division will make the changes if an acceptable corrective document is turned in. Policies related to the recording of assignment documents are designed to maintain the history of any claimed interests in property.