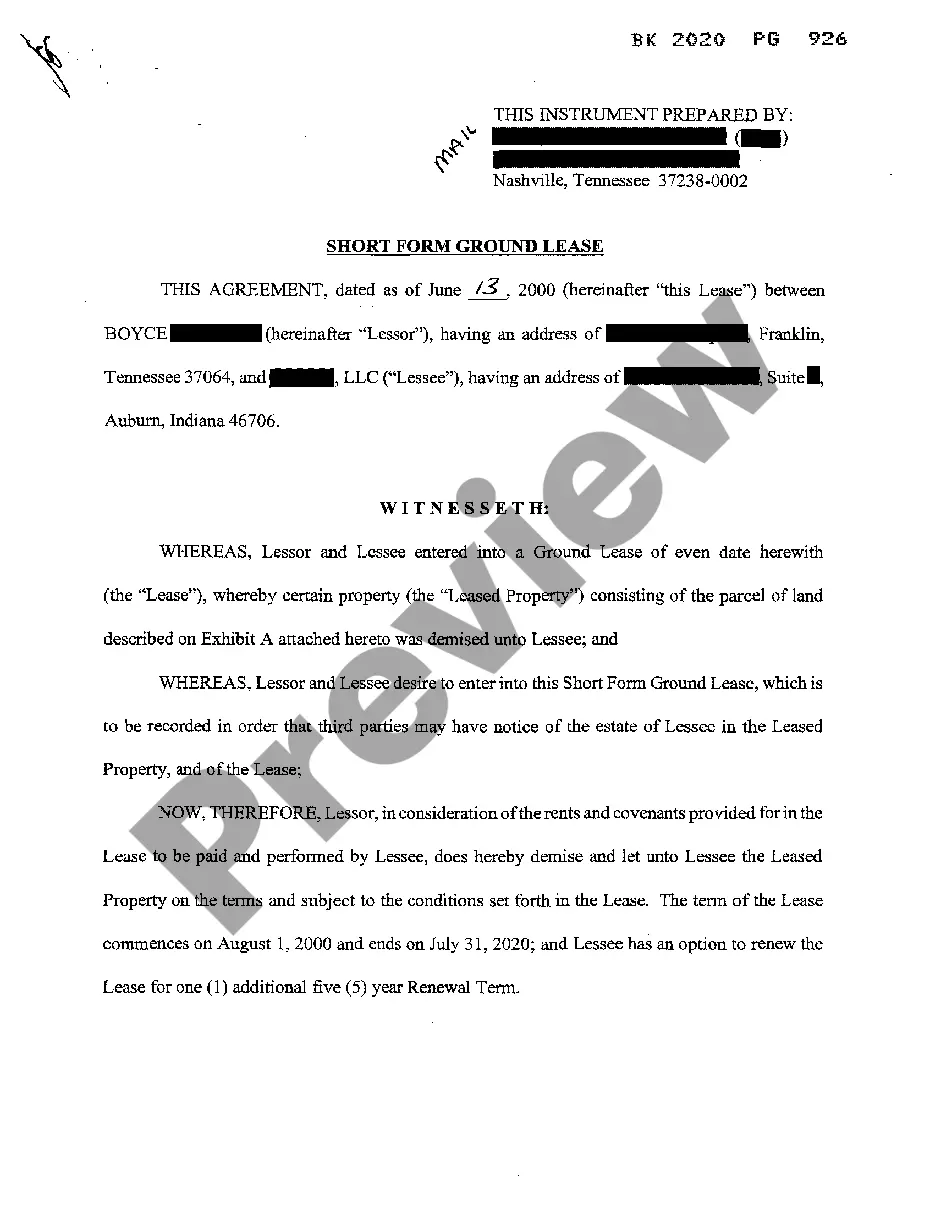

San Diego, California is a vibrant coastal city located in the southwestern corner of the United States. Renowned for its beautiful beaches, perfect weather, and diverse cultural attractions, San Diego is a popular destination for both tourists and residents alike. When it comes to legal matters regarding mineral and royalty interests in San Diego, the use of disclaimers and quitclaim documents becomes relevant. These legal documents allow individuals or entities to relinquish their rights, claims, or interests in mineral or royalty rights associated with a specific property. 1. San Diego Mineral Interest Disclaimer: This type of document is employed when an individual or organization wishes to disclaim any interest in the mineral rights pertaining to a property in San Diego County. By signing this document, the party explicitly states that they do not have any present or future claim or interest in the minerals found within the property. 2. San Diego Mineral Interest Quitclaim: Similar to the disclaimer, the quitclaim document is utilized when someone wants to transfer or convey their ownership or interest in the mineral rights of a San Diego property to another party. This document operates as a formal release of any rights, interests, or claims the granter has over the mineral rights, in favor of the grantee. 3. San Diego Royalty Interest Disclaimer: In some cases, individuals or companies may hold royalty interests associated with the extraction or production of minerals on a specific San Diego property. The royalty interest disclaimer allows them to renounce their rights and claims over the financial benefits or proceeds generated from those minerals. 4. San Diego Royalty Interest Quitclaim: The royalty interest quitclaim document allows a party to voluntarily transfer their ownership or interests in royalties associated with a San Diego property to another individual or entity. This legally binding document ensures a transfer of rights, obligations, and benefits from one party to another. Both the disclaimer and quitclaim documents provide legal means to address mineral and royalty interests in San Diego, offering parties the option to either disclaim or transfer their rights in these matters. It is important to consult with legal professionals well-versed in California and San Diego-specific laws and regulations to ensure the proper execution and validity of these documents.

San Diego California Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest

Description

How to fill out San Diego California Disclaimer And Quitclaim Of Interest In Mineral / Royalty Interest?

If you need to find a trustworthy legal paperwork supplier to get the San Diego Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest, consider US Legal Forms. Whether you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate form.

- You can select from more than 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of learning resources, and dedicated support make it simple to locate and execute different documents.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

Simply type to search or browse San Diego Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest, either by a keyword or by the state/county the document is created for. After locating required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the San Diego Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest template and check the form's preview and description (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Register an account and choose a subscription option. The template will be instantly ready for download once the payment is completed. Now you can execute the form.

Handling your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes these tasks less costly and more affordable. Create your first business, organize your advance care planning, draft a real estate agreement, or execute the San Diego Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest - all from the convenience of your sofa.

Join US Legal Forms now!

Form popularity

FAQ

Average Oil Royalty Payment For Oil Or Gas Lease The federal government charges oil and gas companies a royalty on hydrocarbon resources extracted from public lands. The standard Federal royalty payment was 12.5%, or a 1/8th royalty.

Mineral Deed vs. A mineral deed is less restrictive and grants more rights over the mineral interest than a royalty deed. The second distinction between these types of deed has to do with the size of the financial stake. The mineral deed holder receives a higher reward but at the cost of higher risk.

A lot of money can be at risk. Mineral rights have sold for as high as $40,000 per acre, and usually, the average price can be between $250 and $9,000. If mineral rights buyers and sellers conduct proper due diligence, both parties can negotiate the best mining rights deal and avoid future legal quagmires.

February 12, 2019 The Formula. Decimal Interest = (Net Mineral Acres ÷ Drilling Unit Acres) x Royalty Rate.Finding Your Net Mineral Acres. Your net mineral acreage is found in the Mineral Deeds or other property deed information.Finding the Drilling Unit Acres.Finding Your Royalty Rate.Where to Find More Information.

As a mineral rights value rule of thumb, the 3X cash flow method is often used. To calculate mineral rights value, multiply the 12-month trailing cash flow by 3. For a property with royalty rights, a 5X multiple provides a more accurate valuation (stout.com).

In California, mineral rights can be owned independently from the property. If an individual owns the mineral rights to a piece of land, he has a legal right to the minerals beneath the surface.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

Stated alternatively one (1) mineral acre came to be equated with eight (8) royalty acres. However, some scholars and commentators (like Williams & Meyers) counter that royalty acre should continue to reflect a full lease royalty.

Mineral Rights Owner- If you are solely a mineral rights owner, you earn the royalties that come from extracting the minerals from the land in question. You do not have control over what occurs on the surface. As the mineral rights owner, you can sell, mine or produce the gas or oil below the surface.

A mineral interest owner also possesses the right to receive lease bonuses, delay rental payments, shut-in payments and royalties. A royalty interest, on the other hand, is the property interest created that entitles the owner to receive a share of the production.