Cook Illinois Notice of Payout is a legal document issued by Cook Illinois Corporation, a prominent energy company, to inform stakeholders about changes in interest conversion options. This detailed description will provide an overview of the Cook Illinois Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest, highlighting its purpose, significance, and potential variations. Cook Illinois Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest serves as a notification to individuals or entities with vested interests in Cook Illinois' energy projects. This notice provides important information regarding options available for interest conversion, specifically related to overriding royalty interests (ORRIS) being converted into working interests (WI). Keywords: Cook Illinois, Notice of Payout, Election, Convert Interest, Party, Right, Overriding Royalty Interest, Working Interest. The primary purpose of this notice is to inform stakeholders of their eligibility to exercise the right to convert their overriding royalty interest into a working interest. The conversion from ORRIS to WI enables the stakeholders to become actively involved in the project's operations and decision-making processes, instead of being limited to passive royalty recipients. This transition allows participants to potentially benefit from higher profits, asset appreciation, and increased control over the energy project, subject to the successful conversion. Different types of Cook Illinois Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest may exist, primarily based on various clauses, terms, or specific project-related considerations. These variations can encompass aspects such as: 1. Conversion terms and conditions: Different Cook Illinois projects may have specific conversion terms and conditions, including eligibility requirements, timelines, fees, and documentation. Stakeholders need to carefully review these particulars before initiating the conversion process. 2. Conversion ratio: Cook Illinois Notice of Payout may stipulate a conversion ratio, indicating the proportion in which the overriding royalty interest would convert into a working interest. This ratio determines the exact interest stake that stakeholders will acquire upon conversion. 3. Project-Specific Requirements: Projects within Cook Illinois Corporation's portfolio may have unique requirements or limitations concerning overriding royalty interest conversion. These requirements could be influenced by factors like project status, geographical location, resource extraction methods, or regulatory obligations. 4. Additional Benefits or Obligations: The Notice of Payout may outline additional benefits or obligations associated with the conversion process. For instance, stakeholders converting their interests may be entitled to additional revenue streams or bear additional responsibilities beyond the initial royalty interest. Successfully navigating the Cook Illinois Notice of Payout and executing the election to convert ORRIS to WI enables stakeholders to actively participate in energy project operations. Detailed comprehension of the notice's contents is crucial to make informed decisions about interest conversion and ensure optimal engagement and financial returns. Therefore, stakeholders should thoroughly review the Cook Illinois Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest and consult legal or financial advisors to understand the implications, evaluate potential variations, and make sound decisions aligned with their desired involvement and financial goals.

Cook Illinois Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest

Description

How to fill out Cook Illinois Notice Of Payout, Election To Convert Interest To Party With Right To Convert An Overriding Royalty Interest To A Working Interest?

Laws and regulations in every area vary throughout the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Cook Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals looking for do-it-yourself templates for different life and business situations. All the forms can be used multiple times: once you pick a sample, it remains accessible in your profile for future use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Cook Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Cook Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest:

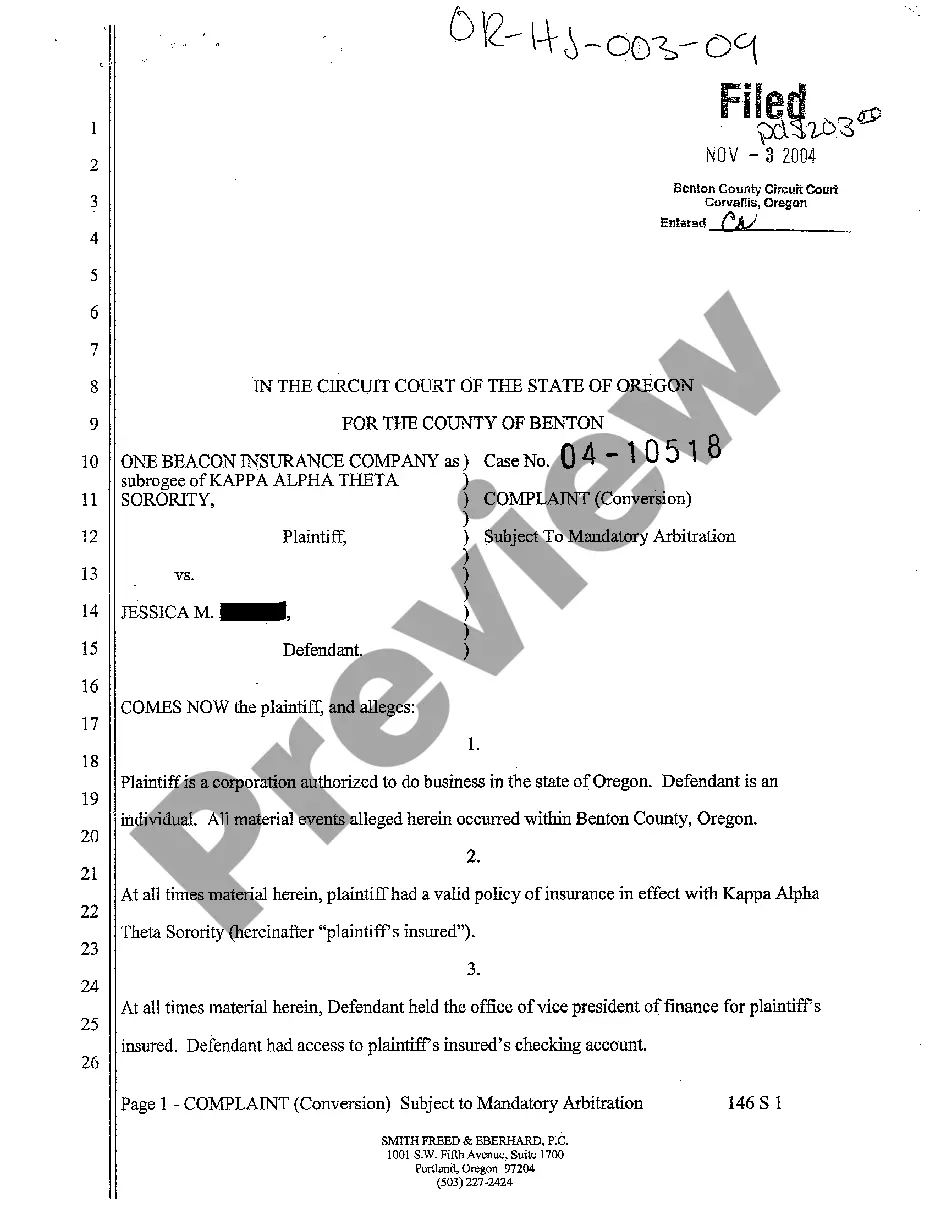

- Analyze the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the template when you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!