Dallas Texas Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest is a legal document that outlines the terms and conditions for the conversion of an overriding royalty interest to a working interest in Dallas, Texas. This document is relevant for individuals or entities involved in oil, gas, or mineral rights transactions. In the oil and gas industry, an overriding royalty interest (ORRIS) is a non-operating interest in a lease or well. It entitles the holder to a share of the revenue generated from the production, without the responsibility for operating costs. On the other hand, a working interest (WI) grants the holder both the right to the revenue and a share of the responsibilities and costs associated with production operations. The Dallas Texas Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest serves as a legal notice between the parties involved. It specifies the terms under which the ORRIS owner can convert their interest into a WI and outlines the conditions that must be met. This document aims to protect the rights and interests of all parties and fosters transparency and clarity in conducting business transactions in the oil and gas industry. The different types of Dallas Texas Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest can vary based on the specific terms agreed upon by the parties involved. Some key variations may include the percentage of ORRIS being converted, the timeline for the conversion, the payment arrangements for the conversion, and the obligations and responsibilities of the parties post-conversion. During the conversion process, it is crucial to consult legal professionals specializing in oil, gas, and mineral rights to ensure compliance with local laws, regulations, and industry practices. This document plays a significant role in facilitating the transfer of interests and ensures that all parties are informed and protected throughout the process. Keywords: Dallas, Texas, Notice of Payout, Election to Convert Interest, Party With Right, An Overriding Royalty Interest, Working Interest, oil and gas industry, lease, well, revenue, operating costs, legal notice, transparency, clarity, business transactions, terms, agreements, compliance, industry professionals.

Dallas Texas Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest

Description

How to fill out Dallas Texas Notice Of Payout, Election To Convert Interest To Party With Right To Convert An Overriding Royalty Interest To A Working Interest?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare formal documentation that differs throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and download a document for any personal or business objective utilized in your region, including the Dallas Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest.

Locating templates on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Dallas Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guide to obtain the Dallas Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest:

- Make sure you have opened the right page with your localised form.

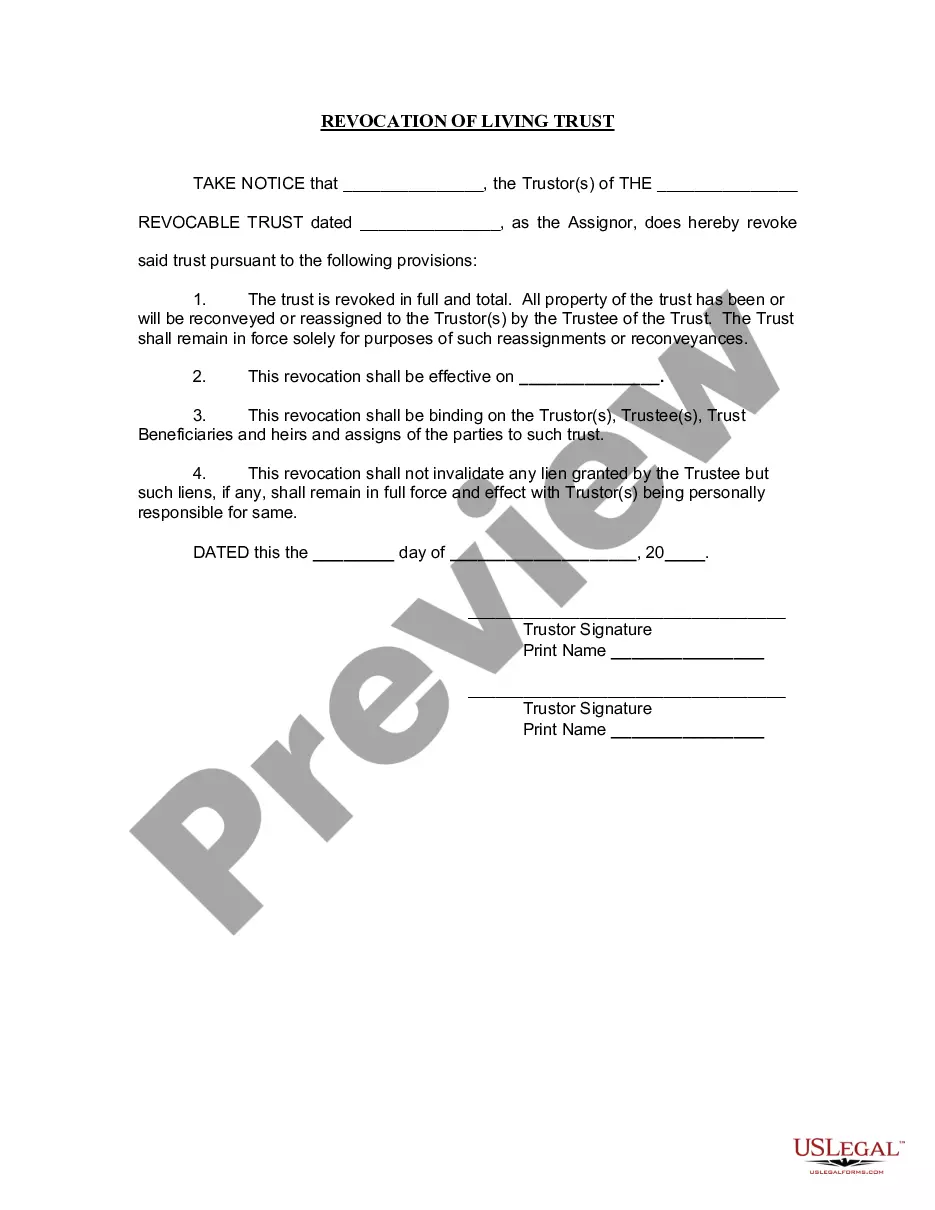

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template corresponds to your needs.

- Search for another document using the search option in case the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Dallas Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!