Collin Texas Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease is a legal provision that addresses the payment of nonparticipating royalties in the context of oil and gas leases in Collin County, Texas. This stipulation is designed to ensure fair and equitable distribution of royalties for owners of segregated tracts within a larger leased area. Under this stipulation, nonparticipating royalty owners are individuals or entities who do not hold a working interest in the leased property but are entitled to a share of the royalties generated from the extraction and production of oil and gas. These royalty owners typically hold a mineral interest in the property and receive a predetermined percentage of the total proceeds from the sale of hydrocarbons. The Collin Texas Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease establishes guidelines and procedures for determining and distributing these royalties among the nonparticipating interest owners. It ensures that each owner receives their fair share of the proceeds and prevents any potential disputes or unfair practices. This stipulation also addresses the specific treatment of segregated tracts covered by a single oil and gas lease. Segregated tracts are distinct portions of land within a larger leased area that may have different ownership or mineral interest holders. The stipulation outlines how the nonparticipating royalty payments will be calculated and allocated for each segregated tract, taking into account the size, location, and production potential of each tract. Different types of Collin Texas Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease might include variations in the royalty percentage, payment frequency, and specific provisions for different types of mineral interests or tracts. For example, there could be separate stipulations for segregated tracts with different mineral rights holders or distinct stipulations for royalty payments from oil production versus gas production. Keywords: Collin Texas, stipulation, nonparticipating royalty, segregated tracts, oil and gas lease, payment, distribution, mineral interest, hydrocarbons, proceeds, guidelines, disputes, unfair practices, ownership, allocation, production potential, variations, frequency, provisions, mineral rights, oil production, gas production

Collin Texas Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease

Description

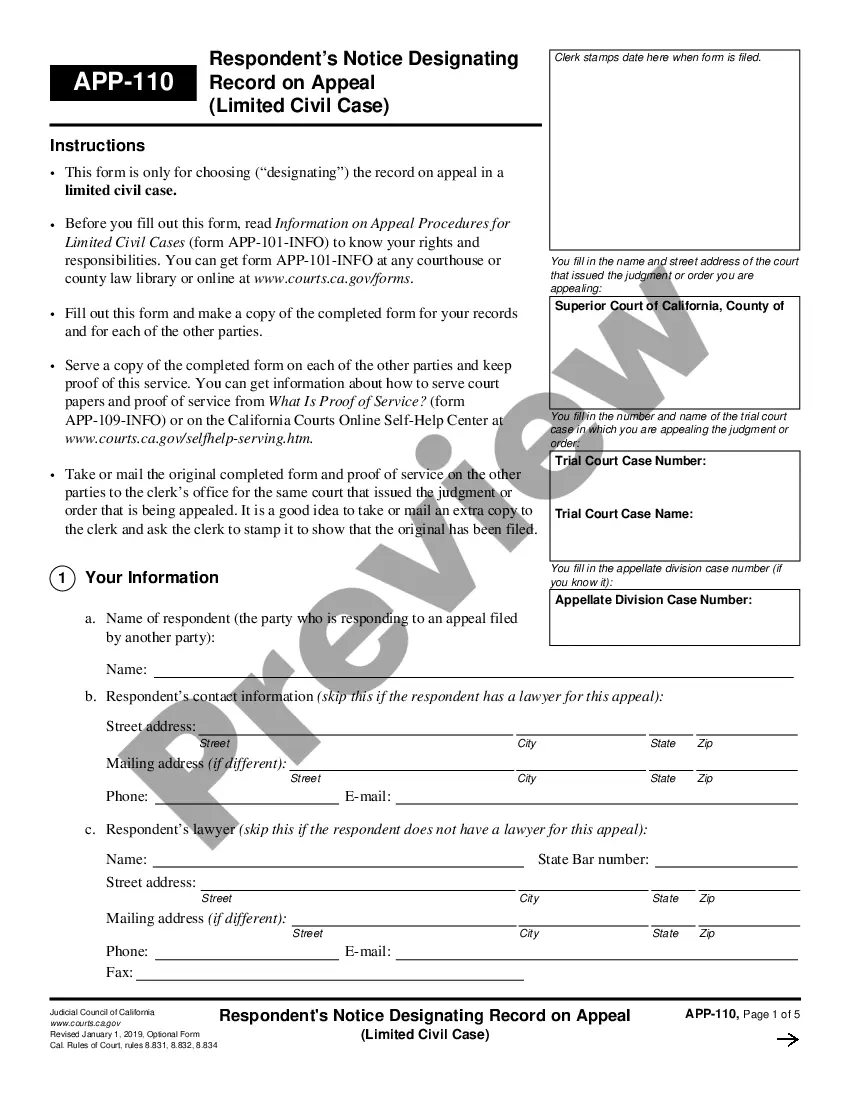

How to fill out Collin Texas Stipulation Governing Payment Of Nonparticipating Royalty Under Segregated Tracts Covered By One Oil And Gas Lease?

Whether you intend to start your company, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare specific documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business occurrence. All files are collected by state and area of use, so picking a copy like Collin Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few more steps to obtain the Collin Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease. Adhere to the instructions below:

- Make sure the sample fulfills your personal needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the file once you find the right one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Collin Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

The formula to calculate NPRI without proportionate share reduction is LRR RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain royalty interest it is expensefree, bearing no operational costs of production.

What is an NPRI? A non-participating royalty interest owner has a right to all or a portion of the royalty from gross production, but does not have the right to execute a lease, receive a bonus or any delay rentals.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain royalty interest it is expensefree, bearing no operational costs of production.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

A mineral interest owner also possesses the right to receive lease bonuses, delay rental payments, shut-in payments and royalties. A royalty interest, on the other hand, is the property interest created that entitles the owner to receive a share of the production.

The owner of a nonparticipating royalty interest, like the owner of a nonparticipating nonexecutive mineral interest, does not have the right to enter into a lease of the minerals nor the right to enter upon the land for the purpose of exploring for or producing oil, natural gas, or other minerals.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.