The Harris Texas Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease is a legal agreement that outlines the procedures and terms for the payment of nonparticipating royalties in the Harris County, Texas area. This stipulation is specifically applicable to oil and gas leases covering segregated tracts. Nonparticipating royalty owners are individuals who own a share of mineral rights but do not take part in the actual operations or drilling activities on the leased property. In such cases, the nonparticipating royalty owners are entitled to a percentage of the revenue generated from the production of oil and gas on their property. Keywords: Harris Texas stipulation, nonparticipating royalty, segregated tracts, oil and gas lease, Harris County, legal agreement, payment procedures, mineral rights, drilling activities, revenue. Different types of Harris Texas Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease may include variations in payment terms, royalty percentages, or specific provisions related to the management or administration of the nonparticipating royalty interests. These types can be tailored based on the specific requirements and agreements made between the parties involved in the lease. It's essential to consult with a legal professional specializing in oil and gas law to ensure adherence to the relevant regulations and to accurately draft or interpret the Harris Texas Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease.

Harris Texas Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease

Description

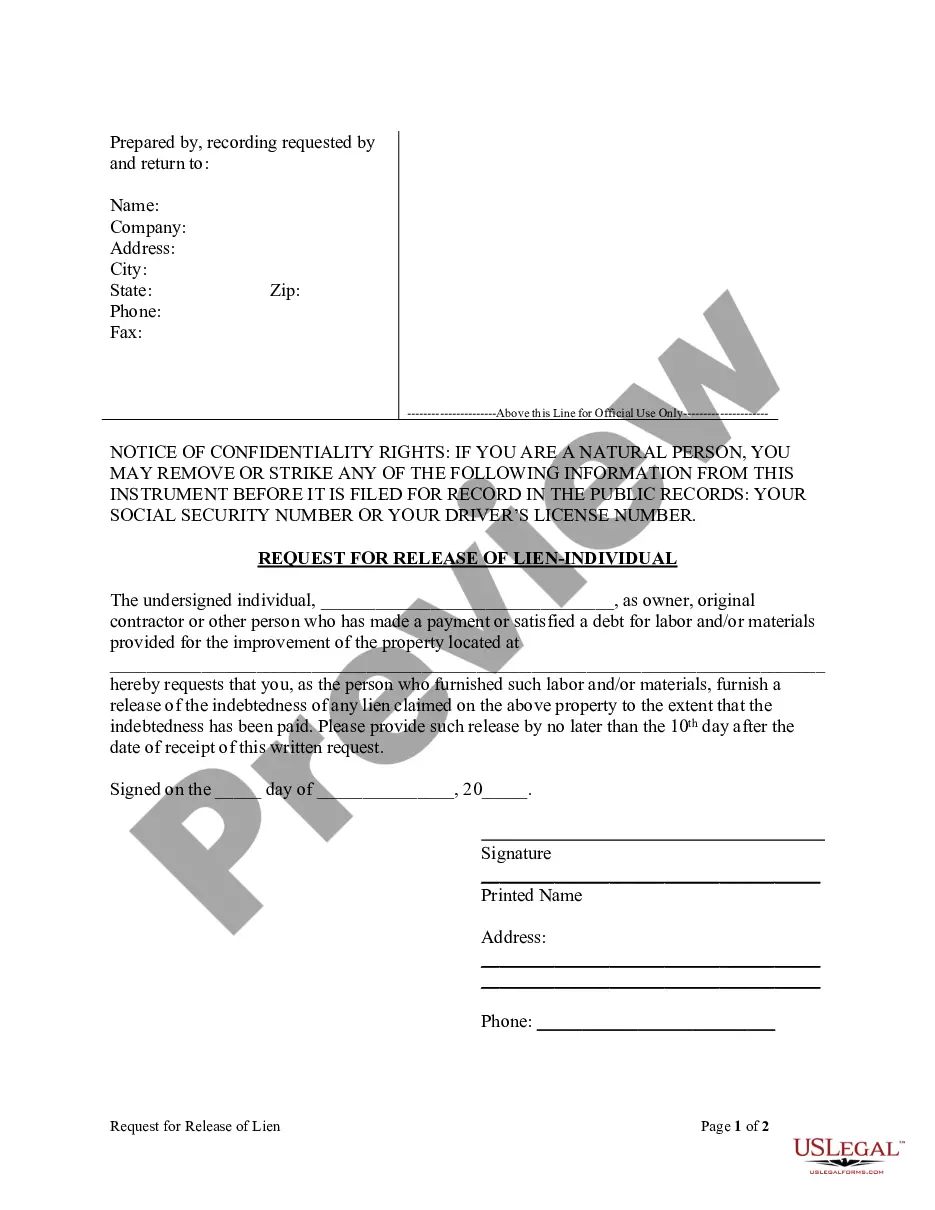

How to fill out Harris Texas Stipulation Governing Payment Of Nonparticipating Royalty Under Segregated Tracts Covered By One Oil And Gas Lease?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask an attorney to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Harris Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

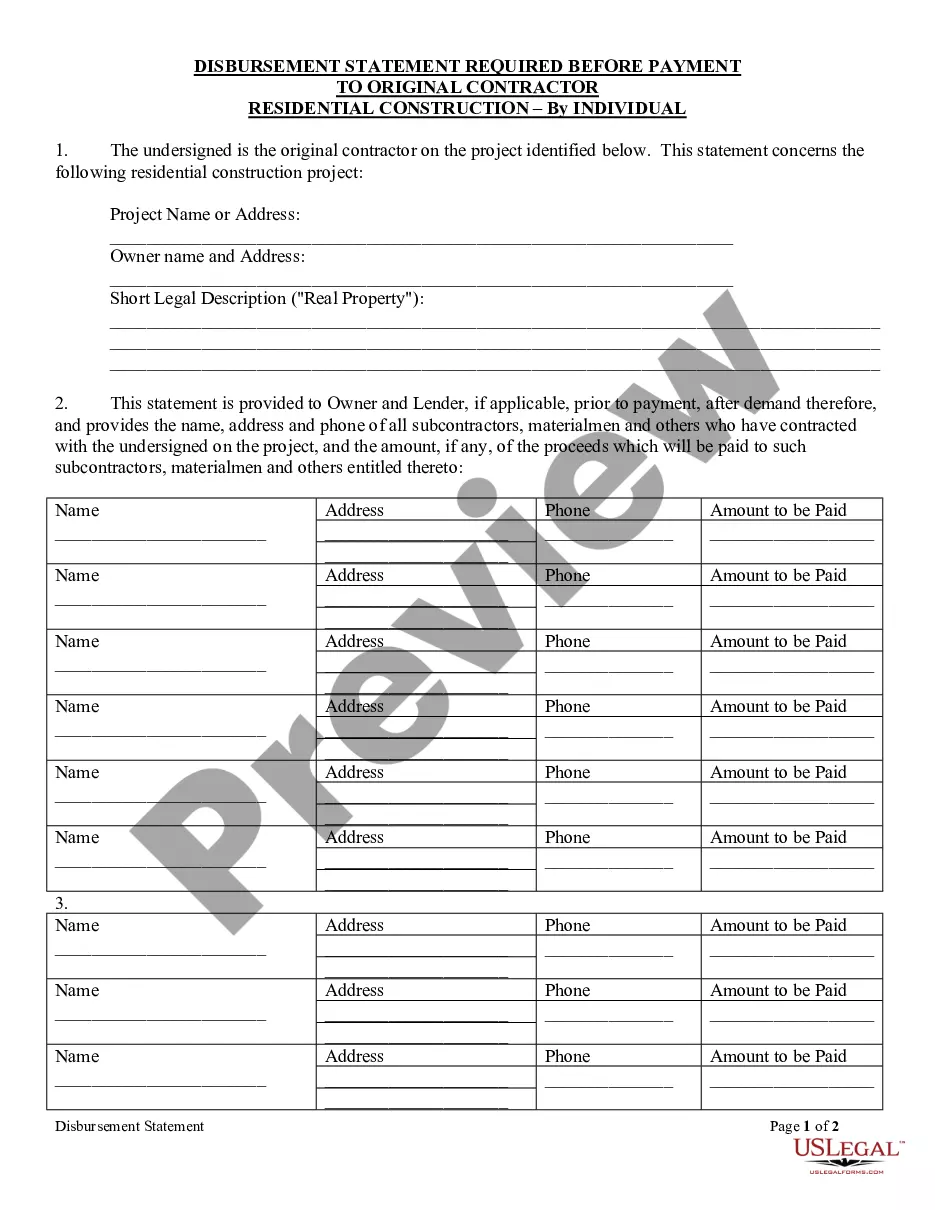

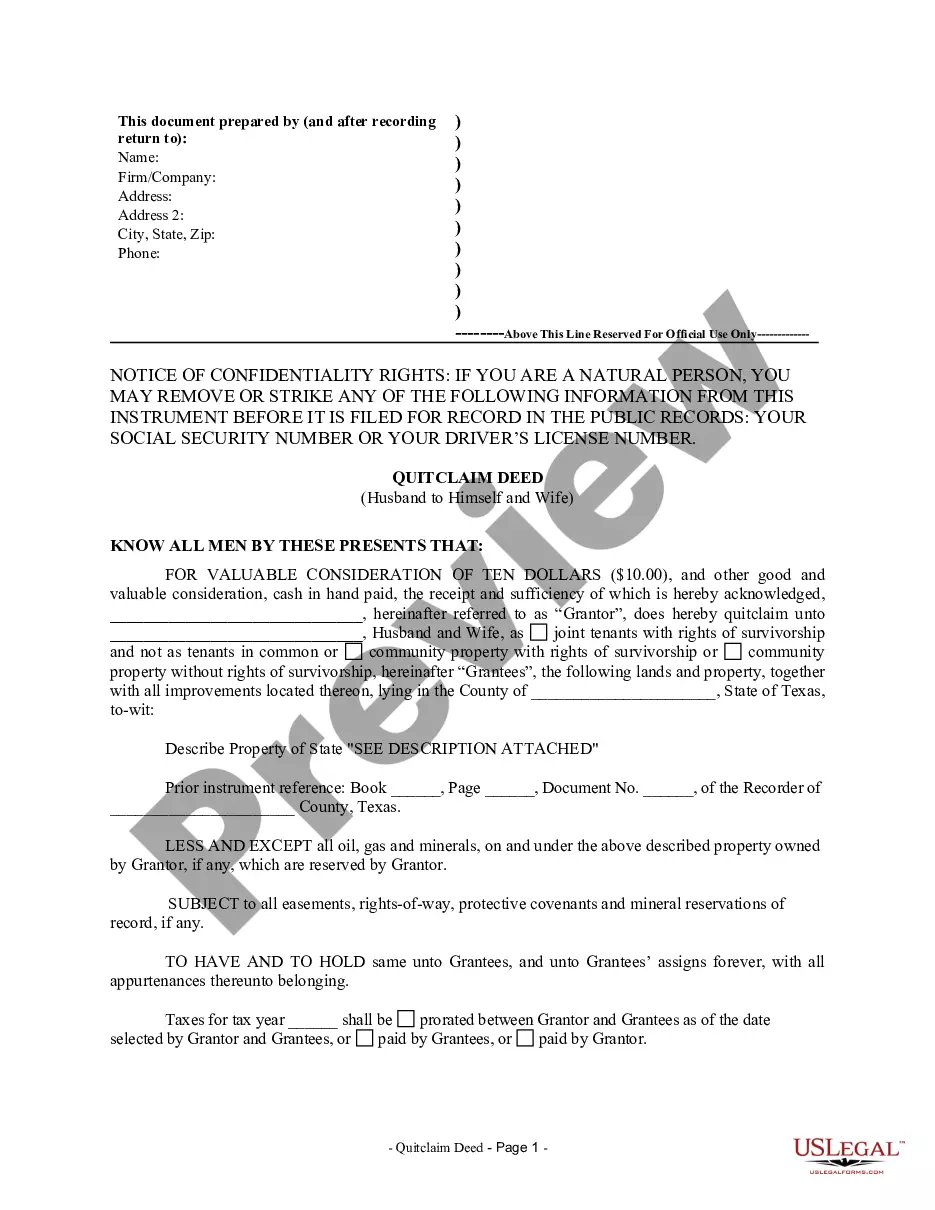

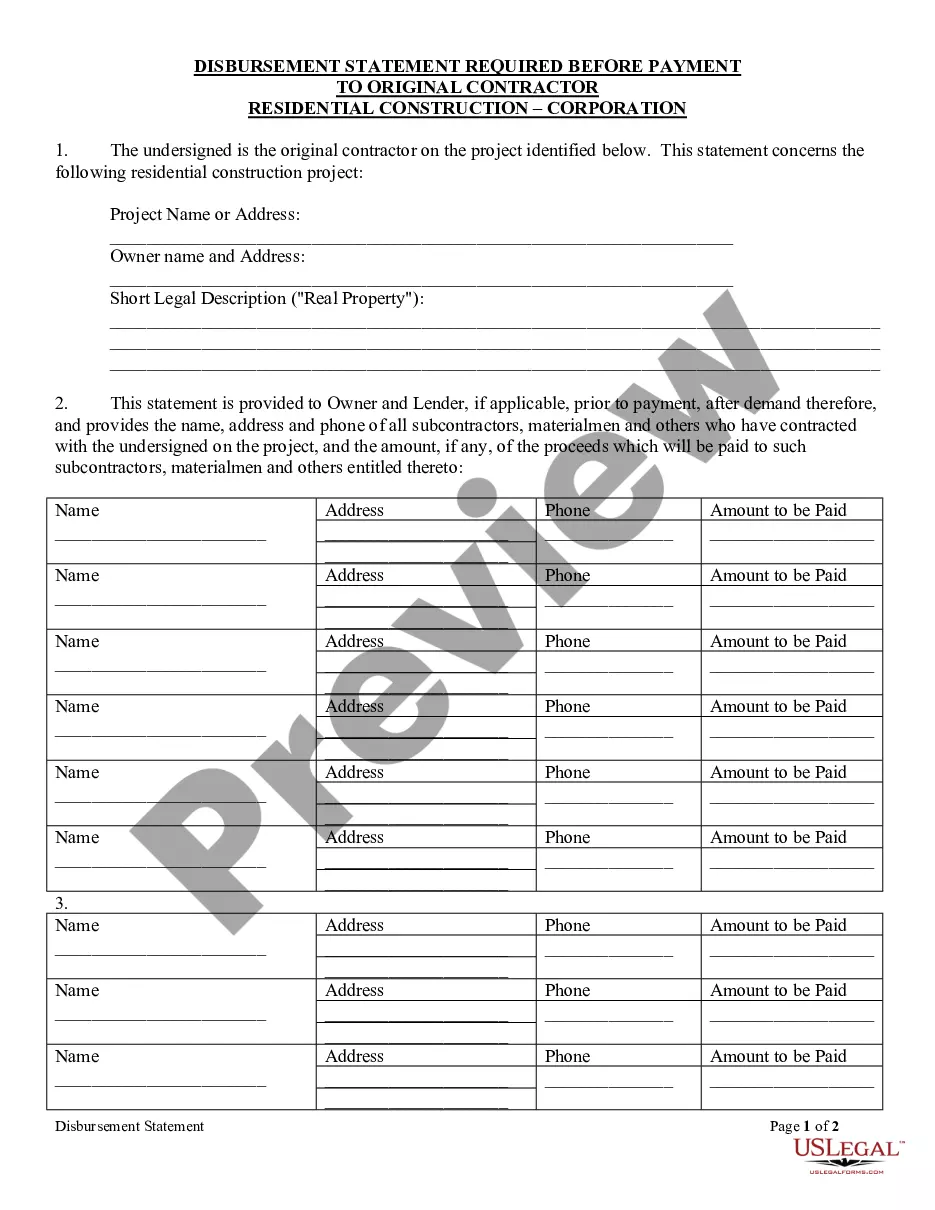

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case gathered all in one place. Consequently, if you need the latest version of the Harris Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Harris Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your Harris Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease and save it.

When finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!