Montgomery Maryland Stipulation of Ownership of Mineral Interest, also known as Mineral Ownership in Specific Lands, is a legal document used to establish and define the ownership rights and interests associated with mineral resources in specific areas within Montgomery County, Maryland. This stipulation plays a vital role in clarifying property rights and preventing disputes between multiple parties claiming ownership or access to minerals on a particular tract of land. Key terms and relevant keywords for this topic include: 1. Montgomery County, Maryland: This refers to the specific geographic location where the stipulation of mineral ownership is applicable. Montgomery County is a county in the state of Maryland, known for its diverse communities and proximity to Washington, D.C. 2. Stipulation of Ownership: This indicates the legal agreement and document that outlines the ownership rights and conditions related to mineral resources in Montgomery County. It establishes who has the right to access, explore, and extract minerals on designated lands. 3. Mineral Interest: This term refers to the legal rights associated with owning minerals found beneath the surface of the land. Mineral interest holders may include individuals, corporations, or government entities who have the right to profit from the extraction or production of minerals. 4. Specific Lands: This phrase signifies the designated tracts of land within Montgomery County subject to the stipulation. It identifies the geographic boundaries where mineral ownership rights and regulations apply. 5. Mineral Ownership: The collective rights and interests held by individuals, companies, or organizations pertaining to minerals within the specified geographic area. 6. Ownership Disputes: Mention of disputes that may arise between individuals or entities claiming conflicting ownership rights over mineral resources in the specific lands of Montgomery County. Types of Montgomery Maryland Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands: 1. Residential/Agricultural Stipulation: This refers to the stipulation of mineral interest on lands primarily used for residential or agricultural purposes in Montgomery County. It may have specific regulations to protect homeowners or farmers while allowing for limited extraction activities. 2. Commercial/Industrial Stipulation: This type of stipulation applies to lands zoned for commercial or industrial purposes in Montgomery County. It considers the unique aspects and potential impacts of mineral extraction on these types of properties. 3. Public Use Stipulation: Public use stipulations govern mineral ownership rights in lands designated for public use, such as parks, conservation areas, or government-owned lands within Montgomery County. These may have stricter regulations to ensure the preservation of natural resources or public enjoyment of these areas. 4. Utility Easement Stipulation: This stipulation focuses on mineral ownership rights over lands designated for utility easements, such as transmission line corridors or pipelines. It ensures coordination between mineral rights holders and utility companies for responsible development and infrastructure maintenance. In summary, the Montgomery Maryland Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands serves as a crucial legal document that outlines rights, responsibilities, and regulations related to mineral ownership in designated areas within Montgomery County, Maryland. It helps prevent conflicts and provides clarity for individuals, corporations, and government entities that seek to access and benefit from mineral resources while considering the specific land classifications and potential disputes that may arise.

Montgomery Maryland Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands

Description

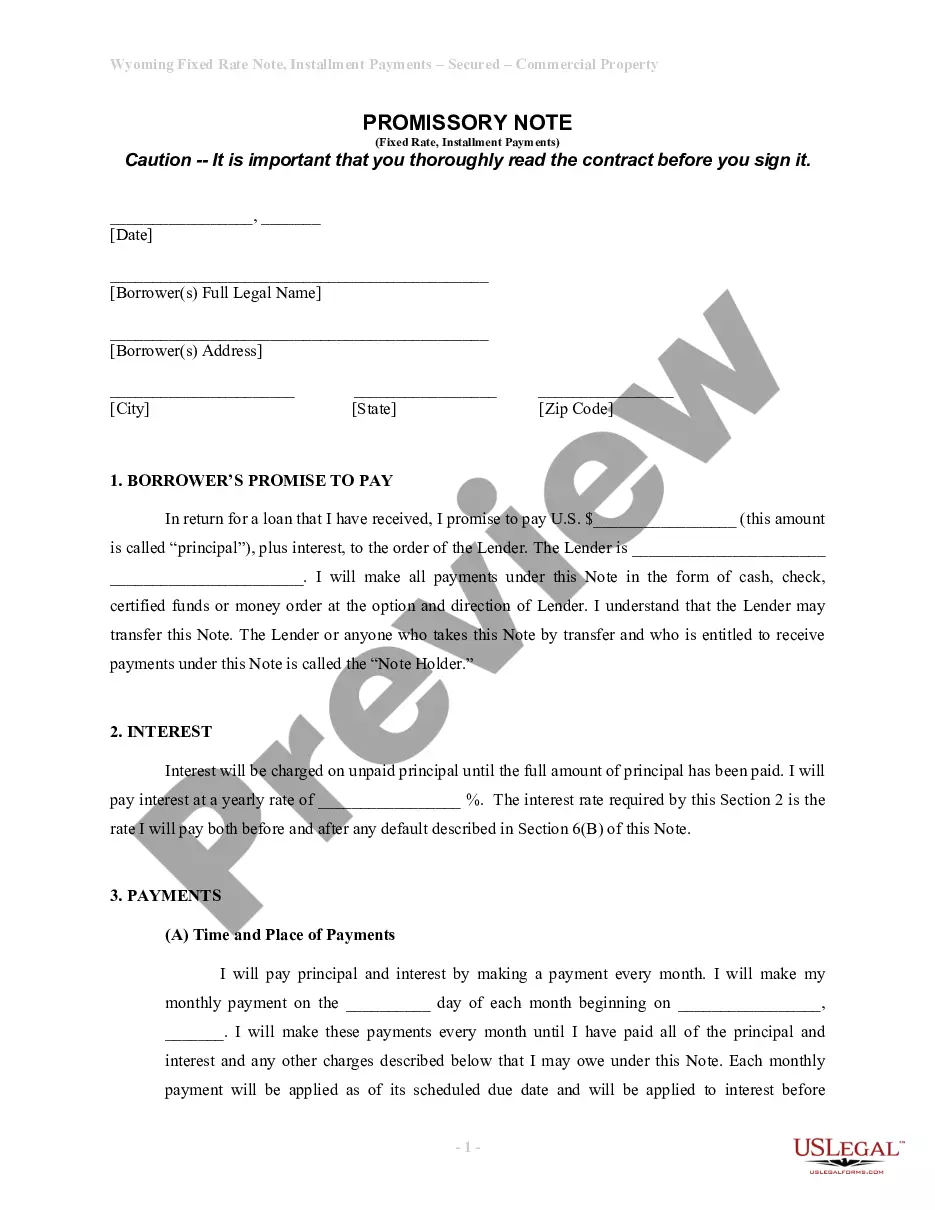

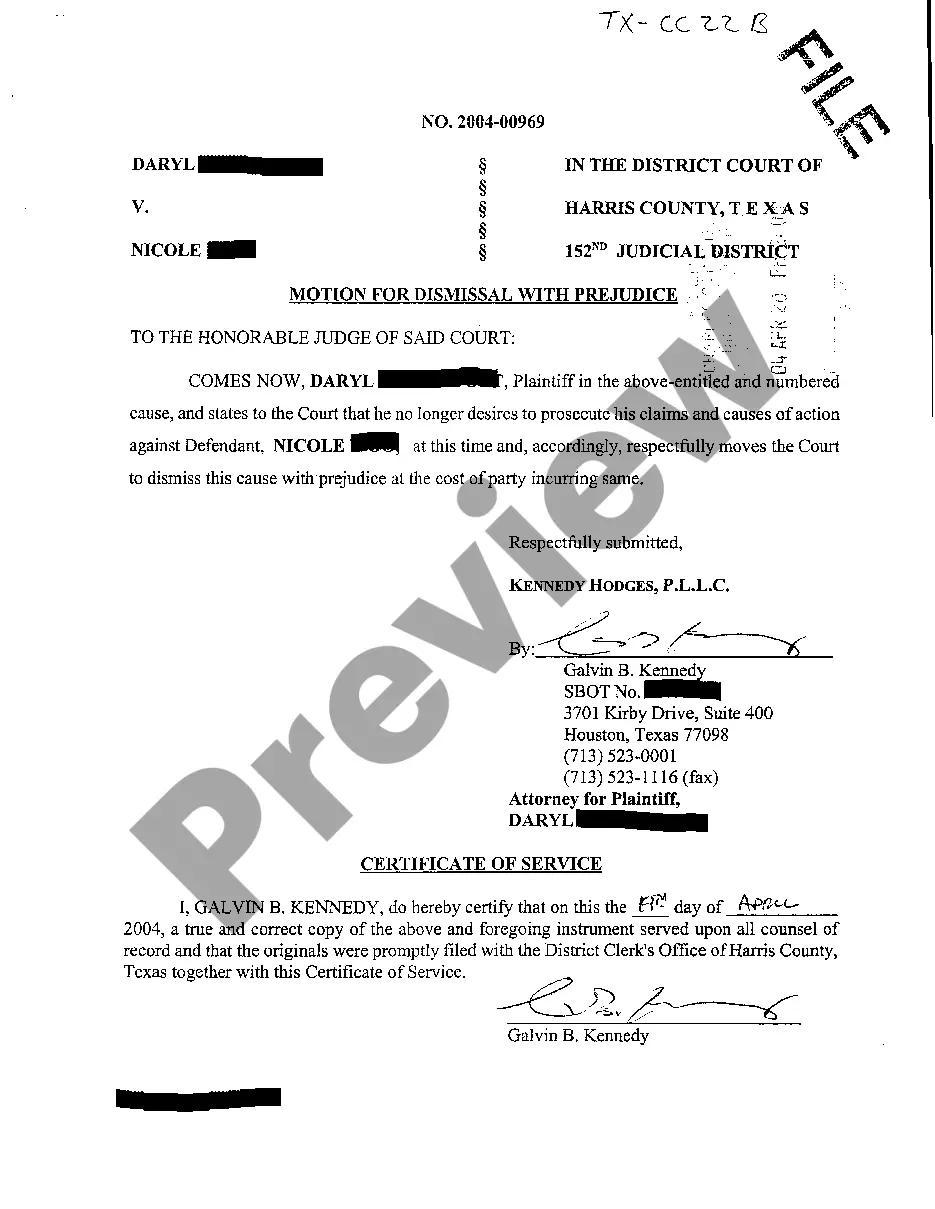

How to fill out Montgomery Maryland Stipulation Of Ownership Of Mineral Interest Of Mineral Ownership In Specific Lands?

Whether you plan to open your company, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you must prepare certain documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business case. All files are grouped by state and area of use, so picking a copy like Montgomery Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few more steps to obtain the Montgomery Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands. Adhere to the guide below:

- Make certain the sample meets your individual needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to get the sample once you find the right one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Montgomery Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

By investing in mineral rights, you can receive greater returns on your real estate investments than just equity appreciation. Mineral rights to oil, coal, natural gas, or other valuable natural resources can substantially boost your investment portfolio as labor-free sources of revenue or passive income.

A mineral owner has the right to extract and use minerals found beneath the surface of a particular piece of land.

If you did happen to find a large gold deposit on your property and do not own the mineral rights, don't fear. You do still own the property at least from the ground up. The mineral rights owner cannot simply come and remove you and dig up your property.

The ownership of rights to minerals, including oil and gas, contained in a tract of land. A mineral right is a real property interest and can be conveyed independently of the surface estate.

Unlike a mineral interest owner, a royalty interest owner does not possess executive rights. In addition, a royalty interest owner does not possess the right to receive lease bonuses, delay rental payments, or shut-in payments.

The Fort Worth, Texas, company has separated the mineral rights from tens of thousands of homes in states where shale plays are either well under way or possible, including North Carolina, Alabama, Mississippi, Virginia, New Mexico, Nevada, Arizona, Oklahoma, Utah, Idaho, Texas, Colorado, Washington and California.

Go to the Courthouse to Search Mineral Ownership Records If you don't have the description, go to the tax office first. As a surface owner, you are paying property taxes and they can assist you with your property description. It's best if you have the deed that was signed when you or a relative purchased the property.

Mineral rights don't come into effect until you begin to dig below the surface of the property. But the bottom line is: if you do not have the mineral rights to a parcel of land, then you do not have the legal ability to explore, extract, or sell the naturally occurring deposits below.

Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner.

The mineral interest owner is the person granting the lease to a company or agent thereof (Lessor). Throughout everything, the mineral interest holder has full rights to the property and full ownership of the minerals that might exist there.