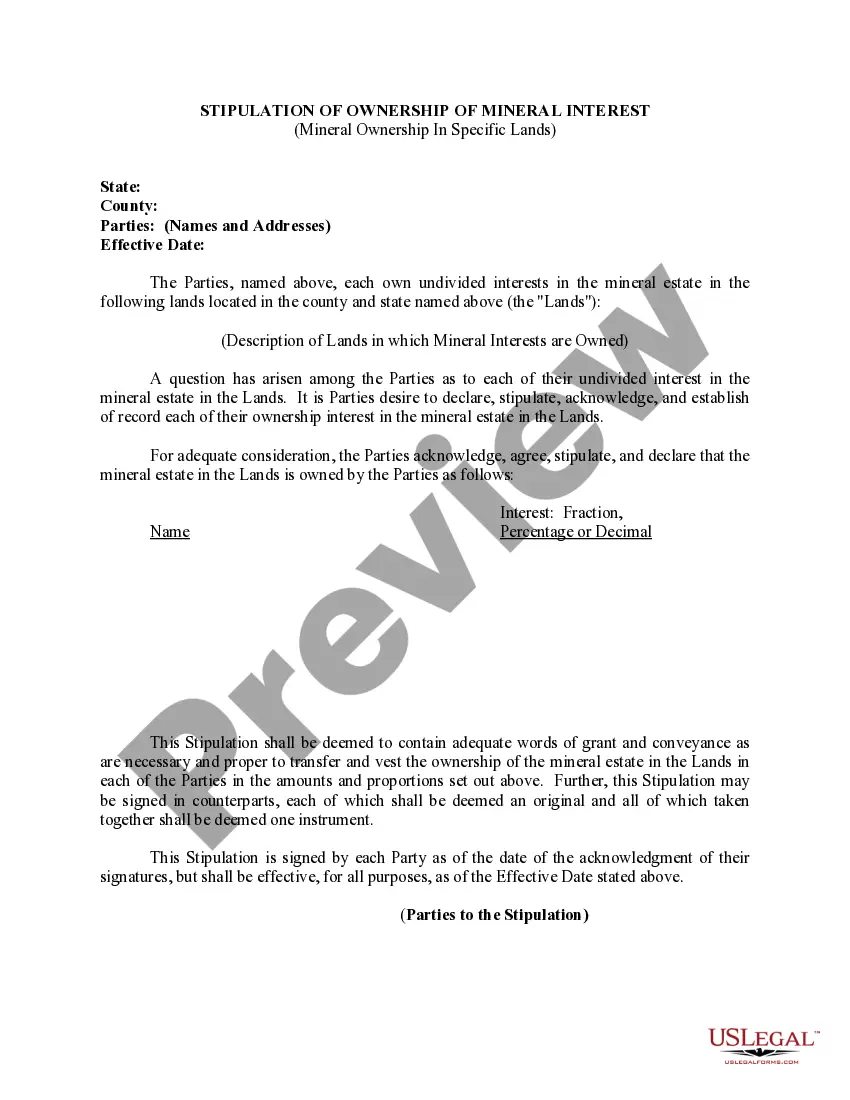

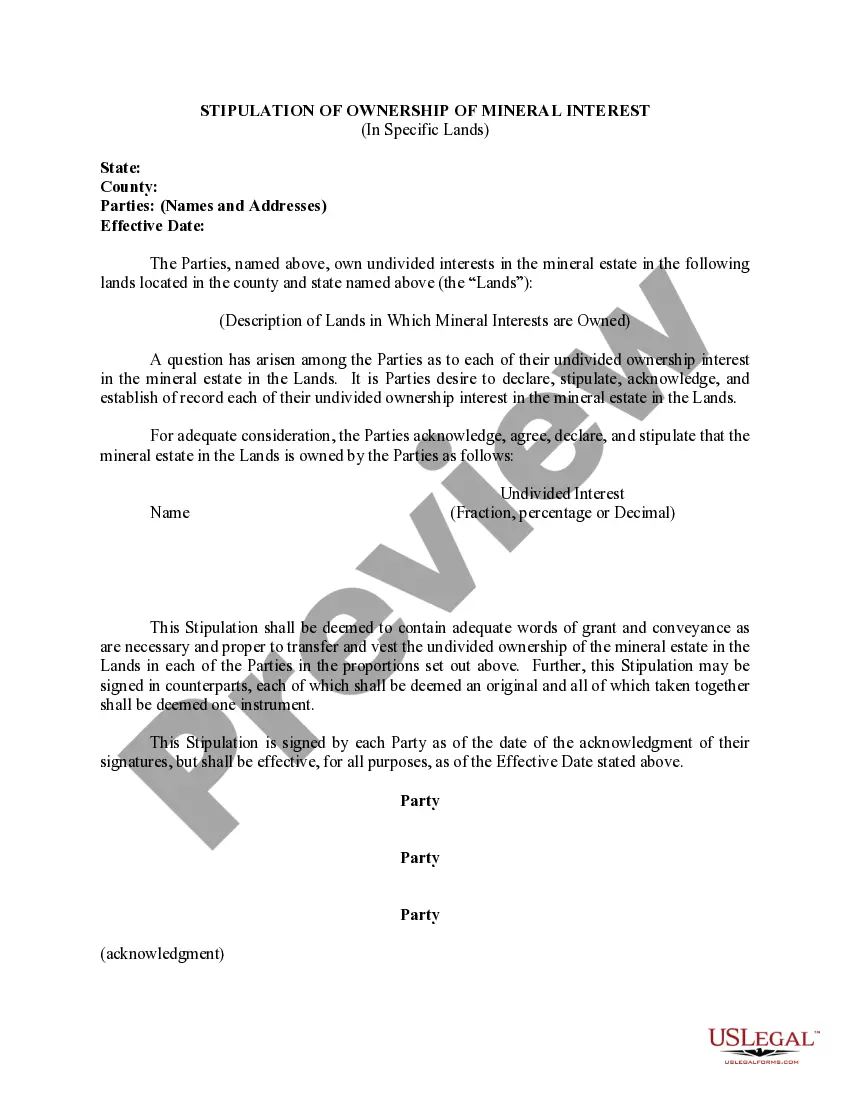

Travis Texas Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands

Description

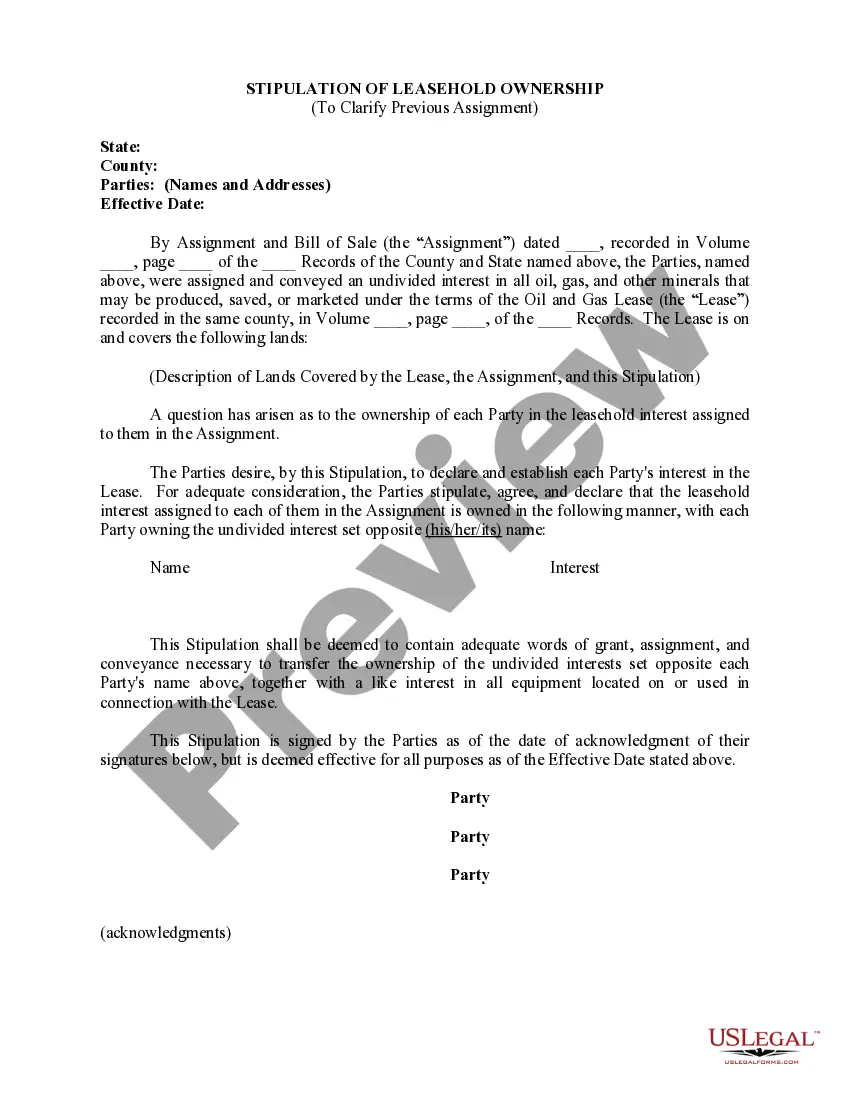

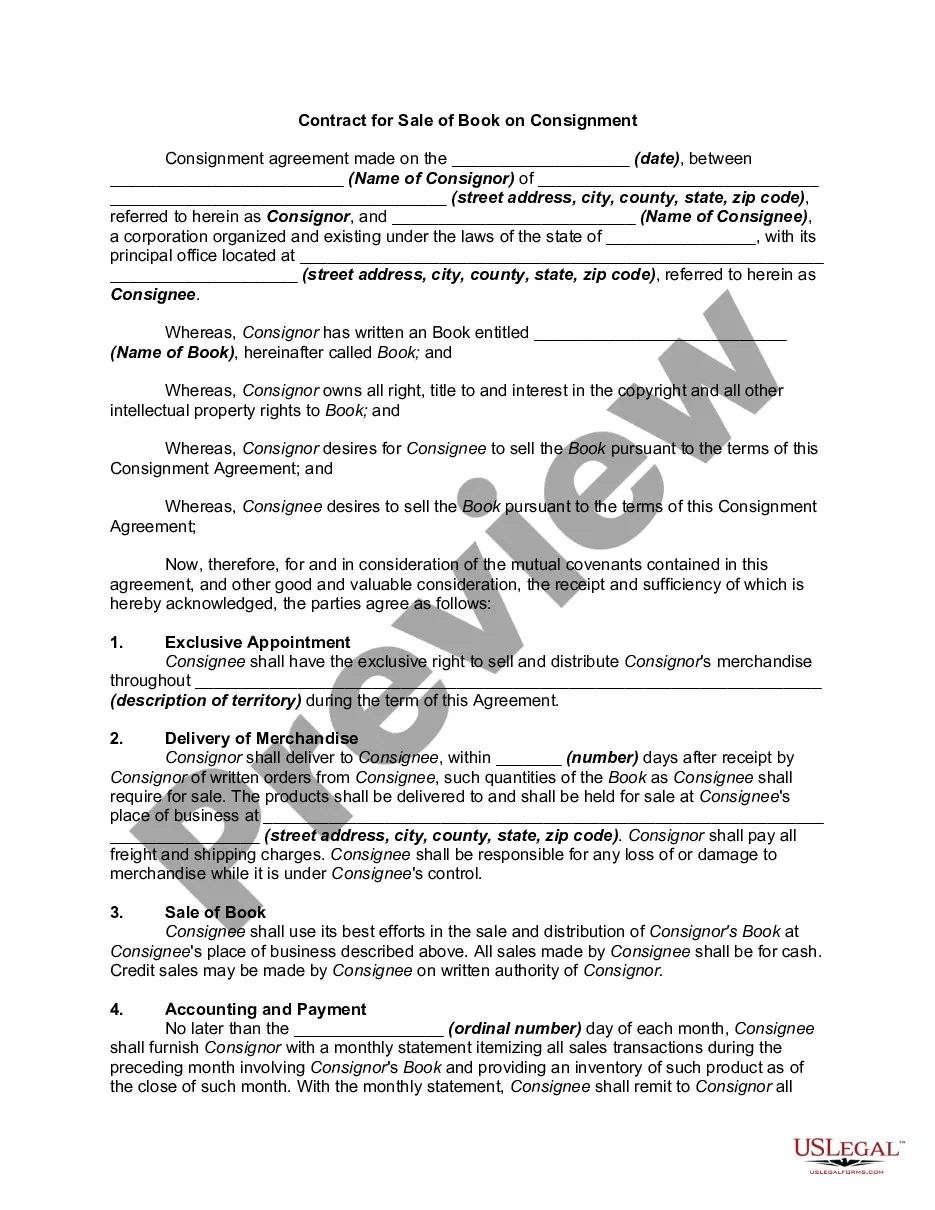

How to fill out Stipulation Of Ownership Of Mineral Interest Of Mineral Ownership In Specific Lands?

Whether you plan to establish your enterprise, enter into a contract, request an ID update, or address family-related legal matters, it is essential to prepare specific documentation that complies with your local statutes and guidelines.

Finding the appropriate documents can require significant time and effort unless you utilize the US Legal Forms library.

The platform offers users more than 85,000 professionally prepared and validated legal templates for any personal or business occasion. All documents are organized by state and area of application, making it quick and easy to select a copy like the Travis Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands.

Documents available from our library are reusable. With an active subscription, you can access all your previously purchased forms at any time from the My documents section of your account. Stop expending time on a constant search for the latest official documents. Enroll in the US Legal Forms platform and maintain your paperwork efficiently with the most extensive online form repository!

- Ensure the sample satisfies your individual requirements and state law provisions.

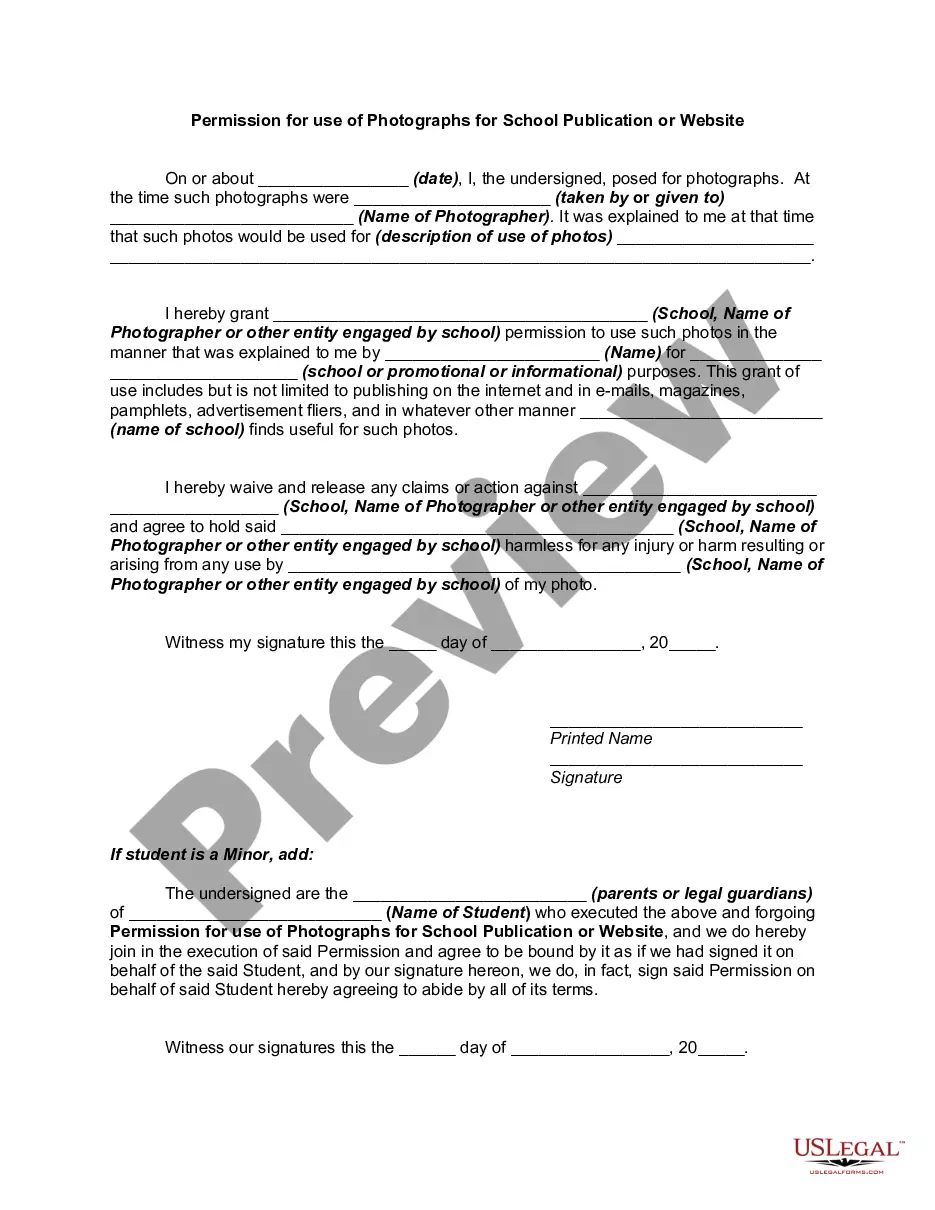

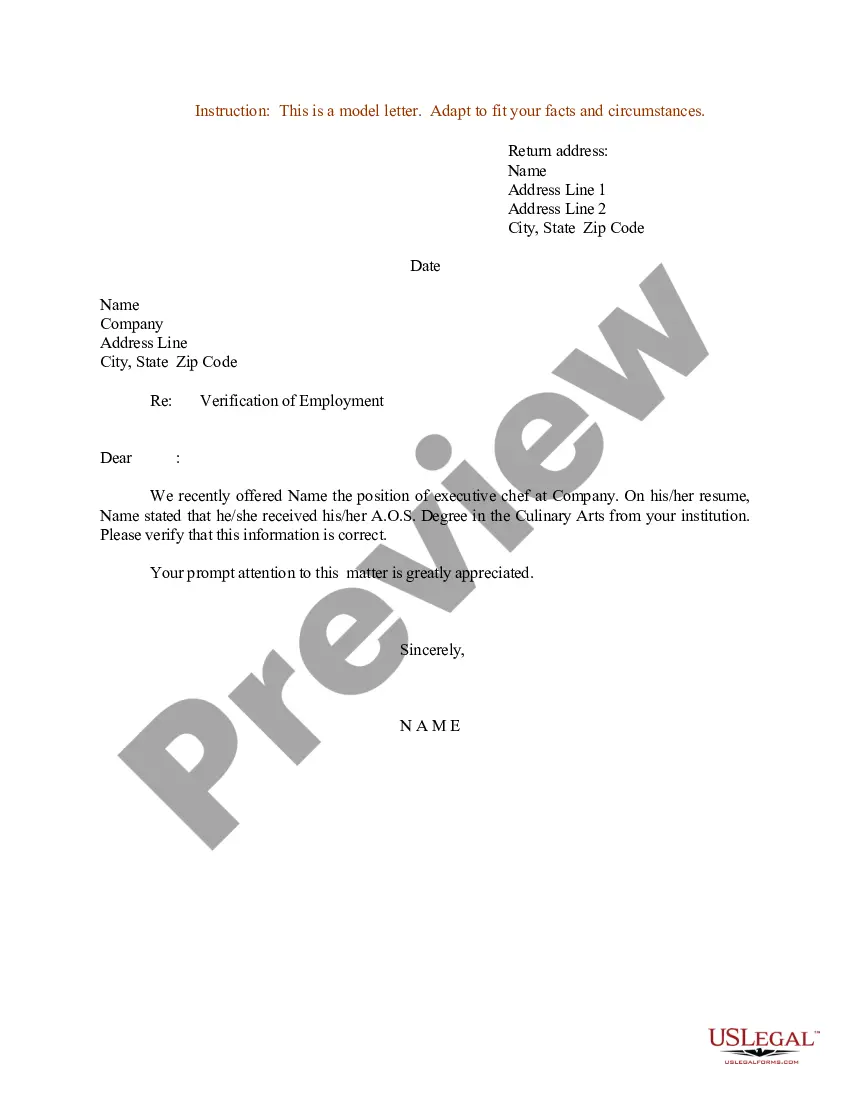

- Examine the form description and view the Preview if available on the page.

- Utilize the search function provided for your state above to find another template.

- Click Buy Now to secure the sample once you identify the appropriate one.

- Choose the subscription plan that best fits your needs to proceed.

- Log in to your account and remit payment using a credit card or PayPal.

- Download the Travis Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands in your preferred file format.

- Print the document or complete it and sign it digitally via an online editor to save time.

Form popularity

FAQ

Mineral rights in Texas are the rights to mineral deposits that exist under the surface of a parcel of property. This right normally belongs to the owner of the surface estate; however, in Texas those rights can be transferred through sale or lease to a second party.

Go to the Courthouse to Search Mineral Ownership Records If you don't have the description, go to the tax office first. As a surface owner, you are paying property taxes and they can assist you with your property description. It's best if you have the deed that was signed when you or a relative purchased the property.

Since the Lone Star state gave property owners rights to their minerals under the surface estate through property rights law in 1840, two main forms of investment have emerged across the country. Investors either buy mineral rights outright or invest in royalty interests.

The only way to determine your rights is to conduct a search of the public land records in the county where the property is located. All the deeds conveying the property must be reviewed. This is known as reviewing the property's Chain of Title.

As a general rule of thumb, the value for non-producing mineral rights will nearly always be less than $1,000/acre. In most cases, the mineral rights value in Texas for non-producing minerals will be $0 to $250, but producing minerals $25,000+ per acre is not unusual.

Because the minerals are considered part of the real estate in Texas, a seller under a contract that fails to mention minerals would have a contractual requirement to convey the entire real estate, including the surface and all minerals, to the buyer.

Landowners commonly sever and sell their mineral rights, often to big oil and gas exploration companies. The most common way of claiming mineral rights today is by buying them at auction or through private sales .

A mineral owner's rights typically include the right to use the surface of the land to access and mine the minerals owned. This might mean the mineral owner has the right to drill an oil or natural gas well, or excavate a mine on your property.

Mineral rights are automatically included as a part of the land in a property conveyance, unless and until the ownership gets separated at some point by an owner/seller.

Mineral rights in Texas are the rights to mineral deposits that exist under the surface of a parcel of property. This right normally belongs to the owner of the surface estate; however, in Texas those rights can be transferred through sale or lease to a second party.