Chicago Illinois Accounting Procedures refers to the set of rules and practices followed by businesses and organizations located in Chicago, Illinois, for managing their financial transactions, recording information, and preparing financial statements. These procedures ensure accuracy, consistency, and compliance with relevant laws and regulations governing accounting practices. The accounting procedures in Chicago, Illinois cover various aspects, including bookkeeping, record keeping, financial reporting, and internal controls. Proper execution of these procedures is crucial for maintaining the integrity of financial data, facilitating informed decision-making, and meeting statutory requirements. Chicago Illinois Accounting Procedures can be categorized into several types based on their purpose and application. Some notable types include: 1. Financial Reporting Procedures: These procedures outline the steps for recording, summarizing, and reporting financial data. They encompass the preparation of financial statements, such as balance sheets, income statements, and cash flow statements, which provide an overview of the organization's financial performance and position. 2. Tax Accounting Procedures: These procedures focus on complying with federal, state, and local tax regulations. They encompass processes for calculating and recording tax liabilities, preparing tax returns, and ensuring adherence to tax laws while maximizing tax benefits where applicable. 3. Internal Control Procedures: These procedures aim to safeguard an organization's assets, prevent fraud, and maintain reliable financial records. They involve establishing policies and practices that ensure segregation of duties, proper authorization and approval processes, regular internal audits, and effective risk management. 4. Accounts Payable and Receivable Procedures: These procedures govern the processing, recording, and management of vendor invoices, payments, and customer receipts. They ensure accurate and timely tracking of payable and receivable balances, as well as efficient cash flow management. 5. Cost Accounting Procedures: These procedures are critical for organizations that engage in manufacturing or producing goods and services. They involve accurately allocating and recording costs associated with the production process, determining the cost of goods sold, and analyzing cost variances. 6. Budgeting and Forecasting Procedures: These procedures guide the preparation of annual budgets and long-term financial forecasts. They outline the steps for gathering relevant data, creating realistic financial plans, and monitoring actual performance against budgeted targets. 7. Auditing and Compliance Procedures: These procedures aid in the preparation of financial data for external audits and ensure adherence to applicable accounting standards. They involve maintaining proper documentation, facilitating audit review processes, and addressing any identified non-compliance issues. By adhering to these Chicago Illinois Accounting Procedures, businesses and organizations can maintain accurate financial records, ensure compliance with legal obligations, make informed financial decisions, and promote transparency and accountability.

Chicago Illinois Accounting Procedures

Description

How to fill out Chicago Illinois Accounting Procedures?

Drafting documents for the business or individual needs is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to draft Chicago Accounting Procedures without expert help.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Chicago Accounting Procedures on your own, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal templates that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed document.

If you still don't have a subscription, follow the step-by-step instruction below to obtain the Chicago Accounting Procedures:

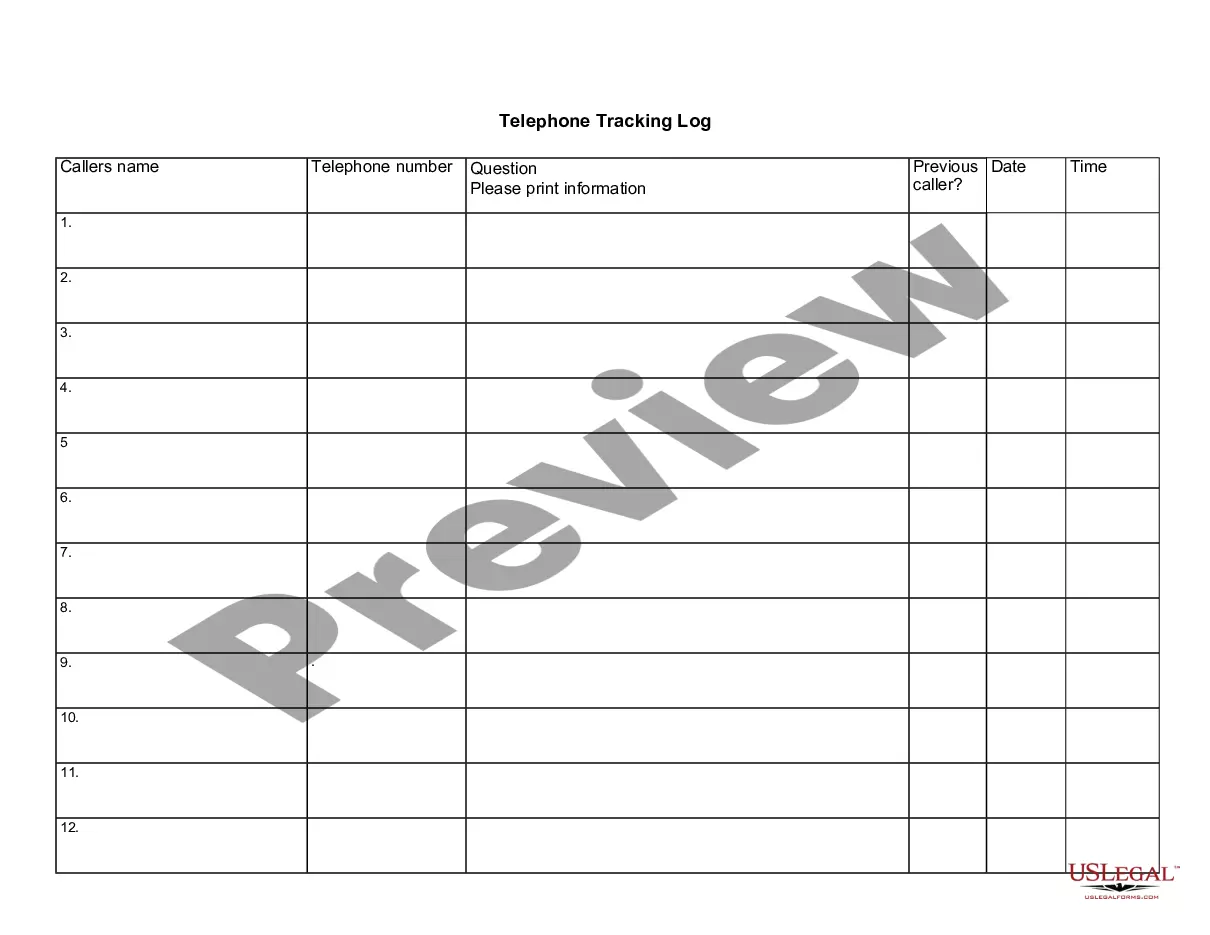

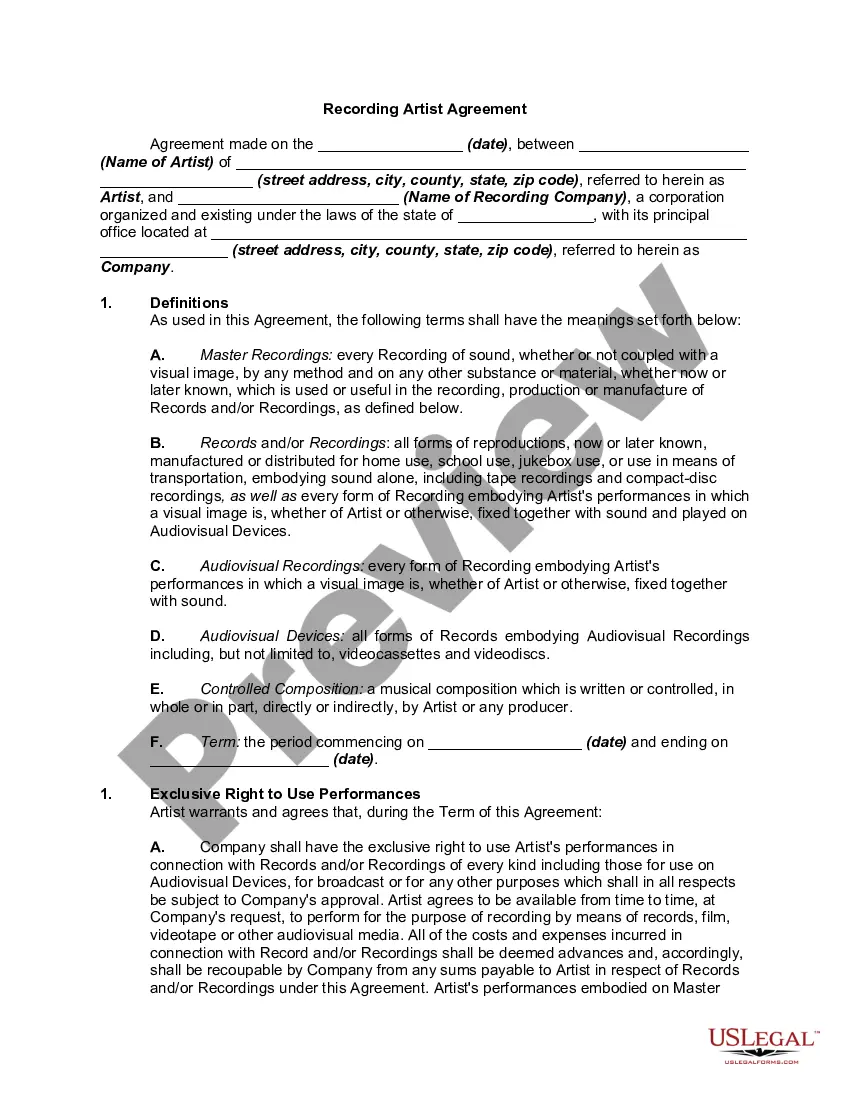

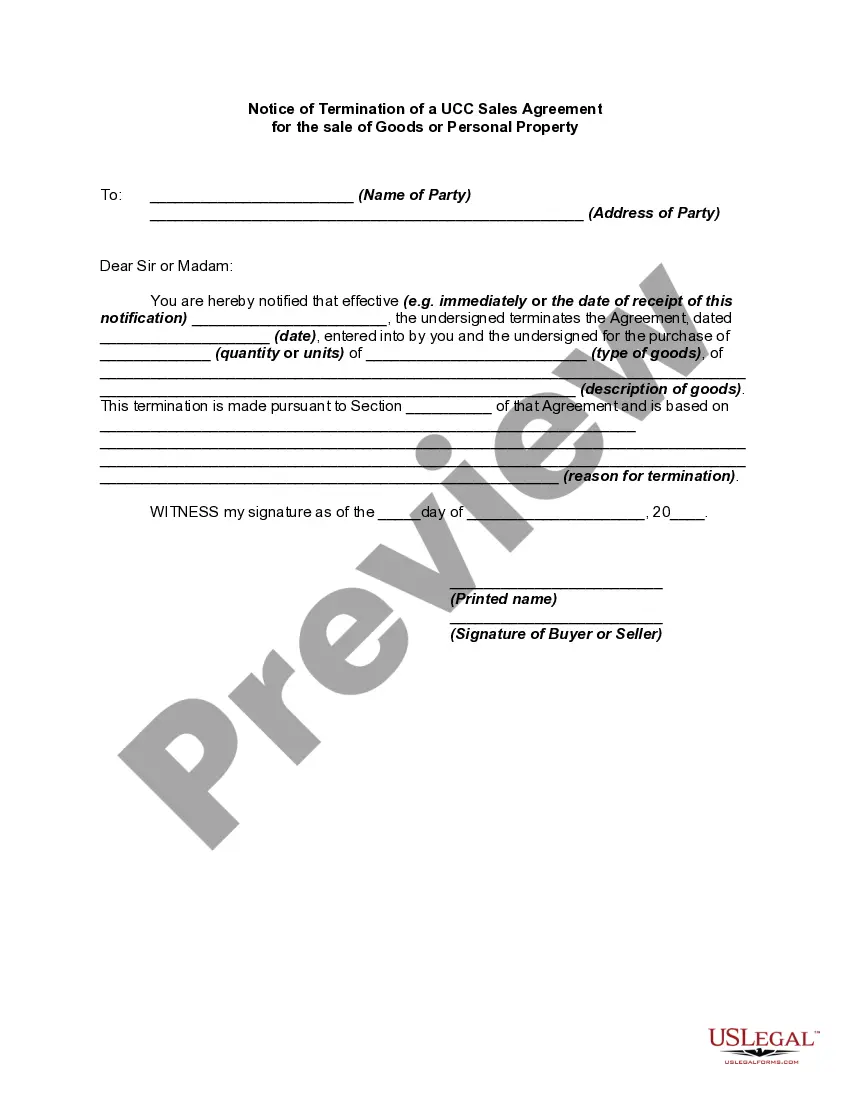

- Look through the page you've opened and verify if it has the sample you need.

- To do so, use the form description and preview if these options are available.

- To find the one that satisfies your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any scenario with just a few clicks!