Maricopa, Arizona is a city located in Pinal County, Arizona, United States. It is home to several businesses, organizations, and government agencies that utilize various accounting procedures to efficiently manage their financial operations. The accounting procedures followed in Maricopa, Arizona are crucial in handling financial transactions, tracking expenses, ensuring compliance with regulatory requirements, and maintaining accurate financial records. One of the prominent types of accounting procedures often employed in Maricopa, Arizona is General Accepted Accounting Principles (GAAP). GAAP provides a set of standardized guidelines and principles that govern financial reporting for businesses, nonprofits, and governmental organizations. This framework ensures transparency, comparability, and reliability in financial statements, making it an essential requirement for various entities in Maricopa, Arizona. Another important accounting procedure commonly found in Maricopa, Arizona is tax accounting. Tax accounting focuses on complying with federal, state, and local tax laws and regulations. It involves accurately calculating and reporting taxable income, preparing tax returns, and managing tax liabilities. Tax accountants in Maricopa, Arizona help individuals and businesses navigate complex tax codes and optimize tax-saving strategies to minimize tax burdens. Furthermore, Maricopa, Arizona encompasses different industries, including retail, manufacturing, healthcare, and real estate, among others. Each industry may require specific accounting procedures tailored to their unique needs. For instance, job costing accounting is prevalent in manufacturing and construction sectors, as it helps determine the cost of specific projects or jobs. Similarly, inventory valuation accounting procedures are essential for retail businesses, ensuring accurate assessment of inventory and cost of goods sold. Additionally, Maricopa, Arizona Accounting Procedures encompass budgeting and financial planning. Budgeting involves setting financial objectives, outlining revenue and expense forecasts, and monitoring performance against the budget. It plays a vital role in financial decision-making, resource allocation, and evaluating business performance. Many entities in Maricopa, Arizona employ this procedure to establish disciplined financial planning and control. In conclusion, Maricopa, Arizona employs various accounting procedures, including GAAP, tax accounting, industry-specific procedures like job costing and inventory valuation, and budgeting and financial planning. These procedures contribute to the efficient management of financial operations, enhance financial transparency, and enable informed business decisions.

Maricopa Arizona Accounting Procedures

Description

How to fill out Maricopa Arizona Accounting Procedures?

Laws and regulations in every area vary from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Maricopa Accounting Procedures, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for various life and business situations. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Maricopa Accounting Procedures from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Maricopa Accounting Procedures:

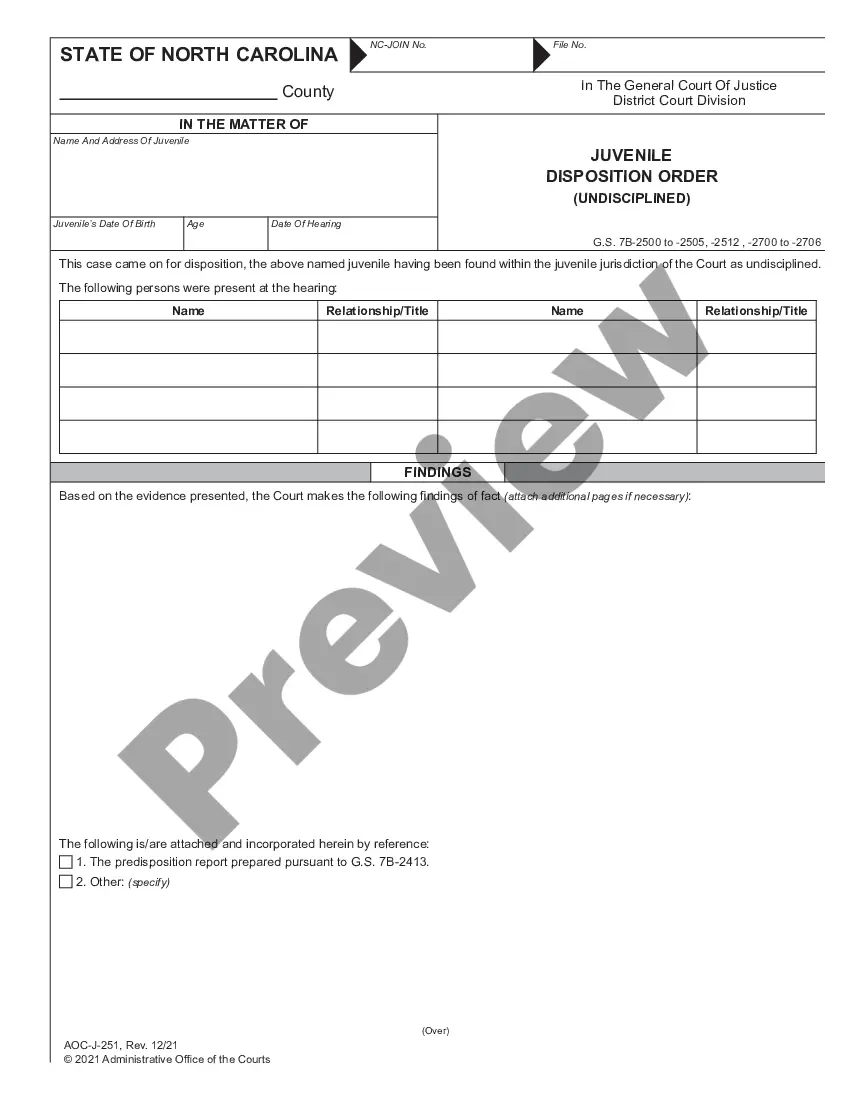

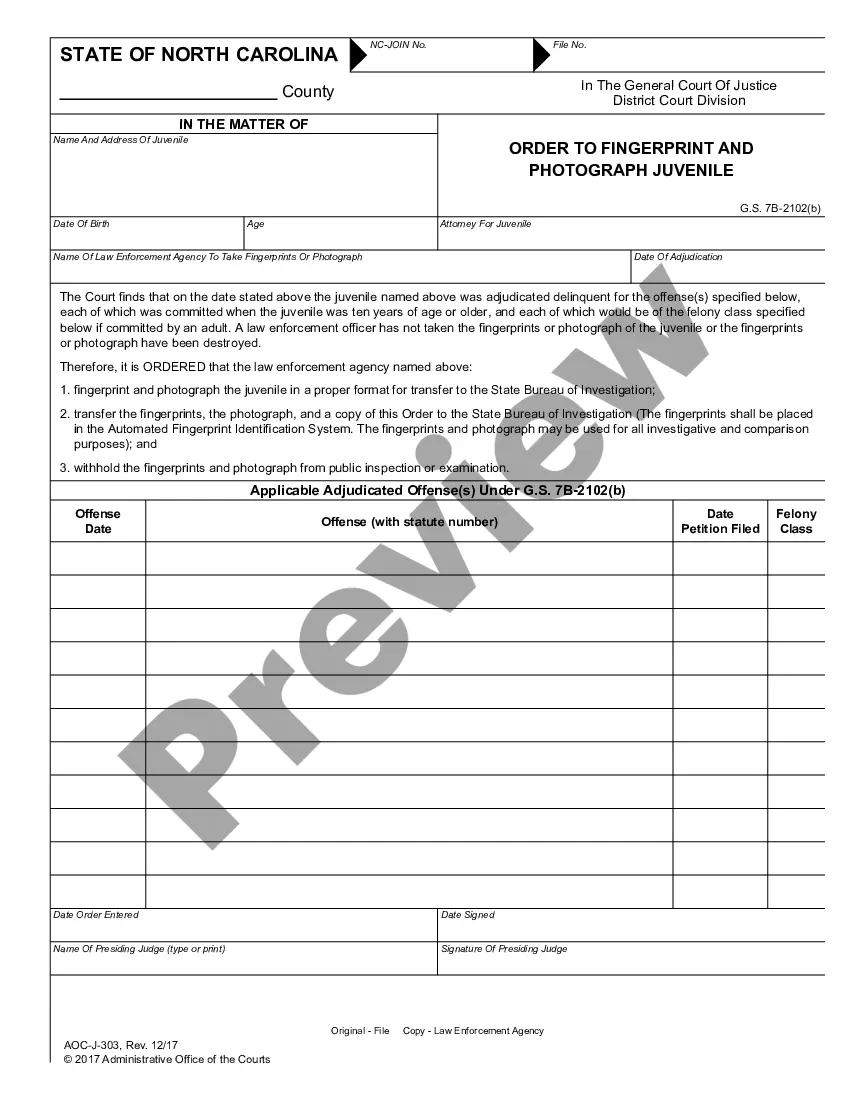

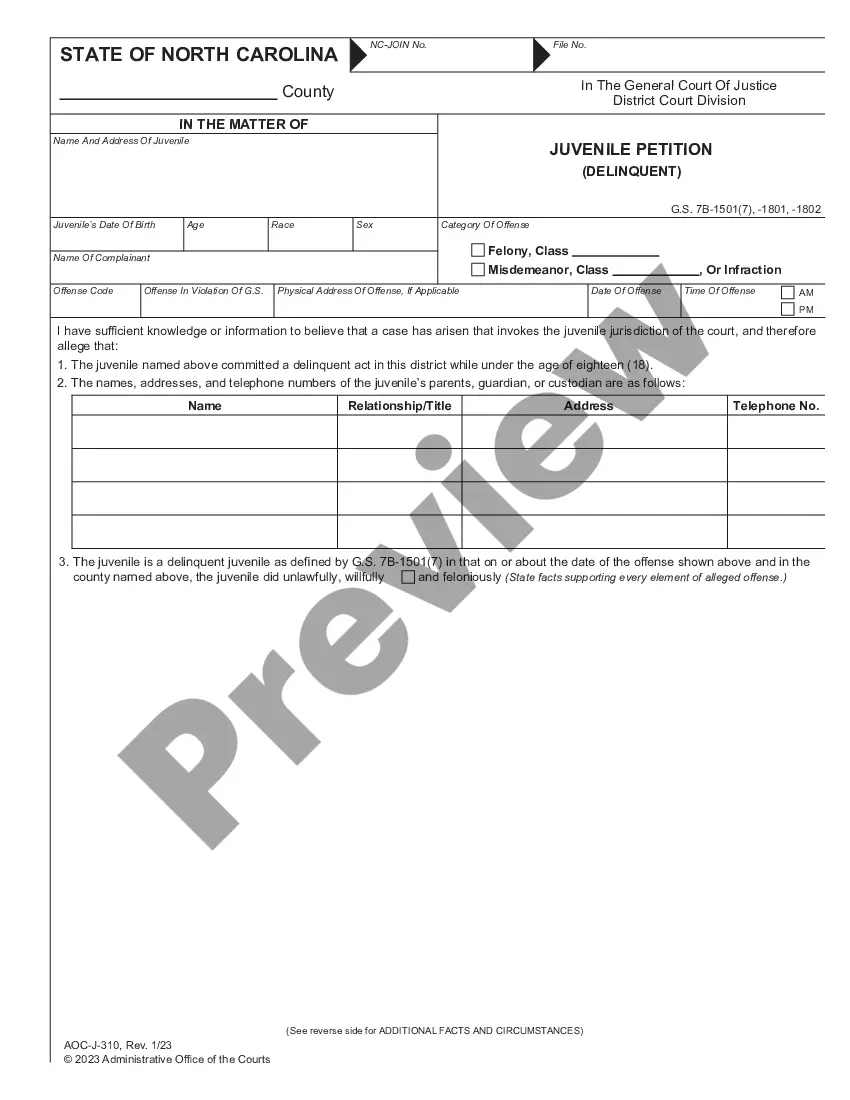

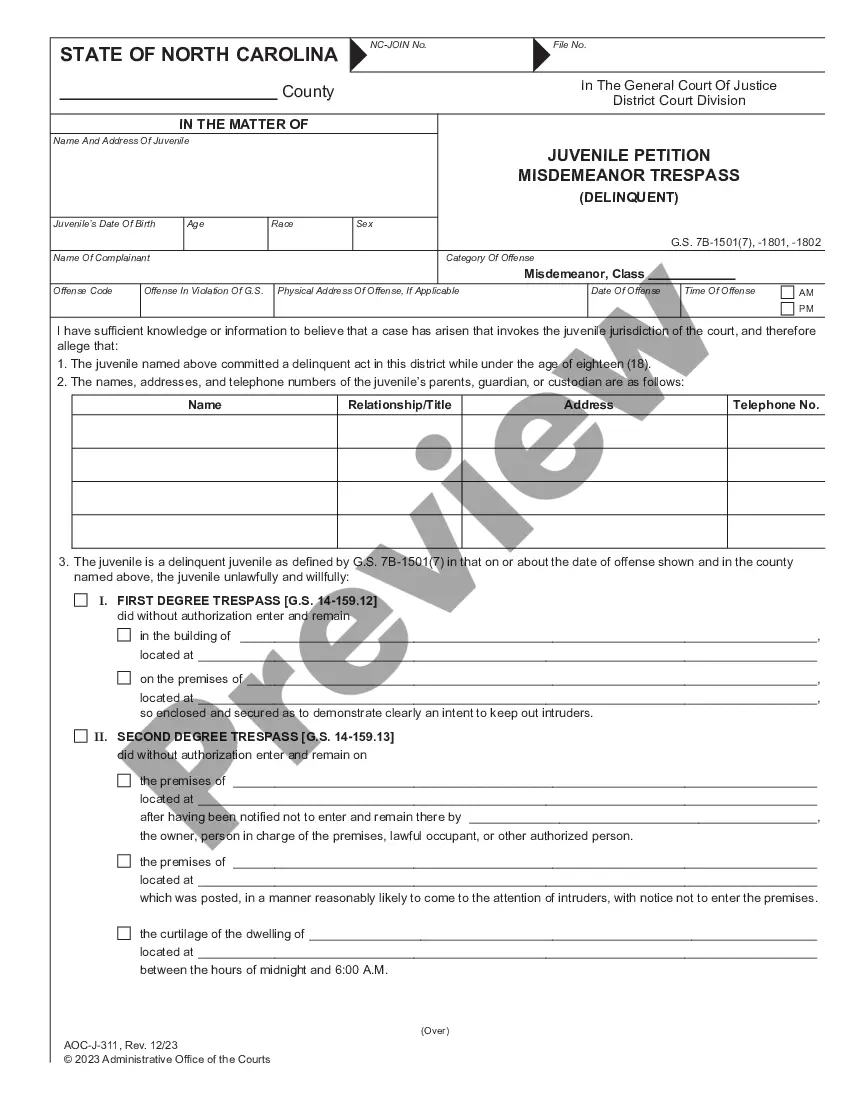

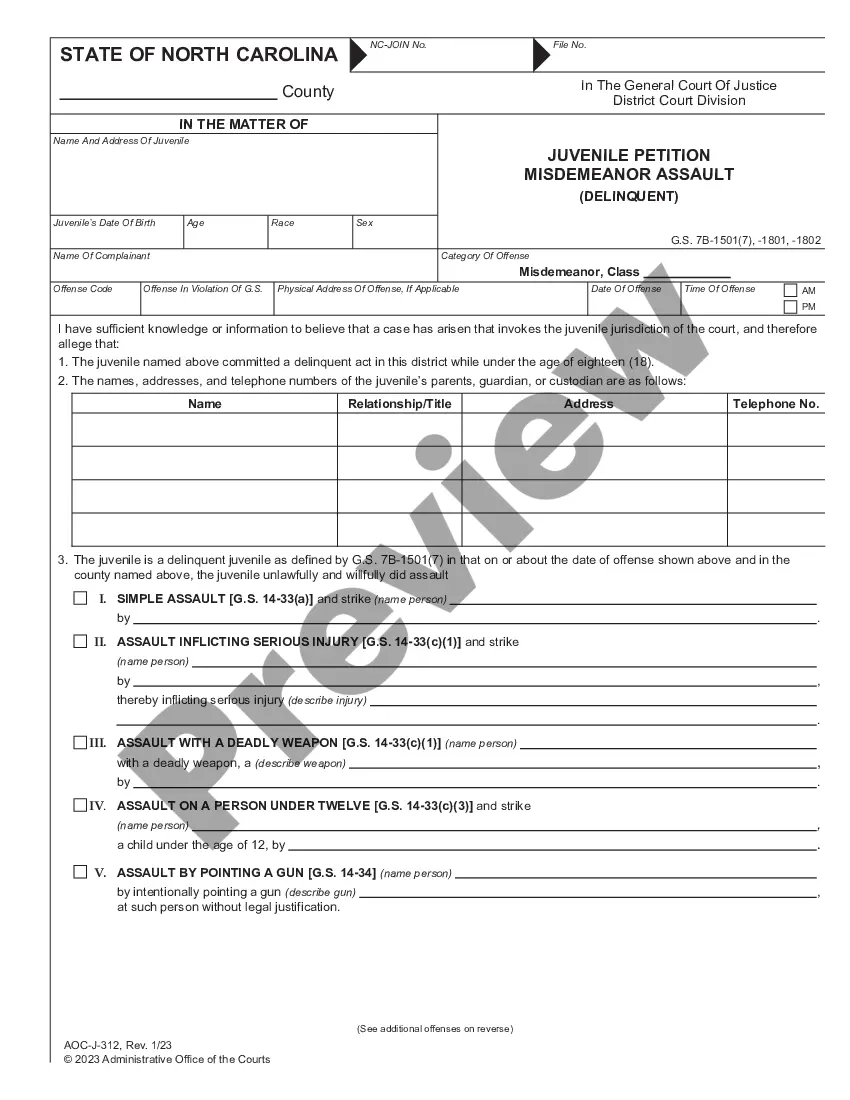

- Analyze the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the document once you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!