Alameda, California is a city located in Alameda County, California, United States. It is situated on Alameda Island and Bay Farm Island, and is known for its charming coastal landscape and vibrant cultural scene. Alameda offers a great mix of urban amenities and natural beauty, making it an attractive place to live or visit. Exhibit D to Operating Agreement Insurance — Form 1 is a legal document related to insurance provisions within an operating agreement. This exhibit outlines the specific insurance requirements and coverage details for a business or organization mentioned in the operating agreement. Different types of Alameda California Exhibit D to Operating Agreement Insurance — Form 1 may include: 1. General Liability Insurance: This type of insurance provides coverage for claims related to bodily injury, property damage, and personal injury that occur on the premises or are caused by the operations of the insured entity. 2. Property Insurance: This insurance coverage protects against damage or loss to the property owned or leased by the insured, including buildings, equipment, and inventory. 3. Workers' Compensation Insurance: This insurance is essential for businesses employing workers. It covers medical expenses and lost wages for employees who are injured or become ill while performing job-related tasks. 4. Business Interruption Insurance: This type of coverage helps mitigate financial losses when a business is temporarily unable to operate due to unforeseen circumstances such as fire, natural disasters, or other covered events. 5. Professional Liability Insurance: This insurance, often referred to as errors and omissions (E&O) insurance, provides coverage for professionals such as consultants, lawyers, or accountants against claims arising from errors or negligence in their professional services. 6. Cyber Liability Insurance: In today's digital world, cyber threats are a concern for businesses. Cyber liability insurance protects against data breaches, hacker attacks, and other cyber-related risks, providing coverage for costs associated with data recovery, legal expenses, and customer notification. These are some examples of the different types of Alameda California Exhibit D to Operating Agreement Insurance — Form 1. The specific insurance requirements can vary based on the nature of the business or organization and the terms agreed upon in the operating agreement. It is essential for businesses to carefully review and tailor the insurance provisions in their operating agreements to address their unique needs and risks.

Alameda California Exhibit D to Operating Agreement Insurance - Form 1

Description

How to fill out Alameda California Exhibit D To Operating Agreement Insurance - Form 1?

How much time does it normally take you to create a legal document? Considering that every state has its laws and regulations for every life situation, finding a Alameda Exhibit D to Operating Agreement Insurance - Form 1 suiting all regional requirements can be tiring, and ordering it from a professional lawyer is often costly. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online catalog of templates, gathered by states and areas of use. In addition to the Alameda Exhibit D to Operating Agreement Insurance - Form 1, here you can find any specific document to run your business or personal deeds, complying with your regional requirements. Specialists verify all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed form, and download it. You can retain the file in your profile anytime in the future. Otherwise, if you are new to the platform, there will be some extra steps to complete before you get your Alameda Exhibit D to Operating Agreement Insurance - Form 1:

- Examine the content of the page you’re on.

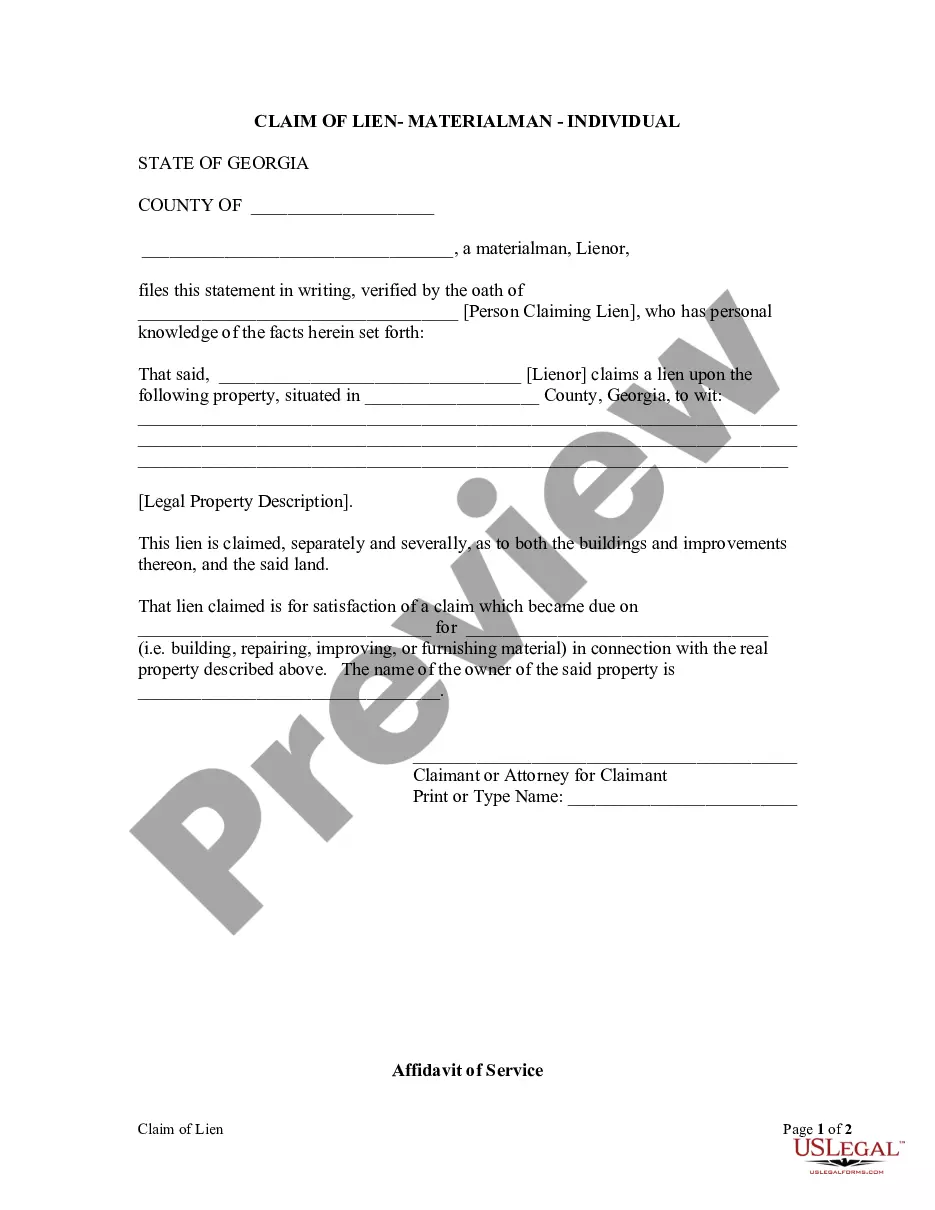

- Read the description of the template or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Alameda Exhibit D to Operating Agreement Insurance - Form 1.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!