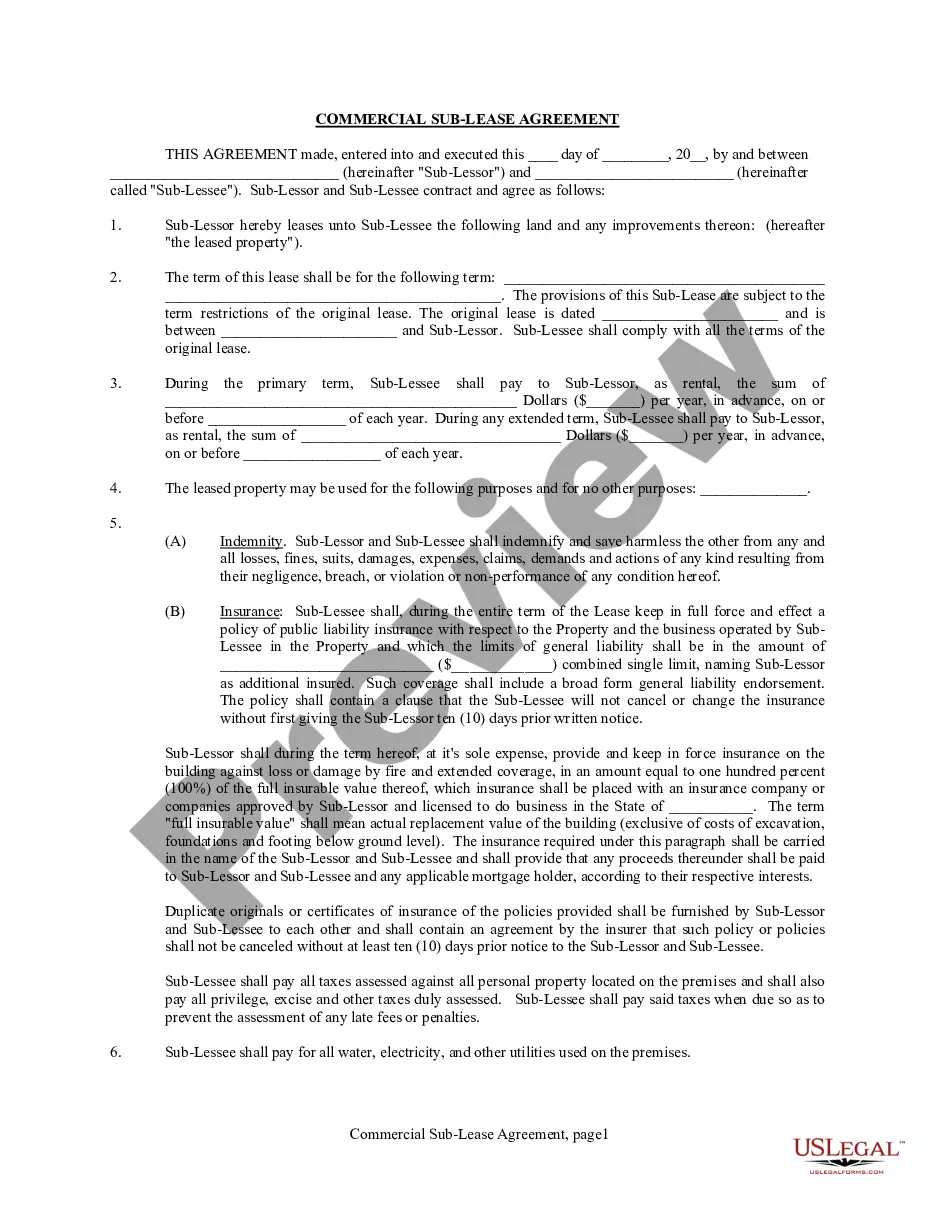

Harris Texas Exhibit D to Operating Agreement Insurance — Form 1 is a specific document that plays a crucial role in the insurance agreement of operating agreements in Harris County, Texas. It outlines the insurance requirements and provisions that all parties involved in the agreement must adhere to. This comprehensive document is designed to ensure that all potential risks and liabilities are properly covered and managed. The Harris Texas Exhibit D to Operating Agreement Insurance — Form 1 addresses various types of insurance coverage that may be required, such as general liability insurance, property insurance, workers' compensation insurance, professional liability insurance, and automobile liability insurance. Each of these types of insurance serves a specific purpose and provides protection against different potential risks. General liability insurance is vital as it safeguards against bodily injury, property damage, and personal injury claims that may arise during the operation of the business or project covered by the operating agreement. Property insurance, on the other hand, is crucial for protecting any buildings, equipment, or inventory owned by the parties involved in the agreement. Workers' compensation insurance is mandatory to cover any work-related injuries or illnesses that employees or workers may experience during their employment. Professional liability insurance, also known as errors and omissions insurance, is specifically tailored to protect individuals or businesses from claims resulting from professional services or advice provided. Automobile liability insurance is necessary to cover any accidents, bodily injuries, or property damage resulting from the operation of vehicles related to the business or project outlined in the operating agreement. It is important to highlight that while the specific requirements may vary, the Harris Texas Exhibit D to Operating Agreement Insurance — Form 1 provides a standardized template that streamlines the insurance aspects of operating agreements in Harris County, Texas. By clearly outlining the insurance obligations, limits, and conditions, this document helps protect all parties involved in the agreement and ensures comprehensive coverage against potential risks and liabilities. In conclusion, the Harris Texas Exhibit D to Operating Agreement Insurance — Form 1 is a crucial document in the insurance agreement of operating agreements in Harris County, Texas. It addresses different types of insurance coverage, including general liability, property, workers' compensation, professional liability, and automobile liability insurance. By providing a standardized template, this document helps protect all parties involved in the agreement and ensures comprehensive coverage against potential risks and liabilities.

Harris Texas Exhibit D to Operating Agreement Insurance - Form 1

Description

How to fill out Harris Texas Exhibit D To Operating Agreement Insurance - Form 1?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to look for professional help to create some of them from the ground up, including Harris Exhibit D to Operating Agreement Insurance - Form 1, with a platform like US Legal Forms.

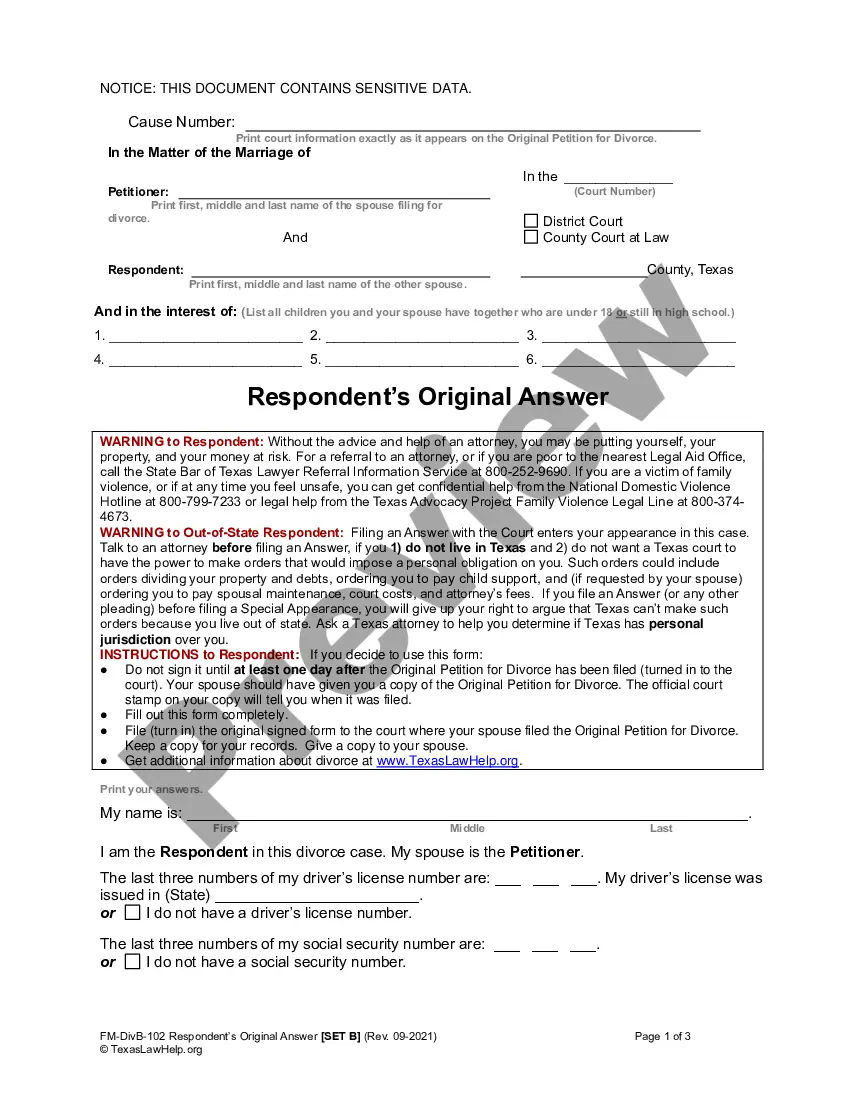

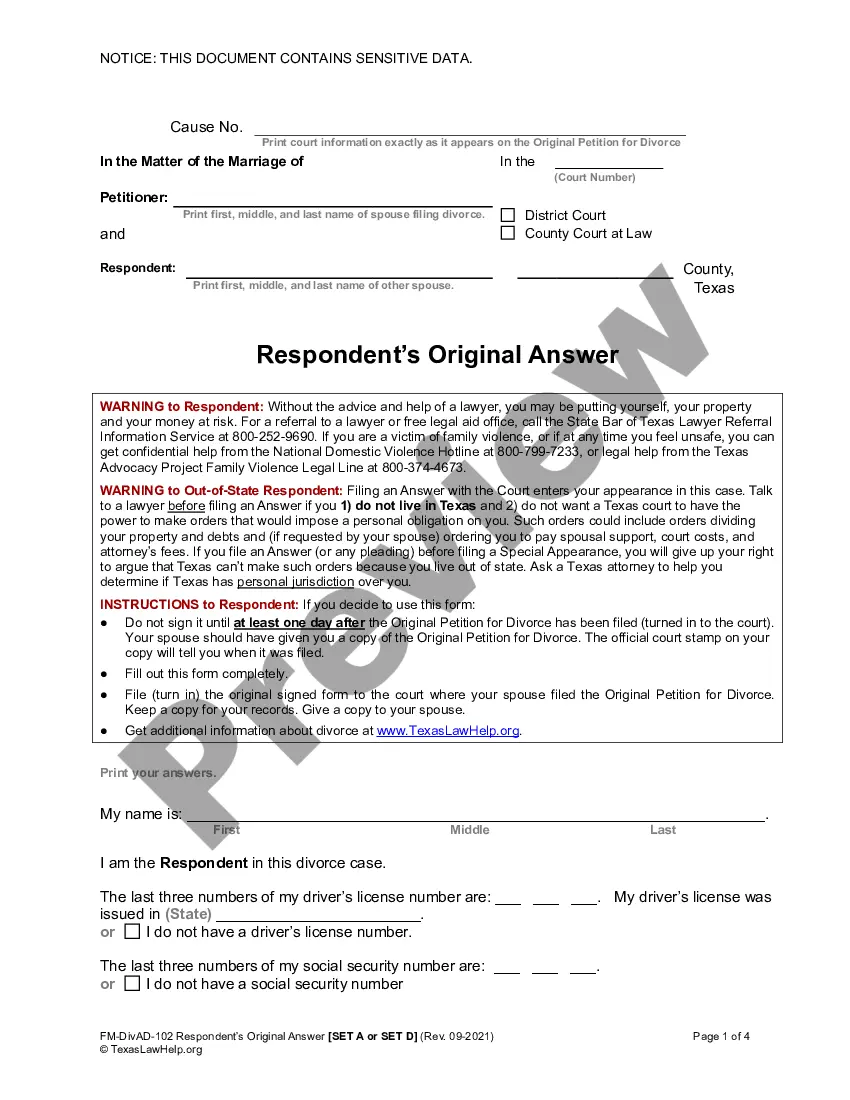

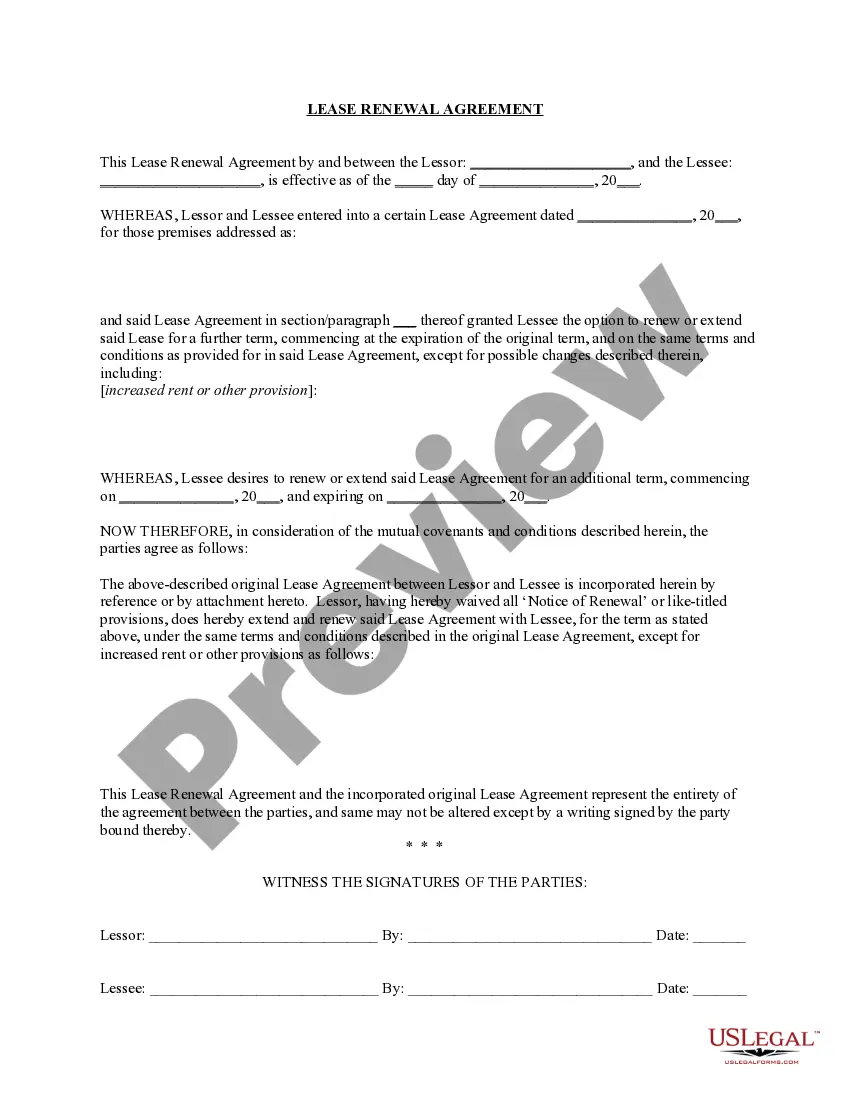

US Legal Forms has more than 85,000 forms to pick from in different types ranging from living wills to real estate paperwork to divorce documents. All forms are organized according to their valid state, making the searching experience less overwhelming. You can also find information materials and guides on the website to make any activities related to document execution simple.

Here's how to purchase and download Harris Exhibit D to Operating Agreement Insurance - Form 1.

- Go over the document's preview and description (if provided) to get a basic idea of what you’ll get after getting the document.

- Ensure that the template of your choosing is adapted to your state/county/area since state laws can impact the validity of some documents.

- Check the related document templates or start the search over to locate the correct file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment method, and buy Harris Exhibit D to Operating Agreement Insurance - Form 1.

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Harris Exhibit D to Operating Agreement Insurance - Form 1, log in to your account, and download it. Of course, our website can’t replace a lawyer completely. If you have to deal with an exceptionally challenging case, we advise using the services of a lawyer to review your form before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Become one of them today and purchase your state-compliant paperwork effortlessly!