Nassau New York Exhibit D to Operating Agreement Insurance — Form 1 is a crucial document that outlines the insurance provisions included in a specific operating agreement in Nassau County, New York. This exhibit serves as an attachment to the operating agreement and provides detailed information about the coverage, terms, and conditions related to insurance matters. Keywords: Nassau New York, Exhibit D, Operating Agreement Insurance, Form 1, insurance provisions, coverage, terms, conditions. Types of Nassau New York Exhibit D to Operating Agreement Insurance — Form 1 may include: 1. Liability Insurance: This type of insurance coverage protects the operating agreement parties from claims or lawsuits resulting from bodily injury, property damage, or personal injury that occur during business operations in Nassau County, New York. 2. Property Insurance: This insurance coverage safeguards the physical assets owned by the agreement parties, such as buildings, equipment, and inventory, against damages caused by fire, theft, natural disasters, or other specified perils in Nassau County, New York. 3. Workers' Compensation Insurance: This type of insurance provides coverage to employees in case of work-related injuries or illnesses. It ensures that medical expenses, lost wages, and rehabilitation costs are covered as required by the laws of Nassau County, New York. 4. Business Interruption Insurance: This coverage compensates for lost income and ongoing expenses if the business operations in Nassau County, New York are disrupted due to an insured event such as fire, flood, or other covered perils. 5. Director and Officer (D&O) Insurance: This type of insurance protects the directors and officers of the business entity in Nassau County, New York from personal liability if they are sued for alleged wrongful acts or omissions committed during the course of their duties. 6. Umbrella Insurance: This coverage provides additional liability protection beyond the limits of other policies held by the agreement parties in Nassau County, New York. It offers broader coverage and helps safeguard against significant financial losses resulting from a lawsuit or claim. It is important for all parties involved in an operating agreement to carefully review and understand the Nassau New York Exhibit D to Operating Agreement Insurance — Form 1 to ensure proper coverage and adequate protection for their business activities in Nassau County, New York.

Nassau New York Exhibit D to Operating Agreement Insurance - Form 1

Description

How to fill out Nassau New York Exhibit D To Operating Agreement Insurance - Form 1?

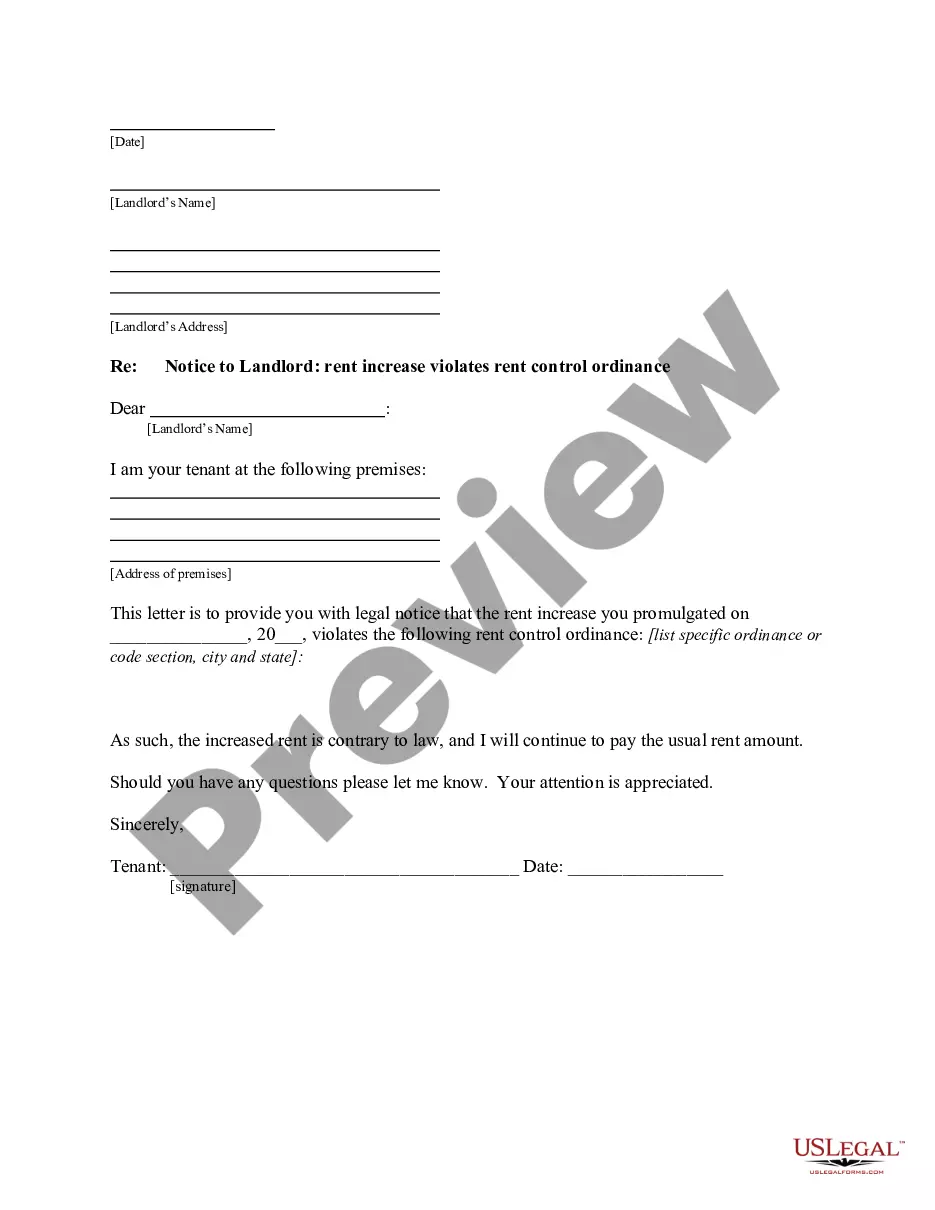

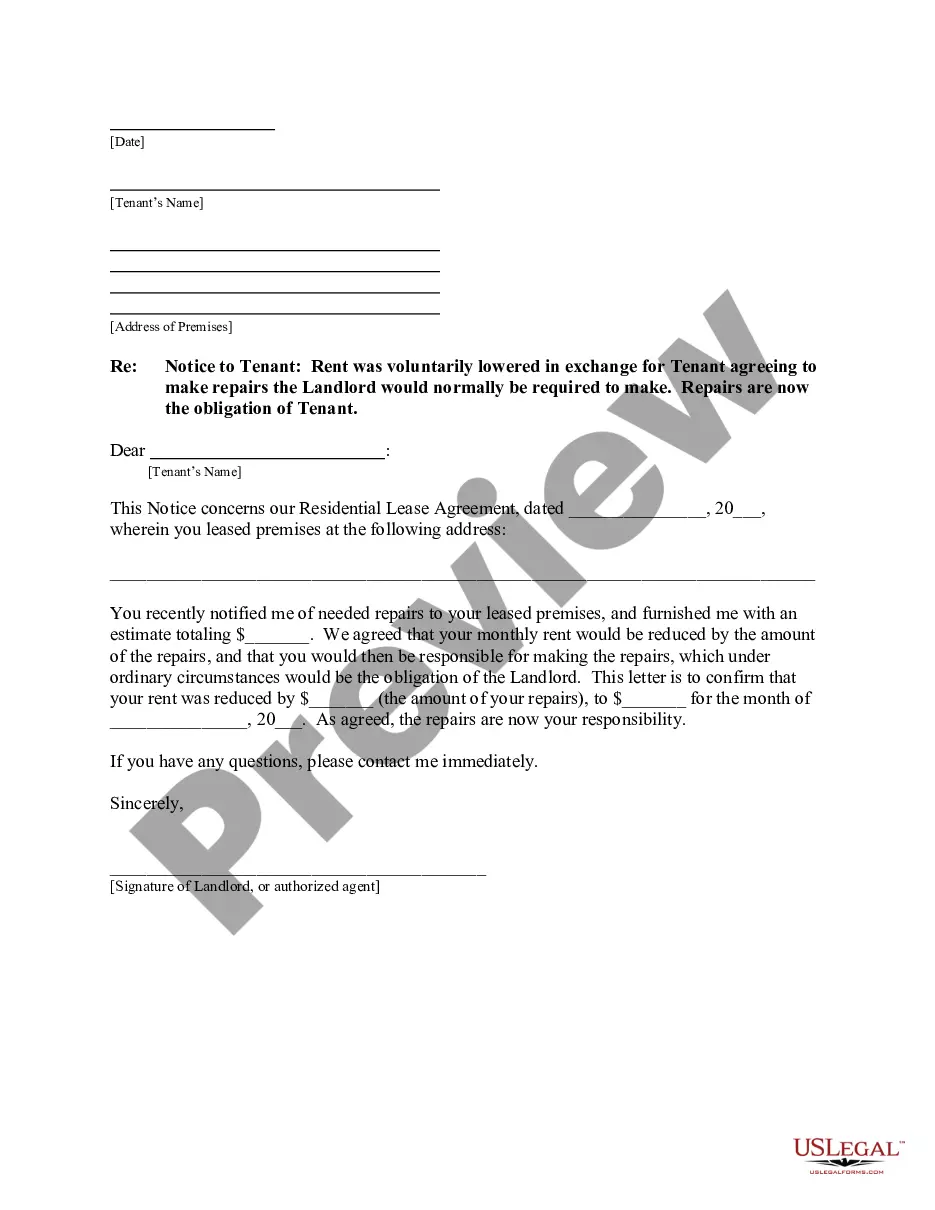

Do you need to quickly draft a legally-binding Nassau Exhibit D to Operating Agreement Insurance - Form 1 or maybe any other document to manage your personal or corporate matters? You can go with two options: contact a professional to draft a legal paper for you or create it completely on your own. Thankfully, there's a third solution - US Legal Forms. It will help you receive neatly written legal paperwork without paying sky-high prices for legal services.

US Legal Forms provides a rich catalog of more than 85,000 state-compliant document templates, including Nassau Exhibit D to Operating Agreement Insurance - Form 1 and form packages. We offer templates for an array of use cases: from divorce paperwork to real estate documents. We've been out there for more than 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and get the necessary document without extra hassles.

- To start with, double-check if the Nassau Exhibit D to Operating Agreement Insurance - Form 1 is tailored to your state's or county's regulations.

- If the form includes a desciption, make sure to verify what it's intended for.

- Start the searching process over if the document isn’t what you were looking for by using the search bar in the header.

- Choose the subscription that is best suited for your needs and move forward to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Nassau Exhibit D to Operating Agreement Insurance - Form 1 template, and download it. To re-download the form, just head to the My Forms tab.

It's effortless to find and download legal forms if you use our catalog. Additionally, the paperwork we provide are updated by law professionals, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!