Phoenix Arizona Exhibit D to Operating Agreement Insurance — Form 1 is a legal document that is typically included as an appendix to an operating agreement for a company or business. This exhibit specifically pertains to insurance coverage and outlines the terms and conditions for insurance policies relevant to the company's operations in Phoenix, Arizona. The purpose of Exhibit D is to ensure that the company has adequate insurance coverage to protect against potential risks, liabilities, and losses that may arise during its operations in Phoenix. It provides a comprehensive framework for the company's insurance requirements and obligations, aiming to mitigate risks and safeguard the company's assets and interests. Keywords: 1. Phoenix, Arizona: This location refers to the specific area where the company's operations are based, providing geographical context. 2. Exhibit D: Represents the section of the operating agreement that addresses insurance requirements. 3. Operating Agreement: The legal document that governs the internal operations of a company, defining the rights and responsibilities of its members. 4. Insurance coverage: Refers to the protection and financial compensation provided by an insurance policy for specified risks or losses. 5. Terms and conditions: Specifies the rules, limitations, and provisions that govern the insurance coverage. 6. Risks and liabilities: Refers to potential dangers, threats, or obligations that the company may face during its operations in Phoenix. 7. Losses: Denotes potential damages, costs, or financial setbacks that may occur due to a covered event or circumstance. Different types of Phoenix Arizona Exhibit D to Operating Agreement Insurance — Form 1 may include variations based on the nature of the company's activities, size, and the specific insurance requirements it needs to comply with in Phoenix, Arizona. Some potential variations could include: 1. General Liability Insurance: A type of insurance that covers the company against claims for bodily injury, property damage, or personal injury arising from its operations. 2. Property Insurance: This type of insurance provides coverage for damage or loss of the company's physical assets, such as buildings, equipment, or inventory. 3. Workers' Compensation Insurance: Geared towards protecting the company and its employees in the event of work-related injuries or illnesses by providing medical care, wage replacement, and other benefits. 4. Professional Liability Insurance: Also known as errors and omissions insurance, it is designed to protect the company against claims of negligence or inadequate work performance in professional services. 5. Cyber Insurance: Insurance that covers the company's liability and expenses related to data breaches, hacking, or other cybercrime that may result in loss or damage to sensitive information. 6. Directors and Officers (D&O) Liability Insurance: Provides coverage for the company's directors and officers against claims alleging wrongful acts, mismanagement, or breaches of duty in their roles. 7. Commercial Auto Insurance: Protects the company's vehicles and drivers from potential liabilities or damages caused during business operations. These different types of insurance coverage may be included as options or requirements within Phoenix Arizona Exhibit D to Operating Agreement Insurance — Form 1, depending on the specific needs and risks associated with the company's activities in Phoenix. It is crucial for businesses to consult with legal professionals and insurance experts to determine the appropriate coverage for their operations in Arizona.

Phoenix Arizona Exhibit D to Operating Agreement Insurance - Form 1

Description

How to fill out Phoenix Arizona Exhibit D To Operating Agreement Insurance - Form 1?

Laws and regulations in every sphere differ around the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Phoenix Exhibit D to Operating Agreement Insurance - Form 1, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you obtain a sample, it remains available in your profile for further use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Phoenix Exhibit D to Operating Agreement Insurance - Form 1 from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Phoenix Exhibit D to Operating Agreement Insurance - Form 1:

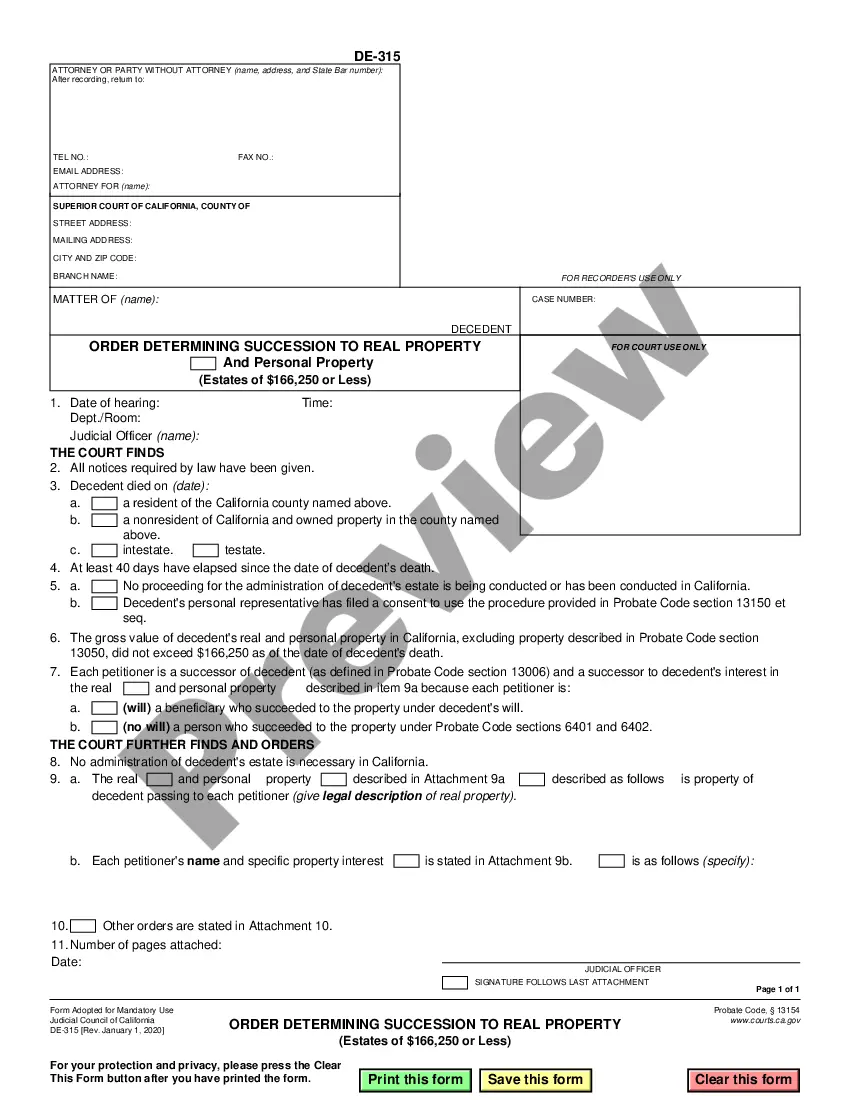

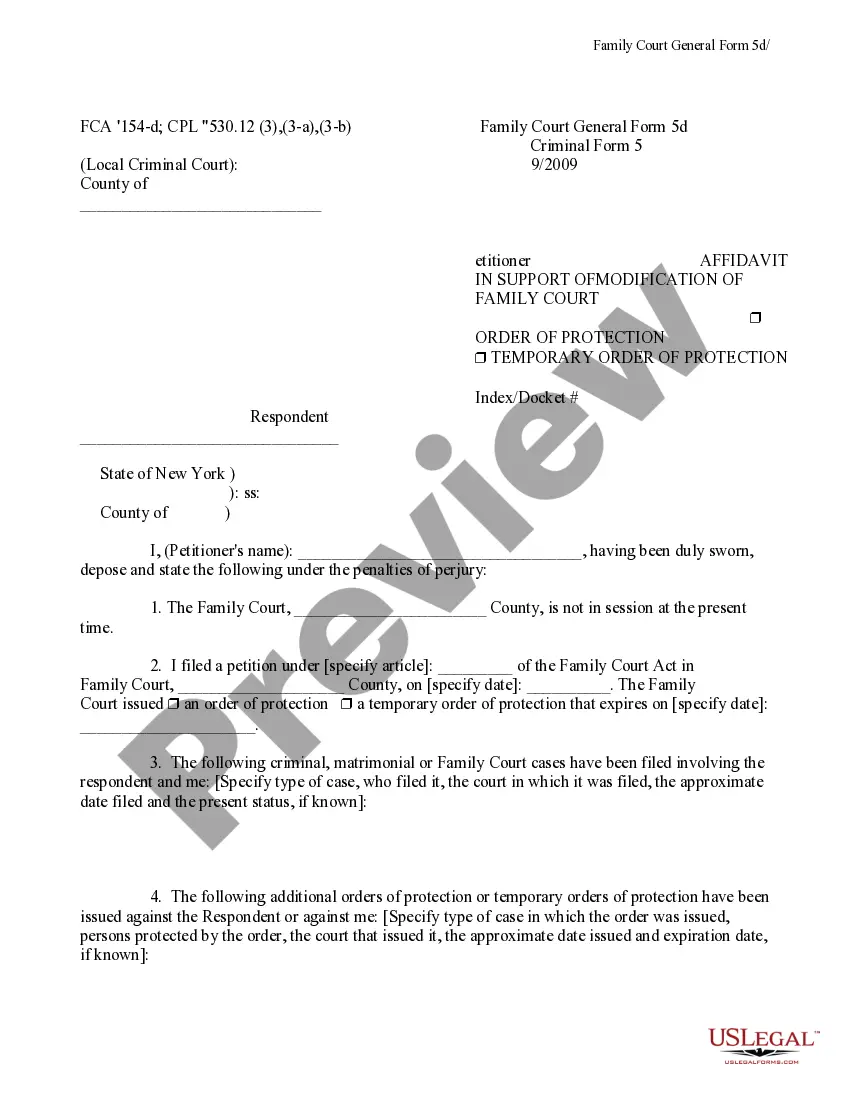

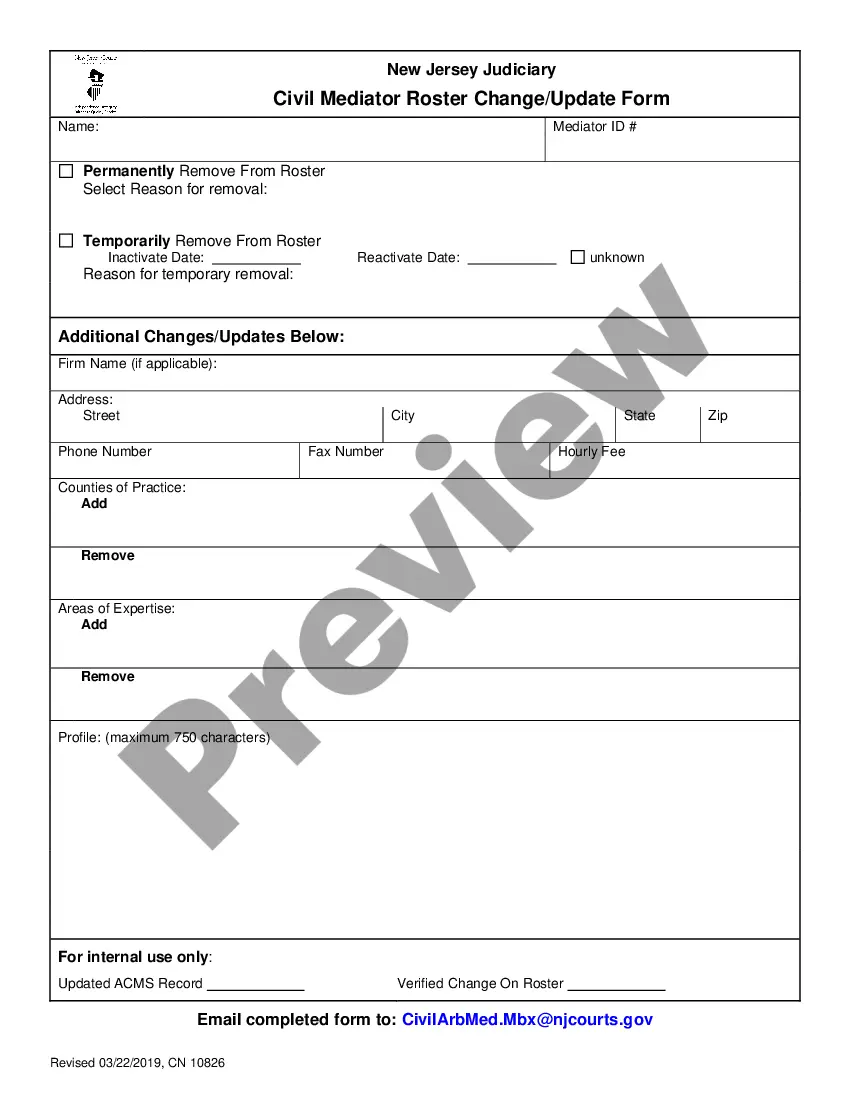

- Examine the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the document when you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!